The U.S. smart cities market that has been fragmented and uncertain now has an added complication: COVID-19. The stress that the pandemic is putting on local budgets is making smart city programs that might have seemed necessary now look like a luxury. As a result, Kagan expects smart city deployments to fall by 7% in 2021, and revenue to be flat over the near term.

The effect of this new environment will focus cities on revenue-generation for their smart cities programs. Newer business models like smart cities as-a-service that lower up-front costs will likely get a closer look, as local governments struggle to meet budgets. In addition, new FCC rules have cooled mobile network operators on smart cities markets, further diminishing the near-term outlook for smart cities.

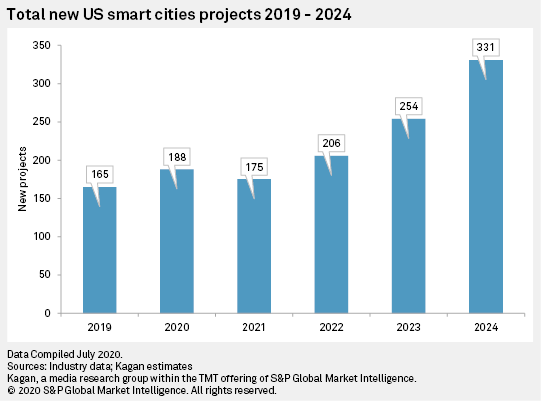

Projected growth in the number of smart cities projects in 2020 is the result of budgets set before the pandemic. The effects of COVID-19 will be fully felt in 2021, when we expect that new projects will shrink. Kagan expects that recovery in the smart cities segment will not be seen until 2022, with the number of smart cities projects expected to increase that year, with faster growth in 2023 and 2024. The compound annual growth rate is expected to be 15% over the length of the forecast. The types of projects expected to drive future growth will include those with the most direct ability to enhance municipal revenues, including public safety, smart streetlights, smart parking and auto/traffic monitoring.

COVID-19 and state of the U.S. economy

The U.S. economy in the second quarter of 2020 contracted by 9.5% compared to the first quarter — a record decline in U.S. quarterly economic growth. Lockdowns and business closures at the local level have created havoc in the municipal tax base, hitting the budgets of local governments hard. This will limit discretionary spending, so the near-term outlook for smart cities project revenue seen in the forecast will remain flat. Smart cities are beginning to feel the effects in 2020, but the worst will be in 2021, as the full weight of limited city tax revenues further restricts the number of smart city projects and revenue.

FCC and smart cities

Contention among the FCC, cities, and mobile network operators over the past few years is also affecting the future of smart cities projects. In September 2018, the FCC passed a set of rules to ease 5G infrastructure installation that included limiting fees that local governments could charge operators for small cell installation. A group of cities and counties subsequently sued the FCC seeking a reversal of these rules. In June 2020, the FCC attempted to further ease 5G implementation by limiting to 60 days the amount of time local governments had to consider applications on infrastructure installation and modification. This effectively limits cities' bargaining power with operators by holding up cell installation projects.

Over the past several years, mobile operators have used smart cities projects to entice cites to allow new cellular infrastructure installation. Each side gained in the bargain: operators got new cells, and cities gained fees, as well as mobile infrastructure that allowed them the ability to collect data on, and offer services to, their citizens.

However, with the new FCC rules, mobile operators do not need the same level of cooperation with cities to get access to street lights, telephone poles and other infrastructure to install small cells. As a result, operators have pulled back from the smart cities market. For example, long-time AT&T Inc. smart cities leader Mike Zeto left AT&T in the first half of 2020 for another company. He has not been replaced, and the AT&T smart cities portfolio has been transferred elsewhere within the company. In addition, Verizon Communications Inc.'s vice president of smart communities left the company in the second half of 2019, and that group was folded into Verizon's public sector business.