The digitalization trend observed in the past years has fuelled the demand for both hyperscalers and retail collocation data centres. The demand is likely to accelerate further with the recent advancements in AI and machine learning driving the need for higher processing power and data storage solutions. All market participants from financial institutions to corporates are seeking a cloud-like experience that offers elasticity, scalability and simplified management. Nature of their activities coupled with regulatory requirements resulted in the need of some market players to keep the services “in-house”, while others could benefit from the third party hosting facilities.

This has led to an interesting development where cloud providers, either public or private, are not only key customers of data centres but, increasingly, competitors.

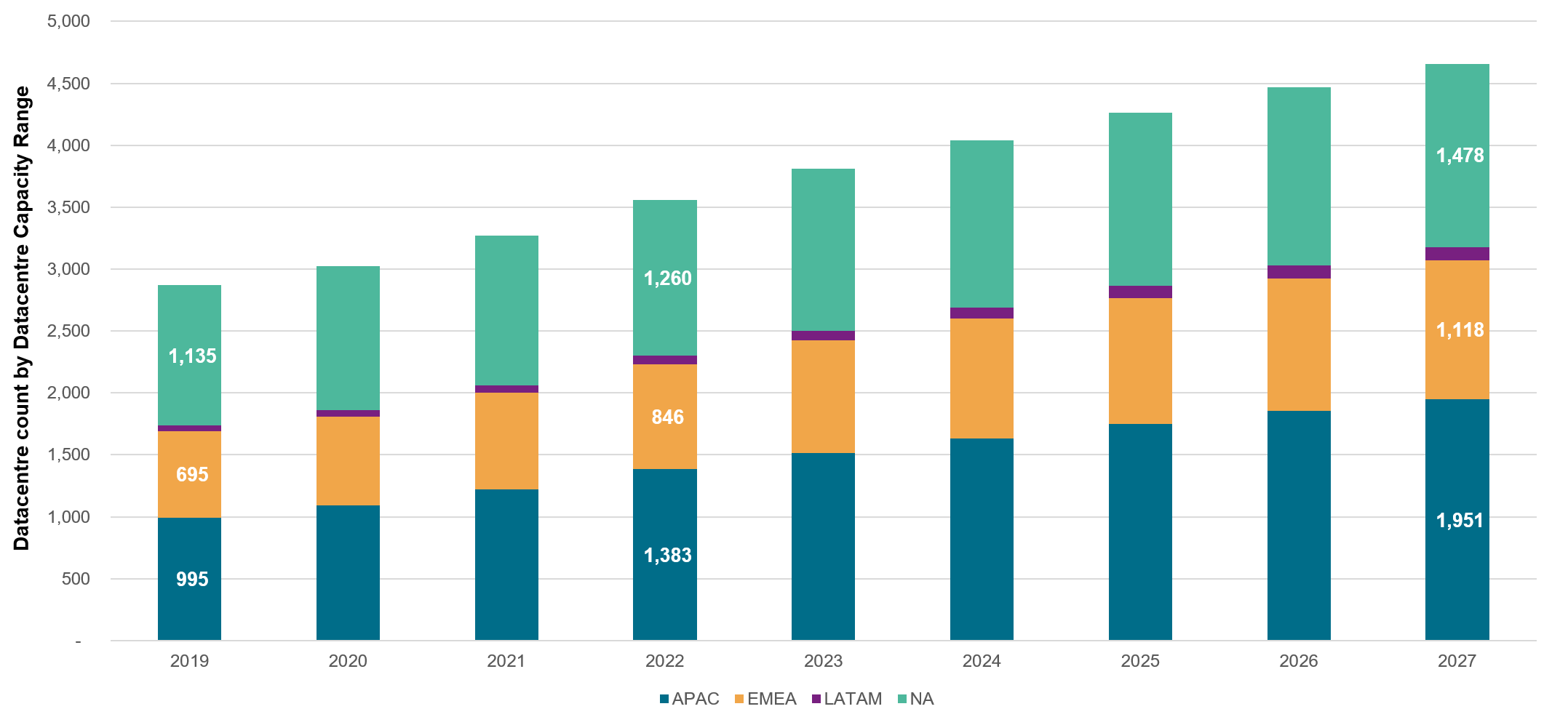

Figure 1: Total Datacenter Count > 5 MW, 2019 - 2027.

Source: 451 Research, Datacenter Services and Infrastructure Market Monitor, Nov 2 2022

Historically, the key markets for data centres include North Virginia for the U.S., London, Dublin and Amsterdam for Europe and Singapore for APAC. However, in recent years we see a shift towards the secondary markets. This shift was driven by:

- the sustainability concerns in primary markets;

- the increase in Internet connectivity fueled by increase in sub-sea cables connecting different parts of the world; and

- the introduction of the General Data Protection Regulation (GDPR) that reflects data governance issues and where customer information should reside.

With the rise of the demand for data centres facilities and shift towards secondary and tertiary location we see an increased number of financial institutions interested in understanding the inherent risk of data centres financing either from both continuity of their operations angle or from financial investment viability point of view. One recent trend that we observed is data centres that aim to attract capital are incorporating sustainability features by accessing alternative power and using cooling systems for the servers to ensure that they appeal to the market.

There are several credit risk considerations that investors can monitor when looking at this type of asset financed under the project finance structure such as the cost matrixes, which include land cost, Internet connectivity, power, tax environment, natural disasters, and the workforce.

For greenfield projects, features that would require a closer consideration would be linked to type of technology employed, project management, budgets, supply chain risk and construction counterparty dependency assessment. For instance, hyperscalers are built to suit the needs of the given off-taker, therefore, its approval becomes an integral part of the assessment. Consideration must be paid to assess the risk any late design changes and the associated costs linked to them. Another example would be the increase in prices of raw material such as copper and concrete require for the data centres construction and their impact on the construction budgets.

For projects that are already in operations, some of the credit related features under the investors radar would be performance risk, including resources risk and cyber risk, refinancing risk and the counterparty dependency. Fortune 100 type of tenants or cloud providers cannot afford the drop-down in their connectivity and typically have Service Level Agreements in place guaranteeing certain level of up time making contingencies planning and presence of efficient backup systems become critical. In today’s inflationary world it is also important to evaluate the contracts in place and ability to path through inflationary costs such as increase price of electricity to the end user.

Many market participants struggle to reliably evaluate the level of risk related to project financing. The challenge comes from the inherent complexity of the asset class and its predominantly qualitative analysis, which is unique to each transaction, as well as availability of sufficient data to capture project defaults.

S&P Global Market Intelligence has designed tools with ongoing support to help clients address their expert judgment when it comes to the unrated world of project finance. Please click here to learn more about the Project Finance Credit Assessment Scorecard and the Project Finance LGD Scorecard.