ANALYZE FUTURE SCENARIOS

Uncover risk scenarios, reveal transition pathways, and optimize your net zero opportunities with in-depth data intelligence.

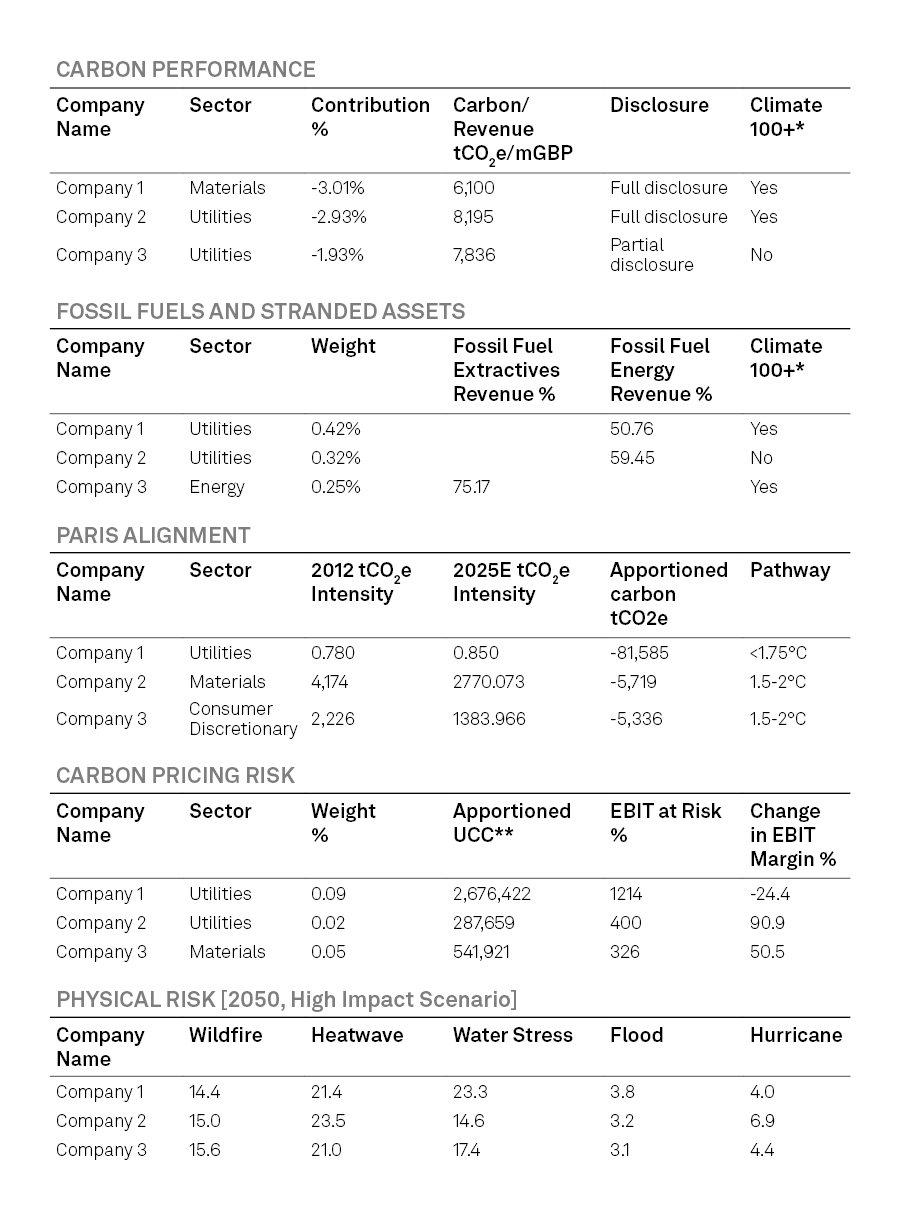

Trucost Physical Risk Data

Understand the exposure of owned facilities and capital assets to climate change physical risks under low, moderate, and high climate change scenarios at 2025, 2030, and 2050. Pinpoint asset exposure to wildfires, flooding, drought, heatwaves, extreme cold, and hurricanes.

Trucost Paris Alignment Data

Understand company alignment with Paris Agreement energy transition pathway to limit global warming to well below 2°C from pre-industrial levels and alignment with net zero.

Trucost Carbon Earnings at Risk Data

Stress test a company’s current ability to absorb future carbon prices and understand potential earnings at risk from carbon pricing on a portfolio level.

Trucost Carbon Pricing Tool

Understand your exposure to current pricing schemes in more than 45 jurisdictions, together with potential future carbon pricing scenarios required to achieve the goals of the Paris Agreement to navigate carbon pricing risk and introduce internal carbon pricing to inform financial decision making.

Market Intelligence Climate Credit Analytics, in partnership with Oliver Wyman

Access counterparty- and portfolio-level analysis of climate related financial and credit risks – and translate climate scenarios into drivers of financial performance.

Platts Integrated Energy Model

Study the evolution of the global energy system, computing long-term pricing under various scenarios through to 2040 with an integrated view of global energy markets encompassing 143 countries (13 regions), 9 end-use sectors, 30 fuel types, and emissions detail.

Platts Future Energy Outlooks

Discover a pragmatic view of the long-term trajectory of energy and commodity markets, with rich insights about the interconnected nature of technology, policy and consumer preference to explain what trade-offs are likely and what the world will look like when they occur.