The Intergovernmental Panel on Climate Change's latest report on decarbonization pathways sounds the alarm that unless the world moves faster to make sweeping emissions reductions, it will be locked into a global warming trajectory with exponentially higher losses and damage for businesses, nature and society.

The report issued April 4 is the third installment of the IPCC's current climate assessment cycle and provides a stark reminder that the world is likely to overshoot 1.5 degrees C (2.7 F) warming relative to preindustrial levels and, without immediate action, is on pace to go over 2 degrees C (3.6 F). At the same time, the IPCC wrote that the use of technologies that can remove carbon from the atmosphere could help return the temperature increase to 1.5 degrees C by the end of the century.

IPCC reports have been highly influential in the environmental, social and governance space and often guide investor engagement and corporate decarbonization plans. Investors are increasingly calling on companies to assess their climate risks and outline their plans for transitioning to a low-carbon future to avoid those risks. Meanwhile, many larger companies as well as cities and some nations are setting net zero targets. The IPCC report notes, however, that many net zero targets are ambiguously defined and are not yet fully supported by the governmental policies needed to achieve them.

Faster action is needed

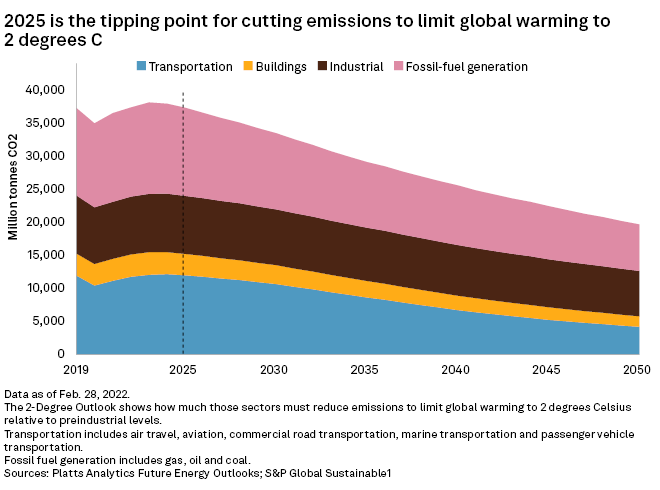

Scenarios limiting warming to 1.5 degrees and 2 degrees show that the world must move more rapidly to curb emissions and show concrete progress by 2025, the IPCC said. This finding aligns with an October 2021 analysis S&P Global Sustainable1 published using S&P Global Platts Analytics’ Future Energy Outlooks.

The IPCC report reiterates that limiting global warming to 1.5 degrees requires achieving net zero emissions by around 2050. But it adds that the deadline for achieving net zero emissions may need to be earlier if emissions reductions are not sharp enough by 2030.

Under a 1.5 degrees scenario with no or limited temperature overshoot, the world would need to reduce emissions by 43% by 2030. However, the world must act even sooner to avoid overshooting 1.5 degrees or 2 degrees.

Specifically, the IPCC is now suggesting that the world must reach peak emissions — meaning emissions would decline after that point — before 2025 under both 1.5 degrees and 2 degrees scenarios. But the chance of the world acting that fast appears to be low, the IPCC found.

Currently, the world is not projected to stop emissions growth by 2025 and is on a path toward global warming of about 3.2 degrees this century, the IPCC wrote. Given that even small increases in annual global temperatures can make a huge difference in the severity of climate change impacts, warming of 3.2 degrees compared to even 2 degrees could come with drastically larger damage and losses. For example, flood risks globally would double at 3 degrees warming compared with 1.5 degrees. And in Europe, the number of deaths and people at risk of heat stress will increase two- to three-fold at 3 degrees global warming compared to 1.5 degrees.

Even assuming countries implement all their current pledges made under the Paris accord, the world would still go above 2 degrees warming. Current national pledges, if they are met in full, would lead to global warming of about 2.8 degrees, the IPCC said.

At least 18 countries have steadily cut their emissions for at least a decade, but they represent a small fraction of the more than 190 countries that signed the 2015 Paris Agreement on climate change. And while costs have gone down globally for low- to zero-carbon technologies such as renewable generation and lithium-ion batteries for electric vehicles, deployment of those technologies has lagged in developing countries even as it climbed in developed ones.

At the same time, dozens of countries have begun enacting climate-related laws and programs. By 2020, 56 countries had climate laws focused on reducing emissions and more than 20% of global emissions were covered by carbon taxes or emissions trading systems, the IPCC found. The panel noted, however, that those mechanisms have yet to price carbon high enough to achieve deep emissions reductions.

The IPCC also highlighted the importance of keeping the UN's Sustainable Development Goals and social equity needs in mind when planning the low-carbon transition, such as ensuring that fossil fuel workers have access to retraining and other forms of support in low-carbon economies.

Financing is still far, far behind

Transitioning to a low-carbon economy will require significantly more money than is being allocated to climate change currently, the IPCC wrote.

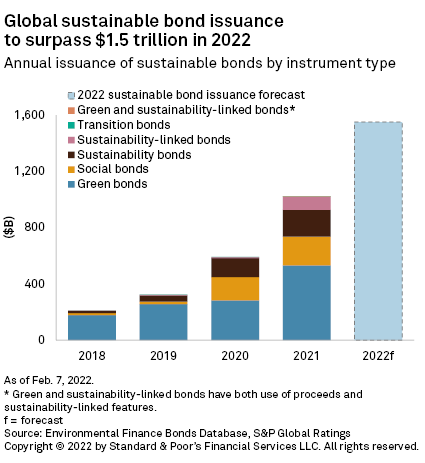

While total annual financial flows for reducing emissions or adapting to climate change have increased, the average growth has slowed since 2018 and remains uneven across regions and sectors. Climate-related financial flows from both private and public sources need to increase by a range of 3x to 6x, the IPCC found. Financial flows to the least-developed countries need to be increased even more, by as much as 8x.

As an example of how much financing will be needed, the IPCC estimates that investments for the global electricity sector’s low-carbon transition to limit global warming to 1.5 degrees with no or limited overshoot would require about $2.3 trillion per year from 2023 to 2052. In comparison, global investments across all energy sectors including electricity in 2019 totaled $1.94 trillion. But there are signs that spending, including from governments, is on the rise. An April 2022 report by the International Energy Agency shows that government spending earmarked for clean energy climbed 50% over the prior five months to more than $710 billion globally.

Reiterating a theme heard at COP26 in November 2021, the IPCC's new report found the world has enough global capital and liquidity to close those investment gaps. However, redirecting that capital toward climate change and distributing it evenly across regions and sectors remains challenging.

Barriers the financial sector faces in reallocating that capital include insufficient assessment of climate-related risks and investment opportunities, a regional mismatch between where money is available and where the investment is needed, economic vulnerability and limited institutional capacity, the IPCC found.

And while the market for green bonds and other sustainable finance products has expanded significantly in recent years, public and private finance for fossil fuels is still greater than those for climate change adaptation and mitigation, according to the IPCC.

Stranded fossil fuel assets are likely

The IPCC warned that continued investment in fossil fuel infrastructure will lock the world into higher emissions and could result in trillions of dollars’ worth of stranded fossil fuel assets. Of the $1.94 trillion invested in energy globally in 2019, $990 billion went to fossil fuel-related activities, while about $340 billion went to renewable electricity investments.

Maintaining this level of fossil-fuel investments in the near term will make it harder to stay on track to limit warming, which could lead to whiplash if the world sprints to cut emissions over the medium term by rapidly abandoning fossil fuels. Doing so would lead to many more stranded assets that became less valuable in a low-carbon economy.

This risk of stranded assets is one of many reasons why near-term policy decisions will be hugely consequential, especially for fast-growing economies looking to keep building out their fossil fuel infrastructure, the IPCC said. These economies could be at the greatest risk of holding stranded assets as carbon-intense activities lose value. In India, for example, between 133 GW and 227 GW of coal capacity could be stranded after 2030. India had about 204 GW of coal-fired generation capacity as of Jan. 31, which represented more than half of its total generation capacity. That means the vast majority of that coal fleet capacity could face stranded-asset risk by the end of this decade.

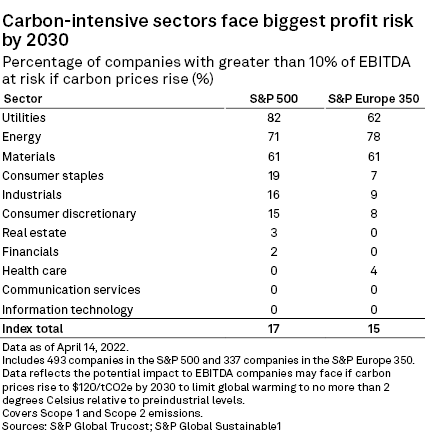

The IPCC report comes as investors are increasingly calling on companies to assess and disclose their climate risks and plans for transitioning to a low-carbon future to ensure companies' long-term performance. A widely observed carbon tax or emissions trading program, for example, will be needed to support a rapid low-carbon transition, the IPCC wrote. But a high price on carbon could directly impact companies’ financial performance.

An analysis of S&P Global Trucost data shows that unpriced carbon risks are particularly high for the utilities, energy and materials sectors. A majority of S&P 500 and S&P Europe 350 companies in these sectors could see a hit to EBITDA of 10% or more by 2030, in a scenario in which carbon prices accelerate in line with a 2 degrees pathway. Overall, about 17% of companies in the S&P 500 and 15% of companies in the S&P Europe 350 would face this risk to their earnings by 2030.

Stranded assets are likely, the IPCC warned. Limiting global warming to 2 degrees or below will "leave a substantial amount of fossil fuels unburned and could strand considerable fossil fuel infrastructure," the panel wrote. The world could have up to $4 trillion worth of stranded fuels and infrastructure from 2015 to 2050 under a 2 degrees scenario. As for when those risks could manifest, the IPCC said the coal sector could see stranded assets before 2030, while oil and gas assets run the risk closer to mid-century. However, technologies such as carbon capture and sequestration could help reduce the risk of stranded assets.

As part of the path to a low-carbon future, including one with fewer stranded assets, energy systems — any system that relies on electricity or fossil fuels to operate — will need a significant overhaul. The IPCC noted that those systems underpin the energy-use-related emissions of other sectors such as industrials and transportation. The IPCC found that low-carbon energy sources such as wind, solar, nuclear, hydropower, bioenergy and fossil fuels or bioenergy with carbon capture and sequestration, will need to provide 74% to 82% of primary energy by 2050 under a 1.5 degrees scenario in which the world has little to no overshoot of that target temperature. Yet low-carbon sources currently provide less than 20% of primary energy globally, the IPCC found.

Natural gas is likely to remain a part of energy systems through mid-century, although its usage would peak around 2035 and decrease to between 21% to 61% by 2050 from 2020 levels under a 1.5 degrees scenario with no or limited overshoot.

Carbon removal technologies will play a key role

The IPCC noted that low-carbon pathways aligned with 1.5 degrees and 2 degrees assume some degree of reliance on negative emissions technologies that remove carbon dioxide from the atmosphere and durably store it for up to thousands of years in geological formations, land-based sources such as trees or soil, ocean reservoirs, or even in man-made products.

Sometimes also referred to as CO2 removal activities, these technologies will be needed to counterbalance any residual emissions that cannot be eliminated from hard-to-abate sectors in the pursuit of net zero global emissions by mid-century. The technologies will also be key to reversing global warming back to 1.5 degrees if the world overshoots that warming target, which scientists say is currently likely.

Carbon removal technologies range from enhancing natural processes through activities such as afforestation, agroforestry and soil carbon sequestration. These technologies can also involve artificial removal processes such as direct air carbon capture and storage, commonly referred to as DACCS, and the production of low-carbon hydrogen through pairing bioenergy with carbon capture and storage, more commonly known as BECCS. But negative emissions technologies face many challenges to widespread deployment, including higher costs than other low-carbon options, infrastructure needs, public acceptance, competing with other demands for land use and the need for broader research and development.

Projections of just how much carbon removal is needed vary even within the IPCC's models and depend on how fast and comprehensively the world and sectors transition.

The IPCC envisions the world could need carbon removal technologies to be capable of removing a cumulative total of 20 GtCO2 to 660 GtCO2 from the atmosphere from 2020 to 2100 under a 1.5 degrees scenario. To put that in context, negative emissions technologies and carbon removal technologies would need to remove emissions equivalent to slightly more than half (54.5%) of how much carbon the world emitted in 2019 (36.7 GtCO2) and up to a whopping 18 times the amount of global emissions in 2019.

This piece was published by S&P Global Sustainable1 and not by S&P Global Ratings, which is a separately managed division of S&P Global.