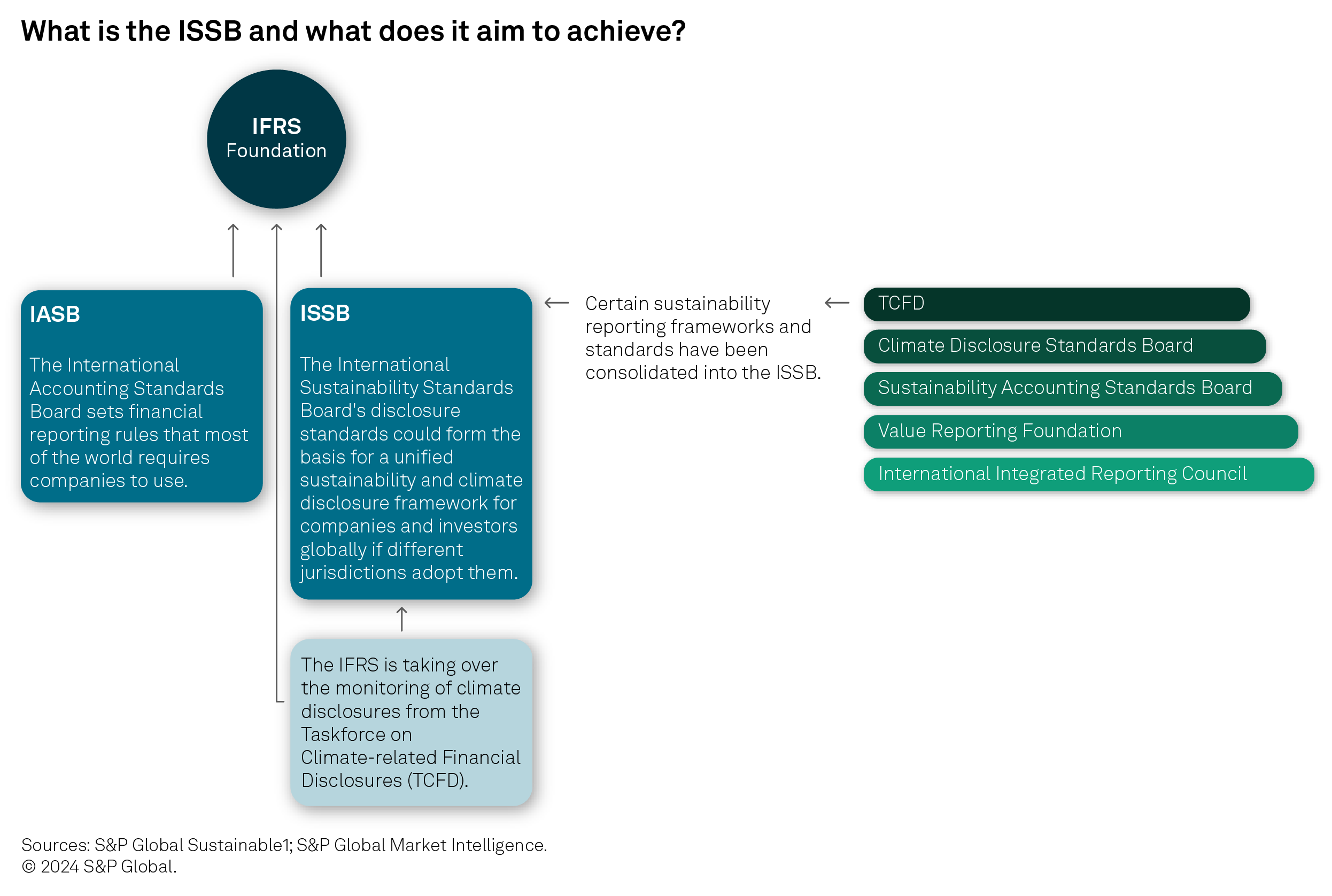

The International Sustainability Standards Board (ISSB) launched its first two sustainability-related standards in June 2023, effective for annual reporting periods on or after Jan. 1, 2024. The standards could form the basis of a consistent sustainability disclosure framework for companies and investors around the world. In this quarterly article, we bring you the latest global developments in the uptake of the ISSB’s standards.

Since the ISSB issued its first two global sustainability standards in June 2023, jurisdictions around the world have stated their intention to adopt the standards or align reporting frameworks with them. Adoption of the standards is gaining traction: As of Dec. 31, 2024, 13 jurisdictions have adopted the standards on a voluntary or mandatory basis with reporting starting as of Jan. 1, 2024, or Jan. 1, 2025, and 22 other jurisdictions are planning to adopt them in the future. Some of those jurisdictions in the process of adoption have finalized the creation of ISSB-aligned standards but have set a reporting date later in 2025. For example, the Hong Kong Institute of Certified Public Accountants published disclosure standards on Dec. 12, 2024, effective for reporting as of August 2025.

What can we expect from the ISSB in 2025?

The ISSB aims to continue its work on implementation of its IFRS S1 and IFRS S2 standards throughout the year. In the first half of 2025, the board plans to provide information on how companies should approach proportionality and scenario analysis to comply with the two standards, ISSB Chair Emmanuel Faber said on the ISSB’s podcast in December 2024. Proportionality addresses the challenges of employing the standards for smaller companies or companies less able to comply with the standards.

-

IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information: Companies are required to disclose sustainability-related risks and opportunities.

-

IFRS S2 Climate-related Disclosures: Companies are required to disclose specific metrics such as greenhouse gas (GHG) emissions, climate-related physical and transition risks and scenario analysis.

The board is also planning to focus on transition plan disclosures after assuming responsibility in June 2024 from the UK’s Transition Plan Taskforce as part of an effort to harmonize transition plan disclosures globally. “There is a huge need from the market,” Faber said of transition plan disclosure on the ISSB podcast. “Every month is adding to the pressure from the market for us to deliver that.”.

The board will also continue its work on developing the Sustainability Accounting Standards Board (SASB) standards. SASB is now part of the IFRS Foundation, and its standards form an integral part of the ISSB’s standards for industry-specific disclosures. For example, IFRS S2 guidance on industry-specific climate-related metrics is based on the SASB standards, according to the ISSB.

The board is planning to publish drafts of its amendments to 12 of the 77 industry-specific SASB standards in the first half of 2025. The amendments address eight standards for the Extractives & Minerals Processing industry, which includes oil and gas as well as metals and mining; one standard for Electric Utilities & Power Generators in the Infrastructure industry; and three SASB standards in the Food & Beverage industry.

The amendments will focus on whether the industry standards can be applied internationally, such as to value chains in emerging markets and developing economies, where information on value chains may be lacking. They will also seek to ascertain how the industry groupings might support proportionality, the ISSB said in a December 2024 paper on enhancing the SASB standards. The amendments will also address the international applicability of disclosure topics within the industry groups. Disclosure topics will include biodiversity, ecosystems and ecosystem services, which include benefits provided by nature such as pollination, carbon sequestration, erosion control and flood and storm protection, among others. The ISSB is conducting research on those topics as part of its 2024-2026 work program, with a view to potentially developing new standards related to these issues.

The ISSB also said in the paper that it had sought feedback from stakeholders, who had suggested adding some new disclosures and removing some among the industry-specific SASB standards. The ISSB said stakeholders had asked “for a less prescriptive” or "more principles-based approach” based on outcomes rather than specific rules. They had also requested that the standards “more directly” incorporate the main concepts of IFRS S1, which are governance, strategy, risk management and metrics and targets, it said. That would provide a wider view of how companies are managing their sustainability-related risks and opportunities, the board said. For example, some investors indicated that for a sustainability-related risk or opportunity, such as capital expenditure, they would be interested in finding out what actions the company is taking to respond to that risk or opportunity, and whether it has set any targets.

When looking at some of the specific disclosure topics and metrics, for example in biodiversity, ecosystems and ecosystem services, stakeholders are requesting the ISSB enhance or remove most of the quantitative data on water management metrics and explore including asset- or location-specific information related to water risks and opportunities.

The ISSB said its staff will continue its outreach and will develop drafts of the amendments in collaboration with SASB advisors. The drafts will be subject to approval by the ISSB.

What guidance is the IFRS giving on ISSB adoption?

The IFRS published on Nov. 19, 2024, a guide designed to help companies identify and disclose material information on how their sustainability-related risks and opportunities might affect cash flows, access to capital and cost of capital over the short, medium, and long term. It sets out the ISSB’s approach to materiality compared to other sustainability-related reporting standards. ISSB standards consider how sustainability issues could materially impact a company’s financial performance. The EU’s Corporate Sustainability Reporting Directive (CSRD) anchors the concept of “double materiality,” where companies need to think of reporting not only in financial terms but also in terms of how their business affects external stakeholders: the environment, employees, consumers and society.

The guide also highlights how companies can use IFRS S1 to disclose how their sustainability-related risks and opportunities might affect companies’ financial prospects. IFRS S1 explains how companies’ dependencies and impacts on resources and relationships through their value chains can result in sustainability-related risks and opportunities that might affect firms’ financial performance.

The guide provides an example of how an electronics manufacturer would consider the financial impact of sustainability-related risks through its value chain. It would consider third-party vendors in determining sustainability-related risks and opportunities because they generate cash flows for the company. Another potential consideration would be a change in the regulatory environment. For example, new rules on electronic waste might limit production on charging devices, thus affecting the company’s operations.

The guide also sets out examples of resources and relationships under IFRS S1, which can include the company’s workforce, the materials it uses, relationships with suppliers and assets in financial statements. It also covers dependencies and impacts, such as how a company might be dependent on water to operate its business model and how its activities might affect local water supplies.

The publication also highlights that companies already applying materiality judgements under the IFRS Accounting Standards — used by companies in more than 140 jurisdictions globally — can use them when using the ISSB standards. It shows how companies can follow a process closely aligned to a four-step process on materiality reporting published by the International Accounting Standards Board, the standard-setting body of the IFRS Foundation.

How are regulators and companies adopting the standards?

Ultimately, the standards will only take effect for corporate reporting if jurisdictions adopt them. The International Organization of Securities Commissions (IOSCO) endorsed the ISSB standards a month after their initial publication, signaling support for adoption in the 130 jurisdictions it represents. The organization is now providing guidance to regulators in integrating the standards into local rules and regulations to encourage alignment with the ISSB standards and minimize different applications of the standards across jurisdictions.

Some jurisdictions have been taking different approaches to adopting and applying the standards, including adopting the standards with modifications for their local market. For example, the Canadian Sustainability Standards Board issued on Dec. 18, 2024, its first two sustainability disclosure standards based on IFRS S1 and IFRS S2. While the two standards are largely aligned with those of the ISSB, they grant companies more time for adopting some of the reporting requirements. For example, companies have a transition period of two years for disclosing sustainability-related risks other than climate, compared with one year under the ISSB. Companies also have a period of three years to prepare for reporting on the emissions throughout their value chain, known as Scope 3 emissions, instead of one year under the ISSB. They will also have three years of relief compared to the ISSB’s one year to align reporting on financial and sustainability disclosures, with reporting required within the first six months following the second- and third-year end, respectively.

The ISSB said on Nov. 12, 2024, that some jurisdictions had changed their initial proposals following feedback from stakeholders to ensure alignment with the ISSB stakeholders. Australia is a case in point. After stakeholder feedback on Australia’s proposed standards and following approval of the standards by the Australian Accounting Standards Board on Sept. 20, 2024, AASB S1 reflects IFRS S1 more closely and is a voluntary standard requiring entities to disclose information about all sustainability-related risks. Japan announced on Nov. 29, 2024, revisions to its proposed sustainability standards following feedback from stakeholders. In a letter to the Sustainability Standards Board of Japan (SSBJ) on July 31, 2024, Norges Bank Investment Management, one of the world’s largest asset managers, pointed to several differences between the Japanese proposals and the ISSB standards, including their calculation periods for certain metrics, something that the SSBJ is now proposing to change.

“Stakeholders, in particular investors and companies with significant cross-border operations expected to be subject to more than one set of jurisdictional requirements, perceive a risk in replacing the current patchwork of voluntary initiatives with regulatory fragmentation should jurisdictions modify ISSB Standards extensively,” the ISSB said on Nov. 12, 2024. Companies that have international operations are also calling for alignment with the “global baseline” of ISSB standards to streamline their reporting requirements and to avoid “unnecessary burden,” the ISSB said.

In a report published Nov. 12, 2024, the ISSB said it had reviewed publicly available reports of listed and private companies across jurisdictions, and 1,151 companies had referenced the ISSB in climate-related disclosure reports between October 2023 and March 2024, with the largest share in Asia-Pacific. In Africa and Asia-Pacific, about half of the 554 companies that referred to the ISSB mentioned their current or future alignment in reporting with the sustainability-related disclosure requirements.

Out of the 1,151 companies, the financial sector had the largest share of companies referencing the ISSB at 372 companies, with 65% providing a general reference and 28% mentioning the ISSB as part of plans to align reporting of sustainability-related disclosure requirements with the ISSB standards. The other7% currently report in line with the standards.

How do the EU’s CSRD and the US Securities and Exchange Commission (SEC) climate disclosure standards compare to the ISSB standards?

The EU has widened the reach of its sustainability reporting regulations for companies through the reform of its Non-Financial Reporting Directive to create the CSRD, which is being phased in from Jan. 1, 2024. Companies in the scope of CSRD are subject to a set of sustainability standards called the European Sustainability Reporting Standards (ESRS). The ISSB published on May 2 interoperability guidance with the European Financial Reporting Advisory Group, a technical advisor to the European Commission, to show to what extent the ISSB standards and the ESRS align and how a company can apply both sets of standards. The guide includes information on how the ISSB standards and the ESRS align on general sustainability disclosures as well as climate disclosures.

Under the ESRS, companies are required to disclose material environmental, social and governance impacts and risks within their upstream and downstream value chains — for example, Scope 1, 2 and 3 emissions as well as total GHG emissions.

In the US, the SEC said in its rule that its reporting framework has elements in common with the TCFD recommendations. The rule, issued in March 2024 but halted a month later to allow legal challenges against it to proceed, requires companies registered under its mandate to disclose at least some material climate-related information, such as risk management practices and risks to their strategy or financial performance. Some larger companies will be required to disclose Scope 1 and Scope 2 GHG emissions — or the emissions associated with their operations and with their purchased energy — but only if the companies deem those emissions to be material. The SEC acknowledged in the final rule there were “similarities” between the ISSB standards and its rule but said it would not recognize the ISSB standards as an alternative reporting regime for the time being.

The future of the US climate rule is uncertain following the election of President Donald Trump, whose nominee to lead the SEC, Paul Atkins, is a former SEC commissioner who opposed the rule when it was proposed. Atkins and four other former members of the SEC argued in a comment letter in 2022 that the rule would overstep the SEC’s statutory mandate and should be rescinded or substantially modified.

Predating the SEC rule, California approved a law in October 2023 that would require large companies doing business in the state to begin reporting Scope 1 and Scope 2 emissions in an annual report starting in 2026, with Scope 3 reporting beginning in 2027. An amendment to the law signed in September 2024 gave the California Air Resources Board (CARB) more flexibility in developing the reporting rules companies will follow to comply with the law but did not change the compliance dates for emissions reporting. CARB announced on Dec. 5, 2024, it would “exercise its enforcement discretion” in the first year of reporting to allow companies more time to prepare for the new rules.