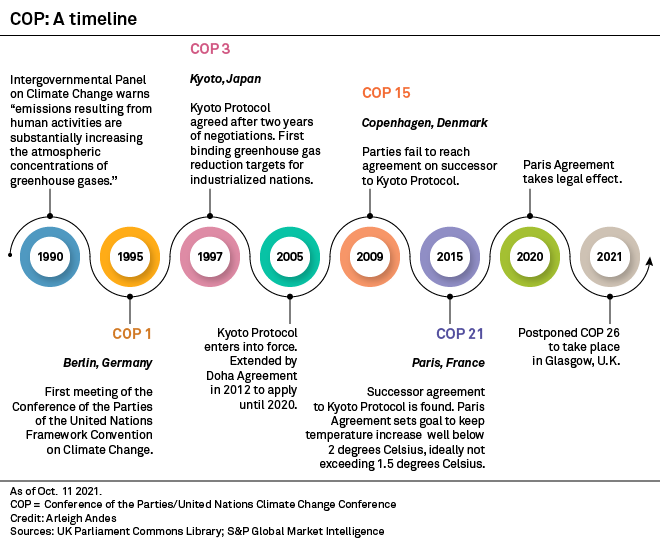

The 26th U.N. Climate Change Conference concluded on Nov. 12 after two weeks of deliberations between political and corporate leaders from around the globe on how to best combat climate change. The talks resulted in commitments for billions of investment in climate finance and to phase-out coal-fired generation in the coming decades, alongside an increased urgency to control greenhouse gas emissions to control global warming below 2 degrees Celsius.

ACCESS THE CONTENTTransition Finance

How public funding and private finance must work together to address climate need

On one end, trillions of dollars to invest in climate. On the other, huge and urgent need. How do we connect the dots? "We need to reimagine finance,” the CEO of the world’s largest asset manager said at COP26.

Financial institutions representing trillions of dollars have committed to tackle climate change but getting that money to the right place remains a huge challenge.

Public policies and private financing must converge to get money flowing into sustainable finance.

Green public spending will lift U.S. and EU GDP and encourage private investment in the transition, research from S&P Global Ratings shows.

ESG Insider Podcast: COP26 climate commitments send “clear signal” on how banks should finance transition

In this episode of the ESG Insider podcast, we talk to Samu Slotte, global head of sustainable finance at Danske Bank, Denmark’s largest bank by assets. Samu talks about Danske Bank’s recent decision to join the Net-Zero Banking Alliance, a group of banks committed to aligning the greenhouse gas emissions of their lending and investment portfolios with net zero by 2050 or sooner, in line with the Paris Agreement.

Listen & Subscribe to the PodcastIt’s important we see a shift in focus from long-term net zero goals to near-term targets with transparency on how these will be achieved. Evidence-based insights, high quality data and advanced analytics will be vital for supporting and underpinning the execution of these plans for companies and investors.

Follow Richard Mattison on LinkedInParis Agreement Alignment & Accountability

You need near-term accountability to meet long-term climate goals

As the global sustainability movement gains momentum, investors are pressing companies to tackle environmental, social and governance issues broadly and climate change specifically. As a result, boards and management teams are increasingly paying attention to climate change — a topic in the spotlight this November as global policymakers and corporate leaders convene in Glasgow for the U.N.’s 26th annual Conference of the Parties, or COP26.

ESG Insider Podcast: At COP26, why Article 6 matters to companies and investors

In this episode of ESG Insider, we talk with Kelley Kizzier, who was a lead Article 6 negotiator at previous COP gatherings, including in 2015 when countries reached the Paris agreement on climate change. Kelley, who is currently vice president for global climate at the Environmental Defense Fund, also recently joined the board of directors of the Taskforce on Scaling Voluntary Carbon Markets.

Listen & Subscribe to the PodcastNatural Capital

Natural Capital Valuation: An Incentive To Protect Nature?

Natural capital accounting pricing measures could potentially encourage more forest-friendly farming practices and help tackle global deforestation, a major issue in the fight against climate change.

Key Takeaways

- The sustainable use of natural resources and the preservation of nature is increasingly becoming a mainstream concern for policymakers and investors.

- While the general decline in nature is a global phenomenon, its effects are especially acute in agricultural-forest frontiers, such as the Brazilian Amazon.

- Using beef produced in the Brazilian Amazon as a case study for pricing nature in nature-dependent supply chains, noting that beef production is a key driver of deforestation in the region, we estimate a hypothetical cost of nature loss for Amazonian-sourced beef of US$4 billion in 2020, or 12% of Brazilian beef processors’ revenues for the same year.

- These illustrative hypothetical nature costs are currently not factored into the price of beef and are borne externally by society. Were these costs to be internalized in the price of beef, by using natural capital accounting pricing measures, they could potentially encourage more forest-friendly farming practices in the region.

Keep up with the latest ESG developments affecting business, trade, and capital investment by subscribing to our free newsletters.

SubscribeThe Role of Carbon Markets

The Energy Transition Atlas

Navigating a pathway to a low-carbon global economy requires a new plan. The S&P Global Platts Atlas of Energy Transition, produced in collaboration with S&P Global Market Intelligence, is your map to the sustainable commodity markets of the future.

Platts Future Energy Podcast: At the Heart of COP26: The Role of Carbon Markets

The landmark Paris Agreement was agreed back in 2015 with 29 different Articles. Almost all have been fleshed out, agreed upon and finalized - but Article 6 has not – given ongoing debates. And this Article's text will prove critical to how international voluntary carbon markets develop going forward – with these markets seeing unprecedented growth and interest as corporates take steps to address their carbon footprints.

Listen & Subscribe to the PodcastZero in on your net zero next steps with unparalleled data and insight to accelerate your journey.

Learn MoreTransition Risks

UN climate conference seeks concrete steps to tackle dirty, energy-hungry buildings

Global emissions from buildings must fall by 56% over the next 30 years to help limit global warming to 2 degrees C, according to S&P Global Platts Analytics modeling. On the current trajectory, emissions from buildings would decline only 7%.

The COP26 meeting in November is the first to properly call attention to the challenge of decarbonizing buildings, which are collectively responsible for 40% of energy-related carbon emissions. Europe has launched a particularly aggressive plan to taper emissions and energy use from buildings, requiring 35 million structures to be renovated by 2030.

Turning the building sector green

Reference Case Outlook shows the current trajectory for global emissions for the building sector until 2050. The 2-Degree Outlook shows how much the building sector must reduce emissions to limit global warming to 2 degrees C relative to pre-industrial levels.

Data Effective: August 21, 2021

Green Spending Or Carbon Taxes (Or Both): How To Reach Climate Targets, And Grow Too, By 2030?

The U.S. and EU have added green spending of about 1.4% and 3.9% of 2019 GDP to their COVID-19 recovery plans. With fiscal multipliers of 1.4-1.6, this could add up to 2 percentage points to U.S. GDP and 6.6 points to EU GDP by 2030.

Read the Economic ResearchInfographic: Surging cost of energy transition casts shadow over COP26 climate talks

Demand for carbon credits and rapidly reopening economies have seen a surge in the value of a basket of S&P Global Platts price assessments this year.

A deal in line with the UN's ambition to keep 1.5 degrees Celsius global warming within reach will increase demand for a range of low-carbon resources from hydrogen to battery metals, bringing the cost of the energy transition into sharper focus.

View the Infographic2025 Could Mark a Tipping Point for the Low-Carbon Energy Transition

The world must move faster to curb emissions and show concrete progress by 2025 or risk overshooting 2-degrees warming, according to an S&P Global Sustainable1 analysis of S&P Global Platts Analytics’ Future Energy Outlooks.

Read the Full ReportThe S&P Global Sustainable Finance Scientific Council brings together leading experts from academia, sustainability and finance, as well as major corporates and investors to foster an eanchge of ideas between these diverse stakeholders to help the global capital markets transtiion toward sustainability. Our recent report discusses climate change litigation and the case for better disclosure and targets.

Read the Full ReportPhysical Risk & Adaptation

Corporate Physical Assets Increasingly in Harm’s Way as Climate Change Intensifies

Vital corporate assets around the world, including factories, transportation networks and power transmission lines, are increasingly in harm’s way as the planet endures a growing number of catastrophic weather events linked to climate change, according to a new analysis by S&P Global Sustainable1.

In a comparison of industries, physical assets owned by the utilities, materials, energy, consumer staples and health care sectors face the greatest danger from the consequences of a warming world between now and 2050, according to S&P Global Trucost data.

Flooding Isn’t the Only Water-Related Climate Risk Facing New York City

New York City headed into Climate Week hard on the heels of flash flooding that claimed more than 40 lives.

The back-to-back climate disasters — the remnants of Hurricane Ida hammered the city less than two weeks after Hurricane Henri, and the resulting flash floods left New York subways and streets submerged — underscore the potential impact of climate change, and the destruction it can cause if large, urban centers fail to invest in adaptation infrastructure and if governments don’t take action to reduce emissions.

Read the Full ArticleNavigating a pathway to a low-carbon global economy requires a new plan. Our robust analytics and long history of experience provide a map to the sustainable commodity markets of the future.

LEARN MORELooking Ahead

COP26: Tension and Angst on Eve of Critical UN Climate Summit

When leaders from around the world gather in Glasgow, Scotland, on Oct. 31 for a pivotal climate summit, they will face a global crisis of unprecedented scope and magnitude.

Since nearly 200 nations came together for the landmark Paris Agreement on climate change in 2015, average global temperatures have risen another 0.3 degree C to reach more than 1.2 degrees above pre-industrial levels, data from NASA's Earth Observatory shows. This rapid warming trend has been accompanied by more extreme weather events that are affecting billions.

COP26: Former UN Climate Chief Draws Hope from Private Sector

Yvo de Boer has been in the room for almost every COP meeting, the United Nations climate change summit held annually since the mid-1990s, serving as executive secretary of the U.N. Framework Convention on Climate Change between 2006 and 2010. He is now president of the board at Gold Standard, a carbon offsetting organization advocating for more robust global emissions accounting. In an interview with S&P Global Market Intelligence, de Boer spoke about what success might look like at the upcoming COP26 summit in Glasgow, Scotland, and how technological progress provides "real hope" in the climate crisis.

Read the InterviewDiscover comprehensive data coverage and hyper-local insight on weather related risks and trends across asset locations, investment portfolios and supply chains.

Learn More