The investment community is worried that the commercial real estate (CRE) market, particularly certain subsectors such as office and multifamily, could come under increased stress. The impact of the COVID-19 pandemic that pushed some workers away from urban centers and encouraged others to work from home continues to be felt. At the same time, the Federal Reserve’s efforts to tame inflation have led to significantly higher interest rates and, accordingly, higher borrowing costs.

These factors have led to a decline in bids for CRE properties putting asset fundamentals in distress. Borrowers must look to other sources of refinancing, secured debt options or prompt lenders to restructure loans. The upshot — CRE valuations will fall further putting more properties at risk.

While many banks are tightening their CRE lending standards given market risks and concentration limits, CRE projects that are focused on clean energy can qualify for more attractive terms from alternative non-bank lenders that participate in state-run programs aimed at increasing green investments. These programs provide longer-term, fixed-rate credit that is lower cost for environmentally friendly initiatives.

The sustainable finance group at this U.S.-based lender wanted to implement a more robust approach for assessing loan applications related to green investments to account for potential losses given today's volatile market conditions.

Today’s volatile market conditions have raised concerns about CRE investments, requiring lenders to sharpen their analysis of potential loan losses.

Pain Points

Members of the sustainable finance group had been calculating the internal rate of return of deals by assessing the contractual terms of a loan. They wanted to broaden their thinking by using a trusted and transparent methodology to assess:

- — A shadow rating for unrated loans.

- — The probability of default (PD) of a loan and loss given default (LGD) to understand the yield degradation due to any credit losses.

- — The final yield they can expect to realize after accounting for credit losses (ECL).

- — Expected default and recovery rates at both the property/loan level and market level, at each year of a loan’s life

The team was familiar with S&P Global Market Intelligence ("Market Intelligence") and reached out to see what capabilities were available.

The Solution

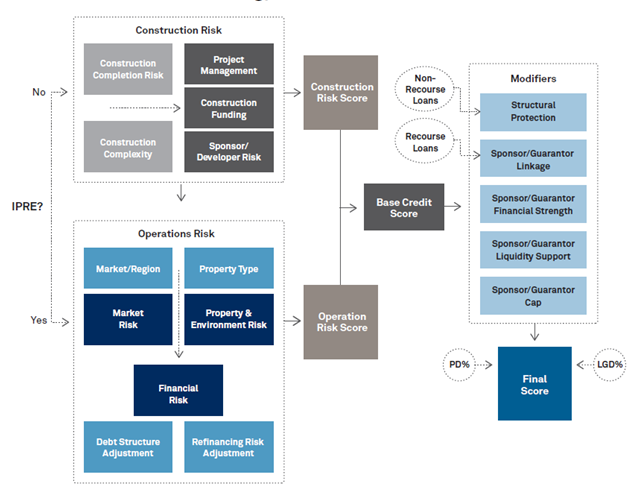

Specialists from Market Intelligence discussed the CRE Scorecard that provides an effective framework to navigate today’s market uncertainty. The CRE Scorecard is especially useful for low-default portfolios that, by definition, lack the extensive internal default data necessary for the construction of statistical models that can be robustly calibrated and validated.

The CRE Scorecard is an easy-to-use tool that draws on a mixture of quantitative and qualitative questions in a check-box style to identify key risks across the multifamily, office, retail, industrial and hotel sectors/subsectors. It is fully transparent and provides the underlying logic, including scoring weights and benchmarks, and generates numerical scores that are broadly aligned with S&P Global Ratings’ criteria[1] supported by historical default data back to 1981. This solution would enable the sustainable finance team to:

|

|

Understand PD and LGD of loans |

The CRE Scorecard synthesizes multiple statistically validated PD and LGD Scorecard methodologies, quantitative and qualitative property-specific risk factors and market benchmarks into a single, robust ratings framework, helping users identify and manage CRE loan credit risk. |

|

|

Calculate ECL |

Scorecard outputs are forward-looking assessments using measures that are sensitive to changes in the CRE market cycles, making them appropriate for estimation of ECL over a long-term horizon. |

|

|

Dig deep by property type |

The CRE Scorecard provides a powerful capability to consistently measure credit risks across all the different property development phases and financing types, as well as all property types that make up CRE. |

Figure 1: CRE Coverage

Source: S&P Global Market Intelligence. For illustrative purposes only purposes only.

|

|

Trust a proven approach |

The CRE Scorecard leverages the analytical process of S&P Global Ratings CRE property evaluation to determine an overall risk score, which is ultimately mapped to historical default and recovery data dating back to 1981. The framework reflects the broad factors that can affect the likelihood of default and recovery of a CRE loan, including:

|

Figure 2: CRE Framework

Source: S&P Global Market Intelligence. For illustrative purposes only purposes only.

|

|

Gain flexible API implementation |

A transparent open-source model enables users to easily feed data into the tool and extract data from the tool for other uses. |

Key Benefits

Members of the sustainable finance team saw many benefits to the CRE Scorecard and subscribed to the offering to obtain:

- — A granular, objective, consistent and transparent framework for the measurement and assessment of loan credit risk, with 75% of CRE Scorecard outputs being within one notch of public credit ratings.

- — The ability to identify PD, LGD and ECL to fully understand potential yield degradation due to credit losses by property type to help with pricing.

- — Technical documentation describing the analytical/statistical processes used to develop the CRE Scorecard, identifying the data employed in its construction and providing testing performance results.

- — Up to date scoring criteria and a User Guide with a rigorous annual methodology review.

- — CRE Scorecard implementation and application training workshops.

[1] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit model scores from the credit ratings issued by S&P Global Ratings.