-

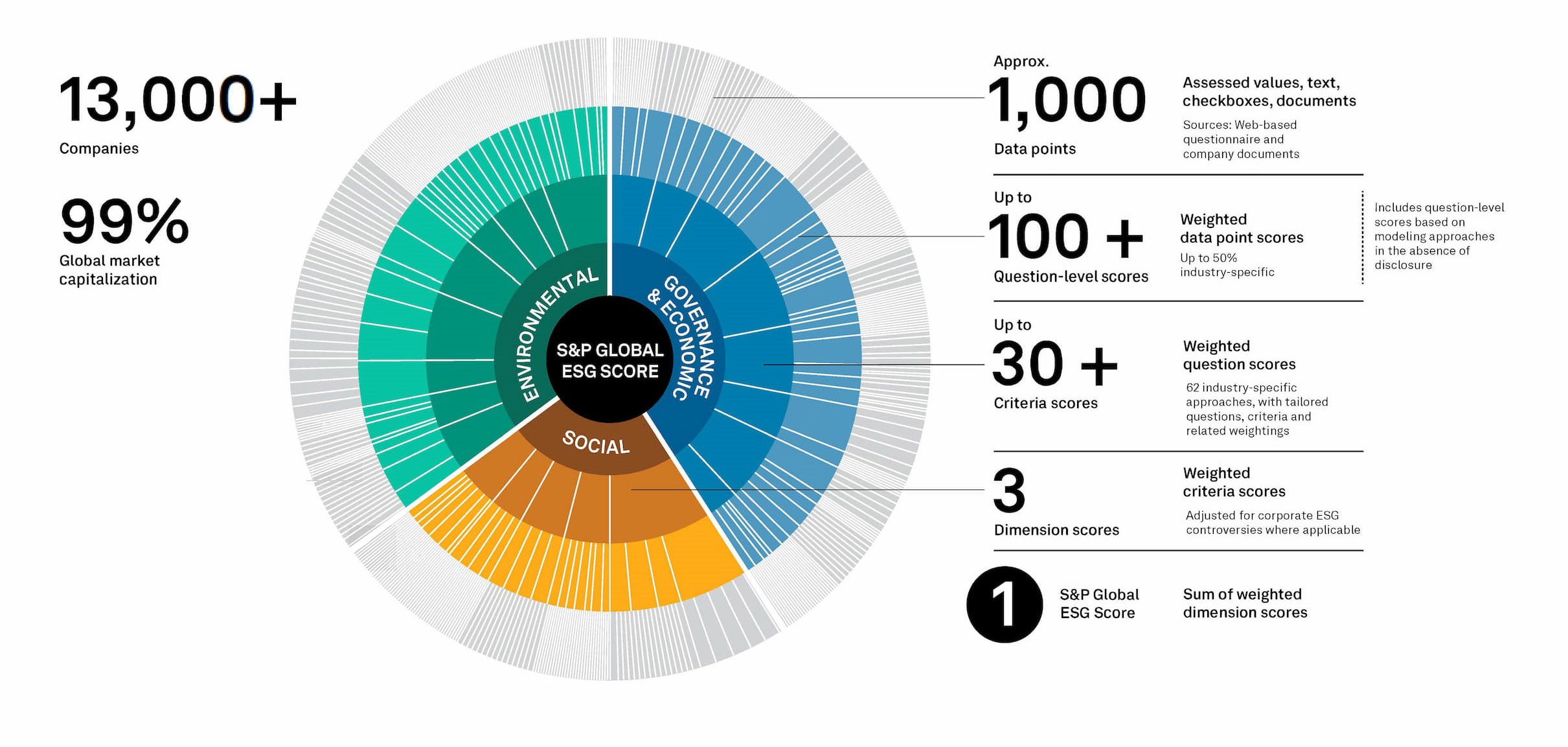

3,500+

unique data points available for use across 35+ sustainability criteria and themes

learn more -

99%

global market capitalization covered by the CSA research universe of more than 13,000 companies

learn more -

50%

global market capitalization actively participates in the CSA providing in-depth ESG data

learn more -

1,000

transparently disclosed ESG datapoints checked against reliable public sources for every company

-

25

years of connecting business and sustainability strategies with the CSA