The speed and scale of biodiversity loss and ecosystem degradation is the highest in history. 85% of the world's largest companies have a significant dependency on nature, indicating the critical importance of greater transparency for market participants on nature-related risks and opportunities. Businesses and financial institutions need help gaining the knowledge, capacity, data, and deep analytics to understand, manage and disclose the nature-related risks they face.

The Ecosystem Footprint metric combines three key areas of analysis: the areas of land impacted by the company (land area), the degree to which the location-specific ecosystem integrity is reduced (ecosystem degradation) and the significance of the location-specific ecosystem footprint impacted (ecosystem significance). In order to provide a decision-useful metric that enables comparison between business operations, land area, ecosystem integrity degradation and ecosystem significance are brought together to calculate the equivalent impact on the most significant areas globally in terms of biodiversity conservation and provision of ecosystem services. This produces an Eecosystem Ffootprint expressed as the equivalent number of hectares in the most globally significant ecosystems that would be fully degraded by the company’s operations.

Ecosystem footprint intensity

(ha HSA eq / USD mn)

0

1

Ecosystem footprint intensity (ha HSA eq / USD mn)

0

1

Biodiversity Areas (KBAs), as defined by the International Union for Conservation of Nature, are sites contributing significantly to the global persistence of biodiversity. Key Biodiversity Areas are identified at the national, subnational or regional level by local stakeholders based on standardized scientific criteria and thresholds. Protected Areas are geographically defined spaces that are managed through legal or other effective means to achieve the long-term conservation of nature with associated ecosystem services and cultural values.

Protected areas include national parks, wilderness areas and nature reserves managed by local, state or national governments. A protected area can also be an area of land that is owned or managed by a private owner, NGO, for-profit organizations or Indigenous peoples.

S&P Global Sustainable1 data shows that 46% of companies in the S&P Global 1200 index have at least one asset located in a Key Biodiversity Area (KBA) and 70% have at least one asset in a protected area.

The dependency score considers the level of reliance that a business has on 21 different ecosystem services, as well as the expected resilience risk of the ecosystem providing these services, where these businesses are operating around the world. Significant dependency is signified by companies that have a dependency score over 0.6 (where 0 represents no dependency risk and 1.0 represents very high dependency risk).

S&P Global Broad Market Index (BMI) data current as of 31 March 2023.

Source: S&P Global Sustainable1, June 2023

At S&P Global, we are committed to delivering the most essential sustainability data, analytics and research to help market participants make sustainable decisions with conviction.

quantifies nature & biodiversity risk for 20k+ companies based on 1.6m+ underlying assets & 800+ asset types to produce 130+ metrics covering impact and dependencies on nature.

LEARN MOREenables financial institutions and companies to upload their location data to analyze nature & biodiversity risks to real assets in their portfolios, operations, and supply chains.

Request a demoReport and act on evolving nature-related risks with in-depth TNFD analytics.

LEARN MOREThe UN Environment Programme (UNEP) and S&P Global Sustainable1 have launched the Nature Risk Profile, a new methodology for analyzing companies' impacts and dependencies on nature. The Nature Risk Profile is aimed at enabling the financial sector to measure and address nature-related risk by providing scientifically robust and actionable analytics on nature impacts and dependencies. Developed by experts from across the conservation, business, and finance communities, it aligns with the emerging approach of the Taskforce on Nature-related Financial Disclosures (TNFD) and will support the implementation of TNFD's disclosure framework.

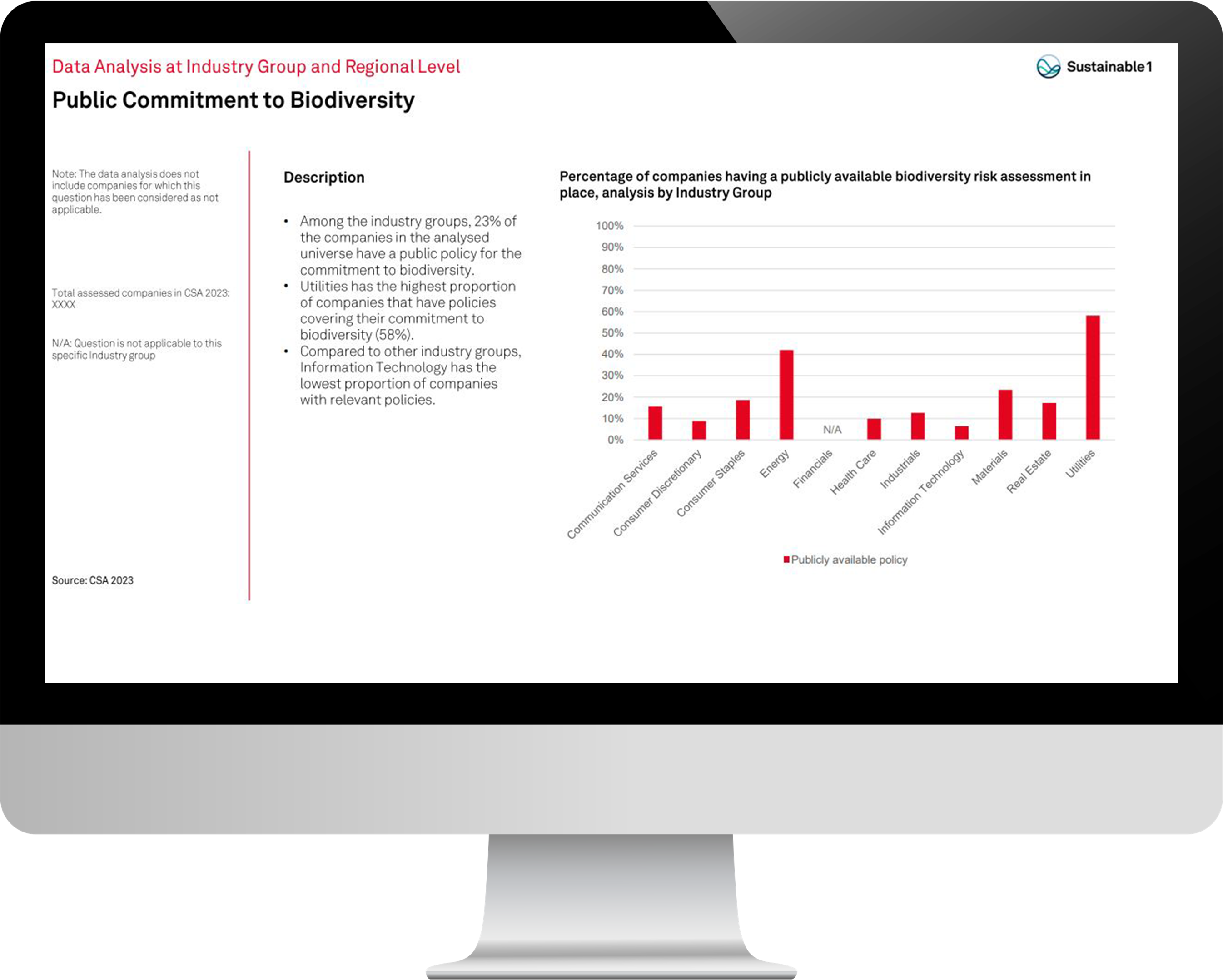

Biodiversity commitment provides a basis for embedding the responsibility to have a commitment through all business functions and conduct risk assessments to address biodiversity risks.

Explore Thematic Data Analysis Reports

Here’s what you need to know about the trends that will shape strategy in a challenging year.

READ MOREThe world's biodiversity loss poses big financial risks to businesses and the global economy. Listen to our episode featuring an interview with Elizabeth Mrema, co-chair at the Taskforce on Nature-related Financial Disclosures (TNFD), one of the organizations working to help companies assess, report and act on these risks.

Hosts: Lindsey Hall and Esther Whieldon

The speed and scale of biodiversity loss and ecosystem degradation is the highest in history. Businesses and financial institutions need help gaining the knowledge, capacity, data, and deep analytics to understand, manage and disclose the nature-related risks they face.

Learn about biodiversity loss and ecosystem degradation