The impact of COVID-19 on the global economy is unique as it has not only affected demand, like crises of the past, but has also severely restricted cross-border supply chains. According to S&P Global Ratings research,[1] the disruption to the global supply chain will be another critical factor that will weigh on the creditworthiness of some sectors. This disruption will be evidenced by reductions in worldwide import and export volumes, alongside diminishing financial performance of firms and the market’s negative sentiment towards some private and public companies.

To understand the implications of COVID-19 on supply chains, we have used shipping data and supply chain intelligence from Panjiva, part of S&P Global. We have also used our Probability of Default Market Signals (PDMS) model, which incorporates stock price and asset volatility to calculate a one-year probability of default (PD). This will capture the more immediate market shocks from COVID-19, and enable us to assess the industries and companies that have experienced material changes to their default risk. In addition, our fundamentals-based CreditModel™ is used to gauge if the mid- to long-term credit risk of these companies has changed significantly.

Industry Trends

As reported by Panjiva research,[2] U.S. imports have slowed in key areas across the Consumer Discretionary, Industrials, and Materials sectors. This research looked at these downturns across several product areas and found that Furnishings had the greatest reduction in the first quarter of 2020, followed by Apparel, Iron & Steel, Machinery/Electronics (Industrial and Consumer Equipment), and Chemicals.

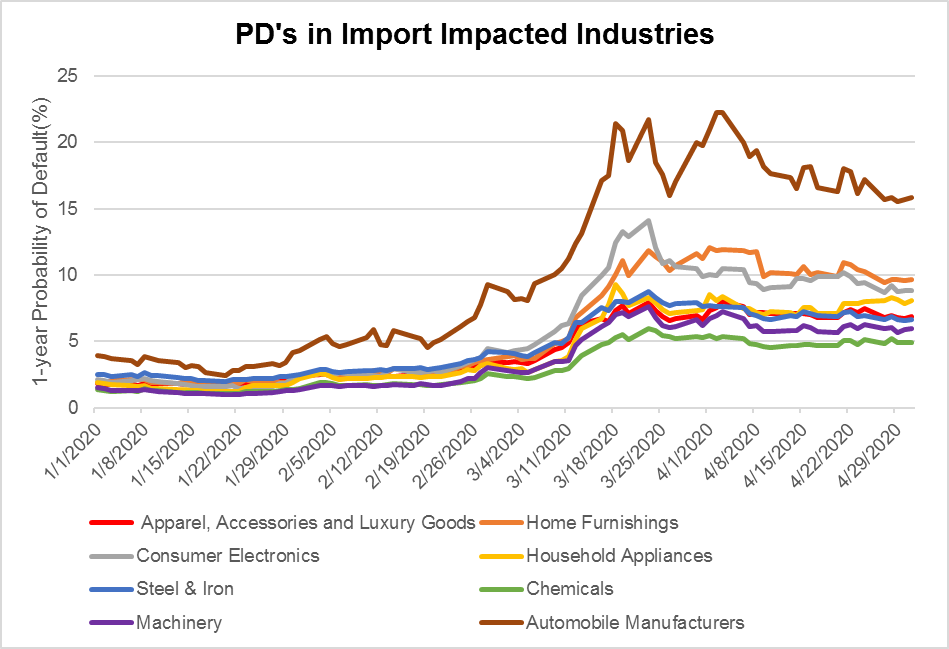

By generating median PDMS scores at the industry level globally, as shown in Figure 1 below, we have a view of how recent market conditions have impacted the default risk for some industries identified by Panjiva as having the greatest reduction in seaborne U.S. imports.[3] The subset of industries within Consumer Discretionary are exhibiting the greatest increase in default risk/ deterioration in credit quality, and the highest overall PDs a key driver being investors’ concerns that non-essential spending will be severely curtailed. Not surprising, auto manufacturers consistently demonstrated PDs that were higher than the other industries, with a PD at the beginning of April 2020 that was more than 20%. This is partially due to a reduced supply of parts, production disruptions, slumping sales, and falling market optimism as a result of COVID-19. Consumer Electronics (a sub-industry that excludes personal computing) also saw a steep rise in risk, increasing more than seven fold from 2.138% to 14.125% between January 1, 2020 and March 23, 2020, while Home Furnishings had the second highest overall PD throughout April 2020. Chemicals saw the lowest PDMS levels given the strong demand for a subset of critical chemical products, such as pharmaceutical active ingredients, disinfectant gels, personal health, and household products in the current pandemic.

Figure 1: PDMS evolution in industries with highest import reduction

Source: S&P Global Market Intelligence, PDMS as of May 4, 2020. For illustrative purposes only.

We can identify these trends since PDMS is an early warning indicator gauged through market estimations of company performance and influenced by falling demand/disruption in the supply chain. Intuitively we can understand this, as reduced imports can be a result of falling demand. Additionally, the restricted supply of parts, materials, and other products will limit an importer’s ability to maintain its output levels. These scenarios could lead to increased default risk. That is not to say that an industry that exhibits higher default risk is necessarily experiencing supply chain related issues as well, as we know that there are many factors that can affect the riskiness of companies within an industry. It is also worth mentioning that PDMS will react to market changes more quickly than import shipping volumes, which, in many cases, will be consigned months in advance.

Company Analysis

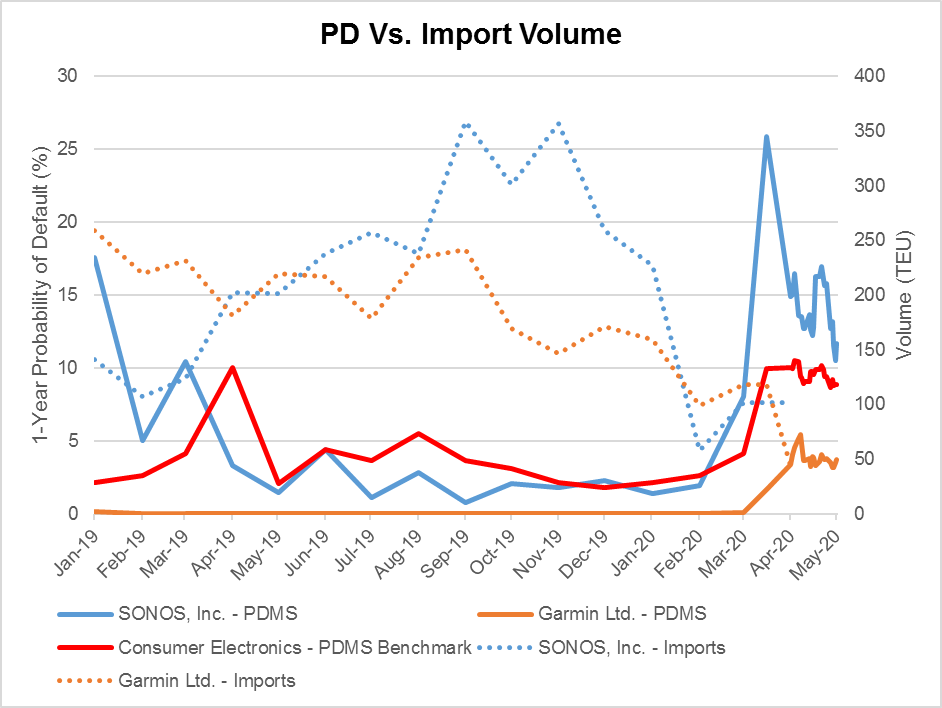

Taking the Consumer Electronics industry as one that has exhibited elevated default risk, we focus on two companies within that industry (Garmin Ltd. And SONOS,Inc.), using Panjiva data to get a more granular view on their supply chain risk, and PDMS to understand the default risk associated with COVID-19.

As seen below in Figure 2, Sonos experienced a 45% year-over-year (y-o-y) fall in its associated import volume, from 107 TEU’s[4] to 58 TEU’s in February 2020. This was partially due to reduced demand and the U.S.-China trade tariffs, with approximately 84% of its seaborne imports traditionally coming from China. This y-o-y fall was reduced to 18% in March 2020 but rose again to 50% in April 2020 despite remaining relatively stable from the previous month. With COVID-19 affecting global supply lines, however, the monthly trend could well worsen and y-o-y fall continue. The PDMS for the firm was more risky than its median Consumer Electronics benchmark (in red) from March 2020 onwards. On March 16, 2020 the PDMS was more than 150% higher than the benchmark at 25.9% and 9.9%, respectively, the company’s worst level in this recent period.

Imports associated with Garmin Ltd. (Garmin) saw a large y-o-y fall in import volume, declining by 55%, 49% and 75% in February, March and April respectively. However, in absolute terms the fall in import volume over the 6 months from November 2019 to April 2020 was much larger for Sonos than for Garmin.[5] The PDMS for Garmin also remained consistently better than the median Consumer Electronics PD for the past 10 years, and from January 1, 2019 to March, 1 2020 remained below 1%. Despite showing some escalation since March, the company’s PD was still outperforming the peer benchmark by more than 300% on March 23, 2020[6] and continued to be better than the benchmark throughout April. Sonos would then appear to be more vulnerable from a credit risk standpoint and has seen more impact to its seaborne supply chain.

Figure 2: PDMS performance and import volume associated with Garmin and Sonos

Source: S&P Global Market Intelligence, Panjiva as of May 4, 2020. For illustrative purposes only.

S&P Global Market Intelligence, PDMS as of May 4, 2020. For illustrative purposes only.

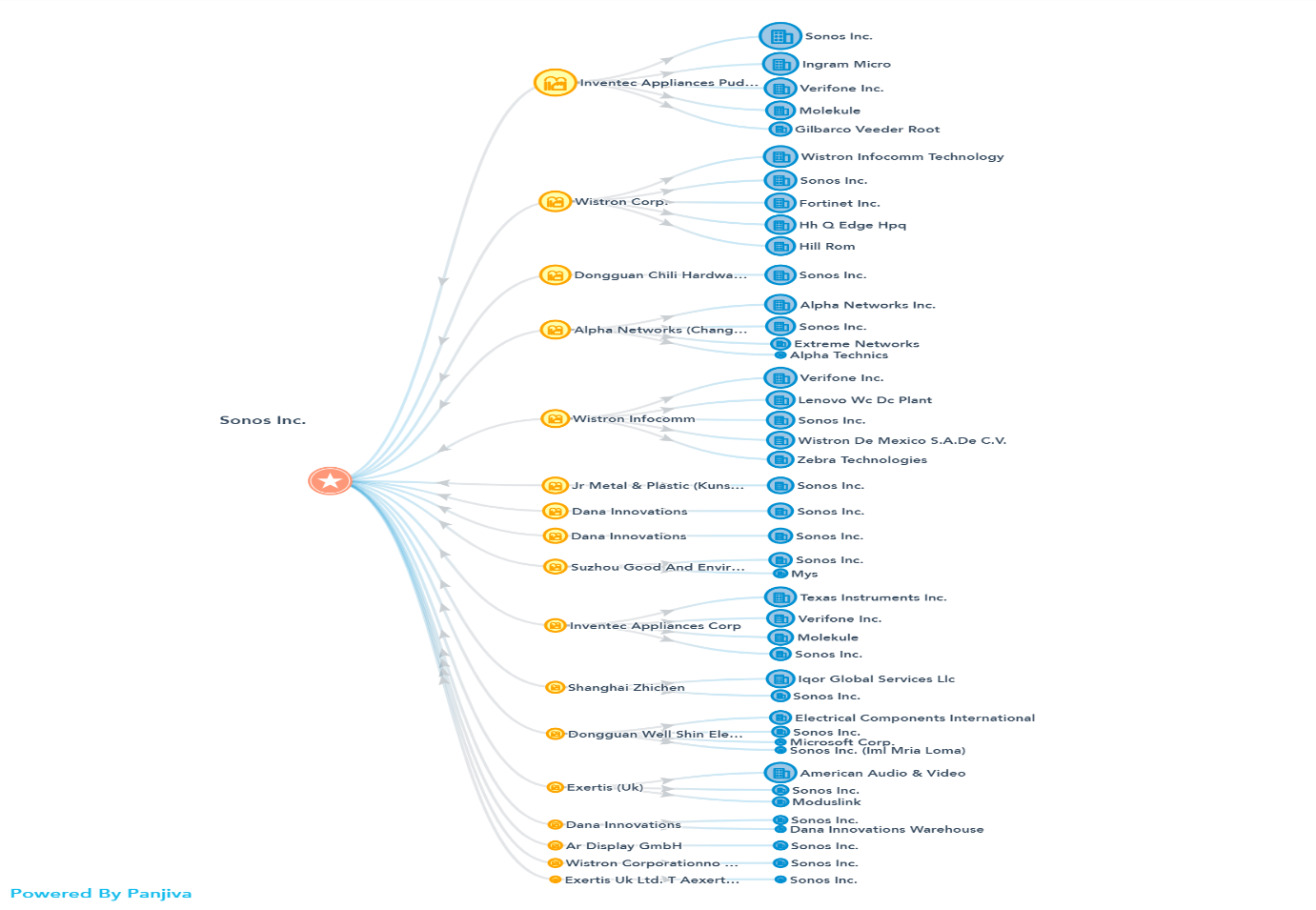

Supply Chain Analysis

Understanding where a company’s critical supplies are coming from and the creditworthiness of those suppliers can be essential to assessing the health of that company. Depending on how integral a supplier is to the company, a sudden reduction in supplies can transmit operational and financial stress, especially if the company cannot find an alternative supplier before current inventory is fully depleted. Using Panjiva data, we see that Sonos has more than 100 companies in its supply chain. In Figure 3 below, we show a simple snapshot of some of the firm’s largest suppliers.

Figure 3: Sonos’ key suppliers and buyers

S&P Global Market Intelligence, Panjiva as of May 4, 2020. For illustrative purposes only.

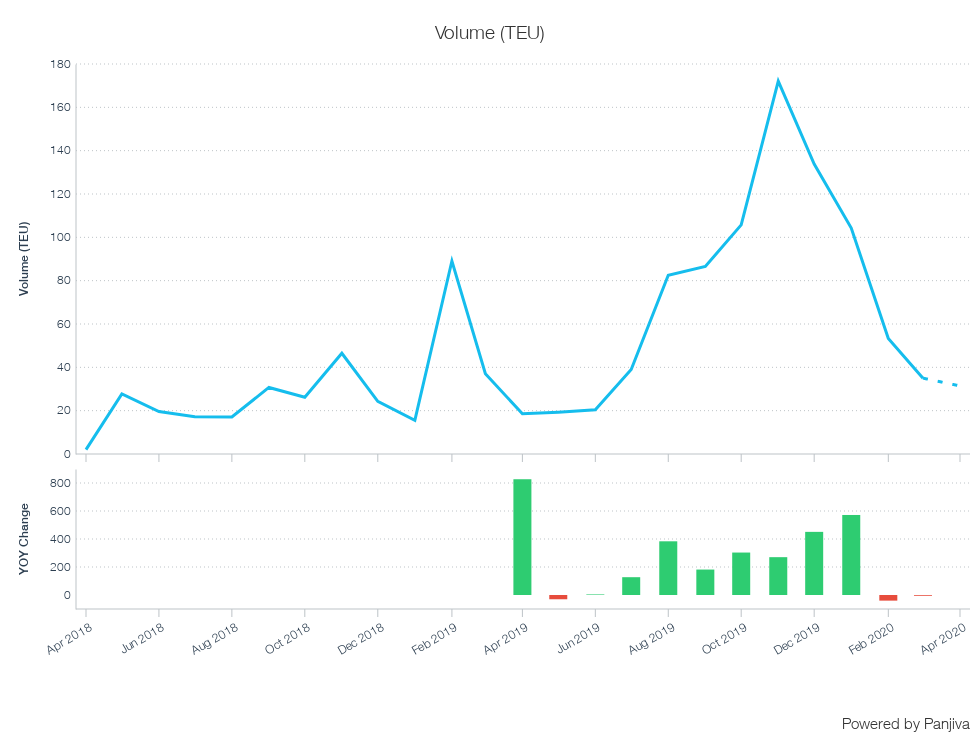

In Figure 4, we look at the export volume associated with one of Sonos’s biggest suppliers, Wistron Corporation, a Taiwan-based provider of technology hardware with significant production capacity in China. It is clear that seaborne export volume peaked in December 2019 at 172 TEU’s, but has been falling since January 2020, ending at 35 TEU’s in March 2020 and seeming to continue the downward trend in April[7]. The U.S.-China trade war dramatically increased the cost of its exports, with the firm being further impacted by COVID-19 supply chain disruptions from the lockdown. Wistron now says it could move more than half of its production capacity outside of China.[8]

Figure 4: Seaborne export volume – Wistron Corporation

S&P Global Market Intelligence, Panjiva as of May 4, 2020. For illustrative purposes only.

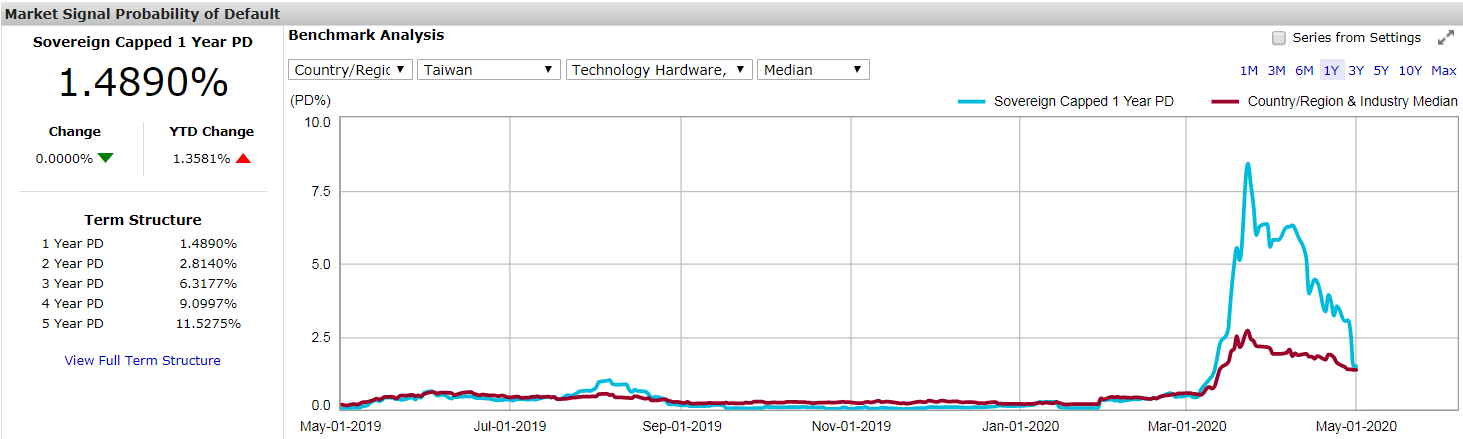

Figure 5 shows that the early warning signals revealed a sharp worsening of the PDMS from the beginning of March to March 23, 2020. However, from late March onwards there were some improvements as Wistron reported positive earnings results, implemented a share buyback scheme, and increased i's dividends. Despite this, the PDMS was still marginally worse than the industry median benchmark on May 1, 2020, due to the COVID-19 market pressures reducing demand and supply capacity, coupled with the negative market outlook.

Figure 5: PDMS performance for Wistron Corporation

S&P Global Market Intelligence, PDMS as of May 4, 2020. For illustrative purposes only.

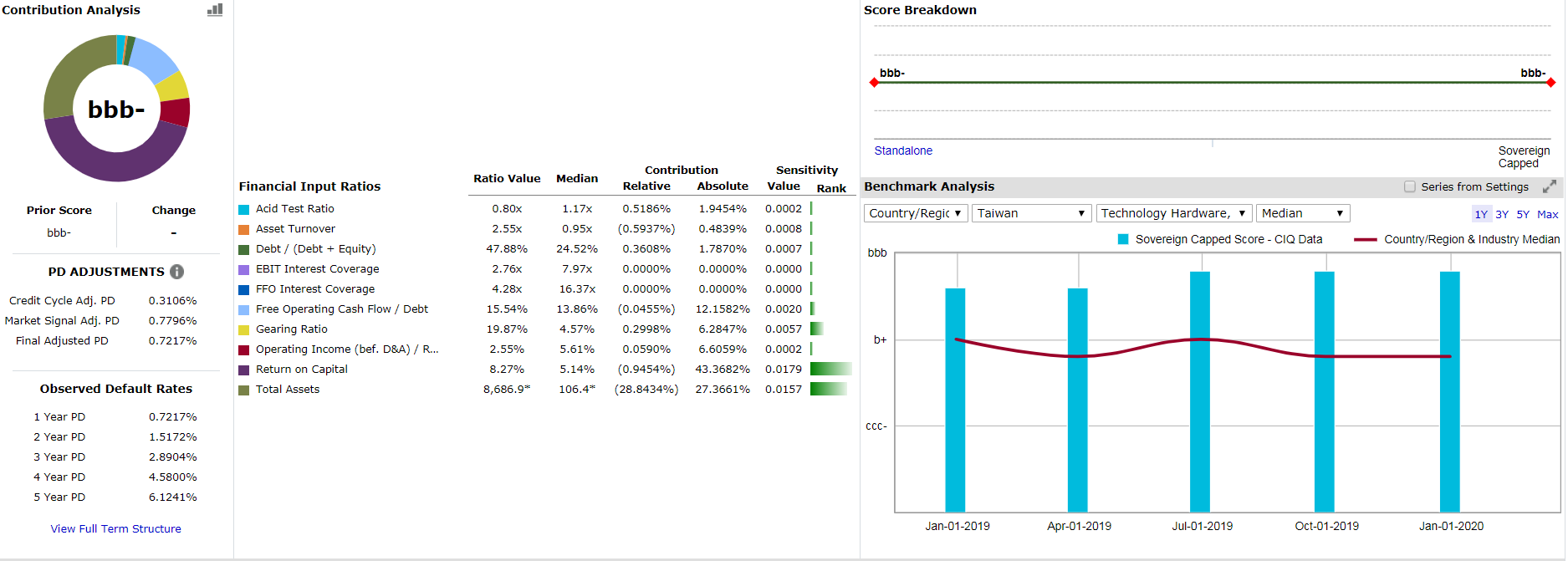

Using CreditModel to assess the mid- to long-term credit strength of Wistron, and perhaps its ability to withstand COVID-19 related business pressures, gives a more positive impression of the long-term creditworthiness of the business. Although this has not yet been factored into its first quarter 2020 financials, Figure 6 shows that in fiscal quarter (FQ) 2019, the second, third, and fourth quarters were consistently displaying a bbb- credit score, which is a notch improvement from the first FQ 2019 at bb+. In addition, the company was outperforming the CreditModel median industry benchmark. We also know from Panjiva data that Wistron is a manufacturing partner for a number of very large companies, including Apple, Lenovo, and Microsoft. This should re-enforce the value of the firm and, perhaps, limit some concerns. However, from a supply chain perspective, their potentially large project to relocate significant production capacity and the trajectory of export volumes will be observed with keen interest.

Figure 6: Long-term creditworthiness of Wistron Corporation using CreditModel

S&P Global Market Intelligence, PDMS as of May 4, 2020. For Illustrative purposes only.

Scenario Analysis

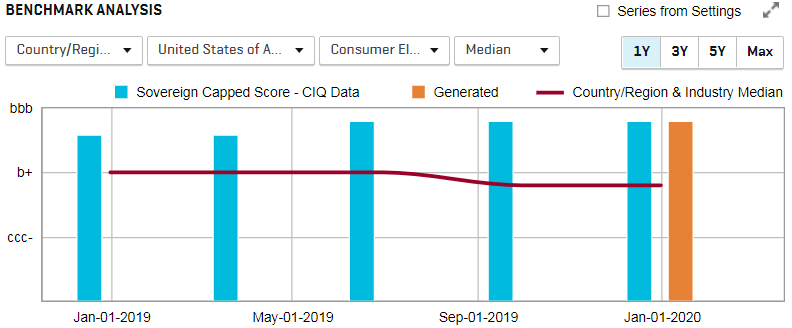

The overall credit strength of a company plays a crucial role in its resilience to market shocks, such as those presented by COVID-19. Even prior to a company releasing its quarterly financials, we can simulate what the possible impact might be to their creditworthiness. To illustrate this using CreditModel,[9] we ran a stressed scenario of a one-year decline of 50% in revenues and cash flow for both an Investment Grade and Speculative Grade entity. In Figure 7, we assume the company has a credit score of bbb-. After making these revenue and cashflow adjustments, the new score represented by the orange bar remains at the same level (bbb-). This impact is entity specific but, providing that the company continues to make a profit and there is not too much degradation in the other model drivers, it will see a moderate PD of 0.22%

Figure 7: Reduction of revenue and cash flow in a company with a CreditModel score of bbb-

S&P Global Market Intelligence, PDMS as of May 4, 2020. For Illustrative purposes only.

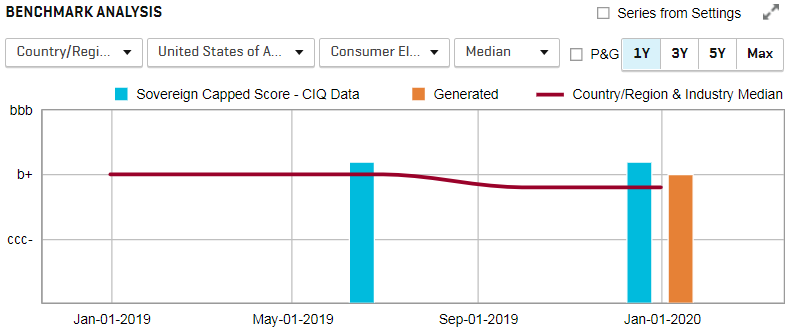

In the example below we make the same adjustment to a company with a credit score of bb- this company which was already experiencing a slight increase in its PD had a deterioration by one notch to b+ (or in PD terms from 1.06% to 2.16%) represented by the orange bar. If this company were impacted by COVID-19 in this way, then it would become much more difficult for it to manage its debt obligations. This supports the view that Investment Grade companies are expected to be more resilient than Speculative companies during an economic downturn.

Figure 8: Reduction of revenue and cash flow in a company with a CreditModel score of bb-

S&P Global Market Intelligence, PDMS as of May 4, 2020. For Illustrative purposes only.

Summary

COVID-19 and the resulting government mandated lockdowns have severely disrupted supply chains and increased the default risk across many industries. Amongst the subset of industries exhibiting high supply chain pressure, Automobile Manufacturers showed a particularly high vulnerability. This was also seen to a lesser extent in other parts of the Consumer Discretionary sector, such as Consumer Electronics. By analysing two Consumer Electronics companies, we were able to use Panjiva data to understand their import behaviour and identify critical companies within their supply chain. By utilising Credit Analytics, we can assess which suppliers were most vulnerable. Finally, using a simple scenario with CreditModel, we were able to illustrate the importance of a primary company’s creditworthiness, or its suppliers’, in its ability to withstand adverse market conditions.

[1] “COVID-19 Credit Update: The Sudden Economic Stop Will Bring Intense Credit Pressure”, S&P Global Ratings, March 17, 2020.

[2] “Bad, with worse to come – COVID-19’s toll on U.S. imports in March”, Panjiva research, April 9, 2020

[3] Panjiva research has identified products which have been mapped to specific industries

[4] The supply chain measure of import volume as provided by Panjiva is denoted by TEU’s (twenty foot equivalent containers) of containerised freight imports.

[5] Reduction from 159 TEU’s to 44 TEU’s for Garmin versus 357 TEU’s to 101 TEU’s for SONOS.

[6] See Sonos, Inc. full PDMS daily movements on the Credit Analytics desktop.

[7] Dashed lines in the chart indicate preliminary import results.

[8] “Coronavirus is Expediting iPhone Makers Plans to Move Beyond China”, Bloomberg News, March 27, 2020.

[9] CreditModel reflects Through-The-Cycle, in contract to PDMS, which is a point-in-time metric.