Regulation is shaping the sustainability agenda and changing the way companies do business in different jurisdictions but keeping pace with constant regulatory updates has become a mammoth task for businesses and investors. In this recurring series, S&P Global Sustainable1 presents key environmental, social and governance regulatory developments and disclosure standards from around the world.

In this month's update, we explore the International Sustainability Standards Board’s new climate and sustainability standards, the European Commission’s new rules on renewable hydrogen, India’s proposals for ESG disclosure rules and more.

International Europe Asia-Pacific United States and Canada

International

ISSB plans to issue climate and sustainability standards by end of June

The International Sustainability Standards Board (ISSB) on Feb. 16 agreed to move forward on standards that would form the basis for a unified disclosure framework for companies and investors globally. The ISSB’s proposed climate standard would direct companies to disclose information on their climate-related exposure and their strategy for addressing climate risks. Under the board’s general requirement disclosure proposal, companies would have to provide information on sustainability-related risks to investors, lenders and other creditors to help them assess a company’s total value. The ISSB plans to draft and review the standards and then issue them by the end of June. They would be effective from the beginning of 2024. The standards are not binding but would establish a global baseline amid calls for consistency in ESG disclosure frameworks.

Europe

European Commission proposes rules on renewable hydrogen

The European Commission on Feb. 13 proposed new rules to define renewable hydrogen and to ensure that all renewable fuels of non-biological origin — the vast majority of which are hydrogen based — are produced from renewable electricity. The first delegated act as proposed includes phasing in requirements for additional renewables to 2028 and monthly matching with contracted power until 2030. Member states can introduce stricter rules on temporal matching of renewables and hydrogen production from July 2027. A second delegated act would provide a methodology for calculating lifecycle greenhouse gas emissions for renewable fuels of nonbiological origin, most of which are hydrogen based. The European Parliament and European Council have two months to scrutinize the acts. They can either accept or reject the proposals but cannot amend them. The scrutiny period can be extended by two months.

EU legislators reach agreement on green bond standard

The European Parliament and the Council of the EU, made up of government ministers of the 27 EU member states, reached an agreement on Feb. 28 on the European Commission’s proposal for a European Green Bond Regulation. Companies using the standard must disclose information on how the bond’s proceeds will be used and show how the money fits into their transition plans. Under the regulation, issuers must demonstrate that 85% of the funds raised by their green bonds are financing projects in line with the EU's green taxonomy. The regulation also establishes a registration system and supervisory framework for external reviewers, which are independent entities that will provide an opinion on the EU taxonomy alignment of the issuer’s bonds.

European Commission proposes new emission reduction targets for new heavy-duty vehicles

The European Commission on Feb. 14 proposed emission reduction targets for heavy-duty vehicles as of 2030 to help cut emissions in the transport sector. Trucks, city buses and long-distance buses are responsible for over 6% of EU greenhouse gas emissions and more than 25% of emissions from road transport, the Commission said. Under the plan, almost all new heavy-duty vehicles will have to reduce emissions by 45% from 2030 compared to 2019 levels, by 65% from 2035 and by 90% from 2040. The Commission is also proposing that all new city buses emit zero emissions from 2030. The proposals are designed to help the EU meet the objectives of its European Green Deal, which aims to make the EU net-zero by 2050.

European Commission launches call for advice from regulatory authorities on ESG risks at financial firms

The European Commission on Feb. 1 launched a call for advice from the European Banking Authority (EBA) and the European Securities and Markets Authority (ESMA) on prudential requirements applicable to investment firms and asked the regulators to assess whether environmental, social and governance (ESG) risks need additional specific requirements beyond what exists in the current prudential framework. In the paper, the Commission said the assessment should include information on whether there was a need to consider ESG risks further in the global standards for banks known as Pillar 1, Pillar 2 and Pillar 3. Pillar 1 establishes minimum capital requirements, while Pillar 2 addresses risk management and supervision. Pillar 3 focuses on disclosure requirements. The Commission said the EBA could build on or refer to its existing work in its analysis. The EBA is making climate disclosure for banks mandatory as of December 2023.

UK financial regulator launches discussion paper on sustainability-related governance at investment firms

The UK’s Financial Conduct Authority on Feb. 10 published a discussion paper to seek views on sustainability-related governance, incentives and competence in regulated firms. The regulator said its questions will focus on whether firms have environmental or social objectives and how these are reflected in their policies and strategies; how firms design their approaches to governance, remuneration, incentives, training and competence; and whether existing rules and guidance in these areas are appropriate or need to be refined to adapt to a changing market. Stakeholders have until May 10 to reply. The FCA will use feedback from the paper to direct its future regulatory approach.

Asia-Pacific

Japan’s cabinet approves policy roadmap for green transformation

The Japanese government on Feb. 10 approved a Green Transformation policy that sets out Japan’s strategy for meeting its goal of net-zero carbon emissions by 2050. The policy includes using nuclear power, boosting renewables and introducing a carbon-pricing mechanism to help the energy transition. Under the plan, Japan will consider replacing nuclear reactors scheduled to be decommissioned with next-generation reactors. The policy includes the launch of an emissions trading scheme in the 2026-27 financial year. There will be a voluntary phase for companies for the three-year period ending March 2026. The plan will also introduce a carbon surcharge for fossil fuel importers from the financial year 2028-29.

Philippines securities market regulator publishes draft guidelines for sustainability-linked bond issuers

The Philippines Securities and Exchange Commission on Feb. 2 published draft guidelines for companies issuing sustainability-linked bonds, which are debt instruments whose financial or structural characteristics vary based on whether the issuer meets predetermined ESG key performance indicators, or KPIs. The guidelines are based on standards issued by the Association of Southeast Asian Nations in October 2022. Issuers must select performance indicators that are material to their business strategy and set targets to reach them. The KPIs must also be disclosed in an issuance document published on a publicly available website.

India securities market regulator proposes ESG disclosure verification rule

The Securities and Exchange Board of India on Feb. 20 proposed new ESG disclosure rules that would require companies to have their sustainability-related disclosures verified by a third party. India introduced reporting standards in 2021, becoming mandatory for 1,000 listed companies in the 2022-2023 financial year. The standards require reporting metrics such as gender diversity, carbon emissions intensity and water consumption. The largest 250 listed Indian companies would be subject to the proposed verification rules for the 2023-2024 financial year. Over the two subsequent financial years, the rules would be expanded to cover 500 and 1,000 companies, respectively. The proposal also aims to set a limited number of disclosures on companies’ supply chains for the largest 250 listed companies on a comply-or-explain basis from financial year 2024-2025. Third-party verification will become mandatory the following year.

United States and Canada

Canada announces plan to boost creation of sustainable jobs

The Canadian government announced on Feb. 17 a Sustainable Jobs Plan as part of its strategy to become a net-zero economy. The initial plan will be developed from 2023 to 2025 with input from provinces and territories, Indigenous partners, industry and other stakeholders. Additional sustainable jobs plans will be issued every five years from 2025. It includes establishing a Sustainable Jobs Secretariat and creating a Sustainable Jobs Partnership Council. The plan will also develop economic strategies, advance funding for skills development in sustainable jobs and improve labor market data collection, tracking and analysis. According to the government, the Royal Bank of Canada estimates the net-zero transition could create up to 400,000 new jobs in Canada by 2030.

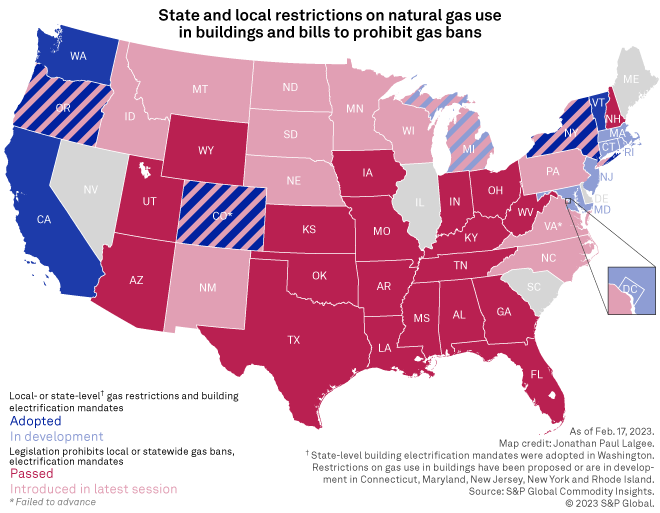

New Jersey governor issues executive order to ensure 100% renewable electricity by 2035

New Jersey Governor Phil Murphy announced a series of executive orders on Feb. 15 designed to speed up the state’s energy transition. Under Executive Order No. 315, New Jersey is targeting that 100% of electricity sold in the state be sourced from renewable energy by Jan. 1, 2035. Executive Order No. 316 aims to install zero-carbon-emission space heating and cooling systems in 400,000 homes and 20,000 commercial properties and make 10% of all low-to-moderate-income properties ready for electrification by 2030. In another executive order, No. 317, Murphy directed the New Jersey Board of Public Utilities to open proceedings to plan for the future of gas utilities in the state, a step other US states have taken.

This piece was published by S&P Global Sustainable1 and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Navigate the regulatory landscape with essential intelligence |

This list is not exhaustive, and information is current as of the publication date. If there are additional significant regulatory developments we should cover going forward, please reach out to Jennifer Laidlaw at jennifer.laidlaw@spglobal.com. We welcome feedback.