Regulation is shaping the sustainability agenda and changing the way companies do business in different jurisdictions, but keeping pace with constant regulatory updates has become a mammoth task for businesses and investors. In this recurring series, S&P Global Sustainable1 presents key environmental, social and governance regulatory developments and disclosure standards from around the world.

In this month’s update, we look at the EU’s Nature Restoration Law, how Australia aims to develop a sustainable finance taxonomy and China’s plan to limit its methane emissions.

Europe United States and Canada Asia-Pacific Latin America and the Caribbean

EUROPE

EU strikes deal on Nature Restoration Law

The European Parliament and the Council of the EU, made up of government ministers of the 27 EU member states, reached an agreement on Nov. 9 over the European Commission’s proposed Nature Restoration Law, which sets a target for the EU to restore at least 20% of its land and sea areas by 2030. The regulation covers a range of terrestrial, coastal and freshwater ecosystems, including wetlands, grasslands, forests, rivers and lakes, as well as marine ecosystems, including seagrass, sponge and coral beds, the Council said. It requires member states to implement measures to restore at least 30% of habitats in poor condition by 2030, a target that rises to 60% by 2040 and 90% by 2050, it said. Once the Parliament and the Council formally adopt the regulation, it will enter into force 20 days after publication in the Official Journal of the EU. Member States then will have two years to submit their first nature restoration plan to the Commission.

EU legislators reach agreement on regulation to reduce methane emissions

The European Parliament and the Council of the EU agreed on Nov. 15 to a new regulation designed to reduce methane emissions and help the EU reach its goal of reducing net greenhouse gas emissions by at least 55% by 2030. Under the regulation, fossil fuel companies will have to quantify and measure their methane emissions and provide reports to the relevant authorities. They will have to check their equipment regularly to detect and repair methane leaks on EU territory within a specific deadline. The regulation also bans oil and gas companies from releasing methane emissions into the atmosphere on a regular basis or from burning methane. It also limits the release of methane from thermal coal mines from 2027, with stricter conditions after 2031. Companies operating in the oil, gas and coal sectors will be required to monitor emissions in inactive or abandoned assets and adopt a plan to mitigate those emissions. The regulation also aims to address methane emissions from imported fossil fuels by establishing a database on methane emissions reported by importers and EU operators. As of January 2027, new import contracts for oil, gas and coal can only be signed if exporters submit to the same monitoring, reporting and verification obligations as EU producers, the regulation said.

EU legislators come to agreement on new environmental crime law

The European Parliament and the Council of the EU on Nov. 16 came to an agreement over new rules that would protect the environment through criminal law. The new directive, proposed by the Commission in 2021, replaces an existing law passed in 2008 and increases the number of offenses that currently exist under EU criminal law to 18 from nine, the Council said. The new offenses include timber trafficking, illegal ship recycling, and the illegal trade and handling of chemicals or mercury. The law also introduces a “qualified offense” clause, which would include offenses comparable to “ecocide” such as widespread pollution or large-scale forest fires, the Parliament said. The new law also imposes stiffer penalties for breaking the law, with prison sentences of up to 10 years and higher fines.

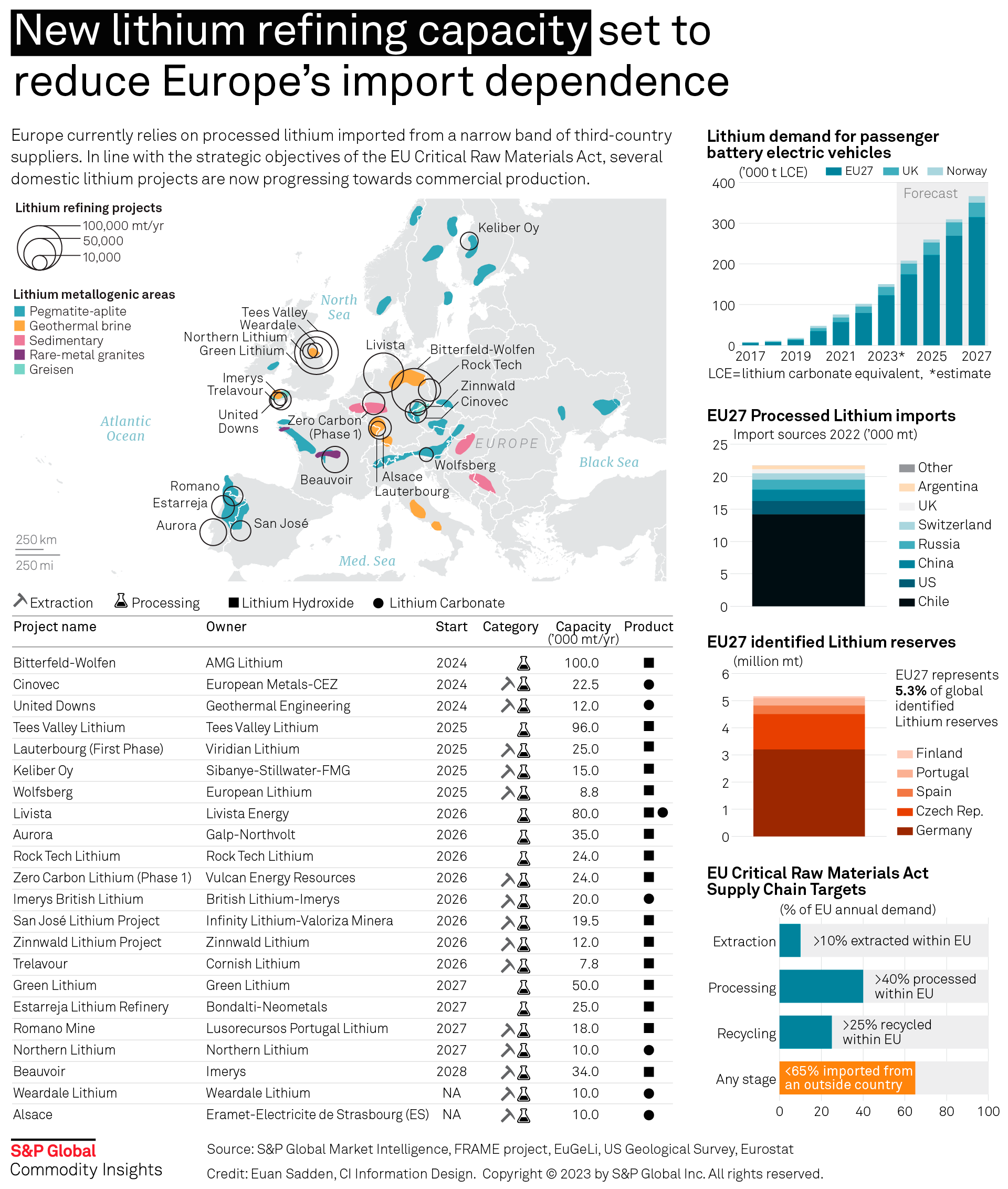

EU legislators agree on raw materials rules to protect supply chains

The European Parliament and the Council of the EU on Nov. 13 agreed on new rules setting thresholds for critical raw material supply within the EU following a proposal by the European Commission earlier in 2023. Under the agreement, domestic mining and extracting capacity of strategic raw materials would need to satisfy at least 10% of domestic demand by 2030. Processing and refining capacity for the materials would be targeted at 40% of demand, and a further 25% of demand would be met by recycling. The regulation also set out measures for the EU to diversify its critical raw material imports, the Council said. No more than 65% of annual consumption of each material should come from a single foreign country by 2030, it said. Critical raw materials such as lithium, nickel and cobalt are essential for the energy transition as they are needed for batteries and electrification. The proposed rules are part of the EU’s Green Deal Industrial Plan, announced in January 2023.

UK financial regulator issues rules on sustainable investment labels

The UK Financial Conduct Authority (FCA) on Nov. 28 issued its sustainability disclosure requirements, which create four product labels it said are designed to guide and protect investors when making sustainable investments. Under the Sustainability Focus label, a minimum of 70% of a sustainable investment’s assets must meet an evidence-based standard. The Sustainability Improvers label applies to assets that aim to improve their environmental and social sustainability outcomes over time. The Sustainability Impact label applies to products that measure a positive environmental and social impact, while the Sustainability Mixed Goals label applies to investment products that contain a mix of sustainability objectives. The FCA also launched a consultation on guidelines for investment firms to ensure their sustainability-related claims are clear and do not mislead investors. The rules will be effective from May 31, 2024, and investment firms can start using the labels from July 31, 2024.

UNITED STATES AND CANADA

US Federal Insurance Office to collect data from insurers to assess climate-related financial risks

The US Department of the Treasury's Federal Insurance Office (FIO) said on Nov. 1 it is planning to collect data from insurers to assess climate-related financial risk to consumers across the US. The largest insurers accounting for 70% of homeowners insurance premiums nationwide will be asked to provide data on their home insurance policies at a zip-code level. The FIO said the data is critical to understanding how climate-related financial risks affect the population following decisions by some insurers to exit certain markets and significantly raise premiums in several states. In 2022, insurance covered only 60% of the $165 billion in total economic losses from climate-related disasters, the FIO said. If approved, data collection would begin in 2024.

ASIA-PACIFIC

Australia lays out plans for sustainable finance taxonomy

Australia announced plans for the development of its sustainable finance taxonomy, or dictionary of sustainable activities, under a new sustainable finance strategy published on Nov. 2. The taxonomy would be aligned with those in other jurisdictions and would start with climate objectives, with the aim to expand to other sustainability objectives such as nature and circularity in the economy. It would use the “do no significant harm” principle, where progress on one objective cannot come at the expense of another. The government also plans to consider how taxonomy criteria could be incorporated into corporate reporting requirements, transition planning frameworks, and labelling schemes for sustainable investment products. A government body would oversee the use of taxonomy once the tool is established. Taxonomies have been springing up globally to steer investments into sustainable activities. The strategy also aims to set up a framework for sustainability-related financial disclosures and create labels for sustainable investment products.

Hong Kong Stock Exchange delays mandatory climate reporting for listed companies by a year

The Hong Kong Stock Exchange said on Nov. 3 that it had decided to push back mandatory climate reporting for listed companies to Jan. 1, 2025, from Jan. 1, 2024, as it awaits guidance from the International Sustainability Standards Board (ISSB). The stock exchange’s disclosure requirements will be based on the ISSB’s two sustainability-related disclosure standards, published in June. The exchange said it was awaiting the publication of the ISSB’s adoption guide, expected by the end of 2023. The guide is designed to support regulators in how to implement and phase in the standards, the stock market regulator said. The delay would give issuers more time to adjust to the new requirements, the stock exchange said. It also said the Hong Kong government would work with financial regulators and stakeholders to adopt the standards in a way that would allow Hong Kong’s financial services to be in line with international standards.

China publishes plans to limit methane emissions

The People’s Republic of China published on Nov. 7 its Methane Emissions Control Action Plan, which sets out measures to control methane emissions in several industries, including agriculture, oil and gas, coal, waste and wastewater treatment. It also aims to control venting of methane from oil and gas fields, as well as encourage oil and gas companies to recycle associated gas and vented gas based on local conditions. It also seeks to increase the capture of methane from manure and will introduce incentives to use methane for heating and power generation. The utilization rate of livestock manure would reach more than 80% by 2025 and more than 85% by 2030 under the plan. According to the International Energy Agency, China is the world’s largest methane emitter.

LATIN AMERICA AND THE CARIBBEAN

Panama launches consultation on sustainable finance taxonomy

Panama’s banking regulator, Superintendencia de Bancos de Panamá, launched on Nov. 15 a month-long consultation on a sustainable finance taxonomy that would mobilize capital flows to investments considered essential for the country’s transition to a sustainable economy. The proposed taxonomy has seven environmental objectives: climate adaptation; climate mitigation; protection and restoration of biodiversity; transition to a circular economy; sustainable use and protection of water; transition to a circular economy; and land management. It has also prioritized nine sectors and 65 economic activities within the sectors the taxonomy will focus on. Each of the economic activities must make a substantial contribution to each of the objectives, and the taxonomy would also apply the “do no significant harm” principle. A finalized version of the taxonomy will be published in the first quarter of 2024. The framework was developed by the United Nations Environment Programme Finance Initiative and financed by the Green Climate Fund and the European Union.

This piece was published by S&P Global Sustainable1 and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Navigate the regulatory landscape with essential intelligence |

This list is not exhaustive, and information is current as of the publication date. If there are additional significant regulatory developments we should cover going forward, please reach out to Jennifer Laidlaw at jennifer.laidlaw@spglobal.com. We welcome feedback.