Worried about IFRS 9? Get what you need to act with confidence.

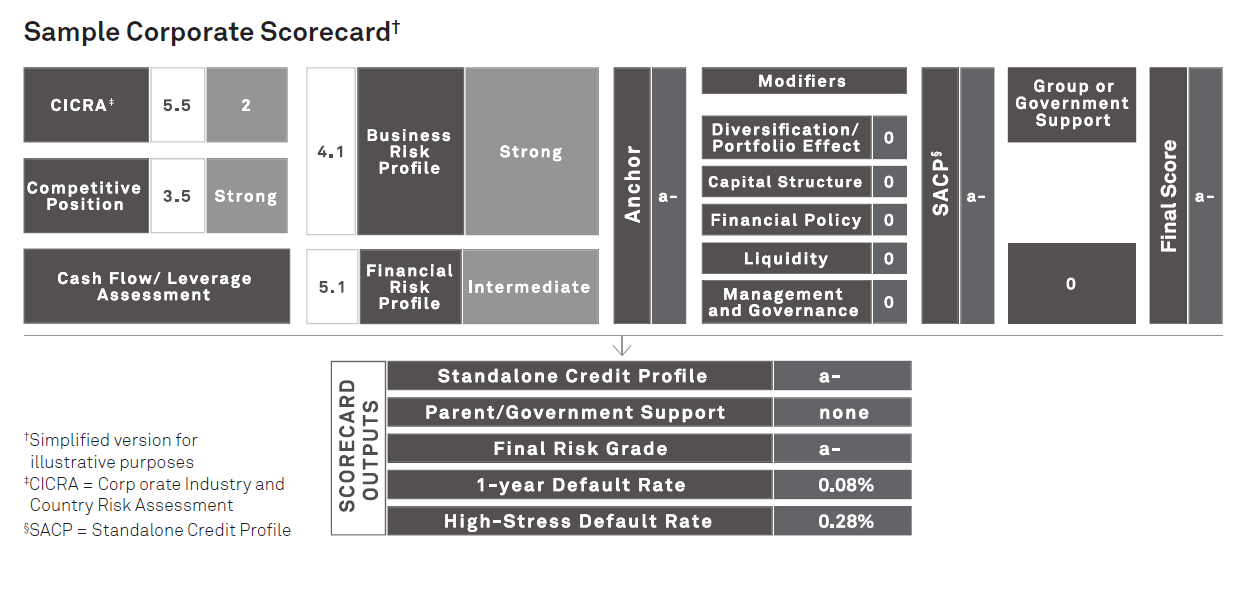

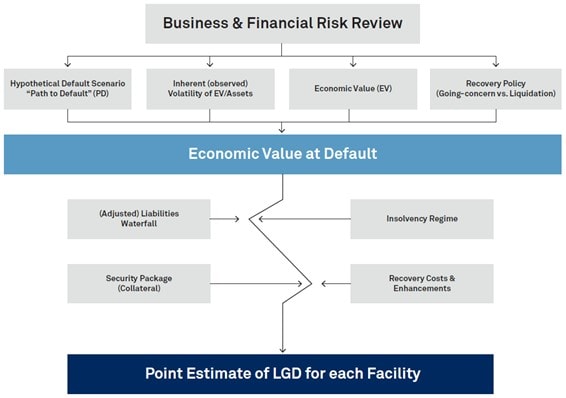

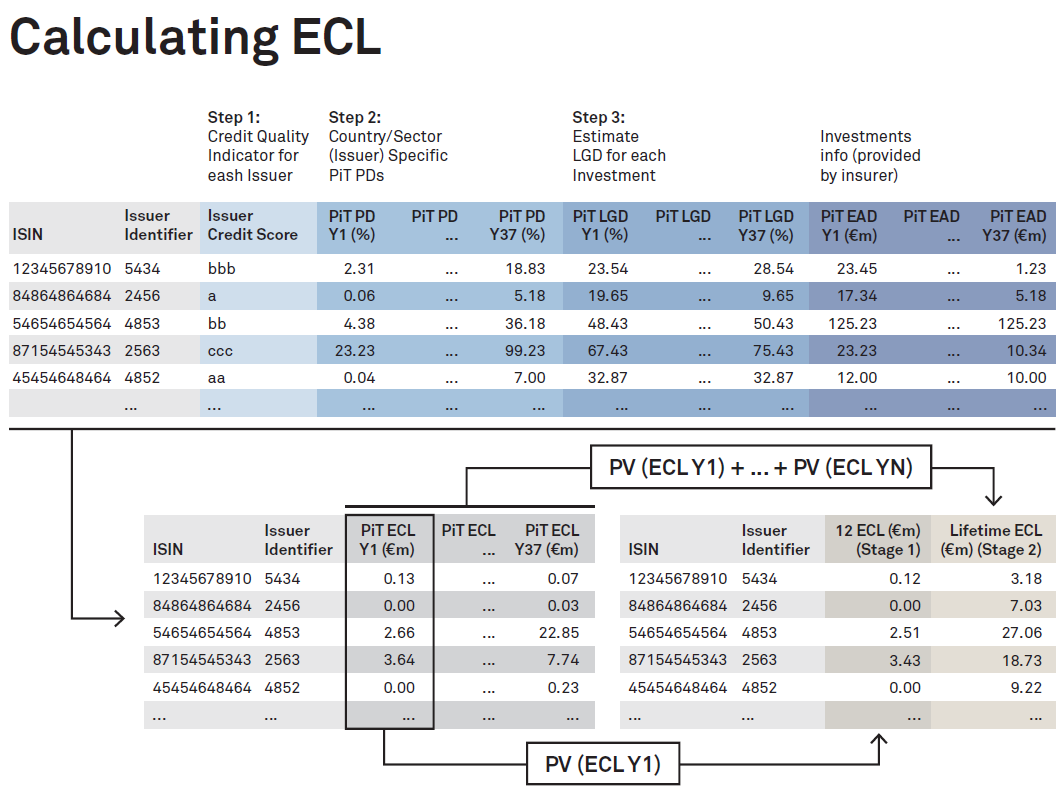

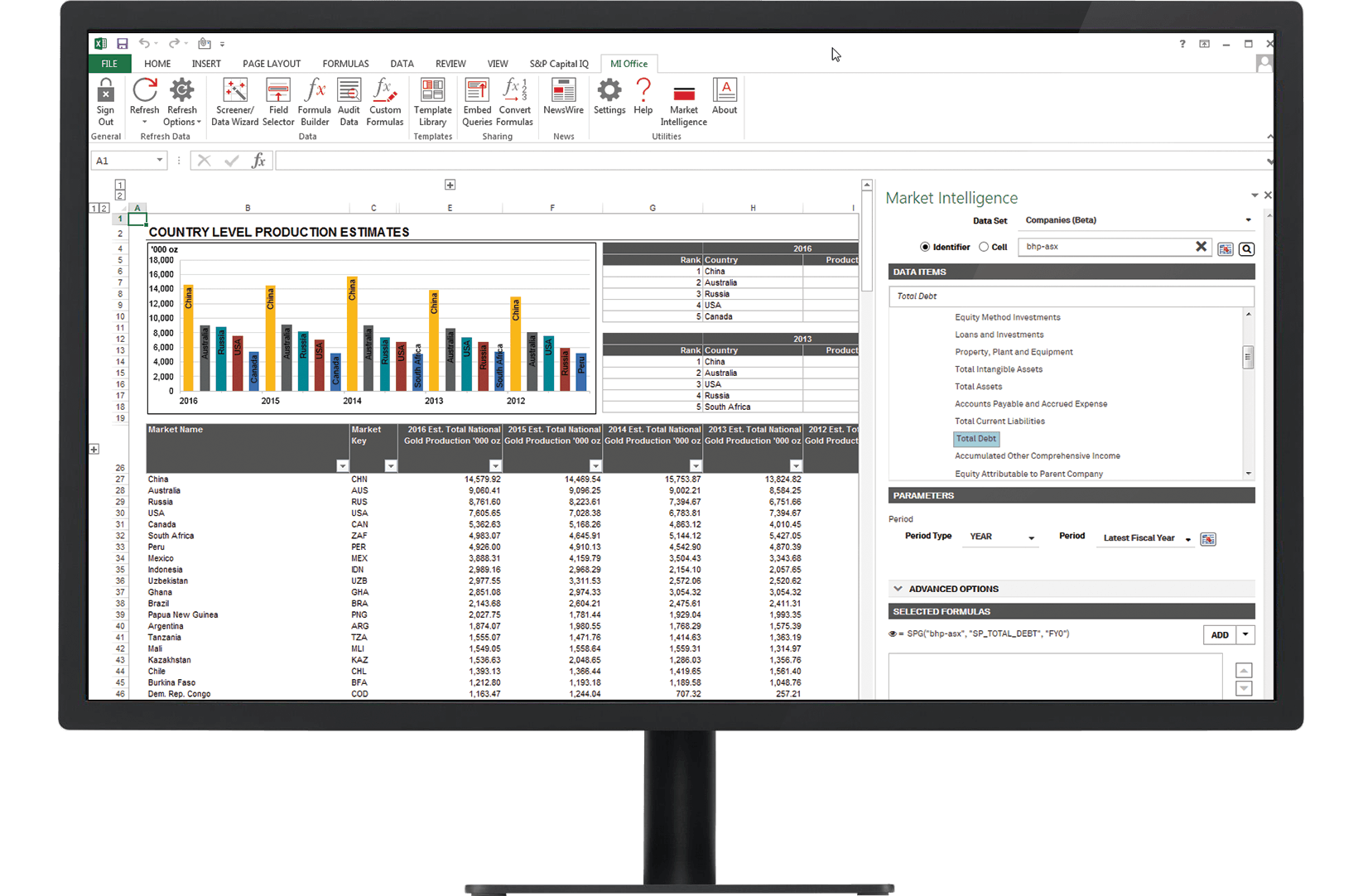

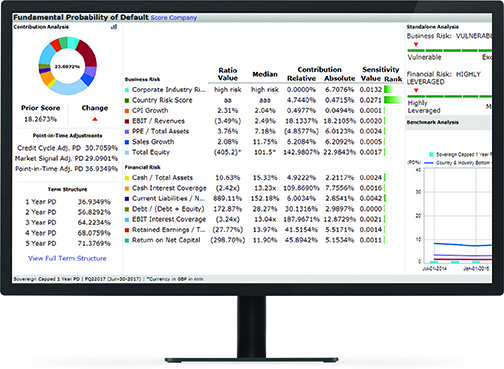

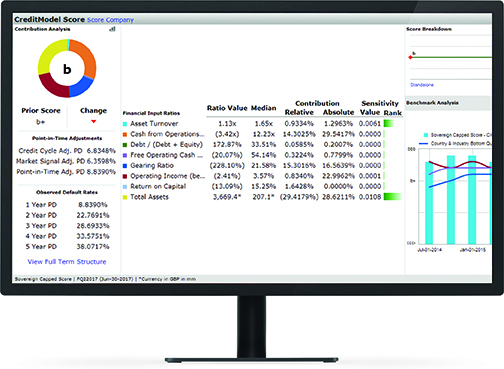

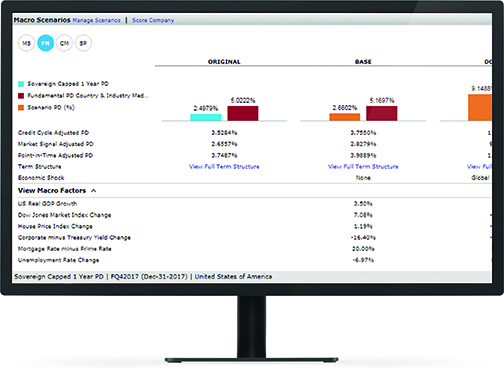

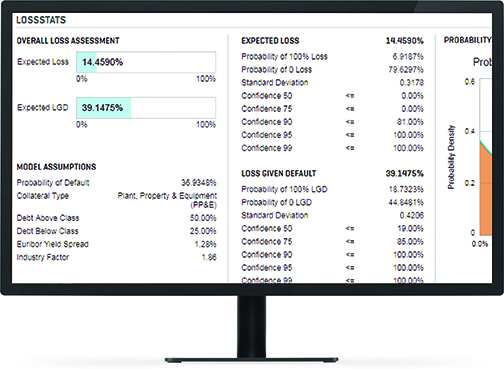

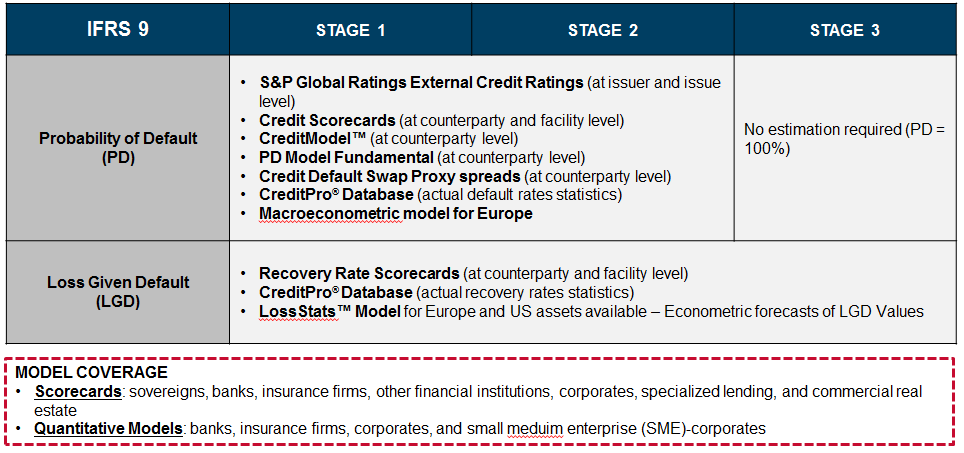

An incomplete approach to new accounting standards could negatively impact your P&L and expose you the risk of lengthy discussions with auditors. Bridge the transition with S&P Global Market Intelligence, offering a suite of IFRS 9 solutions to help you comply with IFRS 9 credit impairment requirements.