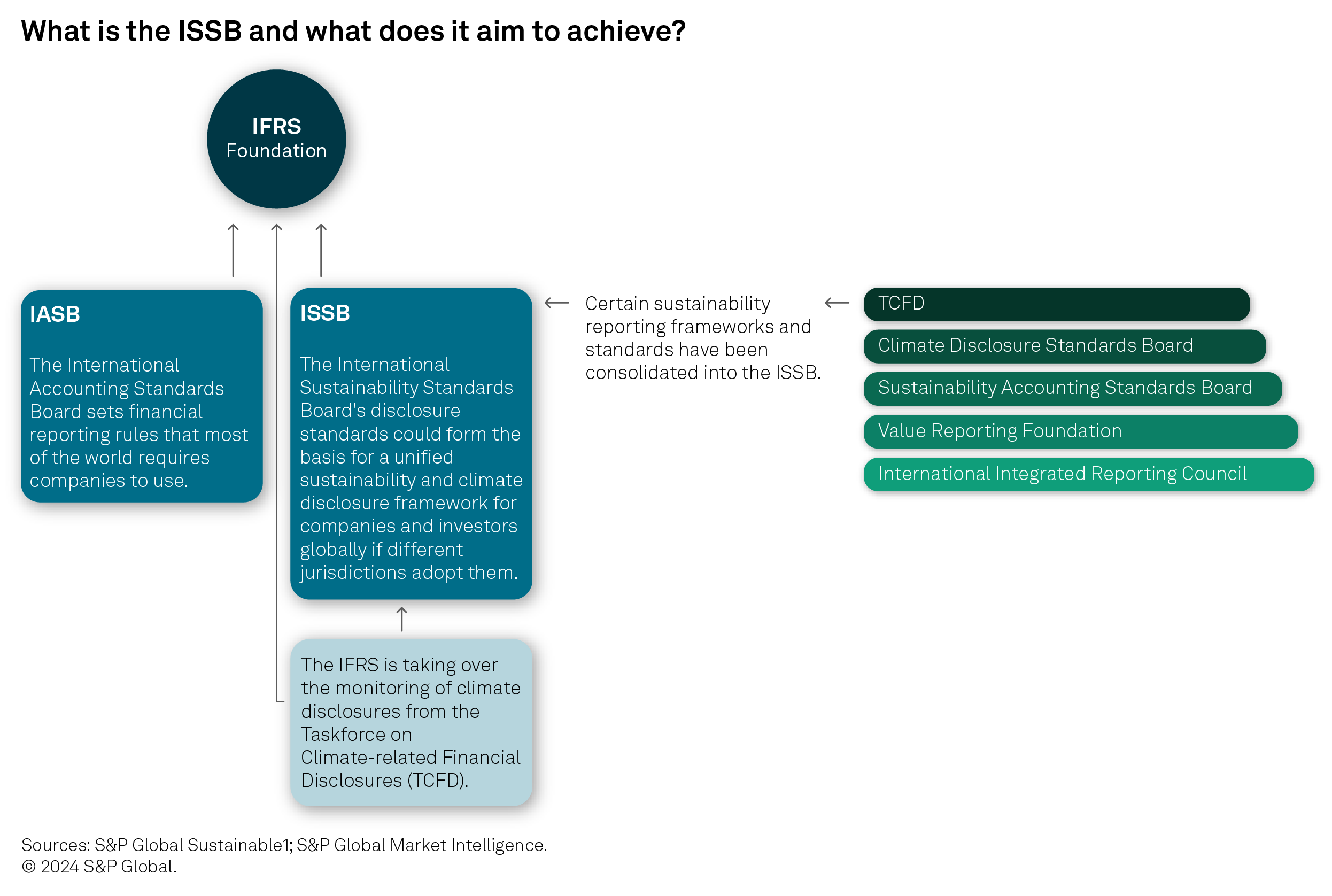

The International Sustainability Standards Board (ISSB) launched its first two sustainability-related standards in June 2023, effective for annual reporting periods on or after Jan. 1, 2024. The standards could form the basis of a consistent sustainability disclosure framework for companies and investors around the world. In this quarterly article, we bring you the latest global developments in the uptake of the ISSB’s standards.

Since the ISSB issued its first two global sustainability standards in June 2023, jurisdictions around the world have stated their intention to adopt the standards or align reporting frameworks with them. Adoption of the standards is gaining traction: As of June 30, 2024, six jurisdictions have adopted the standards on a voluntary or mandatory basis with reporting starting Jan. 1, 2024, and 16 other jurisdictions are planning to adopt them in the future. Many of those jurisdictions in the process of adoption are at varying stages of developing their country’s response to the standards.

What are the standards?

Under the general requirements standard, or IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information, companies are required to disclose sustainability-related risks and opportunities. The climate-related disclosures standard, or IFRS S2 Climate-related Disclosures, asks for specific metrics such as greenhouse gas (GHG) emissions as well as disclosure of climate-related physical and transition risks and whether companies use scenario analysis to gauge their resilience to climate change’s impact on markets and policy.

What guidance is the IFRS giving on ISSB adoption?

The IFRS in May 2024 published a guide for jurisdictions seeking to adopt or use its sustainability-related disclosure standards . It explains the various ways jurisdictions can use the standards, such as full adoption of the standards, partial adoption and permitting companies to use them.

The guide’s aim is to set out “some key things that jurisdictions should think about when they're making decisions about which companies should be required to apply the standards and what particular disclosures should be provided, the pace at which they are introduced,” ISSB Vice Chair Sue Lloyd told S&P Global Sustainable1’s ESG Insider podcast in a May 8 interview, just before the guide's publication.

The document includes a regulatory implementation guide, which Lloyd described as a plan to develop more materials to help jurisdictions to build road maps on introducing the standards. It also describes what steps regulatory bodies may have to take to apply the standards, such as:

-

whether legislation or regulation is needed to apply the standards;

-

if the standards are fully transposed into regulatory frameworks or, if not, how much they align to local standards;

-

what companies the standards are targeting;

-

whether the standards are included in financial reporting and when the standards are effective.

The IFRS also said it is planning to create profiles of jurisdictions that have adopted the standards to provide details on their progress. The profiles, along with the jurisdictional guide, would “provide transparency to capital markets, regulators, other relevant authorities and other stakeholders on jurisdictional progress towards the adoption or other use of ISSB Standards,” the IFRS wrote in the guide. It also encourages regulators to explain how they have adopted standards to consider local circumstances.

How are regulators adopting the standards?

Ultimately, the standards will only take effect for corporate reporting if jurisdictions adopt them. The International Organization of Securities Commissions (IOSCO) endorsed the ISSB standards a month after their initial publication, signaling support for adoption in the 130 jurisdictions it represents. Those jurisdictions regulate more than 95% of the world's financial markets. The ISSB said on May 28, 2024, that jurisdictions representing over half the world’s GDP have announced plans to use the ISSB standards or to fully align their sustainability disclosure standards with those of the ISSB.

Regulators are taking different approaches to introduce the standards, with variations between mandatory and voluntary reporting, the size of companies in scope or timelines for reporting. The ISSB was established to create a global baseline in standards, and that remains the ultimate goal, Lloyd told the ESG Insider.

“What our jurisdictional guide really highlights is, ultimately, we'd like as many companies as possible to be fully aligned with the ISSB's standards. But we realize that there's a path to get there, and you may need to be proportionate and measured in the way that you get companies onto that path,” she said.

She said the ISSB would prefer a jurisdiction to take longer to implement the standards to reach the global baseline set by the ISSB, than simply decide not to take up certain requirements because they would be difficult to implement in the early stages.

Jurisdictions planning to adopt the standards with modifications for their local market include Canada, where its sustainability standards board is proposing to allow companies a two-year exemption before they report on Scope 3 emissions, which are the emissions that occur up and down a company's value chain. Under IFRS S2, companies reporting Scope 3 emissions can have a temporary exemption for a minimum of one year after the standard becomes effective.

In South Korea, the Korea Sustainability Standards Board (KSSB) published draft sustainability-related disclosure standards in April based on the ISSB’s two standards. It also published KSSB 101, a country-specific standard that is not mandatory and allows companies to “selectively” disclose additional sustainability-related information as required by domestic laws or to meet sustainability-related policy objectives.

In May, China also announced plans to adopt the standards and proposed general requirements for corporate sustainability information disclosures for certain companies established in China, with a view of establishing a national standard by 2030.

In other developments among jurisdictions adopting the standards, Brazil’s securities regulator, Comissão de Valores Mobiliários, formally integrated the ISSB standards into its regulatory framework on Oct. 20, 2023, and it proposed draft sustainability-related disclosure standards aligned with the standards in May 2024. It adopted the standards as of Jan. 1, 2024, on a mandatory basis for publicly listed companies beginning with fiscal years after Jan. 1, 2026.

Several jurisdictions announced mandatory reporting requirements based on the TCFD, and those could provide the basis for reporting according to the ISSB standards. For example, New Zealand's standard-setting body, the External Reporting Board, adopted climate-related disclosure standards for certain companies as of Jan. 1, 2023, based on the TCFD recommendations. The board said it would review the country’s climate standards by December 2025 to determine whether any changes to its standards are needed to align with any existing or forthcoming requirements.

The UK has also had mandatory disclosures in place for certain companies since 2022 based on the TCFD recommendations. The UK Financial Conduct Authority plans to update those disclosure requirements to align them with the ISSB standards. The country’s government has also said it would publish UK sustainability disclosure standards by the first quarter of 2025 based on the ISSB standards.

The EU’s Corporate Sustainability Reporting Directive came into effect in 2024. The US Securities and Exchange Commission (SEC) announced its own climate-disclosure standards in March 2024. How do they compare to the ISSB standards?

The EU has widened the reach of its sustainability reporting regulations for companies through the reform of its Non-Financial Reporting Directive to create the Corporate Sustainability Reporting Directive (CSRD), which is being phased in from Jan. 1, 2024. Companies in the scope of CSRD are subject to a set of sustainability standards called the European Sustainability Reporting Standards (ESRS). The ISSB published on May 2 interoperability guidance with the European Financial Reporting Advisory Group, a technical advisor to the European Commission, to show to what extent the ISSB standards and the ESRS align and how a company can apply both sets of standards.

Under the ESRS, companies are required to disclose material environmental, social and governance impacts and risks within their upstream and downstream value chains — for example, Scope 1, 2 and 3 emissions as well as total GHG emissions. The ISSB’s climate standards align with the EU’s, Lloyd told the S&P Global Sustainable1 podcast.

“What's really important is to make sure that where we do have these common disclosures, we do what we can to make sure that the information we ask for is aligned,” she said.

The ISSB jurisdictional guide also aims to help companies provide disclosures “in a way that will indeed enable you to comply with both ESRS, the European requirements, and our requirements, so it's efficient and effective for companies,” she said.

In the US, the SEC said in its rule that its reporting framework has elements in common with the TCFD recommendations. The rule requires companies registered under its mandate to disclose at least some material climate-related information, such as risk management practices and risks to their strategy or financial performance. Some larger companies will be required to disclose Scope 1 and Scope 2 GHG emissions — or the emissions associated with their operations and with their purchased energy — but only if the companies deem those emissions to be material.

The SEC acknowledged there were “similarities” between the ISSB standards and its final rule but said it would not recognize the ISSB standards as an alternative reporting regime for the time being. The SEC issued a stay on April 4, halting the implementation of the rule as legal challenges against it proceed.

Predating the SEC rule, California approved a bill in October 2023 that would require large companies doing business in the state to begin reporting Scope 1 and Scope 2 emissions in an annual report starting in 2026, with Scope 3 reporting beginning in 2027. However, the California law also faces the prospect of delay. On June 21, the state proposed delaying the reporting requirements to 2028 for Scope 1 and Scope 2 and to 2029 for Scope 3.

We plan to update this map and article on a regular basis as jurisdictions adopt and apply the standards. If there are additional significant ISSB-related regulatory developments we should cover going forward, please reach out to Jennifer Laidlaw at jennifer.laidlaw@spglobal.com. We welcome feedback.