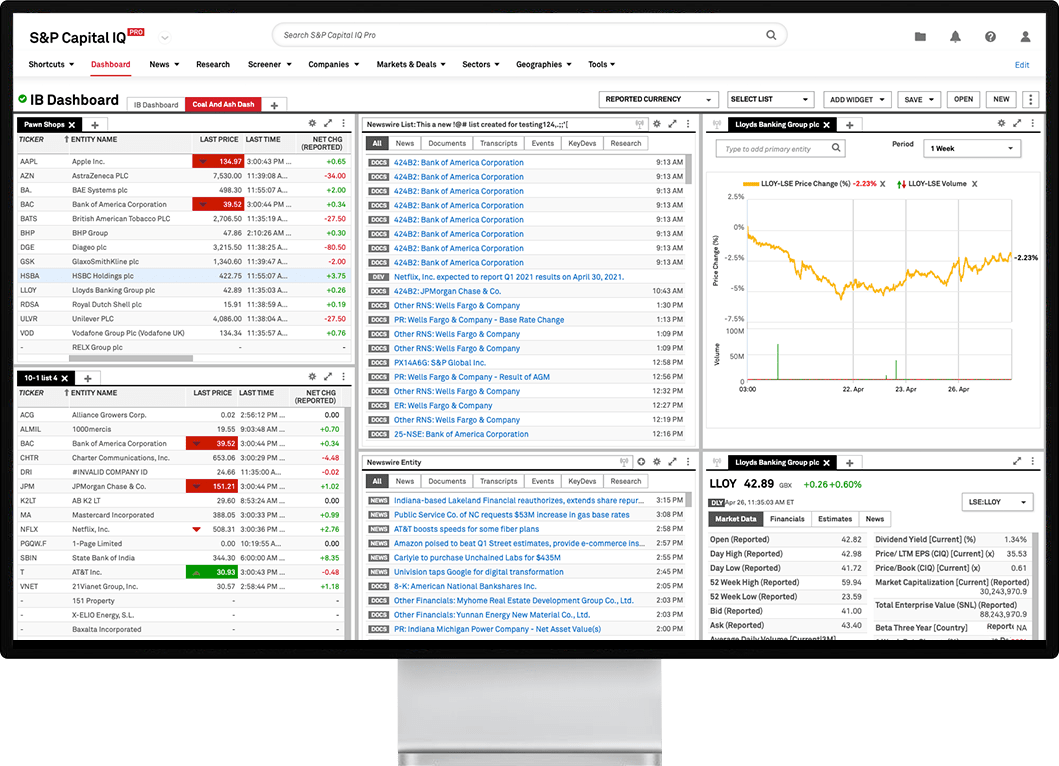

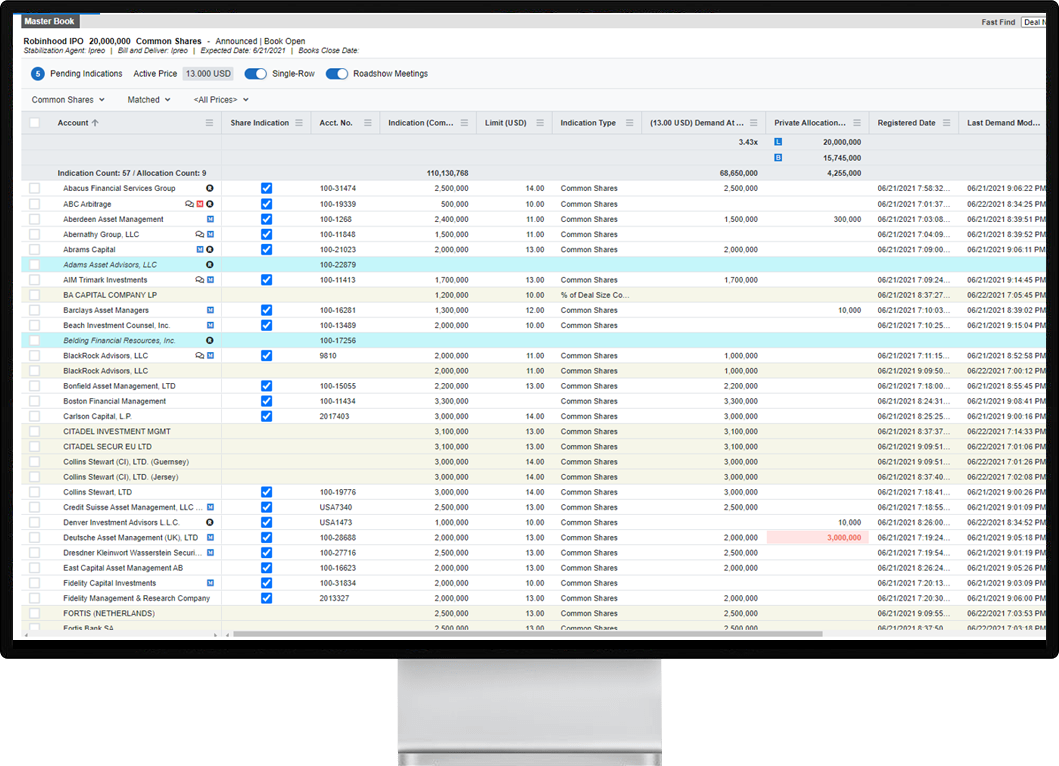

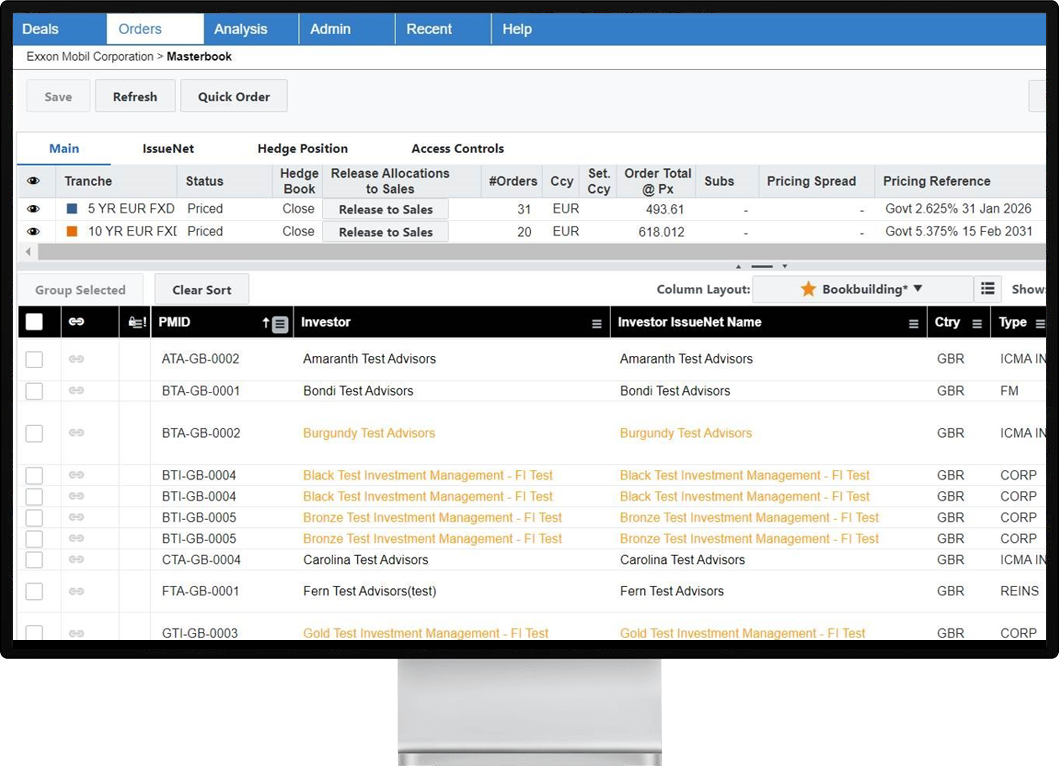

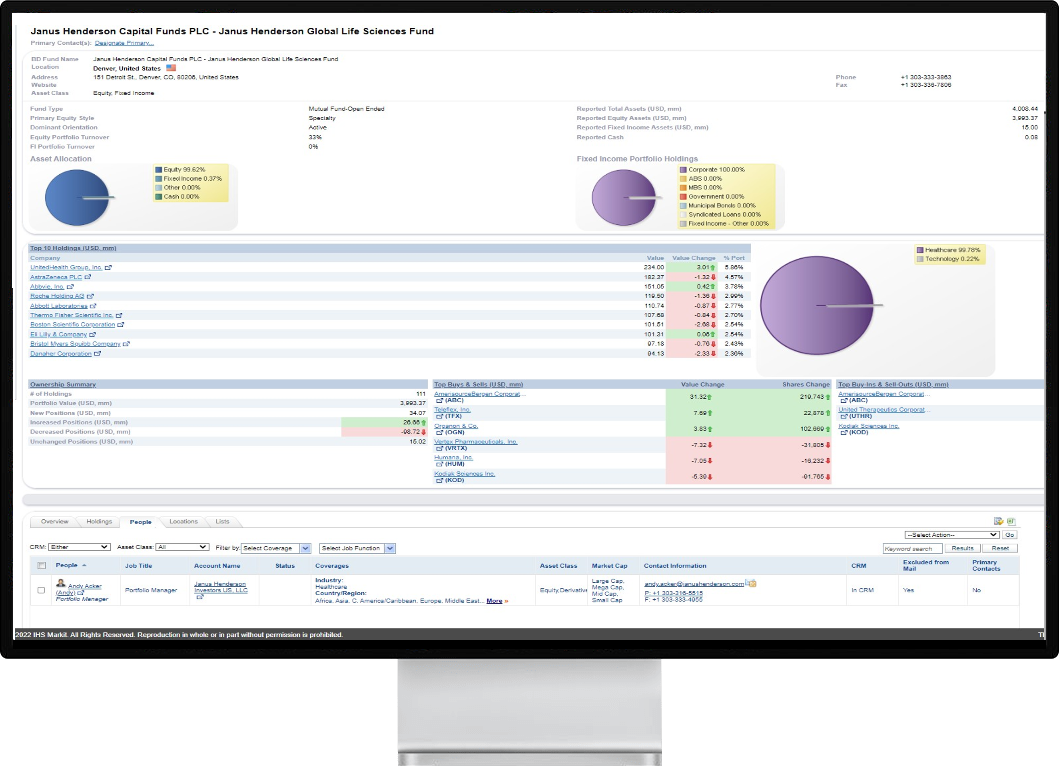

Your one-stop shop for capital formation solutions

Our workflow tools and capabilities help support every step of a transaction, from advice and deal origination, to portfolio risk analysis, optimization, and management so you can add value and achieve greater operational efficiencies pre-, during, and post-trade.