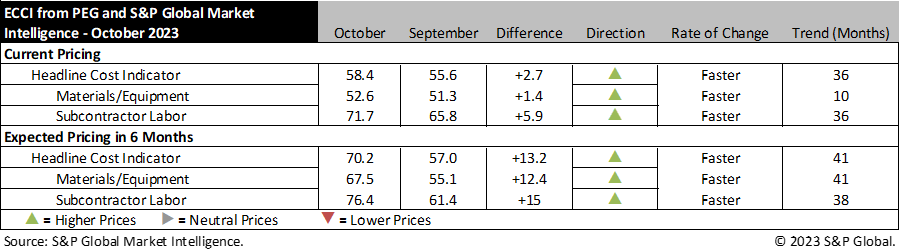

WASHINGTON, D.C. – October 25, 2023 – Engineering and construction costs increased again in October, according to the Engineering and Construction Cost Indicator from PEG and S&P Global Market Intelligence. The headline Engineering and Construction Cost Indicator, a leading indicator measuring wage and material inflation for the engineering, procurement and construction sector, stepped up to 58.4 this month from 55.6 in September, indicating price increases were slightly more widespread than last month. Price pressures saw a minor increase for materials and equipment costs with the sub-indicator rising to 52.6 this month from 51.3 in September. The sub-indicator for subcontractor labor costs increased to 71.7 in October, up from 65.8 last month.

The equipment and materials indicator continued to show rising prices, though—like in September—only five of the twelve sub-indicators indicated rising costs in October. Shell and tube heat exchangers ticked up to a neutral value of 50. Readings for transformers, electrical equipment, and ready-mix concrete remained firmly in expansionary territory again this month. Meanwhile, after one month indicating rising prices, ocean freight prices on Europe-to-U.S. and Asia-to-U.S. routes returned to a neutral reading in October. The categories for carbon steel pipe, alloy steel pipe, copper-based wire and cable and fabricated structural steel were in contractionary territory in October, with values between 27.8 and 45.0.

“Structural steel in the U.S. remains overpriced and prices are expected to continue to decline in coming months, in line with feedstock costs,” said Christos Rigoutsos, Senior Economist, S&P Global Market Intelligence. “However, as more projects supported by the Infrastructure Investments and Jobs Act come online, prices will find their floor and start to rise again by the middle of 2024.”

The sub-indicator for current subcontractor labor costs increased for most regions and employment categories in October, with labor price increases more widespread this month. Labor markets are not nearly as tight as they were in 2022, though availability of construction workers remains tight. According to survey responses, labor cost escalation is more widespread in the U.S. than it is in Canada.

Prices are expected to increase over the next six months for all materials in the survey

The six-month headline expectations for future construction costs indicator increased significantly to a reading of 70.2 in October, illustrating that price increases are expected to be widespread between now and April, when many construction projects are starting after the quieter winter season. The six-month expectations indicator for materials and equipment came in at 67.5, 12.4 points higher than last month’s figure. The outlooks for all 12 categories registered levels above 50 this month; readings increased for every category except electrical equipment, which saw a minor 1.4 point decrease from last month.

Labor costs are expected to see widespread increases over the next six months

The six-month expectations indicator for sub-contractor labor increased in nearly every region and employment category, up 15.0 points to a reading of 76.4. The only category that did not increase compared to last month was Instrumentation and Electrical workers in Eastern Canada which remained flat at a reading of 66.7. Five categories in the U.S. Northeast and U.S. West saw increases as large as 33.3 points higher than the September survey.

Respondents reported some materials shortages again this month, especially for electrical equipment, transformers, and breakers. One respondent also noted shortages of U.S. structural steel. Labor shortages for certain trades are also expected, particularly pipe fitters, welders, and electricians.

To learn more about the Engineering and Construction Cost Indicator or to obtain the latest published insight, please click here.

# # #

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world’s foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity, and automotive markets. With every one of our offerings, we help many of the world’s leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact

Kate Smith, S&P Global Market Intelligence

P. +1 781 301 9311

E. katherine.smith@spglobal.com