Small- and medium-sized enterprises (SMEs) represent approximately 90% of businesses and more than 50% of employment worldwide and are important contributors to job creation and global economic development.[1]

The COVID-19 pandemic delivered a significant economic shock in 2020, with SMEs and entrepreneurs at the center of the impact.[2] Prolonged business shutdowns, depressed demand and value chain disruptions created considerable operational and financial pressures for SMEs, threatening the survival of many viable enterprises. Now SMEs are facing additional challenges with increased energy and raw material prices, volatility in financial markets and disruptions in supply chains and trade.

Given the post-pandemic economic environment, the SME segment offers attractive financing opportunities for banks and other participants, along with unique lending challenges. According to a World Bank report, the world’s micro enterprises and SMEs have unmet finance needs of approximately $5.2 trillion a year, roughly 1.5 times the current lending market for such businesses.[3] While SME financing continues to increase in economic significance and need, banks must look closely at both the risks and opportunities associated with their lending practices to minimize any unwanted surprises. Members of the credit risk team at this commercial bank were looking to enhance their process for evaluating the risks related to a portfolio of multi-sector, global SME assets in the face of today's market uncertainty.

Pain Points

SMEs are typically small, privately held commercial and industrial companies that are unrated. They may not follow a rigorous and common set of financial reporting standards, making it difficult to assess their creditworthiness. Given this, the credit risk team wanted to implement an easy-to-use and consistent framework for evaluating the financial strength of SMEs that:

- Was backed by a well-known data and analytics provider with extensive experience in the credit assessment space.

- Accounted for country- and industry-specific risks to look at firms across geographies and sectors.

- Provided flexibility to consider a firm's liquidity, since many SMEs often rely on informal sources of capital in addition to bank loans, such as cash from family and friends.

- Considered the strength of a firm's management team and financial reporting practices.

- Was kept up to date to capture the latest market performance trends.

Team members also wanted to work with a provider that offered training and ongoing support. They reached out to S&P Global Market Intelligence ("Market Intelligence") to see what capabilities were available.

The Solution

Specialists from Market Intelligence discussed the Corporate SME Credit Assessment Scorecard ("SME Scorecard"). It is fully transparent, provides the underlying logic (including weights) and generates numerical scores that are broadly aligned with S&P Global Ratings’ criteria supported by historical default data back to 1981.[4]

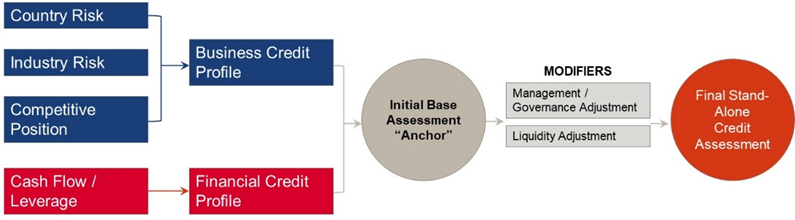

As shown In Figure 1 below, the SME Scorecard uses the proven most current S&P Global Ratings' criteria-driven risk dimensions, including: country/industry risk, competitiveness and profitability, cash flow/leverage, management/governance and liquidity. It enables users to analyze a company's business and financial risk profiles using a combination of quantitative and qualitative inputs to determine a base credit assessment (i.e., an anchor). It then facilities a modification of the base assessment with additional management and liquidity-related risk factor adjustments to arrive at a final stand-alone credit assessment profile. Performance testing shows that 75% of the Scorecard outputs, on average, are an exact match or within one notch of the S&P Global Ratings’ credit rating.

Figure 1: SME Scorecard Framework

Source: S&P Global Market Intelligence. For Illustrative purposes only.

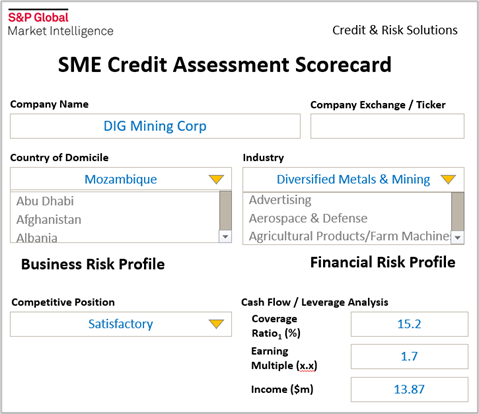

As shown in Figure 2, Scorecards are easy-to-use tools that draw on a mixture of quantitative and qualitative questions in a check-box style to identify key risks.

Figure 2: Sample Scorecard Inputs

Source: S&P Global Market Intelligence. For Illustrative purposes only.

The capability would give members of the credit risk team the ability to:

|

Quickly deploy the solution and generate credit scores |

The SME Scorecard provides an off-the-shelf solution that can readily be used by team members. Point-in-time and forward-looking qualitative factors, along with converging trends, create a comprehensive picture of credit risk. The credit scoring framework is designed to broadly align with S&P Global Ratings' credit rating methodology and best practices. | |

|

Manage default risks |

Users can easily identify and manage potential default risks across a multitude of sectors through a granular 20-point rating scale that can be linked to an internal risk rating. This is especially useful for low-default portfolios that, by definition, lack the extensive internal default data necessary for the construction of statistical models that can be robustly calibrated and validated. | |

|

Gain transparency into the methodology |

Attribute-driven scoring guidelines provide an easy-to-use, logical criteria application for scoring qualitative risk factors. In addition, in-depth model development documentation identifies how the SME Scorecard was developed, use of data and performance. This extensive documentation helps stakeholders understand and communicate the effectiveness of the risk rating system. | |

|

Benefit from ongoing training and support |

SME Scorecard implementation and application training workshops quickly get users up to speed, and ongoing analytical and operational support ensure that team members get the most out of the solution. On-going model updates and periodic validation provide additional comfort that the tools remain up-to-date. |

Key Benefits

Members of the credit risk team recognized that the SME Scorecard would provide them with the consistent and easy-to-use framework they were looking for and subscribed to the offering. They now have access to:

The backing of a well-recognized information provider trusted by companies around the world.

- An off-the-shelf, transparent and intuitive credit assessment framework based on the credit rating methodology.

- Outputs that can be mapped to S&P Global Ratings' letter scale and observed defaults back to 1981, or the company’s own internal scale.

- A Scorecard that can also be extended to evaluate the facility risk based on collateral coverage for each loan.

- Leading benchmarks that include over 140 industry and country risk scores.

- Methodological transparency that reveals all risk factors, weights, benchmarks and scoring algorithms.

- Technical documentation describing the analytical/statistical processes used to develop the SME Scorecard, identifying the data used in construction and providing testing performance results.

- Market Intelligence’s annual review process, which validates models to maintain performance and reflect updates in the User Guide.

Click here to learn more about S&P Global Market Intelligence's SME Scorecard.

[1] "Small and Medium Enterprises (SMEs) Finance", World Bank, www.worldbank.org/en/topic/smefinance, as of January 2023.

[2] "Financing SMEs and Entrepreneurs 2022: An OECD Scoreboard", OECD, March 2022, www.oecd-ilibrary.org/sites/e9073a0f-en/index.html?itemId=/content/publication/e9073a0f-en.

[3] "Small and Medium Enterprises (SMEs) Finance", World Bank, www.worldbank.org/en/topic/smefinance, as of January 2023.

[4] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence PD credit model scores from the credit ratings issued by S&P Global Ratings.