Identify mining investment targets

Screen and evaluate potential mining investment opportunities

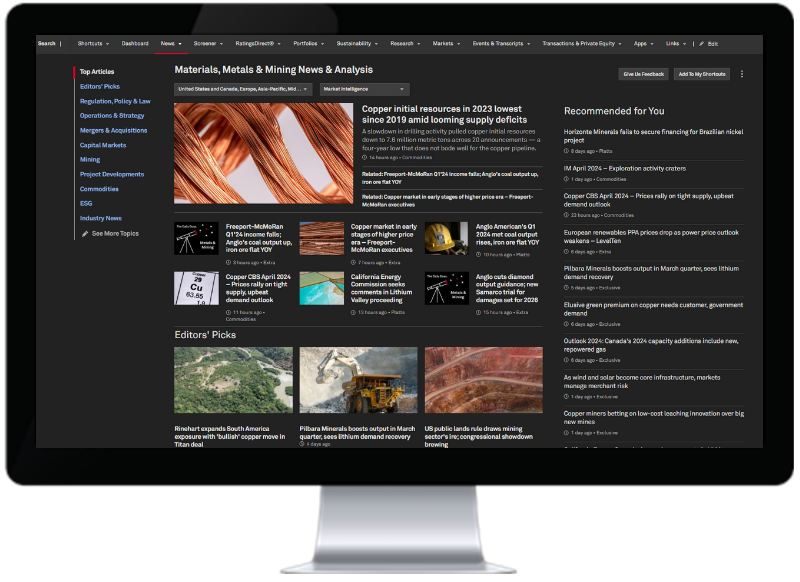

Identify opportunities. Find distressed or quality mining assets.

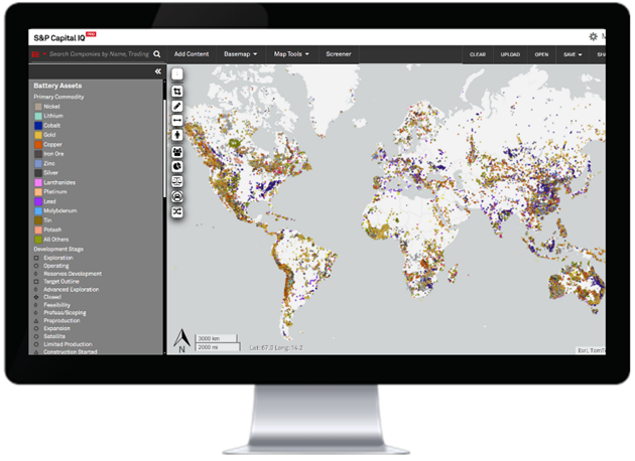

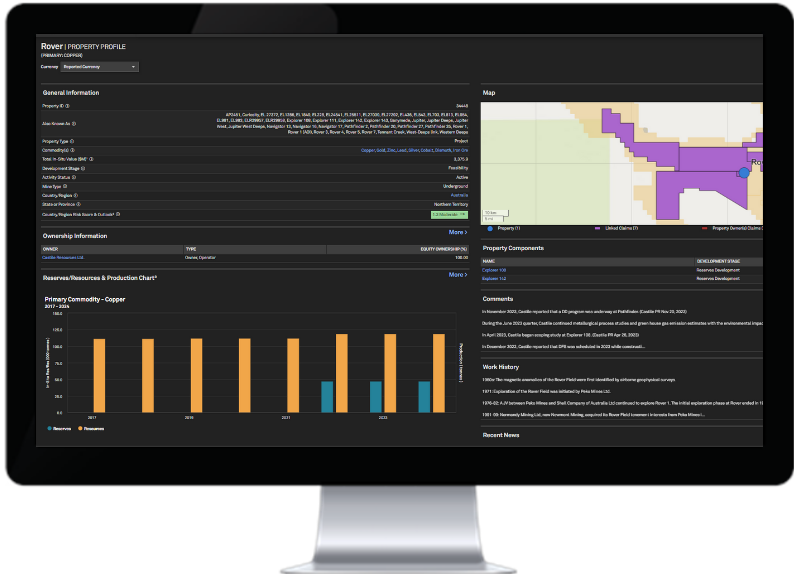

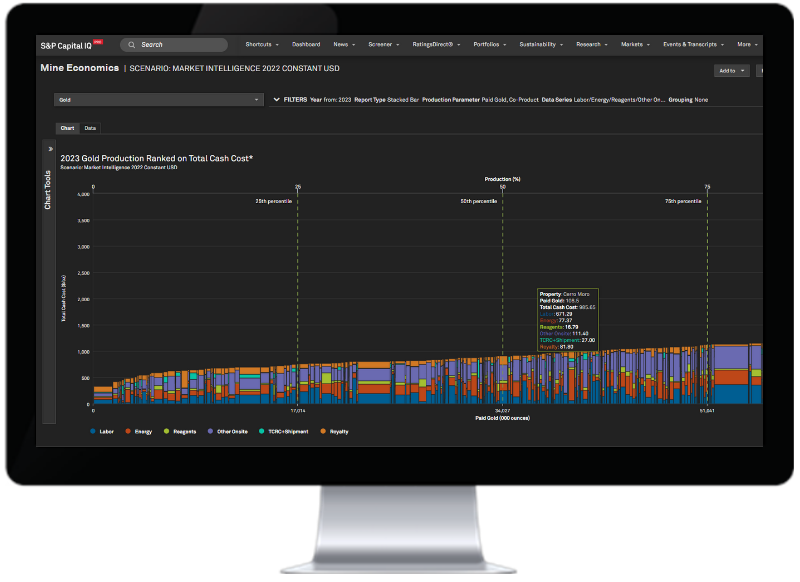

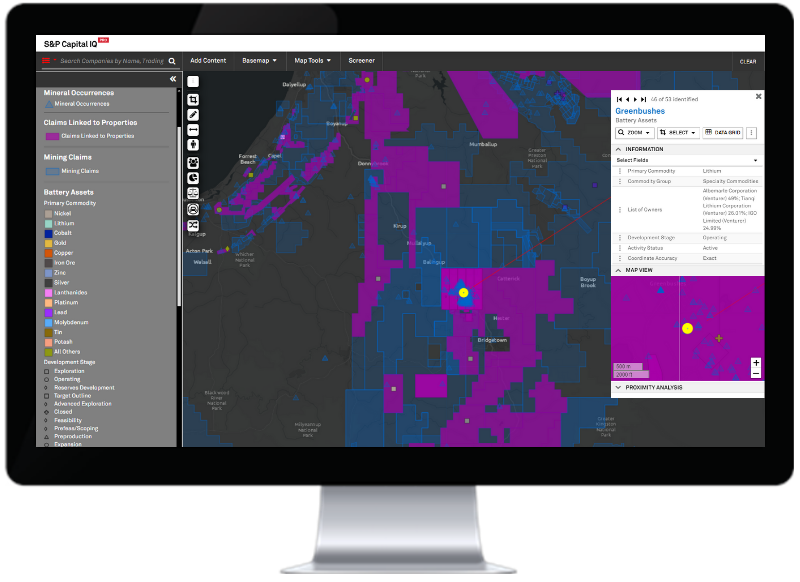

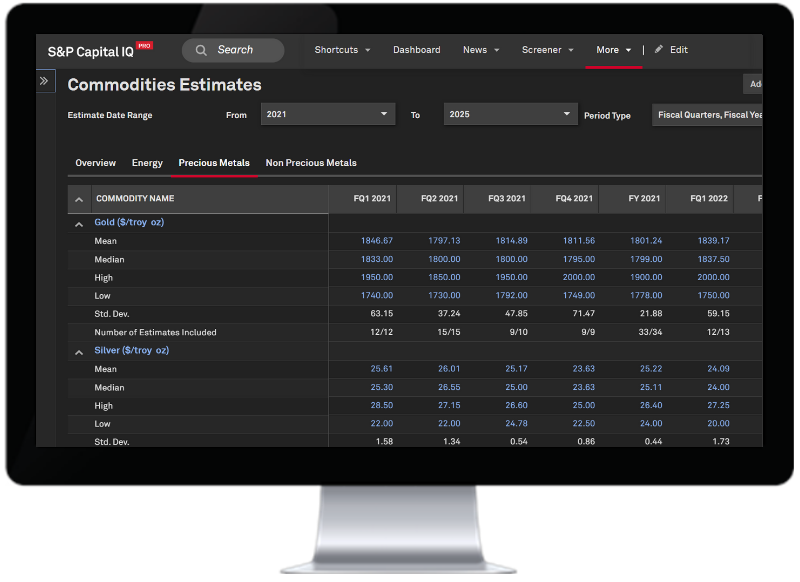

- Screen mining projects by regions, development stage, project size, and the mine life cycle to identify potential opportunities. Drill down into asset-level data (such as reserves/resources/grades, feasibility study results, production output/operating/cash costs, etc.) to find quality mining assets. View all source documentation for due diligence reviews and connect data to your models.

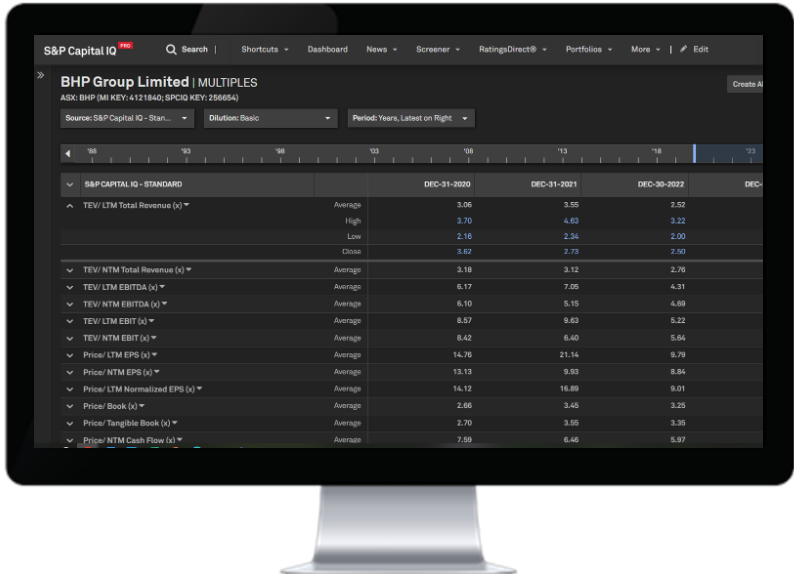

- Assess companies with key financial data such as cash flow, debt, capital structure, institutional ownership, etc. Understand the asset-level ownership by reviewing joint ventures or transactions, directors, ability to raise capital, and complete project funding based on current and historical activity.

- Act when the time is right. Set up a portfolio to track changes and create Alerts for opportunities on your Watch List.

Discover how S&P Capital IQ Pro can help you make well-informed decisions faster and easier. Take a tour below.