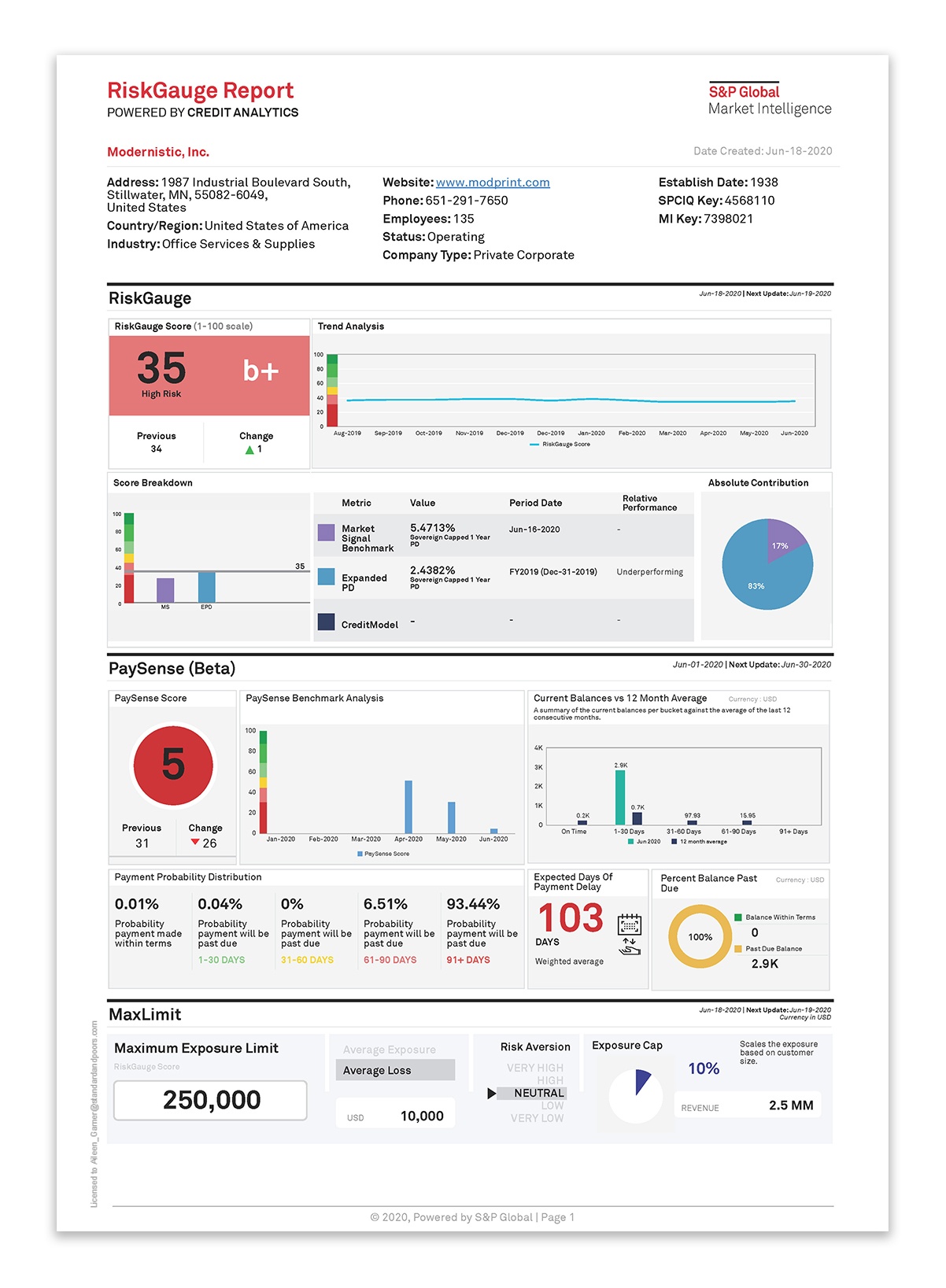

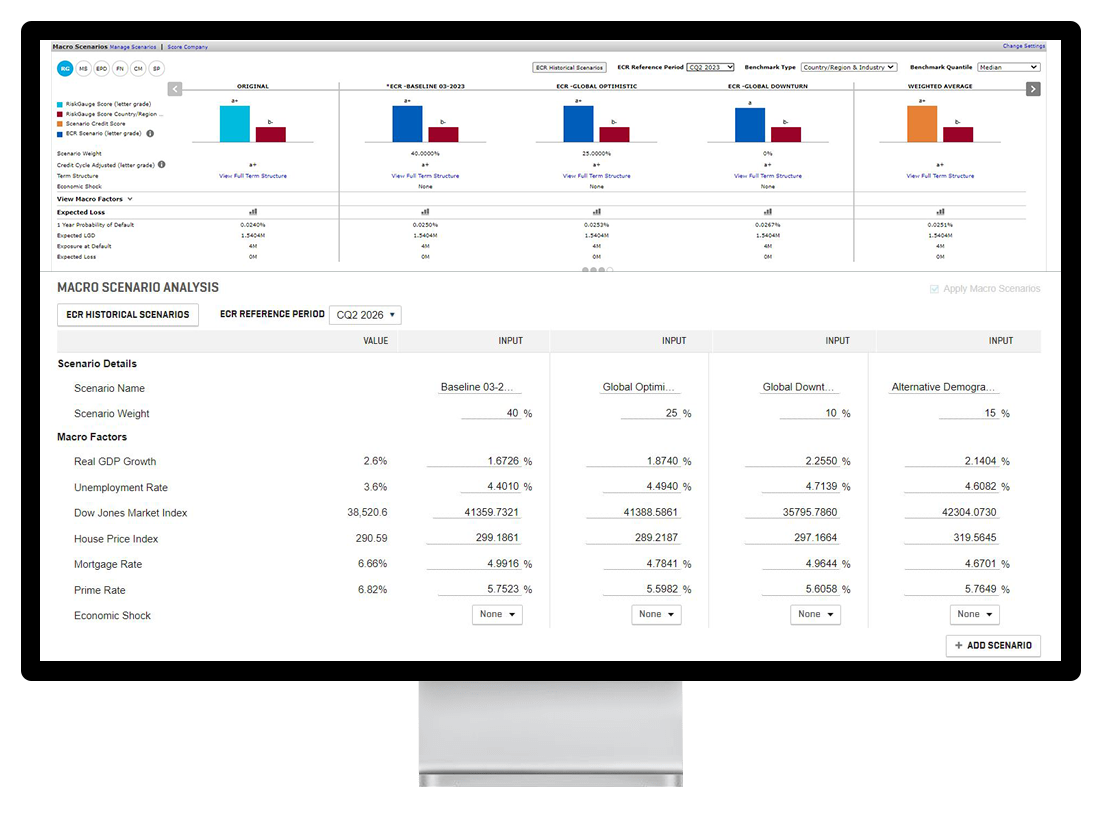

Assessing potential defaults of private, publicly traded, rated, and unrated companies across a multitude of sectors can be especially challenging when there is little default history available to train models.

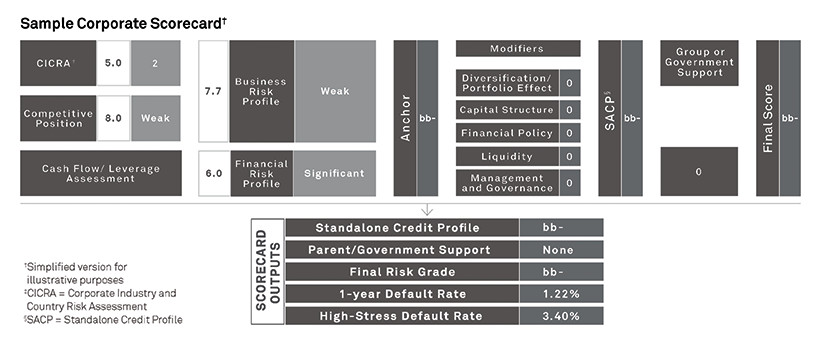

Credit Assessment Scorecards provide an industry-leading methodology that ensures consistency across analysts and regions by combining qualitative and quantitative factors to offer:

- An easy-to-use approach that draws on questions in a check-box style to identify key risks.

- An off-the-shelf “glass box” approach for situations with limited comparable default data revealing all inputs and outputs, with outputs calibrated to PDs from S&P Global Ratings proprietary default data accumulated since 1981.