Regulation is shaping the sustainability agenda and changing the way companies do business in different jurisdictions, but keeping pace with constant regulatory updates has become a mammoth task for businesses and investors. In this recurring series, S&P Global Sustainable1 presents key regulatory developments from around the world.

In this month’s update, we look at new guidance on EU taxonomy disclosures, a growing push toward regulating ESG ratings providers in Europe and India, a carbon emissions disclosure bill in California and new ESG disclosure rules in China.

Europe United States and Canada Asia-Pacific

Europe

European Commission adopts proposal on human rights and environmental protection in supply chains

The European Commission on Feb. 23 adopted a proposal that would require many European firms to identify and tackle potential labor abuses and environmental damage throughout their supply chains. Some EU member states already have rules in place that address these issues, but the proposal will create consistency and level the playing field across the bloc, the commission said. Member states would be tasked with levying fines for noncompliance, and victims would have the ability to take legal action for damages that would have been prevented by compliance. The proposal will now be negotiated between European Parliament and the EU member states. If adopted, member states would then have two years to transpose the rules into their national laws.

EU securities markets regulator sets sights on greenwashing

The European Securities and Markets Authority, or ESMA, is planning to make tackling greenwashing one of its key priorities over the next three years, as it develops rules to oversee the fast-growing environmental, social and governance investment space. According to its new sustainable finance roadmap, released Feb. 11, the regulator will seek to give a clearer definition of greenwashing amid surging demand for ESG-related investment funds. It laid out two other priorities: building out its own sustainable finance skillset and helping EU member state regulators do the same, and indentifying emerging risks that could have an impact on investors and financial market stability.

ESMA gathering information on ESG rating providers

ESMA on Feb. 3 said it was seeking information about the work of ESG rating providers in the EU. Regulators have expressed concerns about potential conflicts of interests in the ESG ratings space. ESMA has asked EU ESG rating providers and their users as well as rated companies for information about revenues, structure, and product offerings. The request for information is open until March 11, and the results feed into the policy process. The move will complement a separate public consultation planned by the European Commission. (Other jurisdictions are also looking at this issue; see the Asia-Pacific section below.)

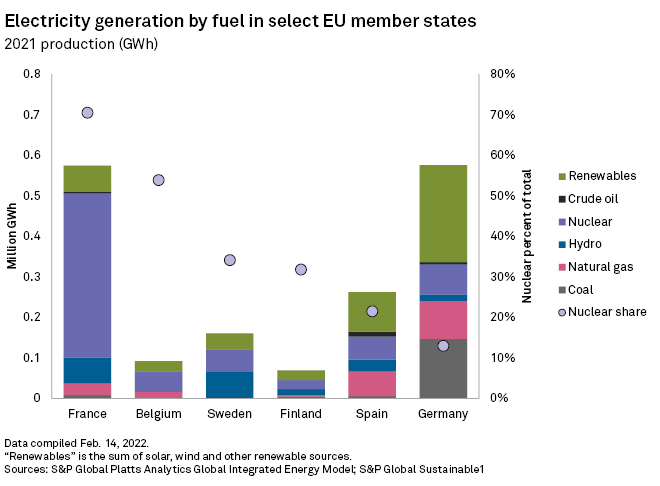

EU pushes ahead with plan to include natural gas and nuclear power in green taxonomy

The EU’s executive arm, the European Commission, on Feb. 2 published a plan to include natural gas and nuclear power in its green taxonomy, a kind of dictionary defining sustainable investments. The controversial proposal, which drew criticism from the EU’s expert group, will be adopted unless 20 out of the 27 member states representing 65% of the EU's population vote to block it in the European Council, or, unless a majority of the European Parliament votes against it in a plenary session. Nuclear projects permitted until 2045 will be classified as green if countries can safely dispose of toxic waste and do not create significant harm to the environment. Gas will be considered sustainable if it replaces coal generation, and operators need to show they can switch to low-carbon gases from 2035. If approved, the rules will apply in January 2023.

Click here to read more about what including nuclear and natural gas in the EU taxonomy could mean for investors and asset managers.

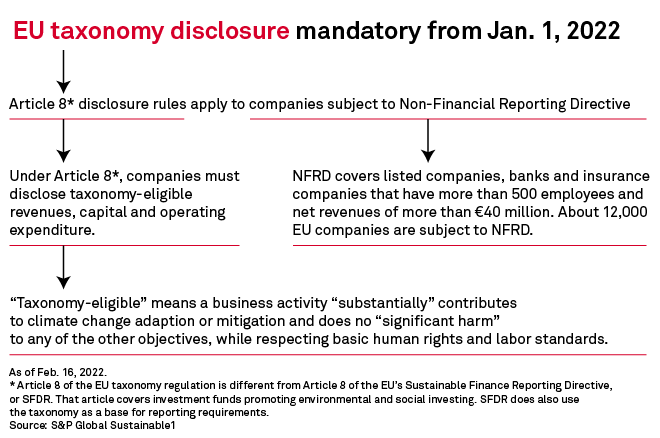

EU publishes guidance on taxonomy disclosures

On Feb. 2, the EU published the second part of guidance for reporting taxonomy-eligible assets and activities under Article 8 of the taxonomy regulation. The document explains who must comply with the regulation, how a business activity counts as taxonomy eligible and how to report. Under Article 8 of the taxonomy regulation, companies subject to the EU’s Non-Financial Reporting Directive, or NFRD, must report how much of their revenue, capital expenditure and operating expenditure are "taxonomy eligible." Reporting what revenue is aligned with the taxonomy will begin from 2023. Article 8 of the EU taxonomy applies from Jan. 1, 2022 for the first two of the taxonomy’s six objectives: climate change adaptation and mitigation. The other four – water and marine protection; circular economy; pollution prevention; and biodiversity – will apply from Jan. 1, 2023.

ESMA seeks comment on incorporating sustainability data collection in MiFID rules

ESMA launched on Jan. 27 a consultation on sustainability-related amendments to the Markets in Financial Instruments Directive, or MiFID II, the financial markets regulation designed to protect investors. Investment firms would have to collect data on clients’ sustainability preferences and propose products accordingly. Firms would also have to give staff appropriate training in sustainability. The consultation closes on April 27, and ESMA will publish a final report in the third quarter. MiFID II came into force in 2018, with the aim of increasing transparency in financial markets. An amendment adopted on April 21, 2021, requires investment firms to provide clients with sustainable products if they wish. The rules will come into force on Aug. 2, 2022.

ESG disclosure becoming mandatory for EU banks

On Jan. 24, the European Banking Authority announced new ESG disclosure requirements for EU banks, effective from 2023 and 2024. Lenders will have to disclose their exposure to carbon-intensive activities and assets at risk of impacts from climate change. They will also have to disclose their exposure to fossil fuel clients, financed carbon emissions and to what extent their financing activities align with net zero goals. The regulator has created a Green Asset ratio, or GAR, to be introduced from December 2023 and a Banking Book Taxonomy Alignment ratio, or BTAR, effective in June 2024, both based on the EU taxonomy. The GAR will calculate what proportion of a bank’s assets are green, using disclosure rules under Article 8 of the EU taxonomy. The BTAR will measure how much of a bank’s financing is climate friendly among non-financial corporations not subject to the NFRD. The introduction of these disclosure standards comes at a time when regulators are becoming increasingly concerned about how financial institutions are managing climate risk.

United States and Canada

California bill requires companies to disclose carbon emissions

The California Senate passed a bill Jan. 26 requiring corporates with more than $1 billion in annual revenue doing business in California to disclose all scopes of their greenhouse gas emissions. The Climate Corporate Accountability Act now goes to the state assembly for committee work before a final version is produced and forwarded to Democratic Gov. Gavin Newsom for a signature. The bill would require the California Air Resources Board to adopt regulations by Jan. 1, 2024, and large corporations would begin reporting their emissions to the state sometime in 2025. Their emissions must first be independently verified by a third-party auditor approved by the state.

Asia-Pacific

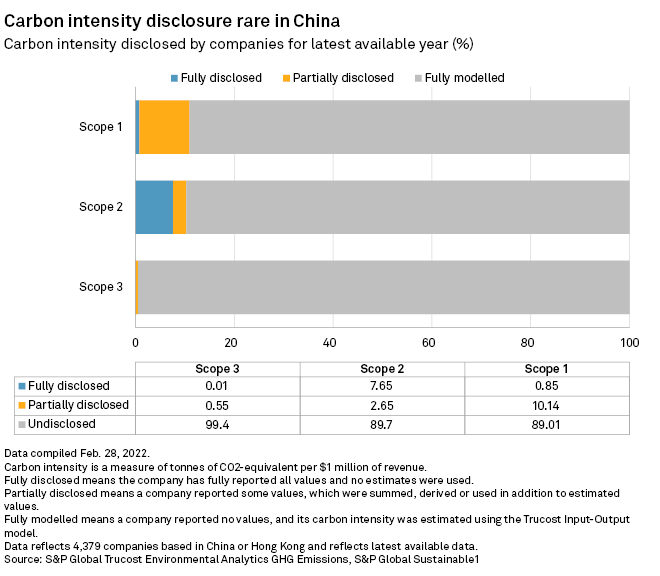

China introduces new environmental disclosure rules

Listed Chinese companies and bond issuers will have to disclose environmental information annually from Feb. 8, under new rules set by China’s Ministry of Ecology and Environment. They will have to disclose information on how they manage their environmental footprint, carbon emissions and pollution, as well as emergency plans for any environmental incidents. Companies will also have to disclose how climate change and the environment will impact their investment and financing decisions.

India explores regulation of ESG ratings providers

The Securities and Exchange Board of India published a consultation paper on Jan. 24 exploring how to regulate ESG rating providers. The paper suggested requiring providers to apply for accreditation to operate in India, with a review of accreditation every two years. The board said it had decided to propose the rules over what it described as concerns around the unregulated nature of the space, inconsistencies in disclosures and a lack of India-specific ESG rating providers. It has requested comments before March 10.

Malaysian stock exchange posts governance and diversity requirements

New requirements by the Malaysian stock exchange, Bursa Malaysia, will limit the length of time an independent director can stay on the board of a listed company to 12 years. Independent directors serving longer than this must resign or become non-independent directors by June 1, 2023. Listed companies with a market capitalization of 2 billion Malaysian ringgit, or about $478.5 million, must appoint at least one woman to their boards by Sept. 1, 2022. Companies with a smaller market cap must comply with the rules by June 1, 2023.

Singapore-listed companies subject to climate disclosures

As of Jan. 1, 2022, companies listed on the Singapore Exchange need to include climate disclosures in their sustainability reports, or explain why they have not done so. Disclosures must be in line with the Task Force on Climate-Related Financial Disclosures. In addition, companies must internally review their sustainability report, and directors must undergo training on sustainability. Companies also have to implement a board diversity policy and include details of diversity targets, plans, timelines and progress in their annual reports. Climate reporting will be mandatory from 2023 for the financial, agriculture, energy, food, and forest products sectors. The rules will apply to the materials and buildings sectors as well as the transportation industries from 2024.

This list is not exhaustive, and information is current as of the publication date. If there are more significant regulatory developments we should cover going forward, please reach out to Jennifer Laidlaw at jennifer.laidlaw@spglobal.com. We welcome feedback.

This piece was published by S&P Global Sustainable1 and not by S&P Global Ratings, which is a separately managed division of S&P Global.