Underwriting

Confident underwriting starts with high-quality data

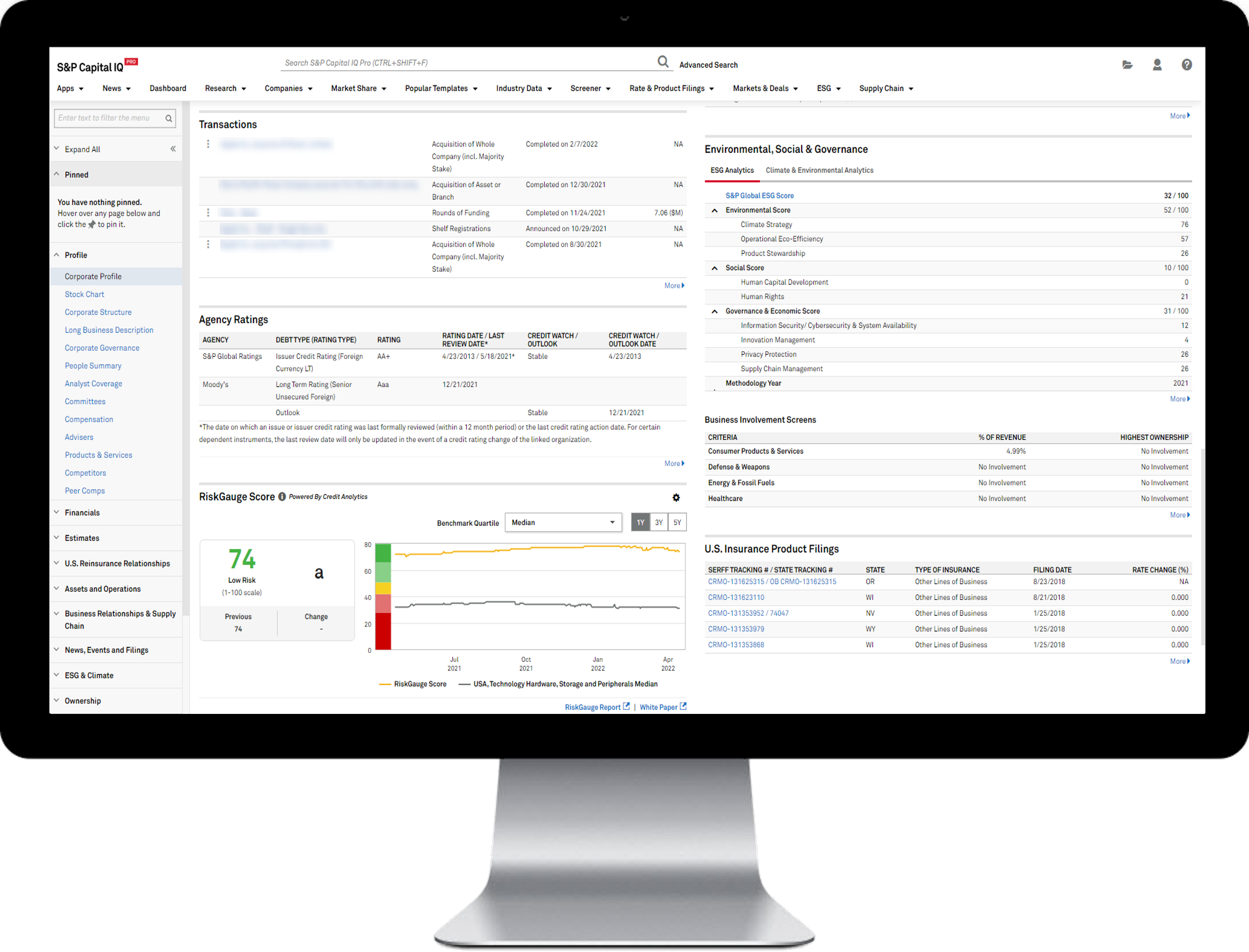

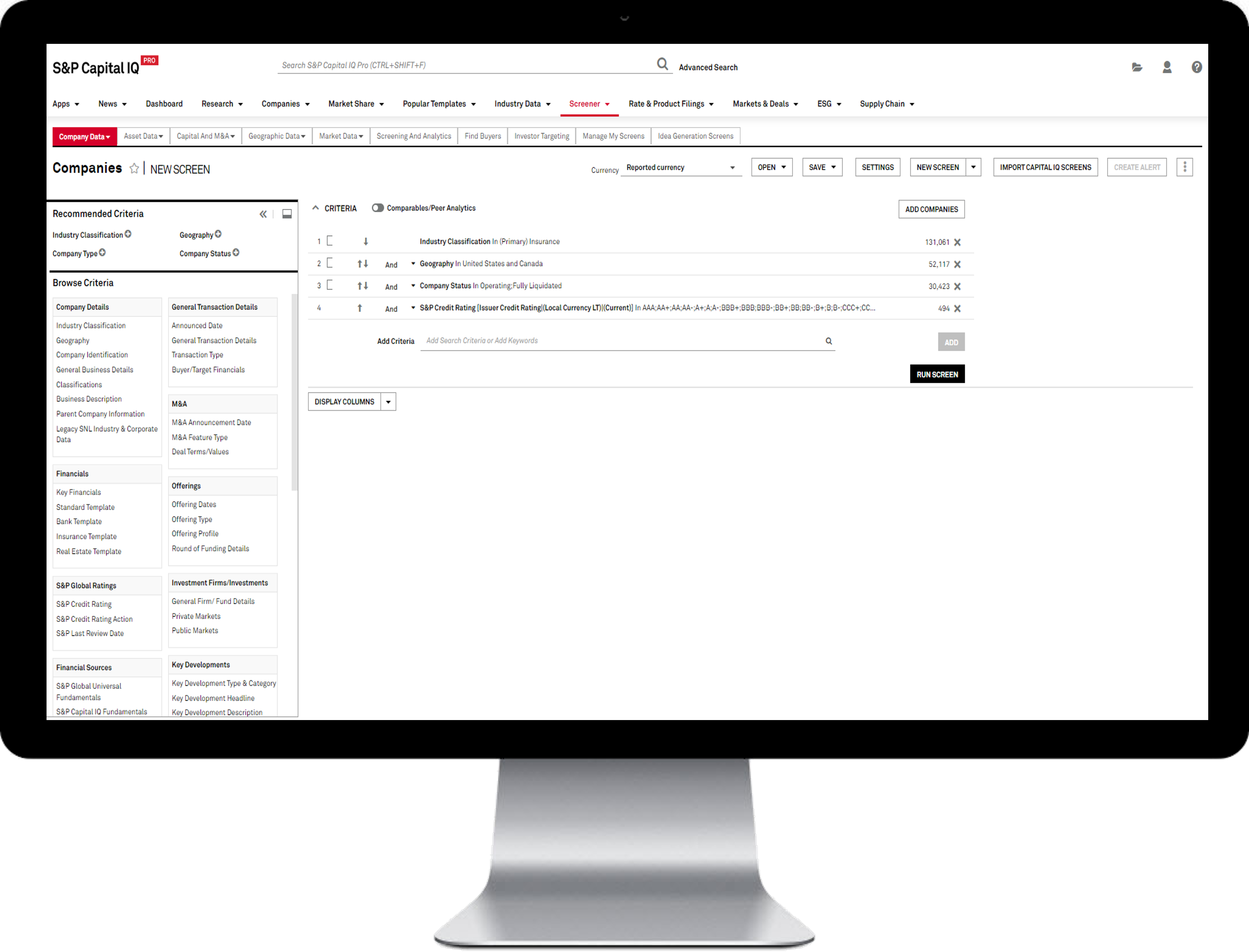

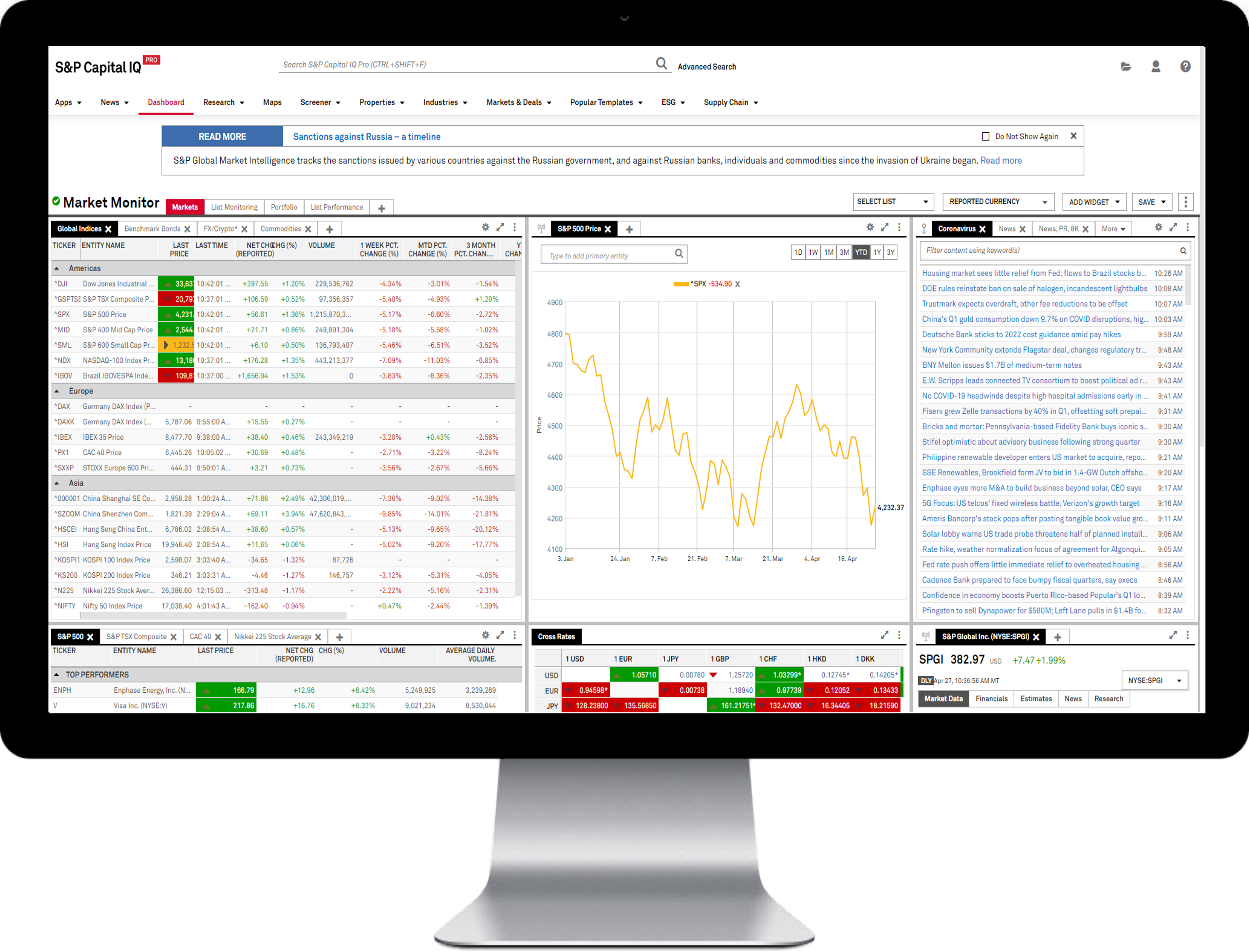

In today's competitive market, insurance companies must understand their book of business and how to position themselves for future growth. With our granular coverage of risk and comprehensive industry exposure data, our insurance market intelligence solutions provide a unique knowledge-led approach to underwriting.

- Quickly and reliably price the risk of a prospective client at any stage of their lifecycle with tools and data that help increase speed of execution.

- Identify new and emerging opportunities with thorough industry-specific data, including access to sustainability factors and analysis.

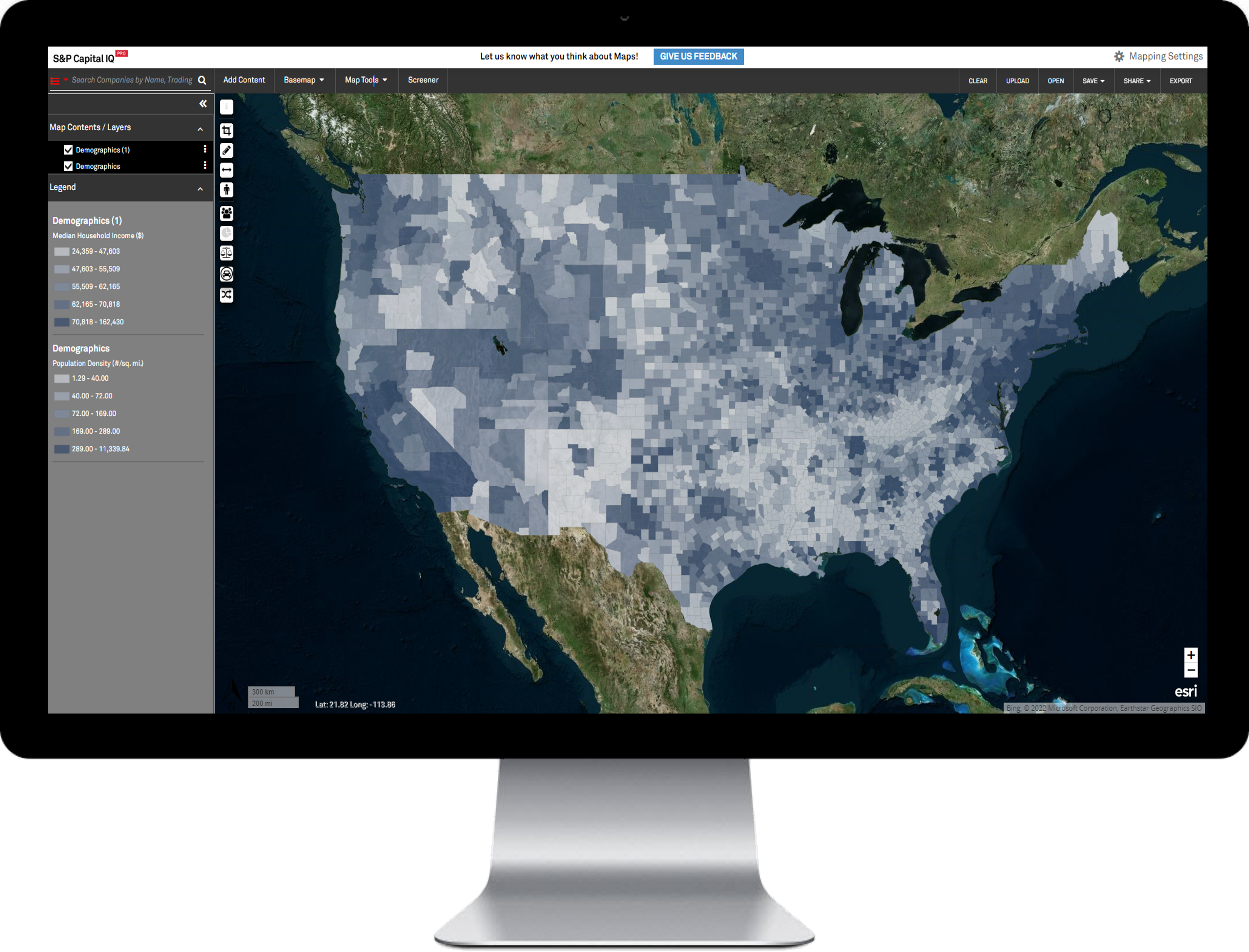

- Visualize location-specific threats to industry assets and supply chains with specialized map layers.

- Generate tailored reports that can be accessed on-demand by teams of country-risk and industry analysts.

- Stay focused on your insureds with documents and news coverage.

- Make smarter business decisions with customized models built on vetted and standardized data. Stay on top of risk and regulatory compliance with solutions that span credit risk, regulations, operations and efficiency, detailed forecasts, entity due diligence, and more.

Our deep domain expertise, reliable data, intuitive workflow solutions, and management services can help you manage your risk exposure with confidence.