New York – April 30, 2024 – Despite Global M&A deal volume falling to the lowest level in almost four years, global M&A value increased in the first quarter of 2024, according to S&P Global Market Intelligence’s newly released 2024 Q1 Global M&A and Equity Offerings Report. The total value of first quarter global M&A deals reached $594.47 billion, an 18.5% increase compared to the first quarter of 2023; however, the value of M&A transactions remains far below the levels recorded in the second half of 2020 and throughout 2021.

The continued drop in M&A transactions is an indication that the market still faces headwinds, which have plagued activity since the early part of 2022. Higher interest rates have increased economic uncertainty and the cost of financing, which have decreased demand for M&A activity.

“While optimism is gradually growing around M&A and equity issuance, questions still remain about interest rates, IPO performance and regulatory approval of transactions,” said Joe Mantone, lead author of the report at S&P Global Market Intelligence. “Lower interest rates would add some fuel to dealmaking as it would lower the cost of acquisition financing and potentially boost equity prices, increasing what buyers pay for targets and entice more private companies to go public and provide a more conducive backdrop for increased private equity investments exits, which have been muted since the second quarter of 2022.”

Key highlights from the quarterly report include:

- The number of global M&A announcements fell to 9,022, the lowest total since onset of the COVID-19 pandemic disrupted markets in the second quarter of 2020.

- During the first quarter, the number of $10 billion-plus transactions reached 10, the highest level since the 11 recorded in the second quarter of 2022.

- The value of global initial public offerings declined by 6.9% to $23.19 billion in the first quarter compared to the fourth quarter of 2023, and over the same period, total transactions contracted by 20.7% to 295.

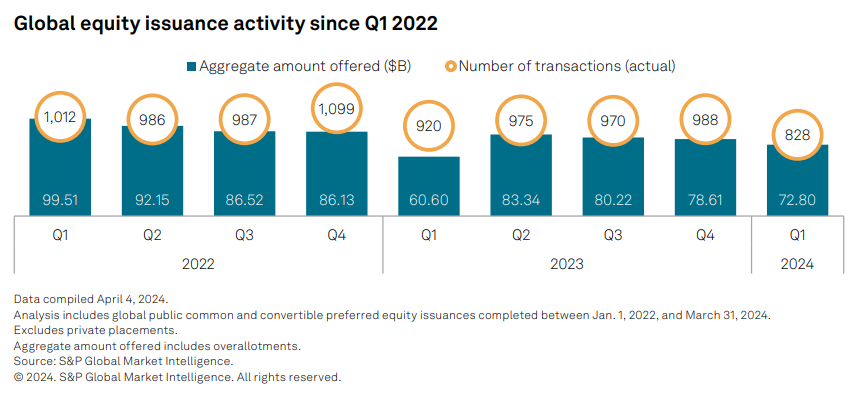

- The total value of first quarter US equity issuance reached $39.78 billion, the highest mark since the fourth quarter of 2021 recorded $102.93 billion in total equity issuance.

The quarterly report provides an overview of global M&A and equity issuance trends, offering insights into the sectors and geographies that are seeing the most activity. It also focuses on deals with the highest valuations and strategies larger players pursue that underscore trends occurring throughout an industry. S&P Global Market Intelligence has produced the quarterly global M&A and equity offering report since the first quarter of 2018.

To request a copy of the 2024 Q1 Global M&A and Equity Offerings Report, please contact press.mi@spglobal.com.

S&P Global Market Intelligence’s opinions, quotes, and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or recommendation to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security.

# # #

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world’s foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world’s leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact :

Kate Smith, S&P Global Market Intelligence

P. +1 781 301 9311

E. katherine.smith@spglobal.com