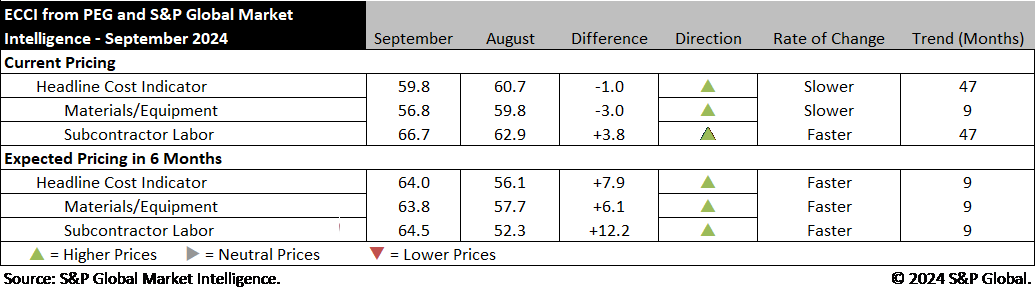

Engineering and construction costs increased again in September, according to the Engineering and Construction Cost Indicator from PEG and S&P Global Market Intelligence. The headline Engineering and Construction Cost Indicator, a leading indicator measuring wage and material inflation for the engineering, procurement and construction sector declined 1.0 points to 59.8 this month. The sub-indicator for materials and equipment costs fell 3.0 points to 56.8 while the sub-indicator for subcontractor labor costs moved up to 66.7 in September from 62.9 in August.

The materials and equipment indicator saw a modest decrease in September but continues to show rising prices. Only six of the 12 components decreased compared to last month, but an additional three were unchanged. The primary drivers of the decline were the 20.0-point decline for ocean freight from Asia and 11.1-point declines for both copper-based wire and cable and electrical equipment. On the other hand, only pumps and compressors saw a double-digit increase, up 11.1-points to 61.1 this month. All three steel categories—carbon pipe, alloy pipe and fabricated structural—remain in contractionary territory this month with readings between 38.9 and 44.4. Shell and tube heat exchangers was unchanged at a neutral reading of 50.0 this month and was joined—after declines—by both ocean freight categories. Tightness remains for transformers (up 9.0-points) and electrical equipment, the two highest readings in September with values of 77.8 and 72.2 respectively.

“Electrical equipment prices continue to face significant challenges. Motors, generators and transformers have been hit hard by a low supply of electrical steel since late 2022 against high demand driven by green energy initiatives like the U.S. Infrastructure Investment and Jobs Act and the EU’s Net-Zero Industry Act. Although electrical steel prices are falling, this reflects canceled projects rather than new operations,” said Philip Azar, Senior Economist, S&P Global Market Intelligence. “Major suppliers of electrical steel are reluctant to expand due to already high profit margins and rising labor costs. Efforts have been made to expand operations from other companies, but these take several years to inaugurate, leaving near-term production in the balance.”

The sub-indicator for current subcontractor labor costs saw a moderate increase, up 3.8-points compared to last month, a result of modest increases in the U.S. Midwest and South regions more than offsetting declines in and Western Canada. Readings for all labor categories in the U.S. South increased 8.3-points to readings of between 66.7 and 75.0. Similarly, all labor categories in the U.S. Midwest increased from 60.0 to 75.0 this month. Meanwhile, all labor categories in Western Canada saw declines, joining Eastern Canada at neutral readings of 50.0, the only exception being instrumentation and electrical subcontractors in Eastern Canada which saw a 16.7-point increase to 66.7 this month. Overall, the data indicates that current pricing for subcontractors is tighter in the U.S. than in Canada.

The six-month headline expectations for future construction costs indicator increased moderately to 64.0 in September. The six-month expectations indicator for materials and equipment came in at 63.8, 6.1-points higher than last month’s figure, partially offsetting the 16.4-point decrease in the same category last month. Ten of 12 categories saw price expectations increase this month, with copper-based wire and cable seeing the lone decline and alloy steel pipe unchanged. The largest increases were seen for electrical equipment, up 14.6-points, ready-mix concrete, up 11.9-points, ocean freight from Europe to the U.S., up 11.1-points and pumps and compressors, up 10.4-points. Despite increases this month, expectations for fabricated structural steel remain in contractionary territory and expectations for carbon steel pipe are neutral.

The six-month expectations indicator for sub-contractor labor saw a sizeable rebound, up 12.2-points this month after being just over 50 last month which followed five consecutive months above 70.0. All regions and industries in the U.S. saw increases this month of between 10.0- and 25.0-points. Western Canada saw declines across the board and joined Eastern Canada at a neutral reading of 50.0.

Respondents continue to report some shortages for electrical equipment and electricians as well as some other skilled labor categories.

To learn more about the Engineering and Construction Cost Indicator or to obtain the latest published insight, please click here.