THE CLIENT:

Trading arm of a large oil and gas company

USERS:

Trading team

Geopolitical risks have returned to center stage with the war between Israel and Hamas, the ongoing Russia-Ukraine conflict, and the ongoing friction between the U.S. and China. These conflicts have significant implications for corporates and governments, as they disrupt supply chains and energy security, and increasing the potential for event risk.

New challenges are also emerging from the necessity to accelerate the world’s transition to a low-carbon economy to limit the potential dramatic consequences of climate change. Given an uncertain environment, S&P Global Ratings expects additional credit deterioration in 2024[1], largely at the lower end of the ratings scale, where close to 40% of credits are at risk of downgrades.

A large oil and gas company's trading arm needed assistance with their credit assessments for hundreds of counterparties because their inability to maintain proper surveillance due to the volume of activity was exposing the company to credit risk. This included exposure to downstream, midstream, upstream and oil field service companies, most of which did not have current financial statements to help the team analyze vulnerabilities.

Pain Points

Members of the trading team faced multiple challenges that limited their ability to effectively monitor the company's counterparties. They wanted to find a solution that would enable them to:

- Track a vast number of counterparties with the team's limited resources.

- Quickly turnaround credit assessments to meet pressing timelines.

- Cover private companies that often do not have financial statements, plus unrated entities across diverse industries and companies.

The team was familiar with S&P Global Market Intelligence ("Market Intelligence") and reached out to see what capabilities were available.

It is essential to have effective systems for monitoring credit risk in today’s environment of heighted economic volatility and geopolitical uncertainty.

The Solution

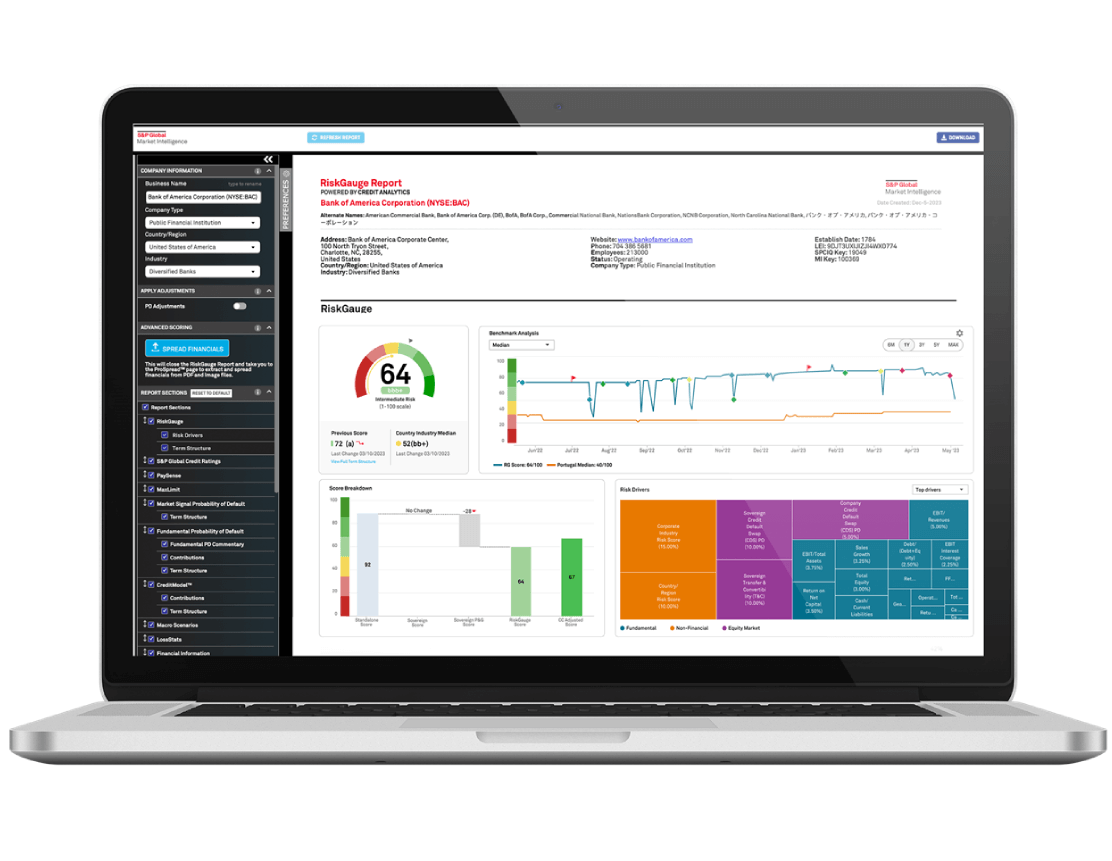

Specialists from Market Intelligence discussed RiskGauge™ Reports that would help the trading team streamline their counterparty credit risk assessments with comprehensive business credit reports for over 50 million companies worldwide, including small- and medium-sized enterprises. (SMEs).[2] Importantly, Market Intelligence credit specialists could help generate the reports to eliminate the backlog. For companies without financials, they could leverage robust data sets, benchmarks and statistical methodologies to calculate each companies’ probability of default (PD). In addition, they could measure relative company performance by benchmarking peers across various dimensions of risk, including business, financial, industry and country risk. This would give the trading team:

|

|

An efficient way to assess counterparty risk around the world |

RiskGauge Reports leverage cutting-edge analytical models and credit scores,[3] robust private company data, company firmographics, relative performance benchmarks and rich, insightful commentary to assess creditworthiness. |

|

|

A RiskGauge Score |

RiskGauge Scores use a multi-dimensional framework that synthesizes both fundamental and market-based metrics into a powerful single credit indicator. RiskGauge Scores generate an overall PD value that is mapped to Market Intelligence’s credit scores. Additionally, RiskGauge provides a credit risk assessment on a 1-100 scale. A score of 100 corresponds to companies with the lowest credit risk, while a score of 50 corresponds to the average credit risk at the boundary between investment-grade and speculative-grade credit scores. PD estimates and credit scores are generated every day for a broad range of private and public companies globally, across a full range of company sizes and industries. |

Figure 1: Sample RiskGauge Report from Market Intelligence

For illustrative purposes only.

Key Benefits

The trading team saw RiskGauge as a valuable tool to efficiently assess an extensive number of counterparties across firm sizes and types around the world and subscribed to the offering. Within a few weeks, Market Intelligence credit specialists helped generate RiskGauge Reports for hundreds of counterparties, enabling the firm to minimize its credit exposure. The team is benefiting from having:

- A robust capability that provides a full picture of credit risk in a timely manner.

- The ability to assess SMEs with little financial data, as well as unrated entities, to pinpoint areas of potential weakness.

- Heightened transparency into counterparty credit quality across firm types, sizes and geographies to minimize negative exposure.

- The support of a team of credit specialists.

Click here to learn more about RiskGauge.

[1] Global Credit Outlook 2024: New Risks, New Playbook, S&P Global Ratings. As of: December 4, 2023.

[2] Coverage as of January 2024.

[3] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence PD credit model scores from the credit ratings issued by S&P Global Ratings.