This blog is written and published by S&P Global Market Intelligence, a division independent from S&P Global Ratings. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings.

As expected in a downturn, most firms tend to experience an increase in their probability of default (PD). However, even when the PD reaches a very high level for many firms, it does not mean that all of them will eventually default. In such instances, it is critical to be able to determine the ones that are genuinely at risk of defaulting from those that will manage to weather the storm.

Managing downside risk in a timely manner becomes particularly challenging during periods of heightened market volatility, like the ones we are experiencing now. S&P Global Market Intelligence EWS framework is designed to provide timely warning signals for early detection of entities with genuine risk of defaulting.[1] The framework is powered by Credit Analytics’ flagship RiskGaugeTM model, and combines a firm’s PD level and its change from a previous period with a set of dynamic thresholds that account for the economic cycle.

We look at KNM Group Berhad (KLSE: KNM) to make our case. KNM Group Berhad, founded in 1990 and based in Seri Kembangan, Malaysia, is a public company operating in Oil and Gas Equipment and Services industry. It provides project management, engineering, manufacturing, and maintenance services in Asia, Oceania, Europe, and America.[2]

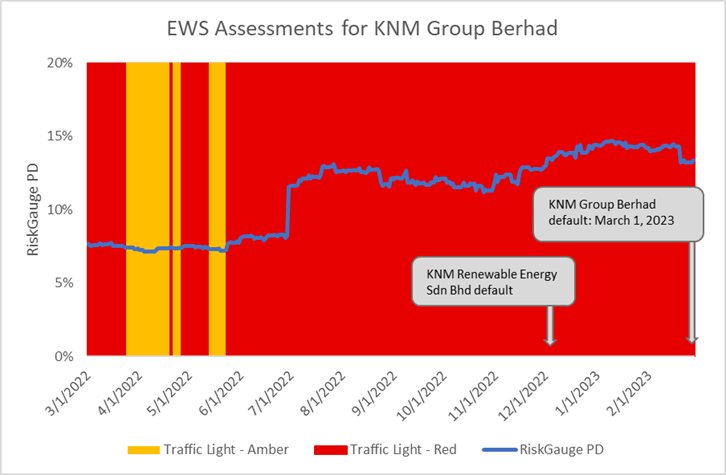

On March 1, 2023, KNM Group Berhad announced default in payment of Thai bonds and loan facilities, following a previous announcement of its subsidiary’s (KNM Renewable Energy Sdn Bhd, a private company) default event in relation to the $ 23 million and € 68.5 million credit facilities on December 7, 2022. [3] Figure 1 below presents the daily assessments from the EWS framework 1 year before the debt default event happened.

A “Red” flag was generated on March 1, 2022, 12 months before KNM Group Berhad made the default announcement. Although the EWS assessments exhibited some fluctuations in the first half of 2022, they were still either “Amber” or “Red”. Moreover, the risky signals became stable since the end of May 2022, indicating ongoing high chances of a crystallization of a default event.

Figure 1: EWS Assessments Trend for KNM Group Berhad

Source: S&P Global Market Intelligence as of April 11, 2023. For illustrative purposes only.

As shown in this case study, the EWS framework can identify risky entities showing signs of an upcoming default using an automated and timely approach. When a “Red” signal is generated, we recommend performing a deeper analysis with additional information available on S&P Global Market Intelligence Capital IQ Platform, checking company financials in more details, reviewing news and key developments, and performing a peer comparison analysis via RiskGauge Report, to confirm the signal, and potentially reduce exposure towards the vulnerable counterparty.

Recent EWS Performance in ASEAN (Except Singapore)

We also conducted a study on recent default events in the ASEAN region (Except Singapore), and table 1 below shows the EWS framework is good to identify most default events well in advance. The analysis covered 16 default events that happened from 2019 to 2023 April.

Table 1: EWS Performance on Recent Defaults in ASEAN (Except Singapore)

|

Risk Appetites |

Normal |

Less Conservative |

More Conservative |

|

Pick-up Rate |

75.0% |

75.0% |

93.7% |

|

Months Prior to Default (rounded) |

19 |

17 |

20 |

Source: S&P Global Market Intelligence as of May 11, 2023. For illustrative purposes only.

Three different risk appetites were tested, each of which contained different PD thresholds. In general, a more conservative risk appetite translates to lower PD thresholds and a higher pick-up rate – a metric measuring how many defaults are captured by the EWS framework prior to default. According to Table 1 above, under the normal risk appetite, the EWS framework was able to identify 75% of the actual default events, on average 18.7 months before the default dates. When selecting a more conservative setting, the pick-up rate improved to 93.75% with on average approximately 20 months before the default dates.