Subscribe to start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

SUBSCRIBE TO THE NEWSLETTERSMining Industry’s Energy Transition

Path to Net-Zero: Drive to Lower Emissions Pays in Metals, Mining Sector

Mining and metals companies that have established tough carbon reduction goals are hoping to cash in on the burgeoning market for sustainably produced raw materials.

S&P Global Market Intelligence found that 21 of the 30 largest metals and mining companies by market capitalization have set some level of net-zero greenhouse gas emissions target or are already claiming carbon neutrality, hoping to prove their commitment to reducing their emissions. Companies are feeling the pressure from customers with their own carbon reduction goals to get in line with the global reductions called for in the Paris Agreement on climate change.

Going green comes with expensive up-front costs, and in some cases new, lower emissions technologies will need to be invented to squeeze out the carbon. But there is an upside: Socially conscious investors and funds are looking to put money into companies with low emissions, increasing their valuations. And customers are willing to pay more too. The price of Good Western-origin premium duty paid in-warehouse Rotterdam aluminum was nearly 11% higher for a zero-carbon product, according to S&P Global Platts' low-carbon and zero-carbon aluminum benchmark price assessment published Dec. 9.

"There is a bottom-line imperative that you are going to be able to access a higher price," said Paul Bendall, global leader of mining and metals at PwC Australia. "You will have a cascading pricing structure based on the provenance of the metal and how much energy is used and where the energy came from."

Squeezing out the carbon

Downstream customers are demanding their suppliers shrink their carbon footprints, and mining companies are starting to respond. The five largest mining companies by market capitalization as of Sept. 30 — BHP Group, Rio Tinto Group, Vale SA, Glencore PLC, and Freeport-McMoRan Inc. — all committed to eliminating or offsetting their Scope 1 and Scope 2 greenhouse gas emissions by 2050 or sooner, according to a Market Intelligence analysis.

Metals Industry Needs Regulation or Framework to Make 'Green' Sales Viable: Miners

Global regulations or economic frameworks are needed to make green metal sales viable as the cost of decarbonization rises, according to major miners.

READ THE FULL ARTICLEESG Reporting in Mining Industry the 'Wild West'

Mining lags other sectors in reporting on its environmental, social, and governance goals as companies struggle with the lack of a single industry reporting standard.

READ THE FULL ARTICLEMine Developers Will Be 'Left Behind' Without Net-Zero Emissions Strategy

After a Nov. 16, 2021 IPO, Arizona Sonoran Copper Company outlined plans to develop the Cactus copper project in Arizona as a net-zero operation.

READ THE FULL ARTICLEMining Sector 'Wildly Unprepared' for Energy Transition – Black Mountain CEO

Black Mountain is a family of natural resource companies established and run by founder and CEO Rhett Bennett with a focus on "identifying and capturing high-growth opportunities in the global energy sector." Operations overseen by Bennett have mined millions of tons of sand for use in hydraulic fracturing for natural gas and drilled thousands of wells.

Read the Full ArticleEnergy Transition to Boost Demand for Copper, Nickel Over Next Decade: Macquarie

The energy transition is due to have a dramatic structural impact on a number of metals markets, especially copper and nickel, in the next five to 10 years, Macquarie analysts said at an Oct. 7 metals media briefing.

Read the Full ArticleBattery Metal Supply Chains

China's Energy Shortage Fuels Inflationary Pressure on Battery Supply Chain

China's energy shortage is curbing lithium and battery production, adding to inflationary pressures and supply tightness throughout the supply chain.

China sits at the center of the battery supply chain, refining the majority of the world's lithium, cobalt and rare earth elements, while also producing the bulk of the battery anodes, cathodes and electrolytes needed for electric vehicles. However, in a rush to preserve dwindling coal supplies and to ease heightened pollution levels, China has asked several industries to hit the brakes and lower their electricity use. The disruption is hitting battery suppliers and lithium suppliers, and it could drive up prices amid already tight supply conditions.

"We are rapidly seeing material price increases percolating down the value chain with some Chinese [battery] cell suppliers," Alla Kolesnikova, head of data and analytics at Adamas Intelligence, told S&P Global Market Intelligence.

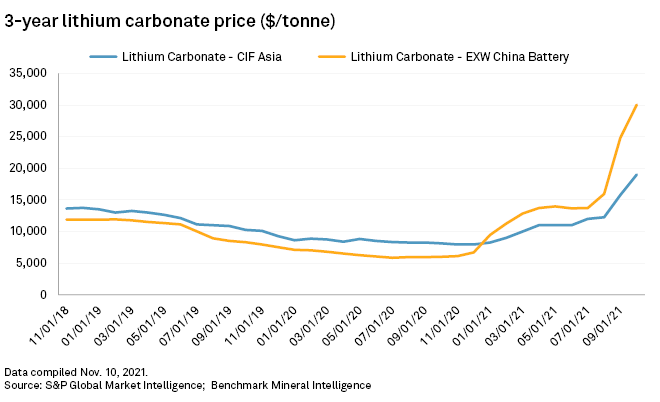

Raw materials represent the bulk of the total cost of a battery. The cost of certain lithium-ion batteries declined by nearly two-thirds between 2014 and 2020, from $290/kWh to $110/kWh, according to Benchmark Mineral Intelligence data. But that trend could reverse in the coming months, as prices for lithium and other battery materials have surged recently.

The Chinese battery-grade lithium carbonate price shot up 113.5% between Aug. 1 and Oct. 22, largely due to supply tightness, according to Market Intelligence research. In addition, Benchmark Mineral Intelligence's battery cathode price index, which tracks the prices of materials used in cathodes, has increased 62.4% in 2021, as of Oct. 27.

The pain is already being felt

Widespread power cuts in China have hit battery markets before, but never when the battery market was so hot. Global passenger plug-in EV sales in 2021 are forecast to more than double last year's sales, reaching an estimated 6.9 million units, according to Market Intelligence research.

"Obviously, this is a booming market," said Andrew Leyland, head of strategic advisory at Benchmark Mineral Intelligence. "So, any reduction in energy is directly impacting production, which is slowing down supply chains. And that's happening across the Chinese economy as the government struggles to source more energy."

In a letter to clients, major Chinese battery-producer BYD Co. Ltd. announced plans to increase its cell prices by 20% starting in November, citing rising raw material costs, according to reporting by Chinese media company Caixin. BYD did not respond to a request for comment.

Chinese production of anodes and cathodes, two of the main components in rechargeable batteries, showed signs of slowing late in the third quarter for some suppliers, potentially due to the energy shortage and the semiconductor chip shortage.

South Korean battery-maker LG Chem Ltd. said energy restrictions and rising coal prices were slowing parts of its petrochemical business, while the semiconductor shortage has been the primary cause of decreased battery production.

Chinese Magnesium Squeeze Persists, Forces Suppliers to Postpone Sales: Sources

China's magnesium supply squeeze has remained persistent over the last few weeks, leading some suppliers to postpone their ingot sales for later deliveries, industry sources said Dec. 13.

READ THE FULL ARTICLEIndonesia's Bauxite Export Ban to Have Limited Impact on China Supply

Major ore exporter Indonesia's plan to stop bauxite outflows are unlikely to have a major impact on the supply of raw material into China, as any gaps in imports can be easily filled by shipments from other countries, industry sources said Nov. 25.

READ THE FULL ARTICLEMetal Producers Will Need to Double Capex to Meet Net Zero by 2050: BofA

Metal producers will need to double capital expenditure in the coming years to ensure there are enough resources available to meet demand coming from decarbonization and the global aim to reach net zero emissions by 2050.

Read the Full ArticleU.S. Needs Its Own Supply Chain of Key Minerals – Perpetua Resources CEO

Perpetua Resources Corp. aims to satisfy about 35% of U.S. demand for the critical mineral antimony, a key ingredient in batteries, solar panels and wind turbines, in the first six years of production at its Stibnite operation at a former mine site in Idaho.

Read the Full ArticleCopper Project Pipeline — Project Shortage to See Supply Lag Demand Post-2025

Mined copper supply growth will relieve concentrate tightness in the market over 2022-25. With a shortage of projects, supply will lag demand in the long term, pushing prices to unchartered territories.

Read the Full ArticleGreen Energy Revolution — Boost for Industrial Metals Demand

The focus on the renewable energy transition has intensified since March 2020, with the world's major economies — the U.S., China and Europe — establishing carbon-neutrality goals through to 2060.

Read the Full ArticleBattery Value Chain Action Needed to Meet Unprecedented Demand: Panel

Battery raw material demand is expected to be unprecedented in the coming years and participants in the battery value chain have a part to play to ensure sustainable supply to meet that demand, panelists on the FT Mining Summit Oct. 8 panel on strategic metals said.

Read the Full Article

Electric Vehicles

$22.6B Mexican Lithium Mine Bogs Down in Drug Cartel, Tech Risks

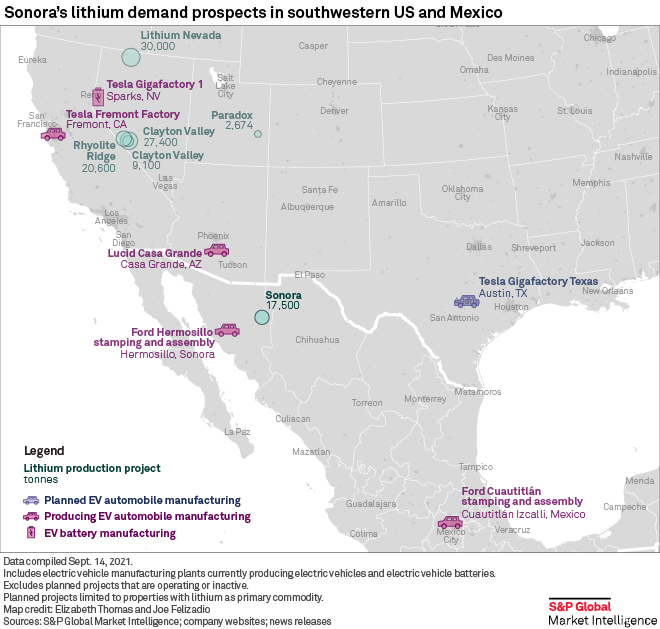

In 2015, the discovery of a massive lithium deposit south of the U.S. border led electric vehicle giant Tesla Inc. to announce a deal with Canadian miner Bacanora Lithium PLC. The automaker agreed to buy an undisclosed amount of lithium chemicals for its Nevada Gigafactory from Bacanora's proposed mine in the state of Sonora in northwest Mexico, creating the potential for a new branch of the North American battery supply chain.

Under the arrangement, the mine had to meet an undisclosed timeline with performance benchmarks. Now, six years later, it is unclear whether Tesla will ever get lithium from its deal with Bacanora.

The mine, also named Sonora, is the 12th-largest lithium project under development in the world based on primary reserves and resources and holds a total in situ value of $22.6 billion, according to S&P Global Market Intelligence data. But it carries unique risks; Bacanora plans to use an unproven extraction process to remove lithium from clay stone, and the project is in territory controlled by drug cartels and plagued by violence associated with the cross-border drug trade and human trafficking.

"U.S. regulatory hurdles might set you back a year or two, but a cartel will shoot you in the head," Emily Hersh, a lithium industry expert and managing partner with DCDB Group, an international consultancy, said in an interview.

Another source

If the electric vehicle revolution finally comes to fruition in the U.S., deals between U.S. automakers and miners across North American could prove crucial for ensuring that EV and battery manufacturers avoid the sorts of hiccups seen in global supply chains during the COVID-19 pandemic. Making matters more complex, the U.S. is heavily reliant on imports for much of its lithium supply as well as other minerals the government considers significant for national security.

Like Canada, Mexico could hypothetically satisfy U.S. demand for lithium. But for now, Tesla's involvement with what is the only lithium mine in Mexico has apparently ended.

Bacanora Company Secretary Cherif Rifaat did not say whether the Tesla deal has been canceled, and Bacanora did not respond to requests for further comment. Tesla did not respond to multiple requests for comment by S&P Global Market Intelligence. The company reportedly dissolved its press relations team in late 2020. Bacanora did not discuss the 2015 deal in its most recent annual financial filing to shareholders released in March and has not mentioned the matter in recent presentations for investors. Asked whether Tesla is still involved with Bacanora, Rifaat would only say the company has 100% off-take agreements with Japanese metals trader Hanwa Co. Ltd. and Chinese lithium miner Ganfeng Lithium Co. Ltd., which is set to take control of Bacanora pending approval from shareholders and Mexican antitrust authorities.

On paper, agreements like the one between Tesla and Bacanora could make sense for companies with big EV plants in development in northern Mexico and the U.S. Southwest. In northern Mexico, a region with fewer government permitting requirements than the U.S., it should be easier to get new mines online.

Strategic Metals Availability May Jeopardize EV Targets: Industry

Strategic or critical metals availability at the right price may threaten some countries' ability to meet electric vehicle take-up targets, disordering the energy transition, key metals industry players told S&P Global Platts.

READ THE FULL ARTICLESustainable Lithium Would be 'Game Over' for Gas Cars – Sigma Lithium Co-CEO

Lithium producers can meet the surge in demand for the white metal used in electric vehicle batteries if they keep costs low and prioritize sustainability, according to Ana Cabral Gardner, co-chairperson and co-CEO of lithium producer Sigma Lithium Corp.

Read the Full ArticleCarmakers Try to Head Off Supply Crunch with Battery Recycler Investments

Investors are pouring hundreds of millions of dollars into recyclers of battery materials, hoping to ease metal shortages, localize supply and make the electric vehicle industry more sustainable.

Read the Full ArticleFord's Electrification Plan Set to Tighten Battery Metal Squeeze

U.S. automaker Ford Motor Co. sent battery markets buzzing when it announced plans to spend $11.4 billion on battery and electric vehicle manufacturing, but it left unanswered questions of where it will find supplies of critical metals.

Read the Full ArticleCanada's Reelected Liberals Must Go ‘Faster Still' to Expand Domestic Mining

Canada's reelected Liberal government must quickly fulfill its promises to the mining and metals industry if it is to take advantage of growing opportunities in the electric vehicle supply chain, sector leaders said in the wake of the Sept. 20 election that saw the incumbents return with another parliamentary minority.

Read the Full ArticleBattery Disruptors are Jolting Metal Supply Chains

As electric vehicle sales ramp up around the globe, key battery metals such as lithium, cobalt and nickel are already facing supply chain constraints.

Read the Full Article

Market Dynamics

Commodities 2022: Global Lithium Market to Remain Tight

The global lithium market has seen prices moving to new record highs almost daily, boosted by limited supply and good demand. This strength is expected to continue into 2022, as supply tightness persists and demand for electric vehicles continues to grow.

Seaborne lithium carbonate prices have gained 413% since the start of 2021 to $32,600/mt CIF North Asia on Dec. 14, while lithium hydroxide prices have climbed 254% over the same period to $31,900/mt CIF North Asia, according to S&P Global Platts data.

Lithium prices were due to remain strong going into 2022, according to a number of market players, due to bullish supply-demand dynamics.

According to S&P Global Market Intelligence, lithium chemical supply is forecast to 636,000 mt lithium carbonate equivalent in 2022, up from 408,000 mt in 2020 and an estimated 497,000 mt in 2021.

This was forecast by MI to be met by chemical demand of 641,000 mt LCE in 2022, up from 342,000 mt in 2020 and an estimated 504,000 mt in 2021.

The ensuing forecast deficit of 5,000 mt LCE in 2022, compares with a surplus of 66,000 mt in 2020 and an estimated deficit of 8,000 mt in 2021, with MI saying the ongoing deficit was expected to allow prices to remain strong in 2022.

Copper Market to be Well Supplied in 2022

The global refined copper market is expected to be in a significant surplus in 2022, following a small supply deficit in 2021.

READ THE FULL ARTICLESaudi Arabia, Nigeria, Kyrgyzstan Seek Investors to Develop Their Mining GDP

Saudi Arabia, Nigeria and Kyrgystan are seeking new investors to develop their mining GDP, government representatives told the Mines and Money conference in London this week.

READ THE FULL ARTICLEThe Cobalt Expansion Drive Is A Copper Story

Driven by a cobalt price rally and cost reduction, some copper-cobalt miners are actively assessing restart and expansion opportunities.

READ THE FULL ARTICLEInflation, Metals Pricing and Availability May Challenge Energy Transition: Mines & Money

A sustained period of inflation and rising production costs are set to pressure supplies of key metals needed for the energy transition, and may lead to the need for governmental intervention, speakers at a Mines and Money conference said Dec. 1.

Read the Full ArticleMetals Prices

Cobalt Prices Set to Fall 8.3% in 2022 as Supply Chain Bottlenecks Ease

Cobalt metal prices are expected to remain supported for the remainder of 2021 as logistical pressures persist, but are then expected to fall 8.3% in 2022 on supply growth and easing supply chain bottlenecks, according to S&P Global Market Intelligence November Commodity Briefing Service report on lithium and cobalt, which was released late Nov. 23.

MI Senior Analyst, Metals & Mining Research Alice Yu said in the report that supply growth in the Democratic Republic of Congo and normalizing supply chain bottlenecks forecast for the first half of 2022 were expected to ease the supply tightness experienced in 2021.

Total cobalt supply was forecast to total 196,000 mt in 2022, up from 136,000 mt in 2020 and an estimated 164,000 mt in 2021.

On the demand side, Yu estimated that cobalt demand would continue growing as higher plug-in electric vehicle sales offset the impact of cobalt thrifting in batteries.

MI forecast total cobalt demand to rise to 195,000 mt in 2022, up from 132,000 mt in 2020 and an estimated 170,000 mt in 2021.

'Sustained' Rise in Battery Metals Prices Without New Mines, IEA Warns

The International Energy Agency has a warning for the warming world: Build more mines or the energy transition will slow down.

Read the Full ArticleEnergy Transition to Benefit Nickel, Copper Prices in Long-Term

The energy transition is set to benefit nickel and copper in the long-term, with the demand-side to be boosted by rising electric vehicle sales and related battery demand, panel participants at the LME Week Seminar held Oct. 11.

Read the Full ArticleMiners Scramble to Develop Rare Earths Deposits Ex-China as Demand, Prices Soar

International mine developers are striving to bring on stream new rare earths projects outside China to secure supplies of the minerals used in electric vehicle engines and wind turbines as prices surge, CEOs of two developer companies told S&P Global Platts.

Read the Full ArticleHigh Metal Prices Could Slow the Race to Zero Carbon

Rising metal prices could slow the world's transition to clean energy by stalling efforts to cut the price of electric vehicles and battery storage systems.

Read the Full Article