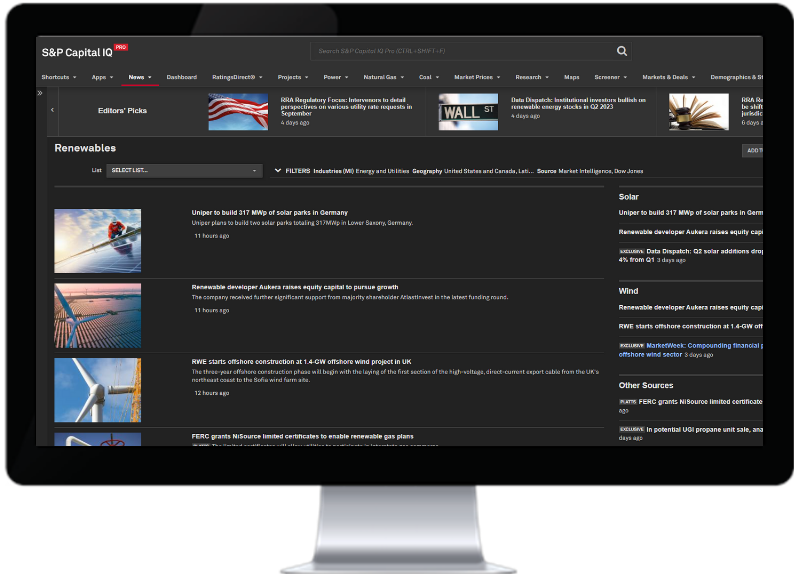

Assess renewable energy opportunities

Evaluate energy projects with comprehensive financial and operational data

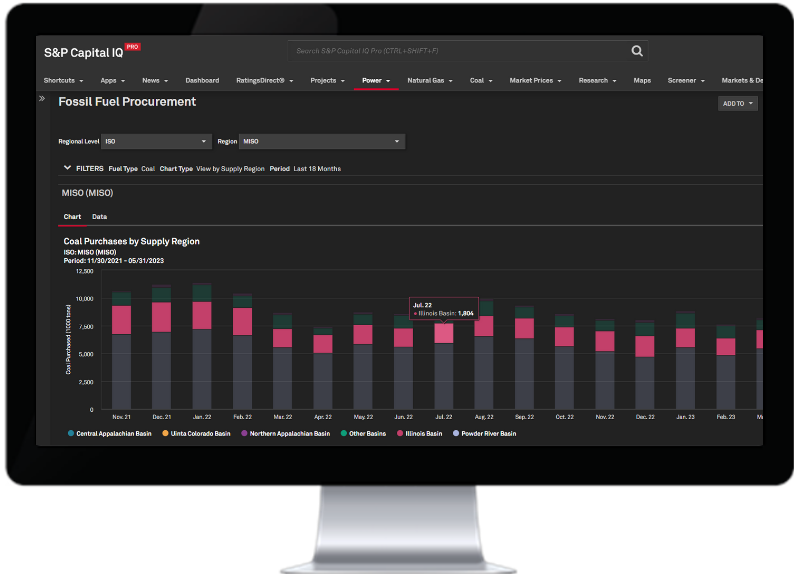

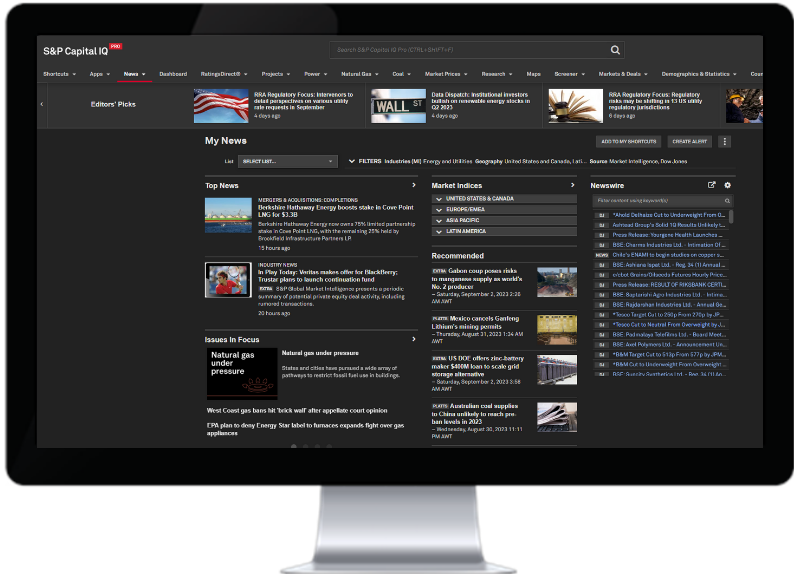

S&P Capital IQ Pro integrates our best-in-class power sector data, electricity price forecasting, and energy market and regulatory research on a single platform. Evaluate renewable energy investment opportunities, assess the potential costs of transition, and inform on the energy transition progress.

- Analyze thousands of continuously updated active power projects and review past renewable energy projects in development.

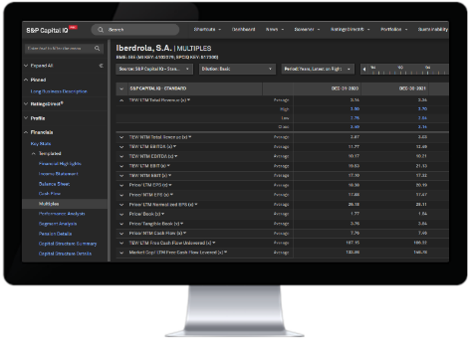

- Bring together Renewable Energy Credit (REC) forecast, hourly power price forecasting, resource adequacy projection, and historical nodal and power generation data to accurately value renewable energy projects.

- Conduct due diligence on PPA procurement using FERC Electric Quarterly Reports (EQR) and data, proprietary PPA tracking, and electricity pricing forecasts.

- Understand the power supply/demand dynamics in data center growth regions and evaluate opportunities for building new power plants. Use our interactive mapping and embed overlapping utility, power transmission, and other infrastructure layers to quickly visualize the competitive landscape.