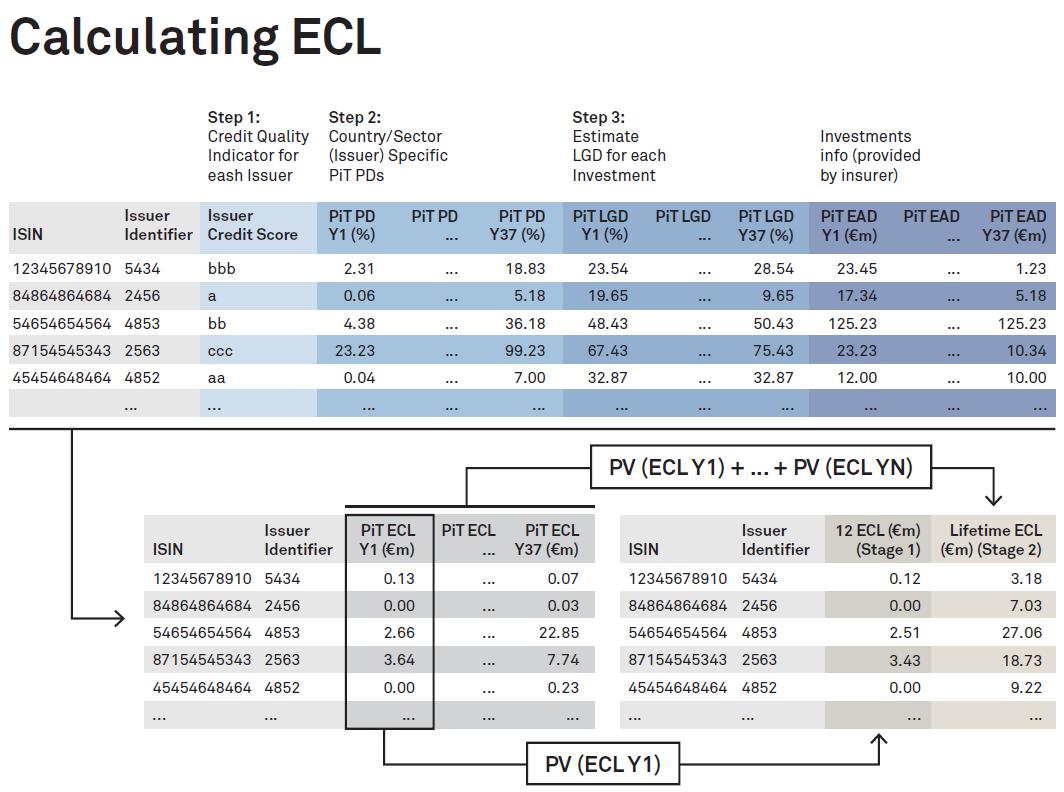

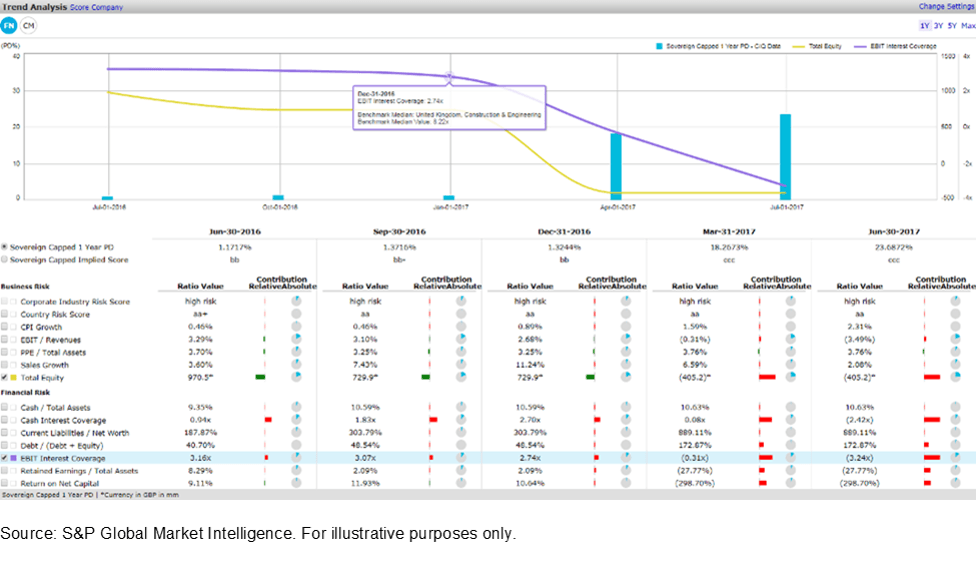

Evaluate Probability of Default, calculate Loss Given Default, and estimate expected credit losses with our Credit Assessment Scorecards. Our suite of IFRS 9 solutions can help you comply with IFRS 9 credit impairment requirements.

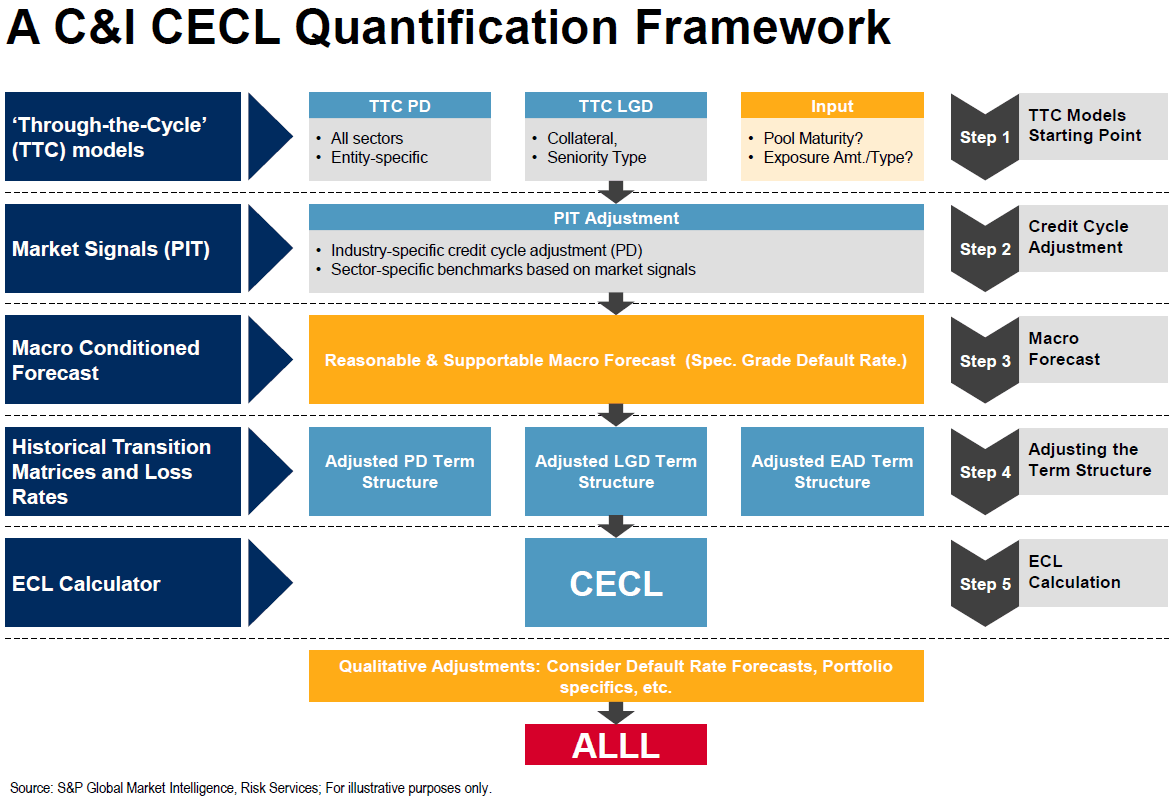

Leverage our CECL Model solution to help with your CECL implementation plans. Our CECL approach applies to all financial instruments carried at amortized cost, such as loans held for investment (HFI), held to maturity (HTM) debt securities, and net investments in leases.

LEARN MORE AT CREDIT ASSESSMENT SCORECARDS