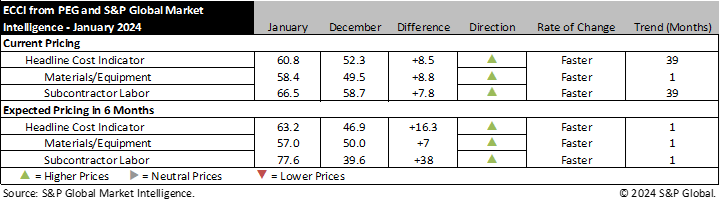

New York – January 24, 2024 – Engineering and construction costs rebounded in January after a weak December, according to the Engineering and Construction Cost Indicator from PEG and S&P Global Market Intelligence. The headline Engineering and Construction Cost Indicator, a leading indicator measuring wage and material inflation for the engineering, procurement and construction sector increased 8.5 points to 60.8 this month, a noticeable step up after the exceptionally weak reading in December. The sub-indicator for materials and equipment costs climbed 8.8 points to 58.4 while the sub-indicator for subcontractor labor costs increased to 66.5 in January from 58.7 last month.

The equipment and materials indicator returned to expansionary territory after a single month below 50. Readings for ten of the 12 components increased compared to last month and only three remain below 50. The three steel categories all remain in contraction, but they did move up compared to last month and now have readings between 36.4 and 41.7. Shell and tube heat exchangers increased just over 11 points to a neutral reading of 50 in January, while gas and steam turbines and electrical equipment remain strongly in expansion despite each registering minor declines. The largest growth was seen in the ocean freight categories which each registered 29.3-point increases, reaching index values of 68.2.

“As carriers continue diverting ships from the Suez and taking the longer route around the Cape of Good Hope, spot prices are seeing major upticks to start off 2024,” said Keyla Martinez, Economist, S&P Global Market Intelligence. “Higher prices are materializing through two main channels: surcharges to insure against any loss/damage to vessels through the Suez and higher costs from the longer diverted route along southern Africa. Despite the U.S. naval force in the Red Sea, carriers are likely to continue to avoid the region. Transpacific east bound vessels that normally would take the Panama Canal were rerouted through the Suez to avoid that bottleneck; however, with the Suez becoming a supply chain risk, carriers are favoring the U.S. West Coast to avoid East Coast delays, ultimately driving spot prices higher on both coasts.

“The Panama Canal has increased transits in January up to 24 ships per day from previous expectations of 20 per day, providing some alleviation to eastbound transpacific routes, but not enough for spot rates to see significant downward corrections in the near term. We expect carriers to continue to reroute around the Cape of Good Hope, increasing transit times and placing upward pricing pressure on shipping costs throughout the first quarter of 2024.”

The sub-indicator for current subcontractor labor costs saw a modest 7.8-point rebound from last month. This increase was quite widespread across almost all regions and employment categories. All subcontractor labor categories have returned to growth this month after many being in neutral territory in December. The largest increases were in Canada, which now has readings between 75.0 and 83.3. The U.S. saw the largest increases in the West region. The West and South regions have the highest index values, with readings between 60.0 and 72.2.

The six-month headline expectations for future construction costs indicator increased significantly to 63.2 in January after a single month of expected price declines in December. The six-month expectations indicator for materials and equipment came in at 57.0, 7.0 points higher than last month’s figure. Ten of 12 categories saw price expectations increase this month, with fabricated structural steel seeing the only decrease and shell and tube heat exchangers remaining unchanged. Fabricated structural steel, carbon steel pipe and shell and tube heat exchanges all remain in contractionary territory from last month, while alloy steel pipe and copper-based wire and cable are neutral. All other categories saw monthly increases, indicating expectations for higher prices in six months.

The six-month expectations indicator for sub-contractor labor saw a 38.0-point increase to a reading of 77.6, more than fully offsetting the 36.6 point decrease last month. Significant increases occurred in all regions and employment categories. Higher costs are expected for all categories in six months with the tightest labor markets in the U.S. South and Eastern Canada.

Respondents reported some shortages again this month for electrical equipment. Shortages were also reported for labor of all types, particularly along the Gulf Coast. Survey respondents indicated that interest rates are slowing market activity and electrical equipment continues to face long lead times, leading to delays in projects. There is also concern on the impact of shipping concerns in the Red Sea and delays at the Panama Canal on the supply chain.

To learn more about the Engineering and Construction Cost Indicator or to obtain the latest published insight, please click here.

###

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world’s foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity, and automotive markets. With every one of our offerings, we help many of the world’s leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact:

Katherine Smith, S&P Global Market Intelligence

P. +1 781 301 9311

E. katherine.smith@spglobal.com