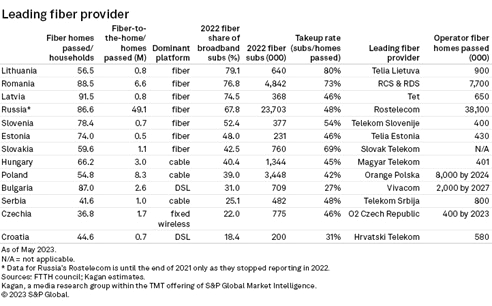

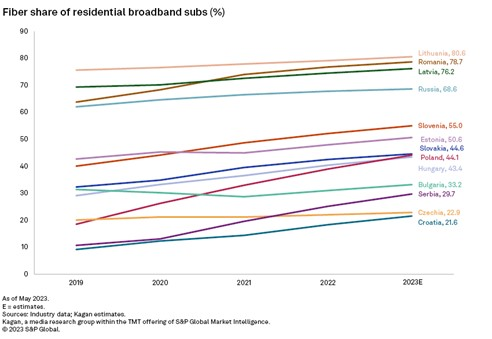

Fiber penetration has been increasing at a varied pace across Eastern Europe, with significant differences in development across the region. Fiber currently is the dominant broadband platform in most of the 13 markets in this study. Lithuania, Romania, Latvia and Russia have the highest fiber penetration of residential broadband subscribers in the region at more than 68% forecast for 2023, while Czechia and Croatia lag at less than 23%. The leading four markets have the highest fiber broadband penetration rates due to support from public funding, favorable geographic factors, and rising demand. Government involvement is key to incentivizing costly fiber rollouts and has helped to drive investment in the region.

Lithuania: Telia Lietuva has heavily invested in fiber infrastructure, offering high-speed broadband services. The government aims to provide internet speeds of at least 100 Mbps to all households by 2027.

Romania: Digi Communications provides the fastest fiber-optic internet service with speeds of 10 Gbps. Consumers have transitioned to individual fiber connections.

Latvia: Tet (formerly Lattelecom) has expanded its fiber network since 2009, partnering with other operators and municipalities. It co-finances rural fiber infrastructure development.

Russia: PJSC Rostelecom focuses on expanding fiber coverage and improving network quality. Partnerships, including with the government of Tatarstan, have aided its fiber development.

Slovenia: Telekom Slovenije's fiber network covers over 400,000 premises. It collaborates with municipalities, focuses on long-term investments, and aims to meet European digital objectives.

Estonia: Telia Estonia prioritizes fiber deployment based on demand, invests in advanced infrastructure, and aims to achieve high-speed and reliable connections across the country.

Slovakia: Slovak Telekom deploys fiber infrastructure in urban and suburban areas and combines it with a hybrid fiber-coaxial network. The national broadband plan targets 100 Mbps coverage for all households.

Hungary: Magyar Telekom expands its FTTH network through partnerships with municipalities and cable operators. The government aims to provide gigabit networks to 95% of households.

Poland: Orange Polska plans to expand fiber reach, relying on third-party networks and partnerships. The focus is on underserved areas and reducing deployment costs.

Bulgaria: VIVACOM partners with Nokia to deploy 10-gigabit networks, aiming to cover 1.7 million households by 2027. Bulgaria prioritizes digital connectivity in its national development program.

Czechia: O2 Czech Republic expands its fiber-optic network and focuses on improving network quality. The national plan aims for comprehensive high-capacity network development.

Serbia: Telekom Srbija connects fiber infrastructure to almost 800,000 households, focusing on expanding network coverage and improving network quality.

Croatia: Hrvatski Telekom invests in network infrastructure, expanding its FTTH coverage. The national plan aims for high-speed connections to all households and essential services.

Eastern European broadband markets demonstrate a commitment to fiber infrastructure investment, with efforts to improve connectivity and extend coverage to rural and underserved areas.