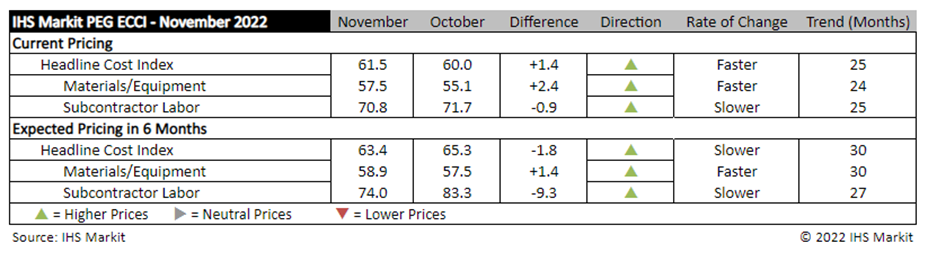

WASHINGTON, D.C. – November 23, 2022 – Engineering and construction costs increased again in November, according to IHS Markit, now a part of S&P Global, and The Procurement Executives Group (PEG). The headline IHS Markit PEG Engineering and Construction Cost Index, a leading indicator measuring wage and material inflation for the engineering, procurement and construction sector, rose to an index level of 61.5 this month from 60.0 in October. The headline index has recorded increasing prices for over two years, with the index last recording price decreases in October 2020. The subcontractor labor index dropped 0.9 index points in November to 70.8, while the sub-index for materials and equipment costs rose 2.4 index points to 57.5.

The equipment and materials index rose for the 24th consecutive month, marking two straight years of price growth. Among the 12 indicators, prices for nine rose, while the other three declined. Most notably shell and tube heat exchangers dropped 15.4 index points to 53.8, and fabricated structural steel rose 12.9 points, crossing the breakeven mark to 53.6. While downstream products might be seeing the lagged effect of carbon and alloy steel pipe price declines during the past few months, the rebound in fabricated structural steel could stem from lower-than-expected inventory levels keeping the market tight amid a weak demand outlook.

“While base metal prices have made considerable declines from their peaks in early 2022, prices for downstream products like electrical equipment are only now beginning to show signs of upcoming relief,” said Will Martorana, economist, S&P Global Market Intelligence. “This deceleration of prices in shell and tube heat exchangers reflect the lagged impact of a negative shift in input costs, and electrical equipment prices should experience this downward pressure throughout 2023 as tighter monetary conditions will keep metals prices decreasing.”

The sub-index for current subcontractor labor costs came in at 70.8 in November, down from October’s 71.7. According to survey responses, labor costs continued to rise in all regions of the United States and Canada. This index has not seen values below 80.0 since March 2022 and has not been below 70.0 since October 2021.

The six-month headline expectations for future construction costs index fell slightly, recording an index reading of 63.4 in November. The six-month expectations index for materials and equipment came in at 58.9, only 2.4 index points higher than last month’s figure, which had an 11.9 point drop between September and October. Additionally, ocean freight – Europe to U.S. fell below the breakeven point to an index of 45.8, while ocean freight – Asia to U.S. saw deeper declines to 42.3, indicating that shipping costs are expected to decrease in six months.

The six-month expectations index for sub-contractor labor decreased 9.3 index points this month to 74.0. Steel-related commodities continue to stay flat in the six-month expectations index, while every other index besides ocean freight reported expectations for rising prices, with electrical equipment registering the highest index figure. Although labor cost outlooks remain elevated, this month’s index figure displayed deceleration in 18 out of the 18 subcomponents.

Respondents continued to report material shortages in November, particularly for electrical equipment, electrical steel, and labor.

To learn more about the IHS Markit PEG Engineering and Construction Cost Index or to obtain the latest published insight, please click here.

# # #

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world’s foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity, and automotive markets. With every one of our offerings, we help many of the world’s leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact:

Katherine Smith, S&P Global Market Intelligence

P. +1 781-301-9311

E. katherine.smith@spglobal.com