-

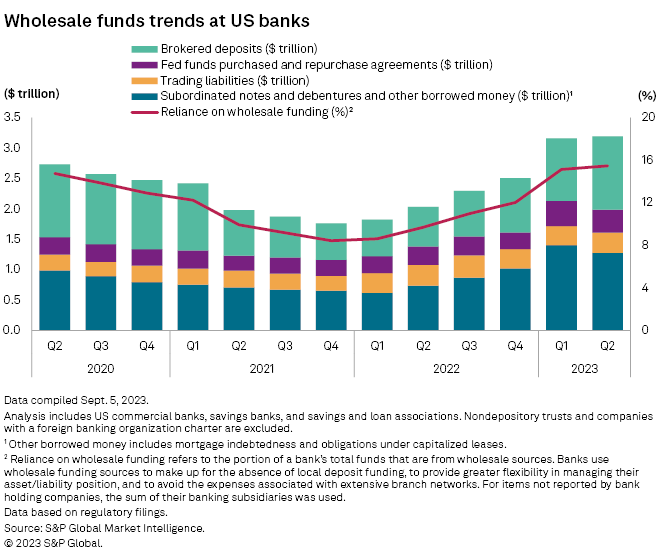

Wholesale borrowing by banks stabilizes after spring turmoil

For most banks, severe deposit outflows did not materialize, and the industrywide deposit decline moderated in the second quarter as banks lifted the rates they pay. Banks remain under pressure from rising funding costs, but the relative calm has allowed the industry to trim cash levels.

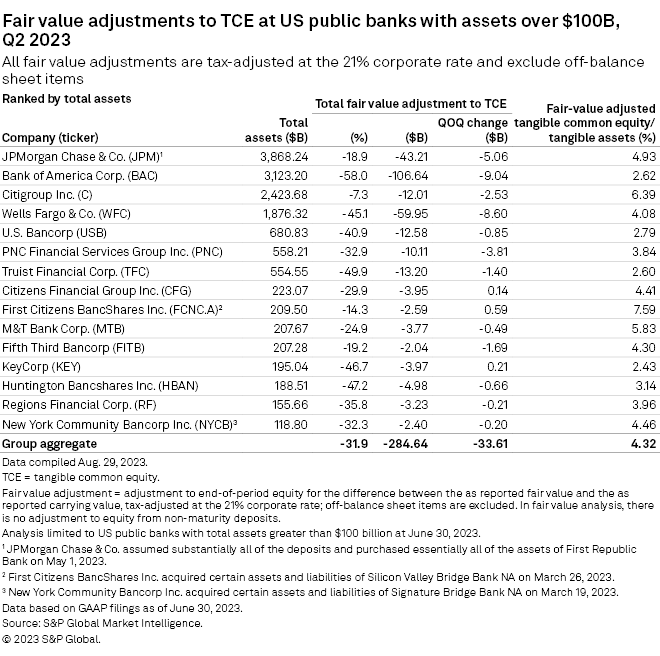

Higher interest rates erase fair value recovery for US banks

Persistently high interest rates, driven by a stronger outlook for the US economy, are keeping the pressure on the fair value of bank assets accumulated when yields were low.

US Commercial Real Estate Chart Book: Weathering the Storm – September 2023