Quantify your baseline carbon footprint

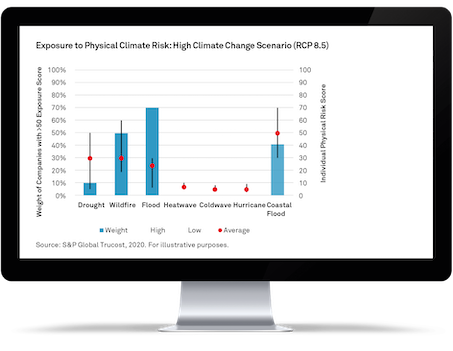

Our approach to TCFD

Quantify your baseline carbon footprint

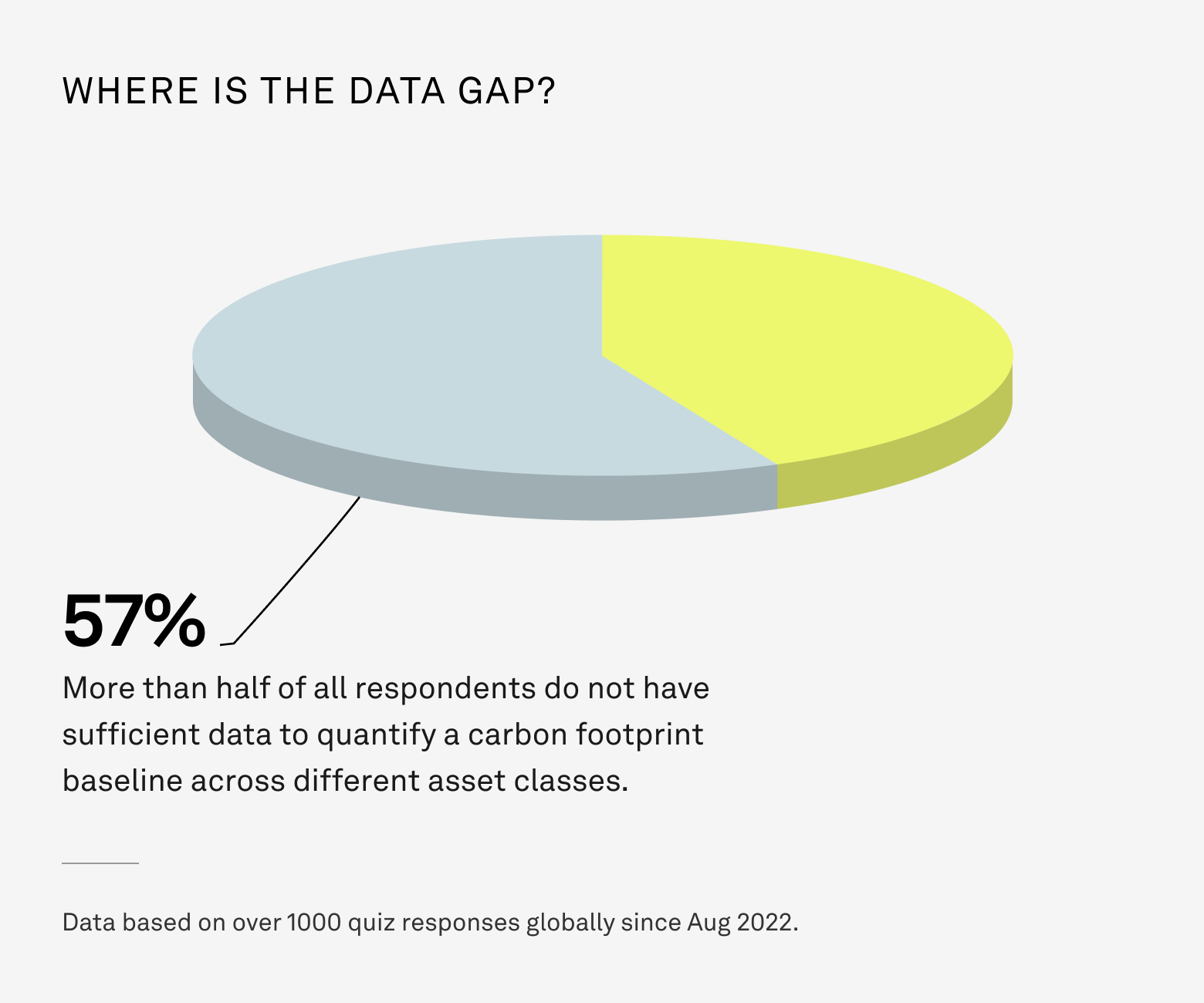

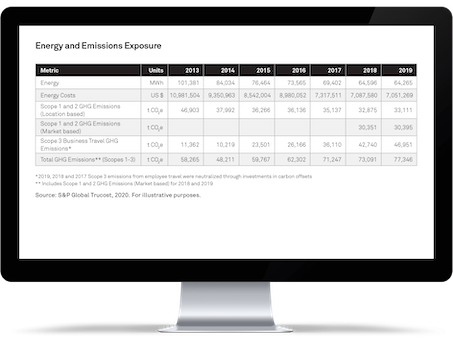

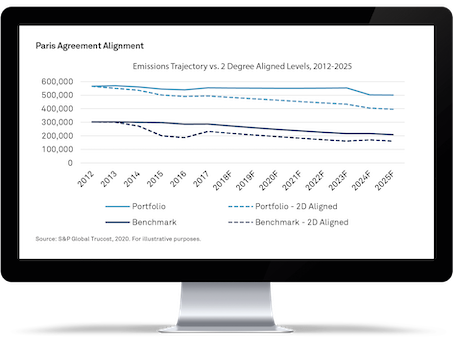

First, companies need to quantify carbon emissions across their value chains – including business operations, supply chains and downstream products in use. Financial institutions need to quantify carbon emissions linked to their capital allocation – it could be across companies in equity and debt portfolios or bank loan books, or investments in other asset classes such as infrastructure and real estate.

We help you to collect the business data you already have on carbon emissions and we provide carbon emissions data to accelerate the process and fill in data gaps.