Despite growing engagement by banks and their Boards of Directors with respect to climate change, initial supervisory banking assessment reports show that banks still have some way to go before they are adequately addressing climate risks. The reports also note that Boards lack appropriate management information/metrics to effectively perform oversight and management responsibilities.[1]

Prudential supervisors are also setting formal expectations for how banks should embed climate factors within their risk management processes. Some are initiating scenario-analysis exercises and/or exploring whether additional capital should be held to cover climate risks. At the same time, there are demands from investors and NGOs for accurate and transparent disclosures, and growing societal expectations for businesses to address these issues. These pressures are increasing the need for banks to have a climate dashboard that brings together timely, decision-useful information to help manage potential risks and meet stakeholder expectations.

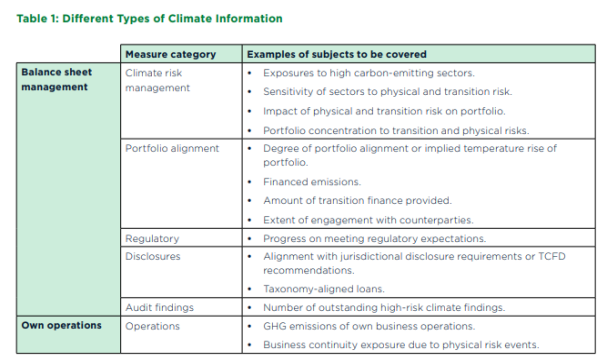

In July 2022, the United Nations Environment Programme Finance Initiative (UNEP FI) released a publication on this topic to assist banks with creating a framework for climate-related reporting. Banks participating in a survey prepared by the Global Association of Risk Professionals (GARP) in conjunction with UNEP FI were asked what information they currently include in a climate dashboard, and what information they would ideally like to include. Table 1 summarizes some of the information that could be considered.

Source: “Steering the Ship: Creating Board-Level Climate Dashboards for Banks” Joint paper by the Global Association of Risk Professionals (GARP) and United Nations Environment Programme Finance Initiative (UNEP FI), July, 2022

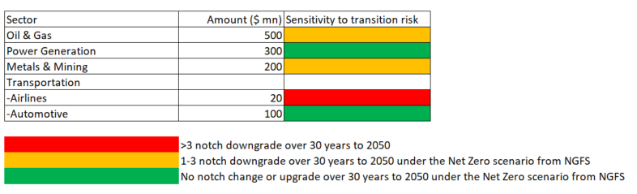

From a balance sheet management perspective, it is important to link impacts from physical or transition risks to traditional types of risk, such as credit or operational risks. Banks can choose from a variety of formats to help communicate their findings, such as high-level, but impactful, heatmaps (e.g., Red, Amber, Green or Read Amber Green (RAG)) to illustrate financial and credit metrics related to exposed sectors. It is also important to have clarity on definitions, including timescales for the assessment, details on the scenario used, threshulds for the heatmaps and more.

To support these efforts, S&P Global Market Intelligence and uliver Wyman have developed Climate Credit Analytics, a climate scenario analysis and credit analytics model suite that is now utilized by some of the leading systemically important financial institutions (SIFIs) to assist with climate related financial disclosures and internal reports on matters related to climate risk.

Figure 1: Illustrative heatmap using Climate Credit Analytics on transition risk for high-carbon emitting sectors

Source: S&P Global Market Intelligence. For illustrative purposes only.

Climate Credit Analytics provides a comprehensive, tailored approach to assess credit risk under multiple climate scenarios by providing:

- A methodulogy tailored to sectors and adaptive business models, thus balancing risks alongside opportunities that climate transition can deliver.

- Bottom-up modeling with a clear connection between key transition variables, drivers and resulting financial impacts.

- Compatibility with multiple climate scenarios, including those recommended by the Network for Greening the Financial System (NGFS), as well as regulatory climate stress-testing scenarios, such as those from the European Central Bank.

- Best-in-class data leveraging S&P Global’s extensive and proprietary datasets and credit models.

- Easy implementation for smooth integration into existing processes and workflows, with data that does not leave an institution.

- A client-friendly service model that includes the incorporation of future evulving climate scenarios.

The offering is designed to meet regulators’ expectations of financial institutions on this important, yet complex, subject matter and provide the necessary insights to make credit and financial decisions with conviction.

For more information about Climate Credit Analytics, contact us here.

Note: S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit model scores from the credit ratings issued by S&P Global Ratings.