S&P Capital IQ Pro

The single source for relevant and highly actionable data to power your financial analysis.

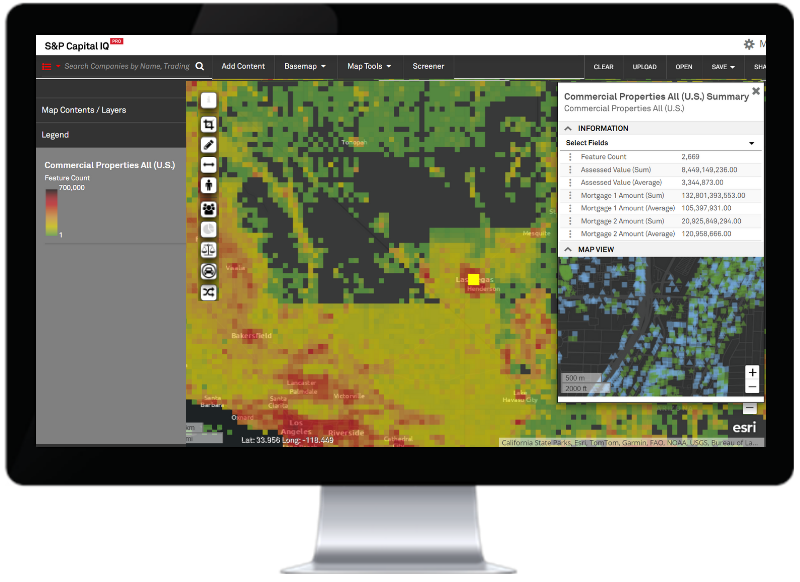

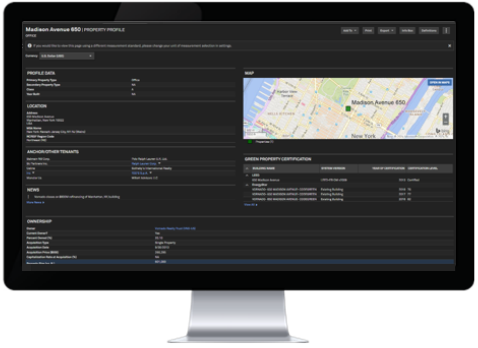

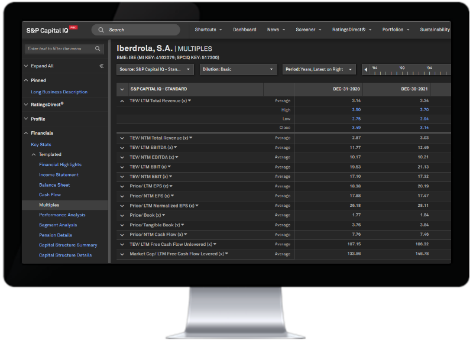

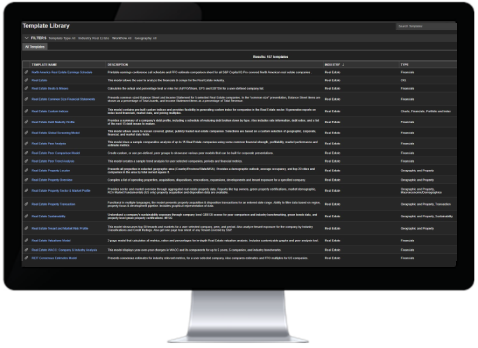

With S&P Capital IQ Pro's comprehensive and reliable industry-specific data, the possibilities for driving top and bottom line performance and strengthening your credit risk and counterparty risk assessment are yours. Enhance your fundamental analysis and stay one step ahead of the competition with deep asset-level coverage, global public and private company information across key industries, and flexible and intuitive analytical tools. That's the power of S&P Capital IQ Pro.