Mandatory climate disclosures are now on the horizon in the U.S. after the Securities and Exchange Commission unveiled a long-anticipated climate disclosure rulemaking proposal. This proposal is the first step in a process that could lead to a requirement for SEC registrants to disclose their greenhouse gas emissions and, in some cases, emissions throughout their entire value chains.

Listen to this episode and Subscribe to the ESG Insider podcast

Highlights of the SEC’s climate disclosure proposalAccording to the SEC, the newly proposed rule would require SEC-registered domestic or foreign companies to include climate-related information in registration statements and periodic reports such as 10-K annual reports. Key proposed disclosures include:

Source: U.S. Securities and Exchange Commission Fact Sheet: Enhancement and Standardization of Climate-Related Disclosures |

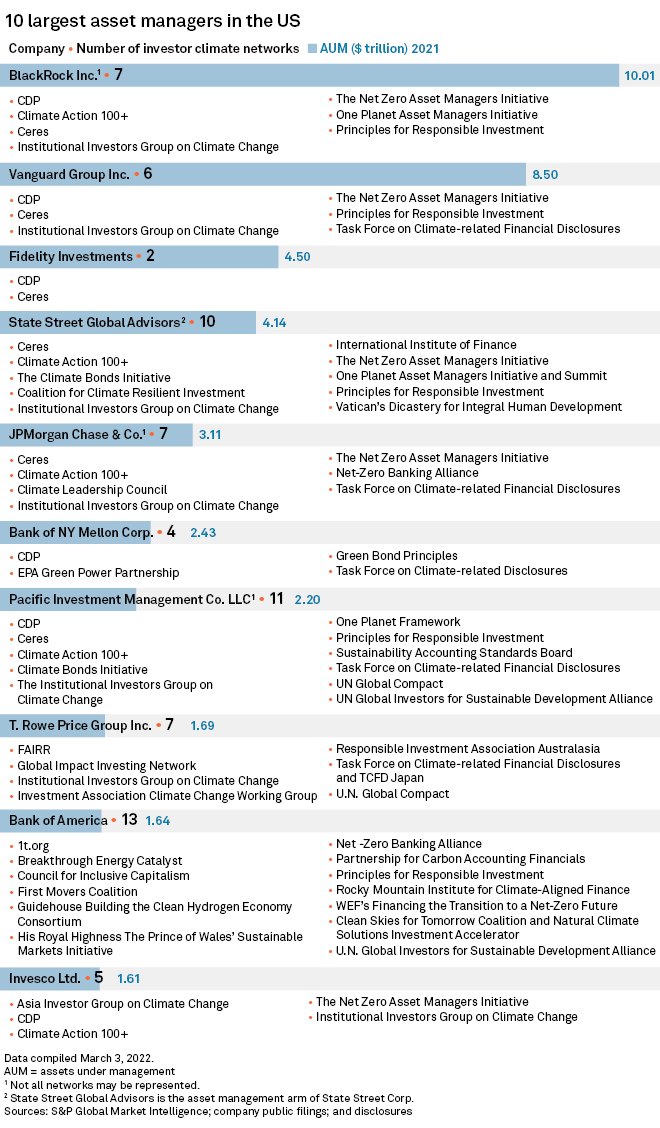

A chorus of investors and stakeholders has called for more comprehensive, consistent and comparable climate-related data, and many of the largest U.S. asset managers belong to multiple groups or alliances that support climate disclosure efforts. But while voluntary disclosure of emissions and climate-related risks and opportunities has been on the upswing in recent years, it remains uncommon in all but a handful of sectors, according to S&P Global Sustainable1 data. In light of the SEC’s proposal, what is the existing state of climate disclosure in the U.S.?

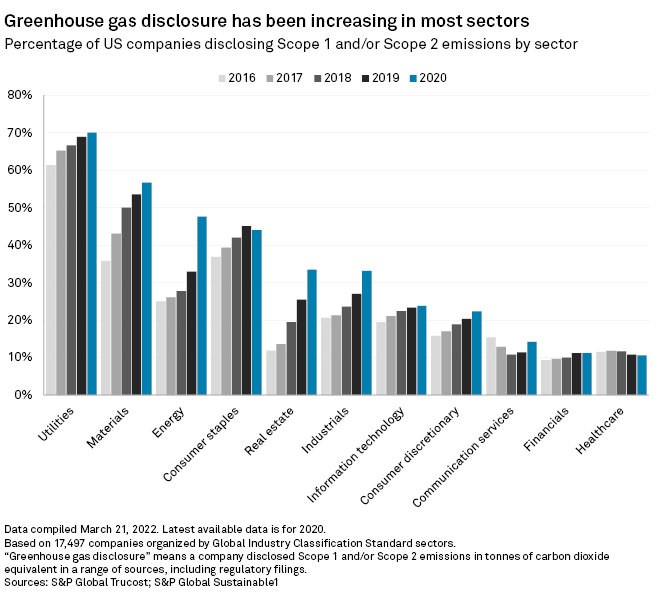

Few US sectors are already disclosing emissions

In its proposed form, the SEC’s rule would require domestic and certain foreign registrants to disclose their Scope 1 direct emissions from operations and Scope 2 indirect emissions from purchased electricity or other forms of energy. For Scope 1 and Scope 2 emissions, companies would have to provide both absolute and intensity-related greenhouse gas emissions figures in the aggregate as well as for individual greenhouse gases such as carbon dioxide, methane and hydrofluorocarbons.

S&P Global Sustainable1 data shows that some sectors are already disclosing Scope 1 and Scope 2 in the U.S. and that the voluntary disclosure rate is rising in nearly all sectors. However, these types of disclosure still appear to be uncommon across the board.

The utilities and materials sectors had the highest levels of emissions disclosures in 2020, the most recent year for which data is available. The disclosure rate in the energy sector saw a significant jump in 2020 but still remained below 50%. In the consumer staples, financials and healthcare sectors, the disclosure rate fell or stayed the same. Fewer than 20% of companies in three sectors disclosed Scope 1 and/or Scope 2 emissions in 2020, which may mean that they would need to take additional steps to report in line with the rule as proposed.

In its proposal, the SEC focused on the extent to which climate change poses a material risk to a company's business operations, financial performance and long-term strategies. Data from the 2021 S&P Global Corporate Sustainability Assessment, or CSA, shows that a rising number companies already view climate change as material. A recent review of CSA data found that nearly a quarter of companies surveyed globally now view climate change as a material issue.

A growing number of the biggest global companies are publishing climate reports, and many of the largest companies are also setting decarbonization pledges such as promising to reach net zero emissions by 2050. About 36.8% of approximately 5,300 companies reviewed in the 2021 CSA had announced plans to curb Scope 1 and/or Scope 2 emissions.

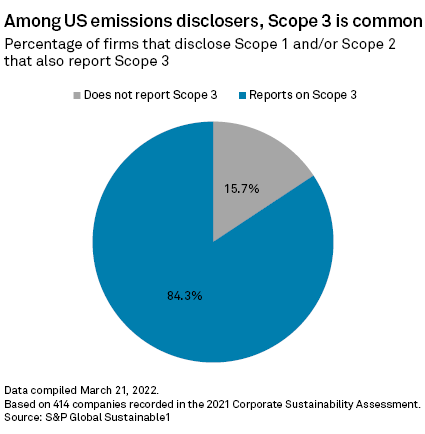

The SEC also proposed requiring disclosure of Scope 3 emissions in some cases. Scope 3 emissions occur up and down a company’s value chain. For example, they could be emitted by a company’s suppliers of raw material, or when a consumer uses a company’s products. Scope 3 also includes emissions tied to financial relationships, such as an oil exploration firm in a bank’s loan portfolio. Given the breadth of Scope 3, it can be difficult for companies to track and estimate these emissions.

Under the SEC rule proposal, large companies would be required to estimate and disclose Scope 3 emissions if they have either set a decarbonization target that includes Scope 3 emissions or have found Scope 3 emissions to be material to their operations and financial performance. These disclosures would be phased in over time, and companies would have a safe harbor for lawsuits over the accuracy of their Scope 3 data.

For the small cohort of U.S. companies that already disclose Scope 1 or Scope 2 emissions, most also disclose Scope 3 emissions, according to the 2021 CSA data.

Attestation needed for some companies

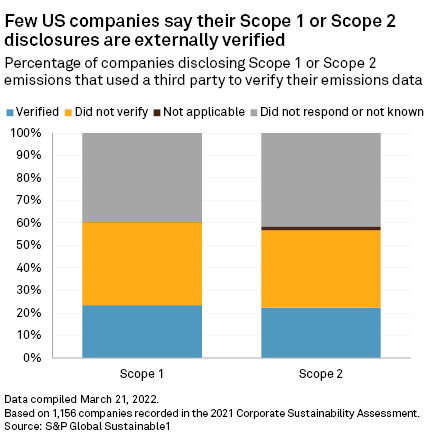

Much of the market-led demand for climate disclosures involves the extent to which this data is comparable and reliable. To address this second challenge, the SEC proposed requiring accelerated filers, a category of SEC registrants based on size and reporting thresholds, to obtain attestation reports that provide a degree of assurance that their emissions data is not misstated in a material way.

The 2021 S&P Global CSA asked companies with Scope 1 and/or Scope 2 disclosures whether they worked with a third party to verify their data. According to the CSA results, few U.S. companies appear to have done so.

Under the proposed rule, the SEC would also make climate-related information in financial statements subject to audit by an independent registered public accounting firm. The SEC has also asked whether it should require an audit of internal controls used in the determination and reporting of greenhouse gas emissions.

Proposal draws on TCFD framework

The SEC’s proposed rule is modeled on the framework created by the Task Force on Climate-related Financial Disclosures, or TCFD, and would require companies to outline their climate-related governance practices, expected risks and energy transition plans, including for meeting decarbonization targets, if the companies have set them. The rule invites companies to outline any opportunities they see coming from climate change. And it would provide companies a safe harbor from lawsuits for any forward-looking statements, except those made in connection with an initial public offering.

TCFD is a voluntary framework, but jurisdictions around the world are using it to guide their climate regulations. The U.S. would join a growing list of countries and securities exchanges that are pushing companies and financial institutions to report their climate-related risk using the TCFD framework on a mandatory basis.

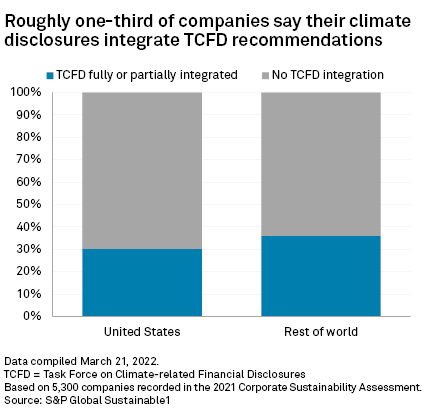

Data from the 2021 S&P Global CSA suggests that roughly one-third of companies with climate disclosures in the U.S. and globally are already using the TCFD as a framework.

Transparency on net zero targets

Effective adaptation plans will need to weigh impacts on ecosystems, communities and overall long-term planetary health to avoid negative unintended consequences, the IPCC wrote. All too often, according to the report, adaptation focuses on short-term solutions and ignores the longer-term implications for nature and society. For example, planting trees in areas that would not naturally support forests can destroy local biodiversity, create water and food supply challenges and increase wildfire risk.

Under the SEC proposal, companies that have climate targets would also be required to explain how they plan to achieve any short- and long-term decarbonization targets, adding a new layer of transparency to corporate net zero promises.

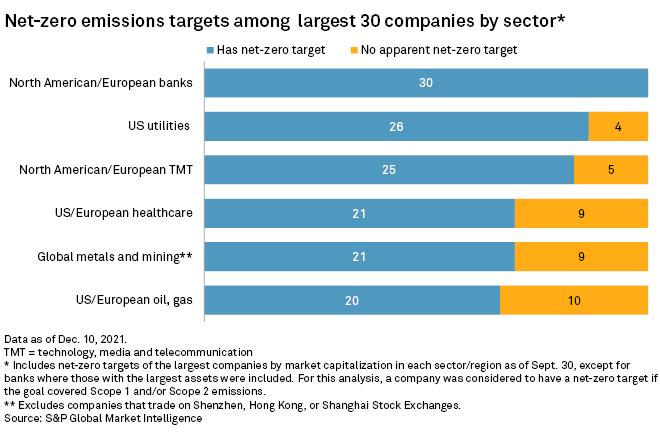

Pledging to become carbon neutral by 2050 was a common refrain in the private sector in 2021. A December 2021 S&P Global Market Intelligence analysis found that many of the world’s largest companies by sector have published a net zero emissions target.

According to the SEC proposal, companies within its scope would also have to describe any reliance on renewable energy credits or carbon offsets to net out their own emissions. Carbon offsets are credits generated by projects that reduce carbon emissions outside a company’s value chain. But because many carbon offsets are outdated, of poor quality, or hard to verify, they may risk boosting global emissions instead of curtailing them. Similarly, renewable energy credits that companies buy don't always encourage the production of new wind or solar projects — an outcome that could undermine broader corporate efforts to cut emissions and fight climate change.

Detailing financial impacts of climate change

The SEC also proposed that companies disclose how climate change is already affecting their finances. Specifically, companies would need to measure and disclose the financial impacts of severe weather events and transition activities on the affected line items of their consolidated financial statements, if the aggregate impact on a line item is greater than 1%.

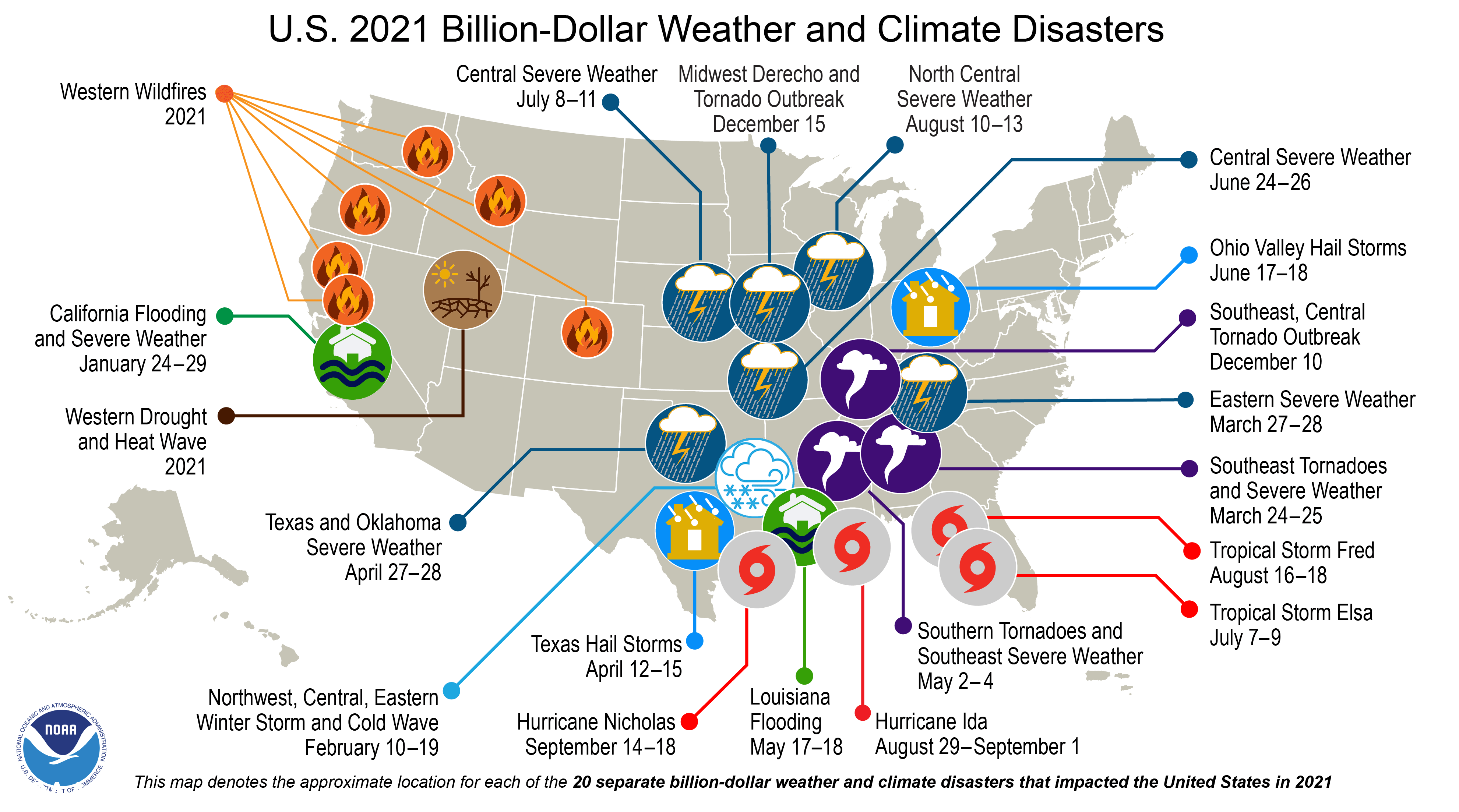

For example, companies would need to quantify the specific losses caused by climate-related events such as hurricanes, wildfires, drought, sea level rise and flooding. These losses could be due to supply chain disruptions, business interruption or direct impairment charges on the value of assets, according to the SEC.

The SEC's proposal comes as losses from climate change-related weather events are on the rise and projected to continue climbing. In 2021 alone, weather and climate-related disasters in the U.S. totaled $145 billion and killed hundreds of people. Globally, natural disasters caused about $280 billion in damages in 2021, according to the German insurer Munich Re.

Investor demand is growing

In its proposal, the SEC wrote that shareholders, investment advisers and investment management companies are increasingly seeking information about how climate conditions may impact their investments.

Many financial institutions have also formed or joined investor initiatives aimed at pressing companies for better information or for transitioning to a low-carbon future. Each of the 10 largest U.S. asset managers belong to at least two of these groups, with several belonging to more than 10 initiatives, according to a recent S&P Global Market Intelligence analysis.

Although these investor groups have encouraged more corporate climate disclosures, their voluntary nature has meant some companies did not provide a full suite of disclosures or opted out of participating some years, the SEC noted. This proliferation of third-party frameworks has also contributed to inconsistent and fragmented reporting, the agency said.

"We are concerned that the existing voluntary disclosures of climate-related risks do not adequately protect investors,” the SEC wrote. “For this reason, mandatory disclosures may be necessary or appropriate to improve the consistency, comparability, and reliability of this information.”