Data silos can be very inefficient, preventing multiple groups within an organization from having easy access to the same set of information needed for a range of purposes. In addition, data housed in different functional areas may not be recognized as being valuable intelligence that can provide useful insight for overall business development initiatives.

The data science and artificial intelligence (DSAI) team at this large bank is responsible for identifying automation, cost-savings and revenue generation opportunities throughout the organization by leveraging technology. The payments team, on the other hand, is a back-office function focused on continually enhancing client payment solutions (e.g., deposit methods, relationships with merchants and fee setting). This team had collected 50 to 75+ million records, often stored in CSV files, which were sitting untouched. The data was in different formats and structures and contained many errors, including spelling mistakes, a mixture of company long names and short names, partial addresses, spotty URL details, abbreviations and truncations. Members of the DSAI team realized that the data was very "messy", but recognized the enormous value it could have for the bank's cross-sell opportunities if it was cleaned, standardized and linked to other pieces of relevant information. They needed to find an efficient way to test a subset of this data to see if it could be turned into an important asset for the bank.

Pain Points

The DSAI team wanted to enhance the back-office payments function by enabling the area to support revenue generation opportunities for the bank with unique customer intelligence captured in its databases. The team needed to find a way to prove that this data had value and wanted to identify a solution that would provide:

- An automated method to cleanse and standardize a subset of the millions of company records to evaluate the results.

- The ability to tie each record to a unique identifier to enable linking to a wide range of additional information, including public and private company financials, transactions, ESG details and more.

- Opportunities to leverage these customer profiles to use as lead lists for banking products.

Another department within the bank utilized an extensive amount of financial and transaction data from S&P Global Market Intelligence ("Market Intelligence") and subscribed to the firm's Business Entity Cross Reference Service to link millions of public and private entities using standardized and proprietary identifiers. The DSAI team contacted Market Intelligence to see what other capabilities were available that could help with the specific payment's initiative.

The Solution

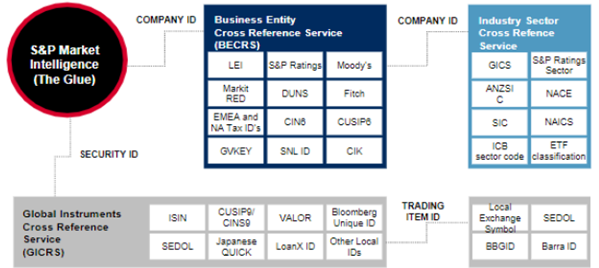

Members of the DSAI team outlined their objectives and the need to thoroughly evaluate a test case for accuracy and reliability before proceeding further. Market Intelligence discussed its Kensho Link solution that is a critical first step to cleanse and standardize bulk amounts of data through a common S&P Capital IQ entity-level identifier. This is done with precision and speed using machine learning models. The entity-level identifier is then linked to the market’s third-party entity- and security-level identifiers to create a single master hierarchy file, as shown in Figure 1 below. This consolidates data feeds through a common mapping solution to cleanse, enrich and maintain high-quality reference data across asset classes.

Figure 1: Linking Company and Security IDs

Source: S&P Global Market Intelligence. For Illustrative purposes only.

Any undertaking would begin with Market Intelligence specialists working with the DSAI team to evaluate the databases and take initial steps to clean obvious discrepancies, such as the use of parenthesis in some cases. Following this, the solution would enable the DSAI team to:

|

Cleanse, standardize and link data |

Kensho Link connects an organization's messy company data, which may have spelling errors or partial addresses, to Market Intelligence's Key Institution IDs to benefit from the unparalleled quality and depth of S&P Global's company data. Kensho's machine learning models have been trained on a wide variety of datasets. This enables users to input a series of fields for each entity, such as a company's name, aliases, address, phone number, URL and year founded. The more information provided, the better the model performs. The solution returns a list of suggested links across databases for each entity, along with the model's confidence in the match. |

|

|

Build detailed company profiles |

Having a unique identifier for each company record enables the data to be linked to numerous Market Intelligence and third-party datasets to create rich customer profiles to better understand current relationships, financial stability and the need for other banking products. |

|

|

Tap into Market Intelligence's expertise |

S&P Global acquired Kensho in 2018 and has used the capability extensively to evaluate its own databases ingested from multiple partner organizations. Along with numerous client engagements, this has elevated the machine learning logic to a high level of reliability. |

Key Benefits

The testing phase went extremely well and members of the DSAI team were confident with the results generated by Kensho Link's logic. They subscribed to the offering that Market Intelligence uses for its own internal linking and are now benefiting from being able to:

- Automate the consolidation and validation of company names within the legacy payments databases to eliminate manual time-consuming processes and scale for the anticipated growth of data records.

- Quicky have thousands of records matched and assigned to a S&P Capital IQ identifier and upload up to 500,000 records at one time with unlimited inputs per day.

- Leverage the standardized profiles to connect to additional data to further qualify businesses for the bank's cross-sell initiatives (e.g., financials, professionals and key developments).

- Consolidate data feeds through a common mapping solution to cleanse, enrich and maintain high-quality reference data across asset classes.

- Set standards for how new information should be captured to have the payments area continue to contribute to revenue-generating activities.

- Rely on the ongoing support of Market Intelligence specialists.

- Consider how other areas of the bank can bring databases to life using Kensho Link. Initial thoughts include information for loan applications and savings deposits, plus the cleansing of the bank's customer relationship management system (CRM), where data is often entered without adhering to specific structures making it hard to obtain a holistic view of a customer.

Click here to explore some of the datasets mentioned in this Case Study.

If you are interested in speaking with one of our specialists, please click here and someone will reach out and assist you.