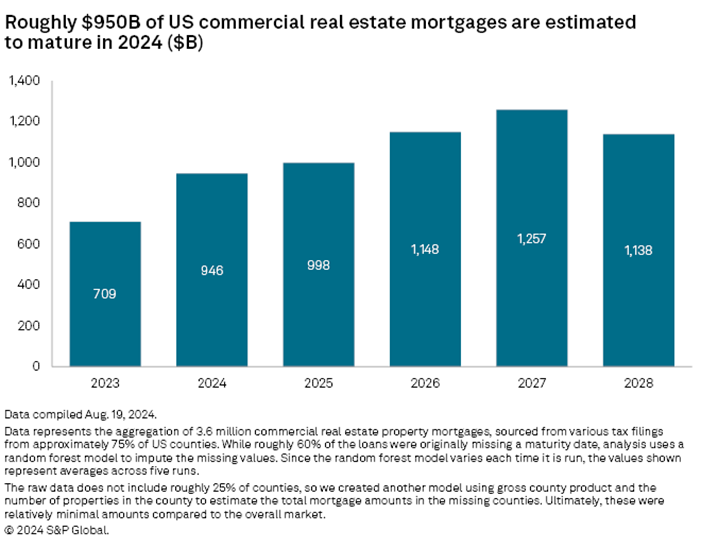

Rate hikes by the Federal Reserve and changes in post-pandemic behavior have put pressure on commercial real estate (CRE) borrowers needing to refinance loans coming due. The tally is nothing to sneeze at, with approximately $950 billion in CRE mortgages set to mature in 2024, according to S&P Global Market Intelligence's analysis of nationwide property records.

Should borrowers fail to seek the necessary refinancing and default on their loans, banks would not only face losses on their loans but valuations in the CRE market could come under significant pressure. Origination data shows that the maturity wall will grow to nearly $1 trillion in 2025 and ultimately peak in 2027 at $1.26 trillion, suggesting that the issue is unlikely to be resolved soon.

Click here to view our complete research report on the CRE maturity wall.