Expectations for future construction costs fall for the first time in more than three years

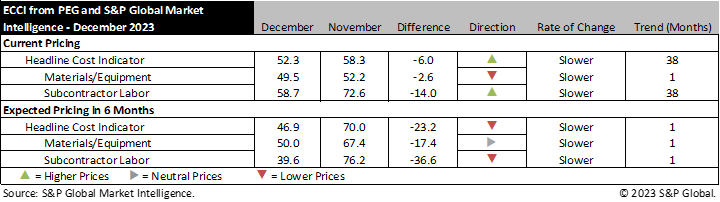

WASHINGTON, D.C. – December 20, 2023 – Engineering and construction costs increased at the slowest rate in more than 3 years in December, according to the Engineering and Construction Cost Indicator from PEG and S&P Global Market Intelligence. The headline Engineering and Construction Cost Indicator, a leading indicator measuring wage and material inflation for the engineering, procurement, and construction sector declined 6.0 points to 52.3 this month, the weakest reading since November 2020. The sub-indicator for materials and equipment costs slid 2.6 points to 49.5, the first sub-50 result since last December and only the second since 2020. The sub-indicator for subcontractor labor costs decreased significantly to 58.7 in December from 72.6 last month.

The equipment and materials indicator’s drop below the breakeven point of 50 ended 11 consecutive months of price growth. Readings for seven of the 12 components are now below 50, with copper-based wire and cable, shell and tube heat exchangers, and both freight rate categories joining the three steel categories in contractionary territory. Weak seasonal demand and sufficient supply, when combined with high interest rates, have brought price increases to a halt for many commodities and shifted some leverage towards buyers. Meanwhile, electrical equipment, transformers, and gas/steam turbines continue to see strong price growth with readings between 70.0 and 80.0 in December.

“Construction-related headwinds are a direct result of a high interest rate environment,” said Maxwell Clarke, Principal Economist, S&P Global Market Intelligence. “However, while pricing weakness for related equipment and materials is to be expected, a lingering shortage of electrical steel should nullify any potential downside for prices for certain categories, particularly transformers.”

The sub-indicator for current subcontractor labor costs saw a 14.0-point decline from last month and registered its second lowest reading in more than 2.5 years. This decline was driven by decreases in all regions and employment categories in the U.S. While readings for almost all subcontractor labor categories in the West and South regions of the U.S. remain in expansionary territory, almost all readings in the Northeast and Midwest regions were neutral in December. Subcontractor costs in Western Canada in the civil sector registered the single increase this month returning it to expansionary territory, but costs in all other regions and categories of Canada were unchanged at neutral readings of 50.0.

The six-month headline expectations for future construction costs indicator decreased significantly to 46.9 in December, ending 42 consecutive months of expected price growth. This 23.2-point decline from November was driven by large declines in both the materials and equipment and subcontractor labor categories. The six-month expectations indicator for materials and equipment came in at a neutral reading of 50.0, 17.4 points lower than last month’s figure. Eleven of 12 categories saw price expectations decline this month, with fabricated structural steel seeing the only increase. Despite a minor increase, fabricated structural steel joins the other two steel categories as well as copper-based wire and cable and shell and tube heat exchangers in contractionary territory.

The six-month expectations indicator for sub-contractor labor declined 36.6 points from November to a reading of 39.6. This is the first sub-50 reading since August 2020. Declines occurred in 15 of 18 regions and employment categories, with the others remaining flat. Instrumentation and electrical subcontractors in the U.S. South is the only category where costs are expected to be higher in 6 months; 12 of 18 categories expect lower pricing.

Respondents reported some materials shortages again this month, especially for electrical equipment, compressors, gas turbine generators, and transformers. Labor shortages for certain trades are also expected, particularly along the Gulf Coast. Survey respondents indicated that interest rates are impacting project approvals and starts, and conversations centered around carbon capture and the hydrogen hub in Houston are increasing.

To learn more about the Engineering and Construction Cost Indicator or to obtain the latest published insight, please click here.

###

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world’s foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity, and automotive markets. With every one of our offerings, we help many of the world’s leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact:

Katherine Smith, S&P Global Market Intelligence

P. +1 781 301 9311

E. katherine.smith@spglobal.com