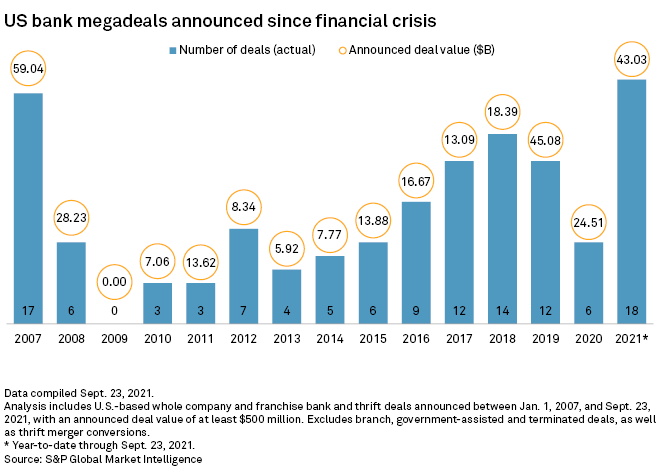

In this edition, we take a close look at the wave of large-scale mergers and acquisition activity in the U.S. banking industry, which has made 2021 the busiest year for $500 million deals in more than two decades. Among the 18 megadeals so far, stock prices for the buyers and the six banks involved in mergers of equals, or MOEs, closed down a median of 0.63% on the day of announcement. The deals carried little to no tangible book value dilution, a key metric for investors.

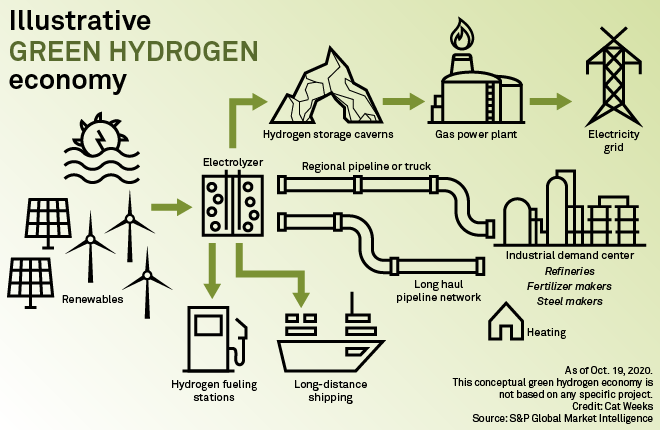

So-called blue hydrogen, viewed as a more sustainable alternative to traditional emissions-intensive "gray" hydrogen, has sparked a debate among scientists and energy experts of its green credentials. Researchers in the U.S. found that blue hydrogen produces 20% more carbon emissions in heat generation than natural gas.

Slowing U.S. economic growth and an expected rise in borrowing costs could erode U.S. companies' ability to invest in growth and make interest payments as corporate debt levels climb ever higher, according to economists and analysts.

US Bank M&A in Focus

Recent string of US bank megadeals book share price gains

Many regional banks' stock prices declined following their respective deal announcements this year. But the market rewarded Valley National, U.S. Bancorp and Home Bancshares for striking deals with little to no tangible book value dilution.

—Read the full article from S&P Global Market Intelligence

Wave of large-scale US bank M&A reaches highest level in 23 years

Eighteen U.S. bank deals with values of at least $500 million have been announced this year, the most in more than two decades.

—Read the full article from S&P Global Market Intelligence

Deep Dives

In-depth features looking at the impact of major news developments in key industries.

Financials

Commerzbank, other German banks among Europe's least efficient

Three large German lenders were among the least efficient in a ranking by S&P Global Market Intelligence.

—Read the full article from S&P Global Market Intelligence

Senate, industry bracing for tough confirmation battle at OCC

Saule Omarova, the Biden administration's progressive pick to lead the Office of the Comptroller of the Currency, will likely face a difficult confirmation process due to her controversial views on the financial system.

—Read the full article from S&P Global Market Intelligence

Biden's bank tax reporting proposal still in play

The reporting requirement was included as part of President Joe Biden's budget to raise revenue and close the tax gap between the amount some wealthy Americans pay and the amount they owe. Its future remains uncertain.

—Read the full article from S&P Global Market Intelligence

Big US banks could face higher capital ratios as balance sheets balloon

The biggest U.S. banks appear headed toward higher capital requirements because of increases in risk scores that the industry argues is largely a byproduct of federal efforts to support the economy during the pandemic.

—Read the full article from S&P Global Market Intelligence

Insurance

Berkshire, AIG neck and neck as excess and surplus market strengthens in Q2

Direct written premiums across the excessive and surplus market were up 33.4% year over year in the second quarter as portfolio management efforts by admitted carriers pushes business toward excess and surplus writers.

—Read the full article from S&P Global Market Intelligence

Higher claims severity, driving activity may create bumpy road for auto insurers

Claims frequency and miles driven have begun to rebound to pre-pandemic levels as loss severity remains elevated for some of the largest U.S. private auto insurers.

—Read the full article from S&P Global Market Intelligence

Credit and Markets

Weakening US economy threatens swelling corporate debt mountain

The rate of default is declining in the U.S., as cheap debt has allowed companies to refinance. But the growing debt burden makes companies vulnerable if borrowing costs rise or the economic recovery stalls.

—Read the full article from S&P Global Market Intelligence

Bear market unlikely, but stumble in stocks may lead to bigger fall

A recent 4% drawdown in the S&P 500 has stoked fears of a larger correction.

—Read the full article from S&P Global Market Intelligence

Energy and Utilities

Gov. Newsom launches $15B package for climate, EVs, hydrogen; orders offshore wind goal

One lawmaker called the package "the largest investment California, or any state, has ever made in the effort to stave off the most catastrophic impacts of climate change."

—Read the full article from S&P Global Market Intelligence

Foreign demand drives wood biomass sector growth despite inconsistent US policy

Biomass fuel production continues to grow in the Southeast to meet demand from abroad, with companies investing in plant expansions or additional facilities, even as some executives in the sector differ on its future.

—Read the full article from S&P Global Market Intelligence

Blue hydrogen under microscope over emissions, role as transition fuel

A sprawling debate has emerged about the merits of blue hydrogen, a fuel often regarded as a transitionary solution in the decarbonization journey.

—Read the full article from S&P Global Market Intelligence

Hydrogen threatens to drive wedge between Democrats, climate activists

As the Biden administration and Congress prepare to deploy vast resources to scale up hydrogen supply and demand, climate groups argue for paring back the nation's hydrogen ambitions.

—Read the full article from S&P Global Market Intelligence

Healthcare

US pharma giants combat emissions crisis with long-term net-zero pledges

The healthcare sector contributes 4.4% of global emissions, and as one of the fastest-growing industries in the world — in part due to the COVID-19 pandemic — that footprint is forecast to triple by 2050 if unchecked.

—Read the full article from S&P Global Market Intelligence

Technology, Media and Telecommunications

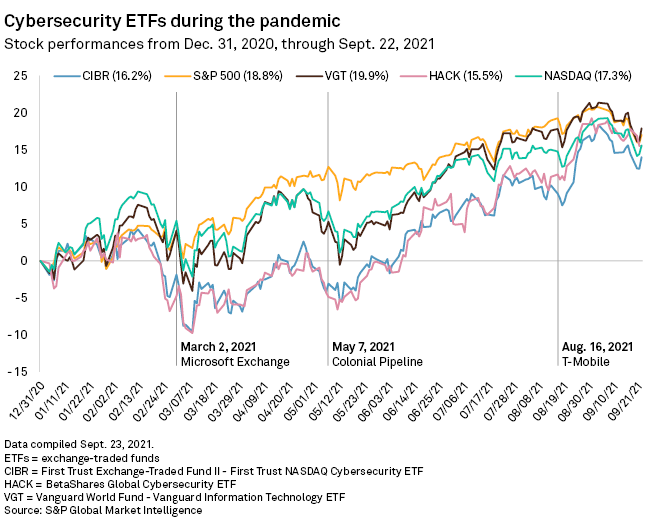

Cybersecurity investments set to grow as threat landscape heightens

Despite several high-profile security breaches this year, prominent cybersecurity-focused exchange-traded funds have not registered a breakout performance year-to-date. But analysts believe the equities in these funds stand poised for greater growth.

—Read the full article from S&P Global Market Intelligence

Leveraged Finance

Scalding CLO market breaks another quarterly issuance mark

The $43.6 billion in deals through Sept. 23 bested the $43.4 billion in deals issued in the second quarter.

—Read the full article from S&P Global Market Intelligence

Leveraged loan market continues to shatter records in Q3 amid hunt for yield

The amount of institutional U.S. leveraged loans outstanding, as measured by the S&P/LSTA Leveraged Loan Index, has hit a record $1.3 trillion as of Sept. 24.

—Read the full article from S&P Global Market Intelligence

Metals and Mining

High metal prices could slow the race to zero carbon

The cost of lithium-ion batteries has dropped dramatically in recent years, but that trend could stall or even reverse on the back of a high commodity price boom, according to industry experts.

—Read the full article from S&P Global Market Intelligence

The Week in M&A

Analysts encouraged by Houlihan Lokey's GCA Corp. deal

Read full article

Perseus Mining prioritizing organic growth over 'challenging' M&A, CEO says

Read full article

Agnico Eagle's Kirkland merger may appease investors 'indifferent' about gold

Read full article

Valley to diversify into venture capital and private banking with Leumi deal

Read full article

The Big Number

Trending

Read more on the S&P Global Market Intelligence and follow @BarichAnthony on Twitter.

S&P Capital IQ Pro. A single platform for essential intelligence.

Do you need a single source of industry intelligence? Discover the S&P Capital IQ Pro platform. Bringing together an unrivaled breadth and depth of data, news, and research, combined with tech-forward productivity tools. All in one platform that powers your edge.

Discover your power >

Upcoming Webinar:

451Nexus | Building the technology foundation for the digital next

Register now

Additional Insights from S&P Global Market Intelligence

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions.

Policy Intel: Explore exclusive news and research on policy and regulatory developments in the U.S. and around the globe. Click here to subscribe.

Essential Healthcare: Our guide to the week's top headlines in pharmaceuticals, biotech, hospitals, medtech and more.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories.

NEXT: Stay up-to-date on how technology is reshaping the future of industries across global markets.