The speed and scale of biodiversity loss and ecosystem degradation are the highest in history. Research from S&P Global Sustainable1 shows that 54% of companies in the S&P Global BMI have a significant dependency on nature across their direct operations, with 16% of companies having at least one asset located in a Key Biodiversity Area (KBA) that could be exposed to future reputational and regulatory risks.1

Analysis from Singapore Sustainable Finance Association (SSFA)’s recently published practical guide for FIs getting started on nature financing2 similarly highlights that investors and banks in the region may face material nature-related risks through their investments and lending and that the next step is for financial institutions to examine specific areas of risk in sectors of economic importance to the region such as agriculture, mining, manufacturing and real estate through a materiality and risk assessment.

Over the course of lunch, we will look to cover:

We would like to extend an invitation for you to join us at the Sustainable1 Summit – Unlocking Transition Opportunities, taking place the same afternoon, also at the National Gallery. Indicate your interest by checking the box in the registration form.

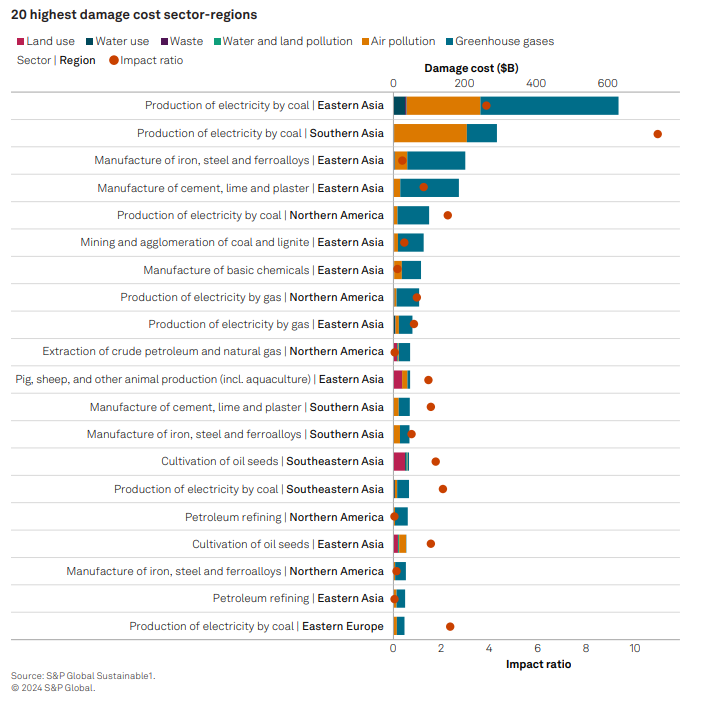

Related Publications1: Unpriced Environmental Costs: The Top Externalities of the Global Market

Related Publications2: Financing our Natural Capital: A practical guide for Fis getting started on nature financing

*This is strictly an invitation only event with limited capacity. Please RSVP via the registration link above

The Platts Events mobile app puts conference navigation and networking at your fingertips. Available one week before the event, the mobile app gives delegates :

* Platts attempts to secure as many speaker presentations as possible, however some speakers choose not to share their materials. Therefore some presentations may not become available. Additionally speaker presentations for this event are only available for download from the networking mobile app and web link

Please contact us if you need more info or need help registering.