Climate risk professionals are often faced with debates and discussions about the necessity for assessing both, physical and transition risk in an integrated manner. Although, there is a fear of underestimating the financial impact if the risks are assessed separately, the complexities and uncertainties of conducting a combined analysis can overshadow this concern.

Before we delve further into this topic, let’s make sure we have our facts straight.

Physical risks are environmental events like floods or storms, whereas transition risks arise from changes in policy and new technologies, such as the growth of renewable energy.

These risks have been assessed separately by companies and financial institutions in general, whereby:

- Physical risk is evaluated on real asset exposures and considers the asset’s geo-location, asset type and various impact functions associated with hazards these assets may be exposed to

- On the other hand, transition risk is associated with the risks a company faces in its effort to reduce emissions and related abatement costs as well as carbon taxation amidst changing policies, technological advances, and the industry’s price elasticity.

Highlighted by the Taskforce for Climate-Related Financial Disclosures (TCFD), scenario analysis is useful in assessing, quantifying, and disclosing climate-related risks and opportunities as it evaluates a range of hypothetical outcomes under a given set of assumptions and constraints. To enable comprehensive scenario analysis, several tools and methodologies have been developed over the last three tofive years. However, these have been divided into those that address transition or physical or liability risks, or then more broadly environmental, social and governance (ESG) risks. In other words, these are assessed independently with separate methodologies, benchmarks and climate scenarios developed by the climate science community.

This has also been observed in several of the 40+ climate-related regulatory stress tests conducted by banking regulators to date, with the mortgage or commercial real estate portfolio requiring physical risk assessment, while the wholesale banking portfolio requires transition risk assessment.

Should we be assessing physical and transition risk simultaneously?

The separation of analysis ignores the interaction between the drivers and impacts of transition and physical climate risks. This could potentially lead to larger and under-estimated losses for individual companies, financial institutions, and the economy as a whole.

Financial institutions should therefore consider the interplay of these risks to develop a full view of climate-risk exposure and evaluate the combined effects of different factors.

This would enable the financial institution to develop a comprehensive climate strategy. However, this is a complex exercise as there are significant uncertainties in the magnitude and timing of each category of climate-related risks. These are further limited by data availability, data granularity, breadth of scenarios and quantification methodology.

Suggested framework for conducting an integrated climate risk assessment on corporates.

At S&P Global Market Intelligence, we have developed an approach that captures the effect of both physical and transition risk on companies in a granular bottom-up manner. Our solution, Climate Credit Analytics, developed in collaboration with Oliver Wyman[1], provides a framework that captures integrated climate risks in a consistent, intuitive and detailed manner. Our approach includes:

- Utilizing scenarios that capture the risks holistically.

Utilizing scenarios that consider the interconnectedness of transition and physical risks, such as those published by the Network for Greening the Financial System[2] (the “NGFS”), highlight the climate opportunities and risks faced by firms through a holistic lens. Mapping catastrophic models to these scenarios would need to be considered.

- Considering sector-specificities as well alongside asset type and location.

Transition pathways differ significantly across sectors and jurisdictions. For example, power generation as a sector has been the quickest to shift towards renewable energy sources, and many utility firms already own a number of these assets. However, due to their heavy reliance on these assets, these companies may be at risk if the assets are located in areas that are vulnerable to physical threats.

- Modeling how transition risk and physical risk affect a financial driver.

For example – capital expenditure will need to factor in assets acquired to reduce or offset emissions related to transition risks, as well as costs associated with repairing or cleaning up damage caused by transition risks.

- Quantifying the financial impact

Companies with strong financials may be better equipped to face physical risks, as they can bear the additional costs associated with them and may be able to transition more swiftly.

Case in example:

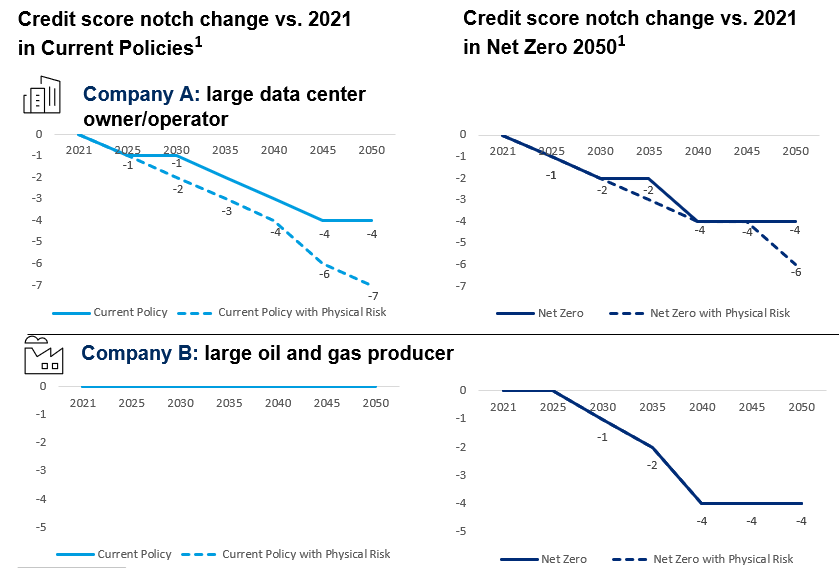

Table 1 illustrates how the interplay between physical and transition risk can affect a company that owns data centers differently compared to a large oil and gas producer when analyzed via Climate Credit Analytics over the projected period.

Table 1:

For illustrative purposes only, using Climate Credit Analytics. Source: S&P Global and Oliver Wyman, as of September 2023

Company A

- Asset Value: Most of the company’s assets are data center buildings, the large amount of net Plant, Property & equipment (“PP&E”) comparing to revenue and total asset leads to higher overall exposure to physical risk.

- Asset Type: Data centers have high exposure to physical risk from extreme heat since they tend to have higher HVAC (Heating, Ventilation, and Air Conditioning) ratio comparing to other asset types, given the cooling requirement for safe operating temperature.

- Industry: Since extreme heat has continues impact to data center operation (i.e., high costs such as electricity for cooling are spent on a regular basis), the incremental impact increases over time and has larger effect in the Current Policies[3] scenario.

Company B

- Asset Type, Asset Location: Most of the company’s PP&E are onshore and offshore oil and gas platforms, which have limited exposure to various hazards include wildfire, floods, drought, and extreme heat.

- Industry: Although oil and gas platforms tend to have large exposure to tropical cyclones, tropical cyclone events are projected to be relatively stable over time with no significant incremental impact. Unlike extreme heat which has continues impact, tropical cyclones cause temporary business interruption/repair costs that even out to smaller impact on average in each year. Thus, the company has no incremental downgrade compared to the “transition risk only” case.

In conclusion, by using an integrated approach we are now able to fully comprehend the impact of standalone transition risk as well as integrated transition and physical climate risks on companies.

Watch webinar replay, to gain an understanding of the latest approaches and capabilities to address market needs for modeling physical and transition climate-related financial risks.

To learn more about Climate Credit Analytics, visit our website.

[1] Oliver Wyman is a global management consulting firm and is not an affiliate of S&P Global, or any of its divisions.

[2] Network for Greening the Financial System, Scenarios for Assessing Climate Risks, July 2019, https://www.ngfs.net/publications/scenarios-for-assessing-climate-risks/

[3] The NGFS Climate Scenarios https://www.ngfs.net/ngfs-scenarios-portal/