Subscribe to start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

SUBSCRIBE TO THE NEWSLETTERSTop Takeaways

5 Key Takeaways from S&P Global Sustainable1

The COP26 climate conference in Glasgow has ended and while we saw progress in some areas such as shifting away from fossil fuels, tackling methane emissions, and protecting nature and biodiversity, the world still has a long way to go in the years ahead. Here, we present our five key takeaways from COP26 on progress made and areas that still need work.

1. Public funding and private financing must connect: Financial institutions representing trillions of dollars have committed to tackle climate change but getting that money to the right place remains a huge challenge.

2. An Article 6 win: Countries reached a deal on Article 6 of the Paris Agreement, which will govern international carbon markets and ensure emissions reductions are not double counted among countries.

3. Nature gets its due: Pledges to preserve or restore nature as part of addressing climate change garnered more attention at COP26 than in past years, particularly on the issue of stopping deforestation.

4. Climate commitments require more accountability: We saw progress at COP26 in terms of government agreements and private sector pledges, but accountability needs to be strengthened.

5. A focus on buildings’ carbon intensity: While much of the focus at COP26 was on moving away from fossil fuels, emissions from the buildings sector remain a key challenge that have yet to be fully addressed at the government or even private sector level.

Did COP26 Deliver?

The dust has now settled on the 2021 UN Climate Change Conference (COP26). Did the gathering of almost 200 nations succeed in putting us on a path towards limiting warming to 1.5°C?

READ THE FULL ARTICLECOP26 Offers Small Wins on Coal, Carbon Trading but Misses 1.5 Degree Target

The 26th UN Climate Change Conference or COP26 failed to achieve goals like mobilizing sufficient climate funds for developing countries or dial down projections of fossil fuel demand in emerging markets, but pledges against coal and methane, and agreements on cross-border carbon trading are being viewed as small wins in a bigger battle.

Read the Full Article

Financing Net-Zero

On One End, Trillions of Dollars to Invest in Climate. On the Other, Huge and Urgent Need. How Do We Connect the Dots?

A key theme emerged during the 26th U.N. Climate Change Conference in Glasgow, known as COP26: There is ample supply of financing to tackle the economic impact of climate change, but the world currently lacks the means of getting that money where it’s needed. This means that coordinated action is necessary between the public and private sector to finance the transition and map a new approach to funding and financing climate-friendly projects.

It's no secret that the world is going to need a lot of money to avoid a climate catastrophe. Limiting warming to 1.5°C relative to preindustrial levels by 2050 will require $3.5 trillion annually in investment, according to a 2018 estimate by the Intergovernmental Panel on Climate Change. And that means annual investment in low-carbon energy technologies and energy efficiency needs to be increased by more than five-fold by 2050 compared to 2015 levels.

The Glasgow conference has been touted as the “last best chance” for addressing climate change because it marks the five-year deadline for countries to update their climate goals agreed under the 2015 Paris Agreement. Those objectives were not ambitious enough to put the world on a path to limiting global temperature rise to 1.5 degrees C relative to preindustrial levels, the target that scientists say the world must hit to avoid the worst-case climate change scenario. Given the urgency of the task, there has been a real sense that money must be put squarely on the table if those goals are to be met.

“Make no mistake, the money is here if the world wants to use it,” Mark Carney, UN Special Envoy on Climate Action and Finance, said at a Nov. 3 COP26 session on the financial system and net zero. Carney is also chairman of the Glasgow Financial Alliance for Net Zero, or GFANZ, a coalition of more than 450 banks, insurers and investors.

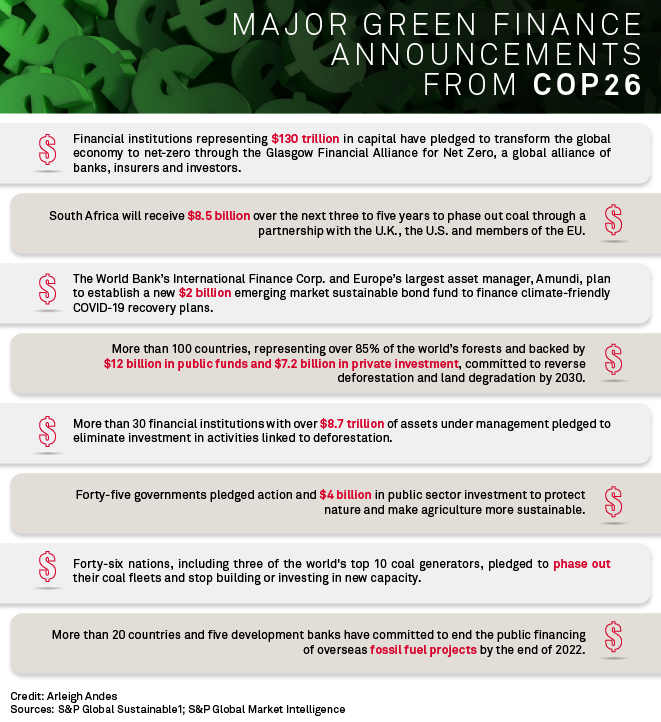

COP26 delivered big headline commitments. Most notably, in a progress report, GFANZ said its membership had expanded to represent $130 trillion in total assets from $70 trillion at its launch in April 2021. Members must commit to being net zero by 2050 using science-based targets and must review their goals every five years.

Only mainstream finance can fund the estimated $100 trillion of investment needed over the course of the next three decades for a clean energy future, Carney said. But that can’t happen without the right government policies in place.

“Finance can fund investment driven … by credible, predictable government policies,” Carney said. “Such initiatives give finance the confidence to invest, point forward the adjustments in our economy, smoothing the transition to net zero and critically driving growth and jobs upwards while they drive emissions downwards."

Countries must develop ambitious new climate plans, Carney said, adding that there was a need to create new structures of blended finance combining private and public funding.

In the penultimate days of the conference, countries were negotiating whether to strengthen national commitments on carbon emissions reductions. The International Energy Agency estimated on Nov. 4 that the updated Nationally Determined Contributions, or NDCs, together with the Global Methane Pledge, which aims to cut global emissions of methane by at least 30% below 2020 levels by the end of the decade, could together help keep temperature increases to just 1.8°C by 2050.

COP26: Implications for the Financial Sector

The COP26 successfully concluded with a last-minute Glasgow Climate Pact which brought important progress to keep global warming below 2ºC.

READ THE FULL ARTICLEAt COP26, Governments and Businesses Turned a New Leaf on Protecting Nature to Halt Climate Change

Calls to slash energy-related greenhouse gas emissions have been a common refrain at the U.N.’s annual climate summits, and COP26 was no different. At this year’s meeting in Glasgow, however, many asset managers, corporations and policymakers embraced a much broader theme: Preserving and harnessing nature to fight climate change.

Read the Full ReportCapital Committed to Net-Zero Emissions Surges to $130 trillion: GFANZ

The sum of global capital committed to achieving net-zero greenhouse gas emissions has surged to over $130 trillion, up from only $5 trillion when the UK and Italy assumed the COP26 Presidency, an international alliance of financiers said Nov. 3.

Read the Full ReportEuropean Investment Bank Defines Highly Innovative Project Funding for Fossil Firms

The European Investment Bank will make funding exemptions for highly innovative low-carbon projects being developed by oil and gas companies, the bank's Vice President Ambroise Fayolle said at the UN's Climate Conference in Glasgow Nov. 3.

Read the Full ReportMiner Vale Joins Brazil State's $91 Million Forest Recovery Program

Vale has joined an initiative launched Nov. 10 at the UN's COP26 Climate Change Conference in Glasgow by Brazilian state-owned development bank BNDES to invest Real 500 million ($91 million) in forest recovery over seven years, the diversified miner said in a statement.

Read the Full ReportSoutheast Asia Moves on Climate with A$2 bil Australia Funding, Net Zero Targets

Southeast Asia's efforts to mitigate climate change gained traction on the first day of UN Climate Change Conference with Australia doubling it climate funding support for the region to A$2 billion (about $1.5 billion) and two major countries – Vietnam and Thailand – committing to net zero emissions.

Read the Full ReportPrioritizing Pledges

Mind The Gap: Pledges At COP26 Give Hope But Significant Shortfall Still Exists

The Glasgow Climate Pact was agreed upon on Nov. 13--a day after the official COP26 deadline expired--and has largely been hailed as a good compromise deal by commentators. It refers to coal for the first time in the U.N. process. It asks for countries to come back with stronger climate plans in 2022, strengthening the normal five-year ratcheting-up cycle. And it also finalized the most contentious elements of the Paris Agreement rulebook, six years after the landmark deal was done. COP26 aimed to close the gaps: the ambition gap, the finance gap, and the credibility gap. Ambition to keep the 1.5-degree Celsius (1.5°C) target alive, finance to address the needs of developing countries for adaptation and loss and damages resulting from climate change-related events, and credibility to restore trust between countries and with civil society. The negotiations were focused on finalizing the Paris rulebook, which sets the policy signals for how to deliver on the 2015 Paris Agreement, specifically what the international rules should be for trading emissions reductions, known as Article 6. With global voices getting louder, particularly from youth and indigenous peoples' organizations, what comes next will be the work to turn good intentions into actions that drive the economy to a new and resilient state.

COP26 Kicks Off With Optimism As Ambition Is Raised

The Glasgow Climate Pact that was ultimately agreed upon calls for a phasing down of coal and "inefficient" fossil fuel subsidies. Both are significant developments since the Paris Agreement did not mention coal nor fossil fuels despite these being the largest causes of human-induced global warming. India proposed a last-minute change from the "phasing out" of coal to "phasing down," based on its view that developing nations should have a larger share of the remaining carbon budget--which all parties eventually agreed on.

The first week of negotiations also saw of a flurry of expected announcements by countries stepping up their ambitions to shift their respective economies toward net zero. Some notable new announcements gave a sense of optimism that global policy goals are aligning, such as from Nigeria and Saudi Arabia, two petrostates reliant on oil exports, committing to net zero by 2060. Many developed countries set a commitment to reach net zero by 2045, with host city Glasgow setting an aggressive target of reaching net zero by 2035. China and the U.S. released a joint statement that included the U.S.'s commitment to reach 100% renewable electricity by 2035 and China to "phase down" coal in the second half of this decade. Both countries will collaborate to reduce methane emissions and develop carbon capture, utilization, and storage, and direct air capture technologies. Direct air capture involves pulling carbon directly from the air for negative emissions. It's still very much in its infancy, with the largest existing facility pulling 4,000 metric tonnes of carbon dioxide (CO2) per year (or 0.00012% of global annual energy-related CO2 emissions) out of the air at a current cost of $1,200 per tonne. These two technologies have been the subject of much debate because they are seen as delaying the energy transition. Still, for the remaining residual emissions that will need to be netted to achieve Paris, they could be required.

On Nov. 4, multiple countries, many for the first time, signed on to a commitment to address coal-fired power. Among the leading coal-burning countries, India did not take part and Indonesia and the Philippines offered only conditional support. According to S&P Global Platts Analytics, the global pipeline for new coal plants has been collapsing since the Paris Agreement, from 1,175 gigawatts (GW) in 2015 to 313 GW ahead of the latest announcements according to the SPGI Power Plant database. But the S&P Global Platts GIEM Reference Case still shows many countries increasing coal burn from 2019 to 2030, with the greatest increases expected in India by far followed by Vietnam, Indonesia, and the Philippines.

Non-state actors, like cities, companies, and financial institutions, have stepped up their ambitions with more than 26,000 entities signed up for the Race to Zero and Race to Resilience campaigns. These campaigns ask that entities have net zero goals, but crucially also interim targets to help track progress and accountability. What's more, the campaign states that offsets cannot be used when viable alternatives exist. Cooperation between sectors is starting to come through, for example Unilever and eight other multinational companies committed to work on zero-carbon shipping by 2040. However, not all parts of the economy are yet represented (such as major private equity firms) and emissions-generating assets could be sold into private markets instead of decommissioned, therefore not contributing to global emissions reduction.

National Climate Pledges at COP26 Fail to Deliver on Paris Goals, Analyses Show

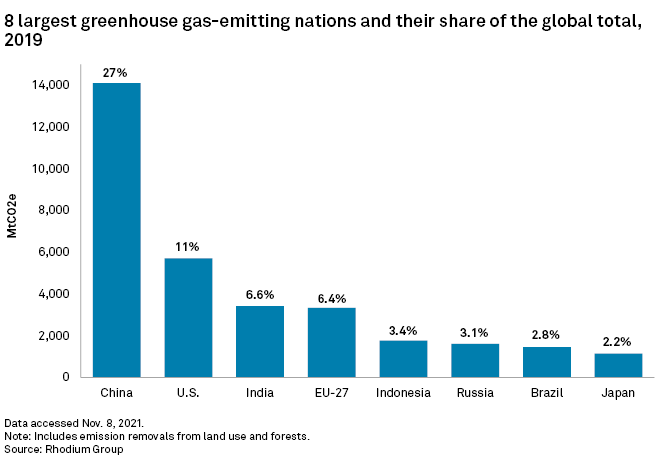

The world's eight largest emitters account for nearly two-thirds of all greenhouse gases that humans spew into the atmosphere, and all those nations are falling short of meeting their net-zero emission pledges, climate researchers warned.

Read the full ArticleUpdated Climate Commitments Still Falling Short of Global Temperature Goals: UNEP

New and updated climate commitments from governments still fall short of the effort needed to reach the goals of the Paris Agreement on climate change, the United Nations Environment Program said in a report Oct. 26.

Read the full ArticleGlobal Methane Pledge Signatories Pass 90 Ahead of Official Launch

Over 90 countries have now joined an international pledge to reduce methane emissions ahead of the initiative's official launch later on Nov. 2 at the UN Climate Change Conference in Glasgow, UK.

Read the Full ReportOPEC's Saudi Arabia, UAE Push Emissions Reduction, Not Fossil Fuel Extinction

While highlighting their green investments, core OPEC members Saudi Arabia and the UAE on Nov. 10 defended the embattled oil industry to the UN Climate Change Conference, saying environmental policies should be balanced with energy security and economic development.

Read the Full ArticleNigeria Vows to Reach Net-Zero by 2060 but Stresses Role of Gas

Nigeria, Africa's largest oil producer, has committed to achieve net-zero carbon emissions by 2060 while underlining the importance of gas as a transition fuel, President Muhammadu Buhari said late Nov. 2 at the UN Climate Change Conference in Glasgow, Scotland.

Read the Full ArticleIndia's 2030 Goals Pose Challenge on Long Haul to 2070 Net-Zero

India's new climate goals of reducing carbon intensity and boosting renewables by 2030 pose stiff challenges to an economy dominated by coal, commentators told S&P Global Platts.

Read the Full ArticleBiden tells COP26 the U.S. will 'sprint' to reach 2030 climate goal

President Joe Biden took the stage at the high-stakes COP26 climate summit in Glasgow, Scotland, on Nov. 1 seeking to assure the world that the U.S. is tackling greenhouse gas emissions head-on even as his policies have been scaled back by Congress and could be blocked by the U.S. Supreme Court.

Read the Full ArticleRussia to Refocus Energy Strategy in Bid to Reach Carbon Neutrality by 2060

Russia's aim to be carbon neutral by 2060 – announced by President Putin in the run-up to the COP26 climate meeting – will require a huge restructuring of its economy, which is today heavily dependent on oil and gas revenues.

Read the Full ArticleSubscribe to the ESG Insider, a newsletter from S&P Global that includes news and insights into environmental, social and governance developments driving change in business and investment decisions.

SUBSCRIBE TO THE NEWSLETTERCalls to Action

Window is Closing' on Keeping 1.5 Degrees C Warming Within Reach

The window on keeping 1.5 degrees Celsius global warming within reach is closing, COP26 President Alok Sharma said ahead of publishing a draft final agreement for the UN Climate Conference in Glasgow Nov. 12.

Going into the talks, the set of 120 Nationally Determined Contributions, or NDCs, were estimated to lead to global warming of about 2.7 degrees Celsius, global conservation group WWF said.

An updated assessment of all climate commitments would still result in 2.4 degrees C warming, according to Climate Action Tracker.

The latest draft of a COP26 final agreement published by the COP President calls on all Parties to accelerate the phase-out of coal power and of inefficient subsides for fossil fuels."

It "recognizes that limiting global warming to 1.5 °C requires rapid, deep and sustained reductions in global greenhouse gas emissions, including reducing global carbon dioxide emissions by 45 per cent by 2030 relative to the 2010 level and to net zero around mid-century, as well as deep reductions in non-carbon dioxide greenhouse gases."

The draft notes "with deep regret that the goal of developed country Parties to mobilize jointly $100 billion per year by 2020 in the context of meaningful mitigation actions and transparency on implementation has not yet been met."

Global Leaders Sign Up to Reverse Forest Loss and Land Degradation by 2030

Some 110 leaders accounting for more than 86% of the world's forests have committed to halt and reverse forest loss and land degradation by 2030, UK Prime Minister Boris Johnson said at the UN's Climate Conference of the Parties in Glasgow Nov. 2.

Read the Full ArticleGlobal Leaders Sign Up to Reverse Forest Loss and Land Degradation by 2030

Some 110 leaders accounting for more than 86% of the world's forests have committed to halt and reverse forest loss and land degradation by 2030, UK Prime Minister Boris Johnson said at the UN's Climate Conference of the Parties in Glasgow Nov. 2.

Read the Full ArticleSustainable1 is tracking major developments set to come out of COP26: the energy transition financing gap, the growing focus on natural capital, emissions from buildings, the role of carbon markets and much more. Bookmark this page for news, podcasts and data-driven thought leadership throughout the coming weeks.

ACCESS THE CONTENTCorporate Commitments

'Deficit of Credibility': UN Deepens Benchmarking of Corporate Net-Zero Pledges

As world leaders took to the stage at the COP26 climate summit in Glasgow, Scotland, on Nov. 1, United Nations Secretary-General António Guterres announced the creation of a new expert panel to analyze net-zero emissions pledges in the private sector.

Keeping alive the 1.5 degrees C global warming limit from the Paris Agreement on climate change requires tighter standards around tracking greenhouse gas emissions, Guterres told delegates.

"There is a deficit of credibility and a surplus of confusion over emissions reductions and net-zero targets, with different meanings and different metrics," the secretary-general said.

"That is why, beyond the mechanisms already established in the Paris Agreement, I am announcing today that I will establish a group of experts to propose clear standards to measure and analyze net-zero commitments from non-state actors," he said.

While the plan remains light on detail, the announcement was a positive surprise to Faustine Delasalle, co-executive director of the Mission Possible Partnership, which works on climate action with 300 companies in industrial sectors that are difficult to decarbonize, such as steel and cement.

"I think it's a good move," Delasalle said in a Nov. 2 interview. "My hope is that this group of experts will not reinvent the wheel," with a lot of work having already been done to define standards that can be leveraged by the U.N. panel, she said.

Experts ought to also remember that there is no one-size-fits-all approach, given the varying degrees of decarbonization challenges between industries, Delasalle said. Instead, focus should be on nearer-term targets for 2030 and actions beyond target-setting, such as investments in cleaner technologies and assets.

Setting credible targets

In the run-up to COP26, the Science Based Targets initiative laid out Oct. 28 what it called the world's first corporate net-zero standard. Piloted by companies such as Danish wind developer Ørsted A/S and pharmaceuticals giant AstraZeneca PLC, the standard requires businesses to take rapid action to halve emissions before 2030 and set long-term goals to reduce emissions by 90-95% before 2050.

Qualcomm Leads Other Major U.S. Chipmakers in setting Net-Zero Goal

Chipmakers require tremendous amounts of energy and water, but U.S. chip producer QUALCOMM Inc. aims to reach net-zero emissions within the next 20 years

Read the Full ArticleBanks' Net-Zero Pledges Ignore Most Fossil Fuel Financing

The majority of banks' financed emissions may be excluded from their climate goals thanks to a loophole afforded to underwriting, raising concerns among shareholders and environmental organizations.

Read the Full ArticleSteel Companies Not Doing Enough to Address Scope 3 Emissions: Kloeckner CEO

Steel companies are not doing enough to address Scope 3 CO2 emissions, which will be the biggest challenge for the steel supply chain in energy transition, Guido Kerkhoff, CEO of German steel stockholder Kloeckner, said Nov. 3.

Read the Full ArticleBHP Shareholders Approve Climate Plan, but Chairman Still on Defense

BHP Group announced at its annual general meeting in Melbourne on Nov. 11 that 84.9% of its shareholders approved the company's Climate Transition Action Plan, but Chairman Ken MacKenzie still had to play defense over the miner's climate ambitions.

Read the Full Article

Carbon Markets

COP26 Confirms Role of Voluntary Carbon Market: Verra

The deal reached at the UN Climate Change Conference in Glasgow Nov. 13 confirms the role of the voluntary carbon market, environmental markets standards-setter Verra said late Nov. 22.

Almost 200 countries reached agreement on Article 6 of the Paris Agreement, which sets out the rules for global trade in greenhouse gas emissions reductions – a move that strengthens the market for voluntary carbon credits, Verra said.

"COP26 confirms the role of the VCM to channel finance, technology, and capacity to climate mitigation activities, particularly in developing countries, and to transfer mitigation outcomes [emissions reductions] that help countries meet their Nationally Determined Contributions and achieve a 1.5 degrees C future," Verra said in a statement.

The deal in Glasgow successfully avoids double-counting of emissions reductions by requiring any countries transferring carbon credits abroad to make a corresponding adjustment – an increase in its national emissions tally.

This plays into the voluntary carbon market by creating an option for companies to buy credits linked to corresponding adjustments.

"Corresponding adjustments – while mandatory to meet NDCs or international mitigation purposes such as ICAO CORSIA – are optional for VCM transactions such as corporate offsetting. Verra will operationalize CAs through labels," the company said.

CORSIA credits gain almost 1,000%

Voluntary carbon credit prices have surged in 2021 as demand grows among companies to offset their emissions as part of strategies to reach net-zero by 2050 or sooner, or to meet targets in other voluntary programs.

S&P Global Platts assessed CORSIA-eligible carbon (CEC) credits at $8.71/mt CO2e at the close Nov. 22 – a gain of 989% since the first assessment of 80 cents/mt on Jan. 4, 2021. Meanwhile, Platts assessed nature-based carbon (CNC) credit prices at $13.90/mt Nov. 22 – a gain of 199% since the first assessment of $4.65/mt on June 14, 2021.

Agreement among nations on Article 6.4 of the Paris Agreement creates a new carbon crediting mechanism under the United Nations Framework Convention on Climate Change, Verra said in a webinar Nov. 22.

The new mechanism creates a successor to the UN's Clean Development Mechanism, which regulated emissions reduction projects in developing countries under the Kyoto Protocol.

Under the new 6.4 mechanism, emissions baseline-setting options will include the best available technology and ambitious benchmarks set by the best-performing comparisons, Verra said.

A key requirement for emissions offsetting projects is additionality – an assurance that emissions reductions from a project are additional to what would otherwise have taken place under relevant national policies.

The new system will ensure that additionality will take account of all relevant national policies, Verra said in the webinar.

After COP26, New Questions Arise Over Carbon Trading as Markets Gain New Prominence

With the UN Climate Change Conference now settling into the rearview mirror, stakeholders questioned Nov. 23 how carbon dioxide removal can be done with climate justice concerns in mind.

READ THE FULL ARTICLEGlobal Carbon Market Rules Edge Nearer at UN Climate Summit

Incremental progress was made overnight Nov. 11 on agreeing the rules for global trading of emissions reductions at the UN Climate Change Conference in Glasgow, according to observers at the summit.

READ THE FULL REPORTVast Support for Voluntary Carbon Market Integrity: IIF Chief

There is vast support for the global Voluntary Carbon Market to place environmental integrity as its central pillar, Sonja Gibbs, managing director and head of sustainable finance at the Institute of International Finance said in an interview Nov. 5.

READ THE FULL ARTICLEAfter 6 Years of Wrangling, COP26 Targets Global Deal on Carbon Markets

The COP26 climate summit, which kicks off in Glasgow, Scotland, on Oct. 31, marks another attempt to tie up a crucial loose end from the Paris Agreement on climate change: the creation of a global carbon market.

Read the Full ArticleRevenue from Carbon Prices on Shipping Must be Targeted, Say Experts

Shipping's decarbonization and developing countries should be the beneficiaries of carbon costs imposed on bunker fuel, according to political and diplomatic transport experts.

Read the Full ArticleVoluntary Carbon Market Value Tops $1 bil in 2021: Ecosystem Marketplace

The value of the global voluntary carbon market has topped $1 billion in 2021, according to information and analysis group Ecosystem Marketplace.

Read the Full Article

Article 6

Paris Accord Article 6 Approval Set to Jump-Start Evolution of Voluntary Carbon Market

The formal adoption the Paris climate accord's Article 6, following the UN Climate Conference in Glasgow, is expected to jump-start the evolution of the voluntary carbon market after years of uncertainty about its future.

Article 6 is the final article to be implemented of the 29 separate articles that make up the 2015 Paris Climate Agreement and sets up the carbon crediting mechanism used by governments to meet their reduction targets under the nationally determined contributions system. Paragraph 6.4 sets the United Nations as a certifier of carbon projects that can generate credits for governments to reach these NDCs.

Paris Article 6 Deal Will Boost Confidence in Carbon Markets: Gold Standard

Agreement on Article 6 of the Paris Agreement at the UN Climate Change Conference in Glasgow would boost confidence in the use of carbon markets to achieve global climate goals, Hugh Salway, head of environmental markets at standards setter Gold Standard said in an interview Nov. 2.

A consolidated draft text has emerged from the COP26 summit, which runs Nov. 1-12, as negotiators work to find common ground among countries on how the mechanism will work, although final agreement is unlikely until the second week of the talks, he said.

Energy Transition

Climate Talks Face Fossil Fuels Dilemma as Supply Crunch Weighs

As world leaders meet in Glasgow, Scotland, for the closely-watched UN Climate Change Conference of the Parties, policymakers face squaring a big circle over pledges to relegate fossil fuels to history and the global need for reliable, low-cost energy supplies.

Global oil demand alone would need to collapse by 75% over the next three decades in order to put the world on a pathway to net-zero emissions by 2050, according to the International Energy Agency. At the same time, solar, wind and other renewable energy sources would need to surge more than five-fold and nuclear power double to shrink fossil fuels' share of the global energy mix from 80% to 20% by 2050.

By its own admission, the IEA sees the window of opportunity to hit this pathway is narrowing fast as global demand for oil and gas rebounds from the nadir of the 2020 pandemic lockdowns.

In March, the IEA said it expects global liquids demand, including biofuels, will recover to reach 103.2 million b/d in 2025, up from 91 million b/d in 2020 and almost 100 million b/d in 2019. A month later, the IEA warned rebounding coal use would outstrip renewables growth by 60% this year.

The furor over record gas prices in Europe in October has only fueled the debate over whether the pace of energy transition is already crippling vital energy security, setting the world up for damaging price volatility in the years to come. Despite calls for the need to double down on booming renewables spending to avoid a supply crunch such as that seen in gas markets, major challenges to back-stopping intermittent renewables with baseload power capacity remain.

But the IEA has been careful to leave the door open on the achievability of its pathway, eager to push policymakers into faster, more radical action to cut ties to fossil fuels while boosting spending on cleaner alternatives.

In its recent new long-term energy outlook aimed at informing the COP26 talks, the IEA concluded that climate pledges to date would result in only a fifth of the emissions reduction by 2030 necessary to put the world on a path towards net-zero by 2050. Breaking out a new "Announced Pledges" scenario, the IEA said the world's existing net-zero targets would see fossil fuels peak by 2025 but only if the pledges are fully met.

Surging Cost of Energy Transition Casts Shadow Over COP26 Climate Talks

Demand for carbon credits and rapidly reopening economies have seen a surge in the value of a basket of S&P Global Platts price assessments this year.

READ THE FULL ARTICLEAt ADIPEC, Oil Industry Defends Fossil Fuels in COP26 Aftermath at Abu Dhabi Expo

After weeks of being in the crosshairs at the UN Climate Change Conference, the global oil industry converged on Abu Dhabi on Nov. 15 for a full-throated defense of fossil fuels and a call for producers and consumers alike to unite behind the cause of energy security.

READ THE FULL ARTICLESingapore Kicks Off Multi-Pronged Energy Transition Strategy

Singapore's journey from an international oil and refining hub, that has been core to its economy for decades, to a new energy future, has kicked off in earnest.

READ THE FULL ARTICLEMission Innovation Targets Decarbonization of Cities, Industry and Accelerated CCS

Global leaders are targeting accelerated decarbonization of cities and industry, along with advancing carbon capture and storage technology, as the Mission Innovation group extends its goals on clean energy investment by 2030.

READ THE FULL ARTICLEWartsila Sees Major Role for Renewables Supported by Thermal Back-up

The future of electricity is a combination of renewable energy supported by thermal back-up plants and energy storage systems, said marine and energy engineering company Wartsila.

Read the Full ArticleRussia, U.S. Deputy Energy Ministers Talk Oil Market Stability on COP 26 Sidelines

Russia's deputy energy minister Pavel Sorokin met his US counterpart David Turk to discuss bilateral cooperation on stabilizing the global oil market, the Russian energy ministry said late Nov.10.

Read the Full ArticleClimate Talks Face Fossil Fuels Dilemma as Supply Crunch Weighs

As world leaders meet in Glasgow, Scotland, for the closely-watched UN Climate Change Conference of the Parties, policymakers face squaring a big circle over pledges to relegate fossil fuels to history and the global need for reliable, low-cost energy supplies.

Read the Full Article

Coal Phase Out

COP26 Deal Reached: Nations Target Coal, Pledge More Climate Action in 2022

Under pressure to avoid catastrophic climate change, nearly 200 nations agreed for the first time to phase down unabated coal-fired power plants and most fossil fuel subsidies while pledging to submit more ambitious emission reduction targets just a year from now.

The 11-page Glasgow Climate Pact also adds pressure on nations to quickly ramp up efforts to reduce greenhouse gas emissions this decade in hopes of limiting the global temperature rise to 1.5 degrees C above preindustrial levels. By adopting the pact, they might be able to keep a narrow window open for meeting the most ambitious goal of the landmark 2015 Paris Agreement on climate change.

The unprecedented deal reached at the COP26 climate summit in Glasgow, Scotland, on Nov. 13 came after days of grueling and often tense negotiations over wording for the coal plant retirements, rules guiding a global carbon market, and how to compensate vulnerable nations for climate disasters happening today.

"Together, over the past two weeks, parties have demonstrated what the world had come to doubt: That countries can rise above their differences to unite against a common challenge," an emotional COP26 President Alok Sharma told delegates after the Glasgow pact was adopted. "I think today we can say with credibility that we have kept 1.5 degrees within reach. But its pulse is weak, and it will only survive if we keep our promises and translate our commitments into rapid action."

Deep disagreements remained over the final Glasgow document, with the European Union and other nations telling the summit they were disappointed with the coal language becoming weaker at the last minute. Coal-dependent China and India nearly jeopardized the final deal by insisting that "phaseout" of coal plants be changed to "phase-down." Small island states and developing nations also demanded and failed to secure finance commitments for the loss and damage they already suffer from climate change.

In the end, government diplomats huddling in the cavernous conference center in Glasgow chose to set their differences aside to support the deal, which also finalized rules of the Paris accord.

Here is how nations delivered and fell short on three critical goals that the U.K. COP26 presidency set for the high-stakes summit.

Major Coal Economies Among Signatories to 'Enormous' Phaseout Pledge

A global agreement at the COP26 climate conference in Glasgow, Scotland, to phase out coal-fired power generation in several major economies will speed up the demise of the fossil fuel, climate experts said Nov. 4.

READ THE FULL ARTICLENations Strike Deal in Glasgow After Late Watering-Down of Coal Phase-Out Clause

A final deal was approved at the UN's Climate Conference in Glasgow Nov. 13 after a late objection by India on the phase out of coal-fired power was reluctantly accepted.

READ THE FULL ARTICLEWestern Nations Pledge $8.5 Billion for South African Coal Phase-Out

Western nations have pledged some $8.5 billion over the next five years to support South Africa's decarbonization efforts with a new political declaration announced Nov. 2 at the UN Climate Change Conference.

READ THE FULL ARTICLEPoland, Vietnam, Chile Among Signatories to Phase Out Coal Power

Poland, Vietnam, Chile and Morocco have for the first time committed to phase out coal-fired power generation in pledges made at the UN Climate Conference talks in Glasgow, the UK government said late Nov. 3.

READ THE FULL ARTICLEUkraine Aims for 2035 Coal Phaseout as More European Nations Join Alliance

Ukraine, which has Europe's third biggest coal-fired fleet after Germany and Poland, has committed to a target of ending coal-fired power generation by 2035 while massively investing in renewables, the Powering Past Coal Alliance said Nov. 4 at the UN Climate Change Conference.

READ THE FULL ARTICLEMore Climate Finance, Less Coal Could Send U.S. Natural Gas Exports Skyrocketing

The eye-popping financial promises made Nov. 3 at the COP26 climate summit in Glasgow, Scotland, could shift global energy markets — and, it appears, with some unintended consequences.

READ THE FULL ARTICLE

Hydrogen Economy

Hydrogen Economy Needs Boosting with Demand Incentives - Air Products

Air Products, the world's largest producer of conventional hydrogen, called on policy makers at the UN Climate Change Conference to focus on boosting low-carbon hydrogen demand in CO2-intensive industries, saying the supply side of the market could be easily scaled up.

Air Products CEO and Chairman Seifi Ghasemi said the company was developing both "blue" low-carbon and renewable "green" hydrogen production alongside its conventional hydrogen production business.

It is making major investments in blue hydrogen, produced from fossil fuels in combination with carbon capture and storage, in Canada and the US, along with its large-scale green hydrogen plant at Neom in Saudi Arabia, produced by electrolysis of water powered by renewables.

"We can build more plants," Ghasemi said at the UN COP26 summit in Glasgow, Scotland, and governments should focus on incentivizing demand in sectors which are hard to decarbonize with electrification.

Sectors with the best potential for new hydrogen demand include the cement, steel and chemicals industries, he noted. A global carbon tax could help underpin such demand, Ghasemi said.

Air Products' President in Europe and Africa, Ivo Bols, said blue hydrogen would be needed to build scale in the market for the low-carbon gas to meet mid-century decarbonization goals.

Speaking at the COP26 Hydrogen Transition Summit, Bols said the main assets for blue hydrogen were already in place, and that CO2 emissions was necessary in the short term before green hydrogen production could come on stream at scale.

Air Products is however exploring global locations with high wind and solar potential to develop renewable hydrogen production.

Regulatory certainty

Bols said governments should provide regulatory certainty to help develop the market.

"There will always be business risk, there are uncertainties," he said. But ensuring a solid market framework would help the industry grow, he added.

In a panel discussion at the event, David Caine, a partner at offshore wind-to-hydrogen developer ERM Dolphyn, said public-private partnerships could help to support projects in the early, unstable phases of growth.

He noted that consensus was growing around the long-term role hydrogen could play in the decarbonization of the economy, but more measures were needed in the short term to build towards the 2050 vision.

Emmanouil Kakaras, executive vice president at Mitsubishi Heavy Industry for its NEXT Energy Business, said scale in the market would first come from blue hydrogen, with early demand gains to be made in replacing existing hydrogen production by adding CCS, while energy storage needs would then help build further volumes.

These two areas would be the "game changers" in promoting the massive deployment of hydrogen, Kakaras said.

Hydrogen Council Calls on World Leaders to Back Pledges on Clean Hydrogen Investment

The Hydrogen Council called on world leaders in the public and private sectors to back pledges on clean hydrogen investment and capacity installations with concrete action, saying investment has reached a "critical threshold."

Read the Full ArticleHydrogen Key to Decarbonizing Rail Transport to Meet Net-Zero Goals: Alstom

Hydrogen will be key to decarbonizing rail transport to meet mid-century climate goals, train manufacturer Alstom said at the UN Climate Change Conference Nov. 10.

Read the Full ArticlePowerhouse Energy, HUI Target Lowest-Cost Hydrogen from Waste Plastic with Linde Deal

Powerhouse Energy and Hydrogen Utopia International plan to bring low-cost hydrogen and syngas to industrial gas customers in Europe using waste plastics as a feedstock, signing an agreement with industrial gas and chemicals company Linde at the UN Climate Change Conference.

Read the Full ArticleHydrogen to Meet 15% of Scottish Energy Needs by 2030

Scotland has launched a GBP100 million ($134 million) fund to implement its 5-GW hydrogen policy, which it said could meet 15% of the country's energy needs by 2030.

Read the Full ArticleUAE Targets 25% of Global Low-Carbon Hydrogen Market by 2030

The UAE is targeting a 25% global market share of low-carbon hydrogen by 2030 with the launch of its "hydrogen leadership roadmap" at the UN Climate Change Conference.

Read the Full ArticleAustralia's FFI Plans $8.4 Billion Green Hydrogen Project in Argentina

Australia's Fortescue Future Industries plans to invest as much as $8.4 billion to build a project for producing green hydrogen in Argentina, with a target of reaching output of 2.2 million mt/year for export by 2030, the Argentinian government said Nov. 1

Read the Full Article

Transportation

Major Automakers, Governments Fail to Sign 2040 Zero-Emissions Transport Pledge

A pledge at the UN's Climate Change Conference in Glasgow to accelerate the transition to zero emission cars and vans, greeted as a "landmark global agreement" by the UK's COP26 presidency, has fallen short of expectation with China, the US and Germany and a clutch of major automakers all failing to sign the accord.

'Cars Have Turned a Corner' as Nations Target End of Polluting Vehicles

A host of countries, cities and companies committed Nov. 10 to phasing out the sale of fossil fuel-powered cars and vans by 2040, and even earlier in some markets, in a declaration at the COP26 climate conference in Glasgow, Scotland.

The pledge includes countries like the U.K. and Canada while corporate signatories include vehicle manufacturers Ford Motor Co. and General Motors Co., which will only sell zero-emission vehicles by 2035 or earlier. Yet, the world's largest carmaking economies, including China, the U.S., Japan and Germany, are absent from the commitment, as are major automakers Volkswagen AG, Toyota Motor Corp. and Hyundai Corp.

Metals & Mining

IAI Models 1.5-Degree Decarbonization Scenario to Reduce Aluminum Industry Emissions

The International Aluminium Institute has modelled a 1.5-degree decarbonization scenario in its efforts to drive the industry to reduce emissions and meet global climate goals, it said Oct. 26.

The modelling was based on the International Energy Agency's Net-Zero by 2050 scenario and complements existing IAI work, such as detailed historical emissions, the 'business as usual' scenario to 2050 and the previously released 'beyond 2 degrees' scenario, IAI director, scenarios & forecasts Marlen Bertram told a pre-COP26 virtual media briefing.

According to the data, a 1.5-degree scenario approach could reduce the sector's total greenhouse gas emissions by 95% between 2018 and 2050.

Five Developed Nations Commit to Support Low Carbon Steel, Cement Sectors

The UK, India, Germany, Canada and UAE have committed to support new markets for low carbon steel, cement and concrete, the UK Presidency of the UN Climate Conference in Glasgow said Nov. 9.

Steel and cement are among the most carbon-intensive industrial materials on the planet. Producing them accounts for between 14% and 16% of global energy-related CO2 emissions.

The countries have pledged to achieve net zero in major public construction steel and concrete by 2050, the UK COP26 Presidency said.

Shipping

22 Countries Sign Clydebank Declaration to Boost Green Shipping

Over 20 countries including the US, Japan, Australia and Canada have signed the Clydebank Declaration to develop at least six green shipping corridors between two or more ports by 2025 and "many more" by 2030, the UK COP26 presidency said Nov. 10.

The global maritime shipping sector accounts for 2.5%-3% of global CO2 combustion emissions, according to S&P Global Platts Analytics.

"It is our collective aim to support the establishment of at least six green corridors by the middle of this decade, while aiming to scale activity up in the following years, by inter alia supporting the establishment of more routes, longer routes and/or having more ships on the same routes," the signatories said.

Shipping Industry Must 'Upgrade; Climate Targets: IMO Chief

Shipping must raise its environmental targets, the International Maritime Organization's secretary-general said during the United Nations Climate Change Conference in an apparent nod to growing pressure from shipping companies and politicians.

The IMO is currently targeting a 50% cut in greenhouse gas emissions from the global fleet by 2050 compared with 2008 levels, following a 40% reduction in carbon intensity by 2030, but there is growing industry and political pressure to raise the 50% goal to 100%.