Risk Management

Assess, monitor, and manage your climate risks and opportunities

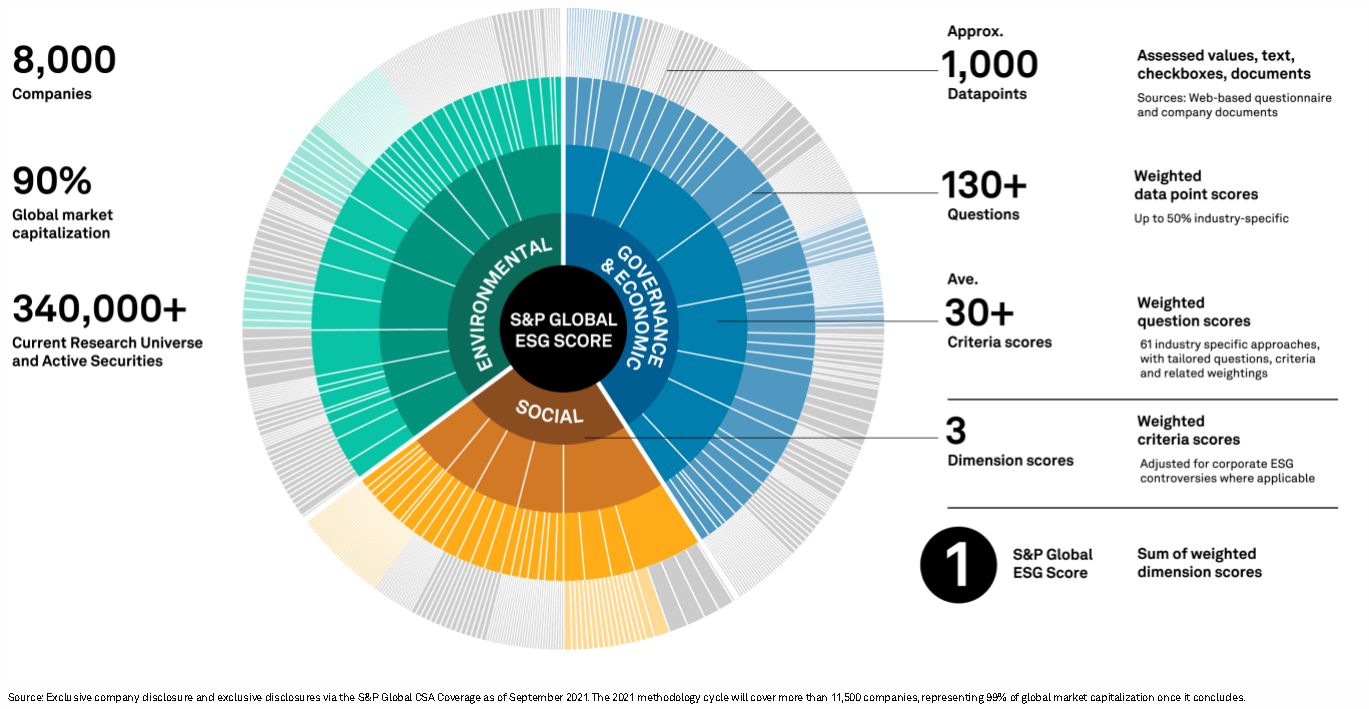

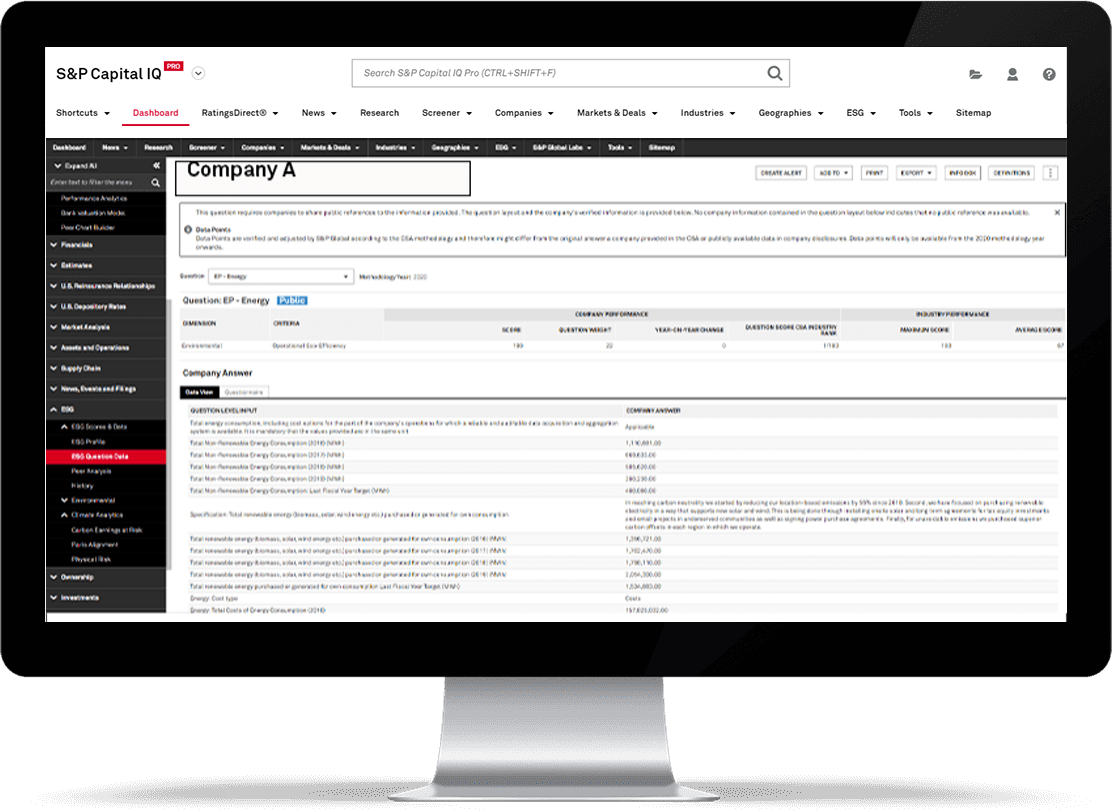

Measure environmental and climate-related risk, opportunities and their impact on your loan book and investment portfolio with our essential climate data and analytics. Calculate your carbon footprint, pinpoint physical risks from climate change, and assess risks associated with increases in carbon prices.

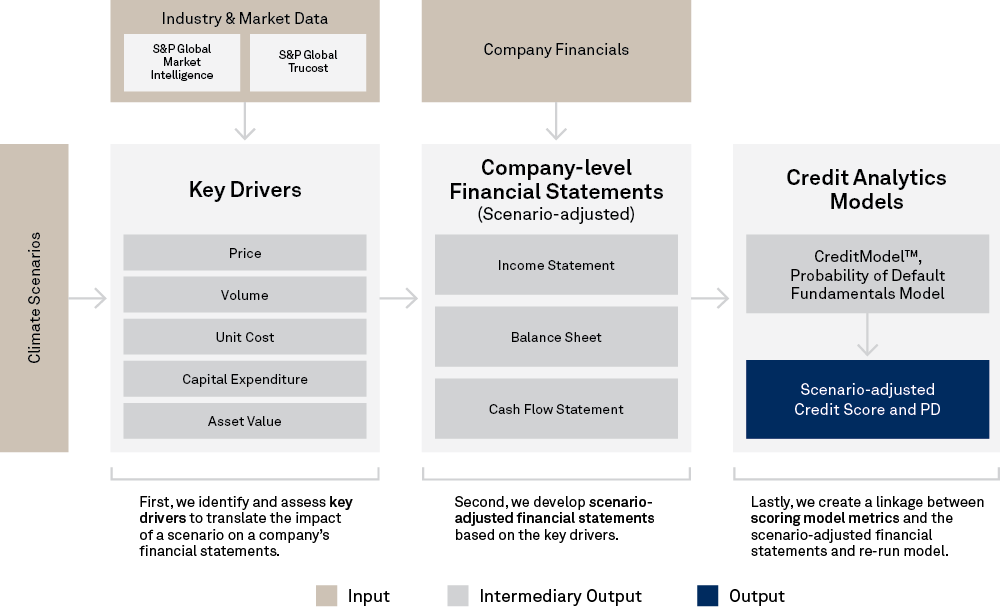

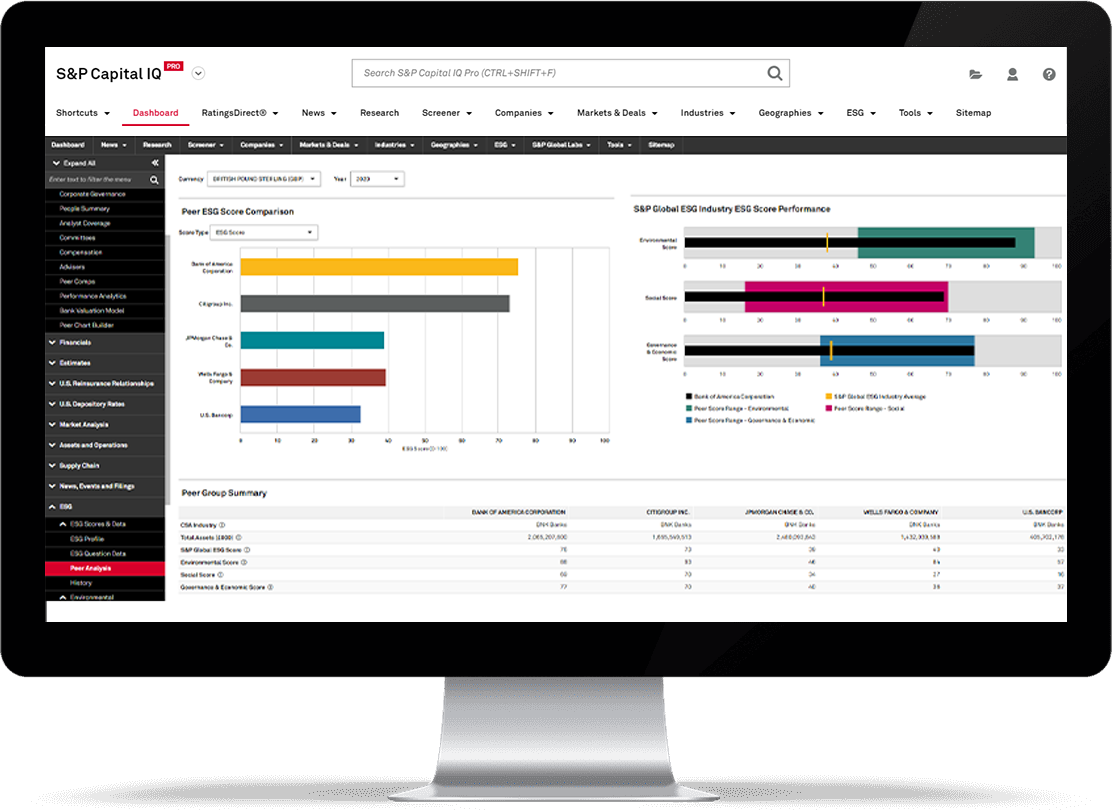

Evaluate the impact of different climate-related scenarios on counterparties and portfolios with Climate Credit Analytics. Perform climate stress testing and scenario analysis and comply with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations.

Evaluate sustainability factors alongside traditional credit analysis and assess their impact on individual credit risk factors to better evaluate their materiality to an obligor's or a project's creditworthiness.

Adopt a rigorous, bottom-up methodology to assess the potential financial impact of climate-related risks and account for these risks in your global decision-making with the S&P Global Climanomics.