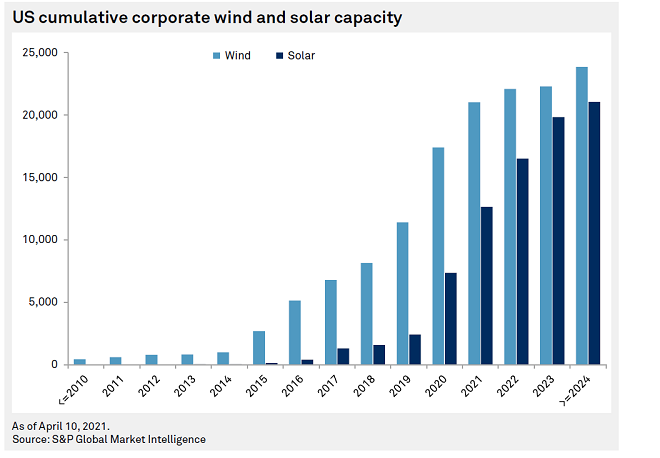

The COVID-19 pandemic proved to be a significant disruption for many corners of the global energy industry, but the corporate renewables market plowed ahead as if nothing had happened. S&P Global Market Intelligence tracked over 20,000 MW of new corporate wind and solar capacity throughout the year, making 2020 the most active year yet in the rapidly growing segment.

Tech leaders setting the pace

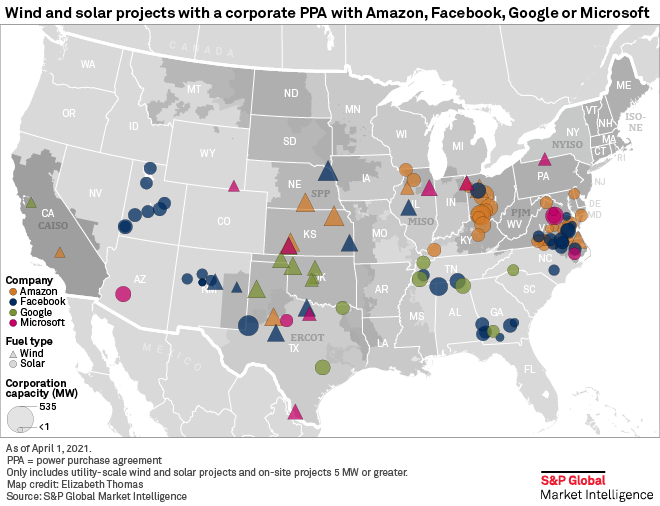

Leading the charge were technology and telecommunications companies, which saw their demand increase due to distancing and stay-at-home mandates worldwide. Internet retail and web services provider Amazon.com Inc. became the leader in corporate renewable capacity in 2020 after signing agreements for nearly two dozen new wind and solar projects around the globe. Amazon added 6,000 MW of new wind and solar capacity over the year for a cumulative total of 8,500 MW of renewable capacity, including on-site renewable generation.

Amazon signed deals with wind and solar projects in 14 countries including the U.S., the U.K., Spain, Australia, Sweden, Canada, South Africa and China. In the U.S., Amazon added over 1,350 MW of solar capacity in Ohio alone, including a 300-MW power purchase agreement, or PPA, with the Highland Solar Farm developed by Hecate Energy and a 200-MW deal with the Hillcrest Solar Project from Innergex Renewable Energy Inc. The Seattle-based company added to its substantial portfolio in Virginia with over 300 MW of new solar capacity to service its data centers in the region.

Social media company Facebook Inc. also substantially expanded its global renewable footprint, adding just shy of 3,000 MW of new wind and solar capacity. Facebook tapped into previously ignored markets in the corporate renewables industry including Utah and New Mexico. In Utah, Facebook has signed nearly 700 MW worth of solar PPA deals, including the 100-MW Hunter Community Solar project and the 99-MW Milford Solar Project developed by First Solar Inc. Facebook has nearly 400 MW of wind and solar capacity in New Mexico as well. Renewable capacity in both markets services data centers in the region with the help of utility renewable procurement programs from Berkshire Hathaway Inc. subsidiary PacifiCorp and PNM Resources Inc. subsidiary Public Service Co. of New Mexico. Facebook also signed deals for renewable projects in Singapore, Norway, India and Ireland.

Alphabet Inc. subsidiary Google LLC slipped to second place in 2020 in the corporate renewables market behind Amazon but remains a leader in the industry. The technology company signed deals for nearly 1,000 MW of new renewable capacity, pushing its cumulative total to around 6,200 MW. Google was one of five companies that signed a PPA with the massive 1,310-MW Samson Solar Energy Project in Texas developed by Invenergy LLC. Google signed 100 MW from this project along with 140 MW from the 7v Solar Ranch Project, also in Texas. The largest deal from Google was an agreement with Berkshire Hathaway subsidiary NV Energy Inc. for 350 MW of solar capacity and up to 280 MW of energy storage.

Microsoft Corp. has nearly 2,700 MW of corporate renewable capacity in PPAs in the U.S., the Netherlands, Singapore and Ireland. Its largest PPA signings to date include the 225-MW Pleinmont Solar II (Spotsylvania Solar Energy Center) project in Virginia, the 178-MW Bloom Wind Power Project in Kansas and the 175-MW Pilot Hill Wind Project (K4 Wind Farm) in Illinois. In 2020, Microsoft announced a portfolio addition of 500 MW of solar capacity across the U.S. with developer Sol Systems.

Other active companies in 2020 include Verizon Communications Inc., which announced nearly 1,700 MW worth of deals for wind and solar projects in Indiana, West Virginia and Texas. The telecommunications company announced agreements for 296 MW of solar with First Solar and 254 MW of solar in Texas with Clearway Energy Inc. Rival AT&T Inc. announced one of the largest single PPA signings of the year in the U.S., agreeing to buy 500 MW from the Samson Solar Project. Automobile manufacturer General Motors Co., fast food corporation McDonald's Corp. and steel manufacturer Nucor Corp. also signed notable deals in 2020, adding 680 MW, 583 MW and 517 MW of renewable capacity, respectively.

Solar gaining ground

There is an estimated 41,000 MW of corporate-tied renewable capacity in the U.S., and matching the trend seen in the overall renewables market, solar is increasing its penetration in the utility-scale segment. Corporate wind PPAs made up roughly 82% of the total corporate renewable capacity installed through 2019. Based on the current pipeline of corporate renewable projects planned to come online, wind's share of the corporate renewables market is expected to drop to 53%, with companies having signed nearly 19,000 MW of solar capacity from projects coming online in 2020 or later.

The rapid development of solar in Texas is helping this trend. Additionally, data centers, which have been a key driver for corporate renewable procurement, are located in several markets where solar is the preferred technology. These markets include Virginia — one of the data center hubs in the world — Utah, New Mexico and the southeast region, which includes Georgia, Alabama and Tennessee. Solar makes up nearly two-thirds of the corporate PPA capacity announced in 2020.

Energy storage is also seeing increasing interest from corporate buyers. In addition to the aforementioned agreement between NV Energy and Google for 280 MW of storage, Apple Inc. signed a deal in 2020 for 60 MW of storage tied to the 130-MW California Flats Solar 130 project. Starbucks Corp. also added a 5.5-MW storage PPA with LevelTen Energy Inc. from the Sanborn Solar Project to its renewable portfolio in 2020. The 357.5-MW Azure Sky Wind Project (Vortex Wind) in Texas developed by Enel SpA subsidiary Enel Green Power North America Inc. is planning to add 81 MW of storage and has five corporate off-takers including Kellogg Co., Akamai Technologies Inc. and Uber Technologies Inc. General Motors signed a 100-MW PPA with the 200-MW Golden Triangle Solar Project (MS Solar 5) in Mississippi, which is expected to add 50 MW of battery storage.

Given the rapidly growing storage market in the U.S., it is likely to become a larger part of the corporate renewables market as well. The battery storage pipeline in the country has increased to 12,300 MW of storage tied to wind or solar projects, with an additional 9,700 MW of stand-alone storage.

The pace of corporate renewable deals did not skip a beat in the midst of a pandemic and is expected to continue to expand its footprint in the U.S. and globally. The interest in going 100% renewable goes well beyond the tech industry and is reaching all corners of the corporate world. Members of the RE100, an organization of companies committed to going 100% renewable, nearly doubled to over 300 members worldwide from fewer than 200 in 2019. This increasing commitment will help the corporate sector.

Regulatory Research Associates is a group within S&P Global Market Intelligence.

Download our full 2021 Corporate Renewables Outlook report for deeper insights.