There is a consensus among economists that central banks’ policy rates have achieved their goal to tame post-Covid inflation in most countries, and they will be gradually decreased, from 2024 onwards. But what would be the potential impact if the easing cycle in each country was delayed by a quarter or more?

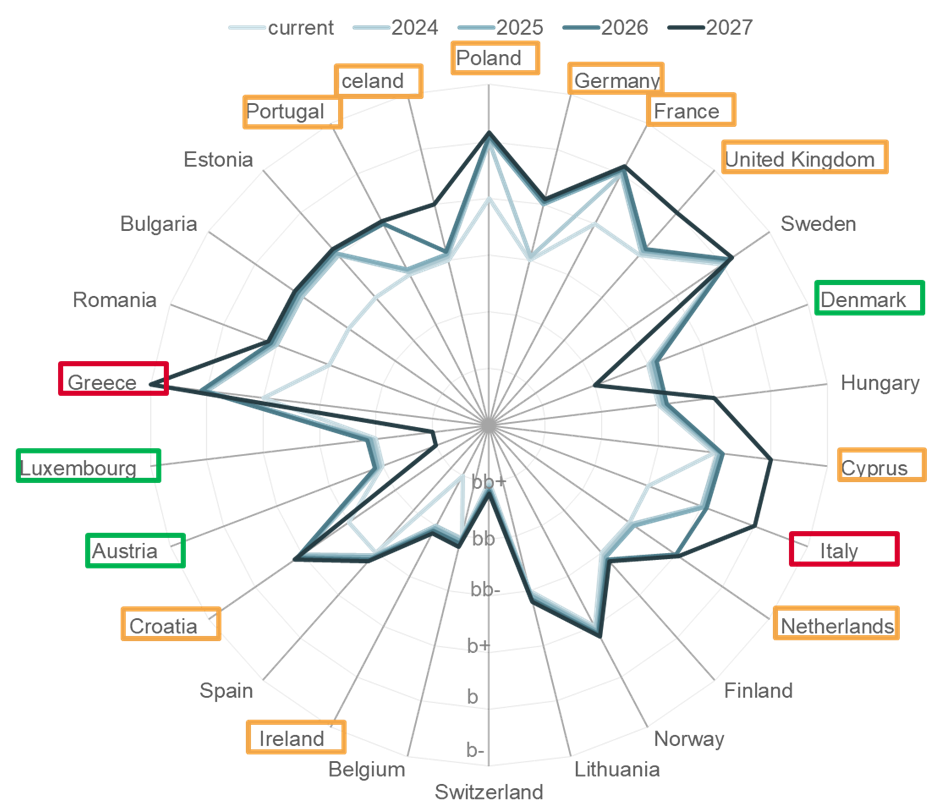

The radar plot below shows the impact of a scenario where the start of each country’s easing cycle is delayed by a quarter or more months, in line with what the European market experienced on average after previous historical hiking cycles. We focus on the median credit risk profile of European publicly listed companies, as measured by Credit Analytics’ RiskGauge™ score, and employ our Macro-Scenario Model to simulate the credit risk impact on those companies between 2024 and 2027.

Our analysis shows that while creditworthiness remains resilient in Croatia, Cyprus, France, Germany, Iceland, Ireland, Netherlands, Poland, Portugal, and United Kingdom, or even shows an improvement due to the normalization of the business cycle (Austria, Denmark, and Luxembourg), Greece and Italy experience a loss of growth and reduced investment, stressing public firms’ profitability and thus increasing credit risk.

Figure. 1: median credit risk score of European public firms, under current macro-economic conditions and a delayed policy rate cuts scenario.

Source: S&P Global Market Intelligence. Data as of November 14th, 2023. For illustrative purposes only.

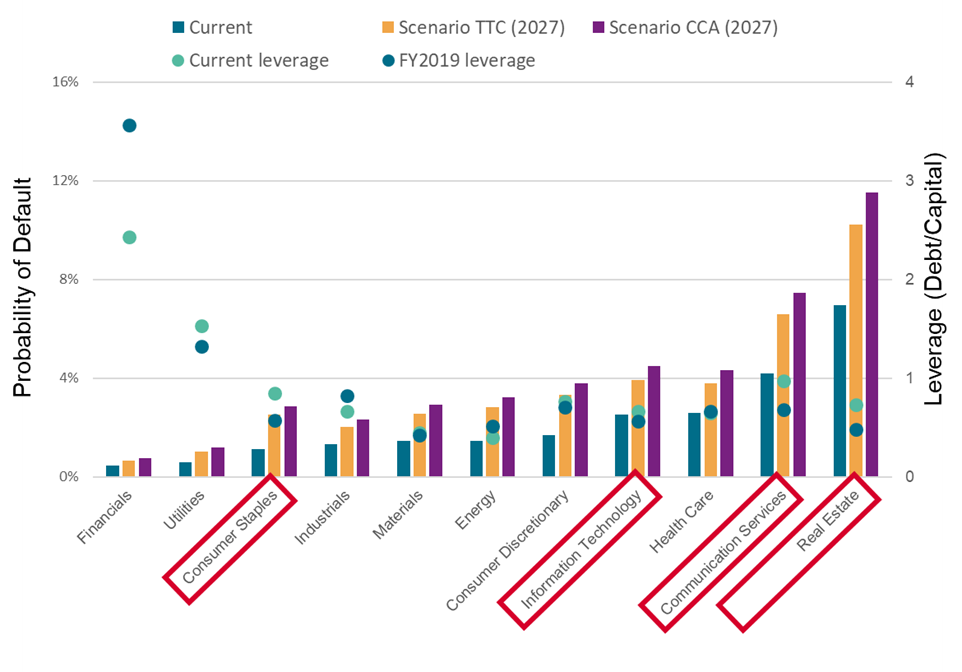

Within each country, not all sectors will experience the same credit risk impact by 2027. In Figure 2 below, we drill down into Italy, where companies experience one of the most negative impacts. Consumer Staples, Information Technology, Communication Services, and Real Estate show an increase in through-the-cycle (TTC) and credit-cycle-adjusted (CCA) probability of default (PD), compared to other sectors within our sample of publicly listed firms, as they currently still exhibit higher leverage than in pre-Covid times.

Figure. 2: median PD for Italian publicly listed companies, under the delayed policy rate cuts scenario.

Source: S&P Global Market Intelligence. Data as of November 14th, 2023. For illustrative purposes only.

Contact us to find out how you can efficiently score and monitor your potential credit risk exposure to over 50 million public and private companies worldwide – including small- and medium-sized enterprises (SMEs).