The results of the European Central Bank (ECB) climate risk stress test published in July 2022 show that banks have not yet sufficiently incorporated climate risk into their stress-testing frameworks and internal models, despite some progress made since 2020.

A total of 104 significant banks participated in the ECB stress test, which consisted of three modules in which banks provided information on their: (i) own climate stress-testing capabilities, (ii) reliance on carbon-emitting sectors, and (iii) performance under different scenarios over several time horizons. The bottom-up stress test within the third module was limited to 41 directly supervised banks to ensure proportionality towards smaller banks. The test required banks to project losses due to extreme weather events and under transition scenarios with both short- and long-term time horizons.

The exercise has provided the ECB with initial insights into banks’ climate-related credit risk modelling capabilities. Overall, it appears that climate risk factors have not yet been fully considered. This may explain the limited differentiation with respect to institutions’ projected credit risk parameters across the different long-term climate risk scenarios.

Specifically, the ECB found that: (i) the sectoral dimension is often not properly reflected in banks’ credit risk models, since the asymmetric shocks across industry sectors assumed in the scenarios did not result in notable differences in projected sectoral risk parameters, (ii) climate risk variables were mostly captured using proxies (e.g., with respect to emissions), the quality of which seems highly variable across institutions, and (iii) with carbon prices often being the only climate-related explanatory variable, existing credit risk models do not seem to incorporate all relevant climate risk channels – i.e., both direct channels (e.g., carbon price shocks and emissions pathways) and indirect channels (e.g., macroeconomic variables) – that could affect the credit quality of each counterparty.

Banks, in turn, mentioned challenges regarding how to: i) model loss projections over a 30-year time horizon and connect scenario assumptions to credit risk parameters (i.e., probability of default (PD) and loss given default (LGD)), ii) characterize extreme weather events (i.e., incorporation of physical risks), and iii) anticipate changes in customers’ behaviors, which is one of the main triggers of transition risk.

Understandably, a framework that can address these shortfalls and challenges and help reliably quantify the financial and credit impact of climate risk, is much desired.

To support these efforts, S&P Global Market Intelligence and Oliver Wyman[1] have developed Climate Credit Analytics, a climate scenario analysis and credit analytics model suite that is now utilized by some of the leading systemically important financial institutions (SIFIs) to support stress testing, as well as to inform their credit policy and net-zero strategy. These tools combine S&P Global Market Intelligence's data resources and credit analytics capabilities with Oliver Wyman's climate scenario and stress-testing expertise.

Speak to a climate risk expert to learn more

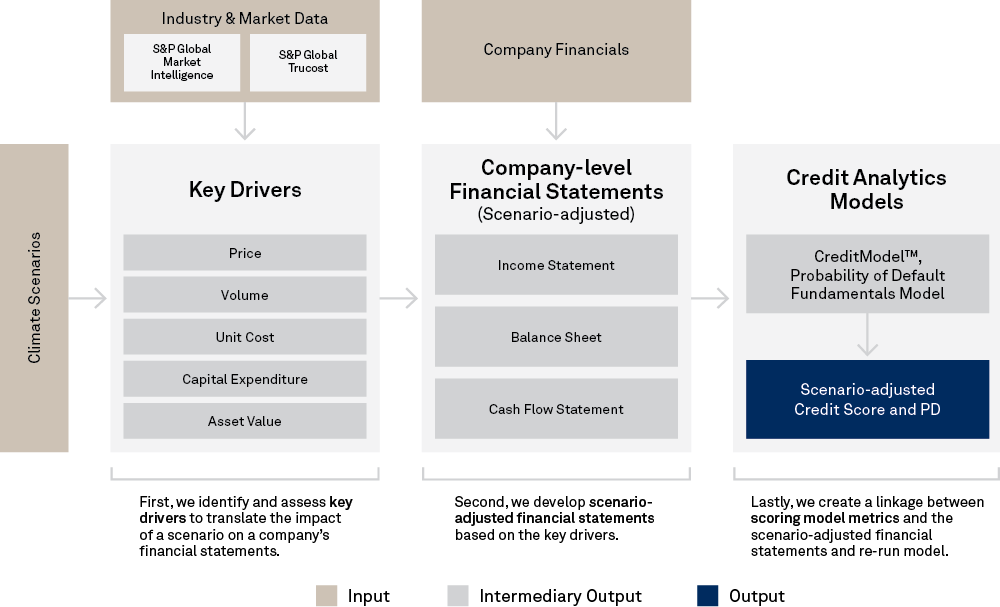

Figure 1: Climate Credit Analytics Methodology

Source: S&P Global Market Intelligence. As of: July 2021. For illustrative purposes only.

Climate Credit Analytics provides a comprehensive, tailored approach to assess credit risk under multiple climate scenarios by providing:

A sector-specific methodology tailored to real economics across sectors and adaptive business models, thus balancing risks alongside opportunities that climate transition can deliver.

- Bottom-up modeling with a clear connection between key transition variables, drivers and resulting financial impacts.

- Compatibility with multiple climate scenarios, including those recommended by the Network for Greening the Financial System (NGFS), as well as regulatory climate stress-testing scenarios, such as those from the ECB.

- Best-in-class data leveraging S&P Global’s extensive and proprietary datasets and credit models.

- Easy implementation for smooth integration into existing processes and workflows, with data that does not leave an institution.

- A client-friendly service model that includes the incorporation of future evolving climate scenarios.

The offering is designed to meet regulators’ expectations of financial institutions on this important, yet complex, subject matter and provide the necessary insights to make credit and financial decisions with conviction.

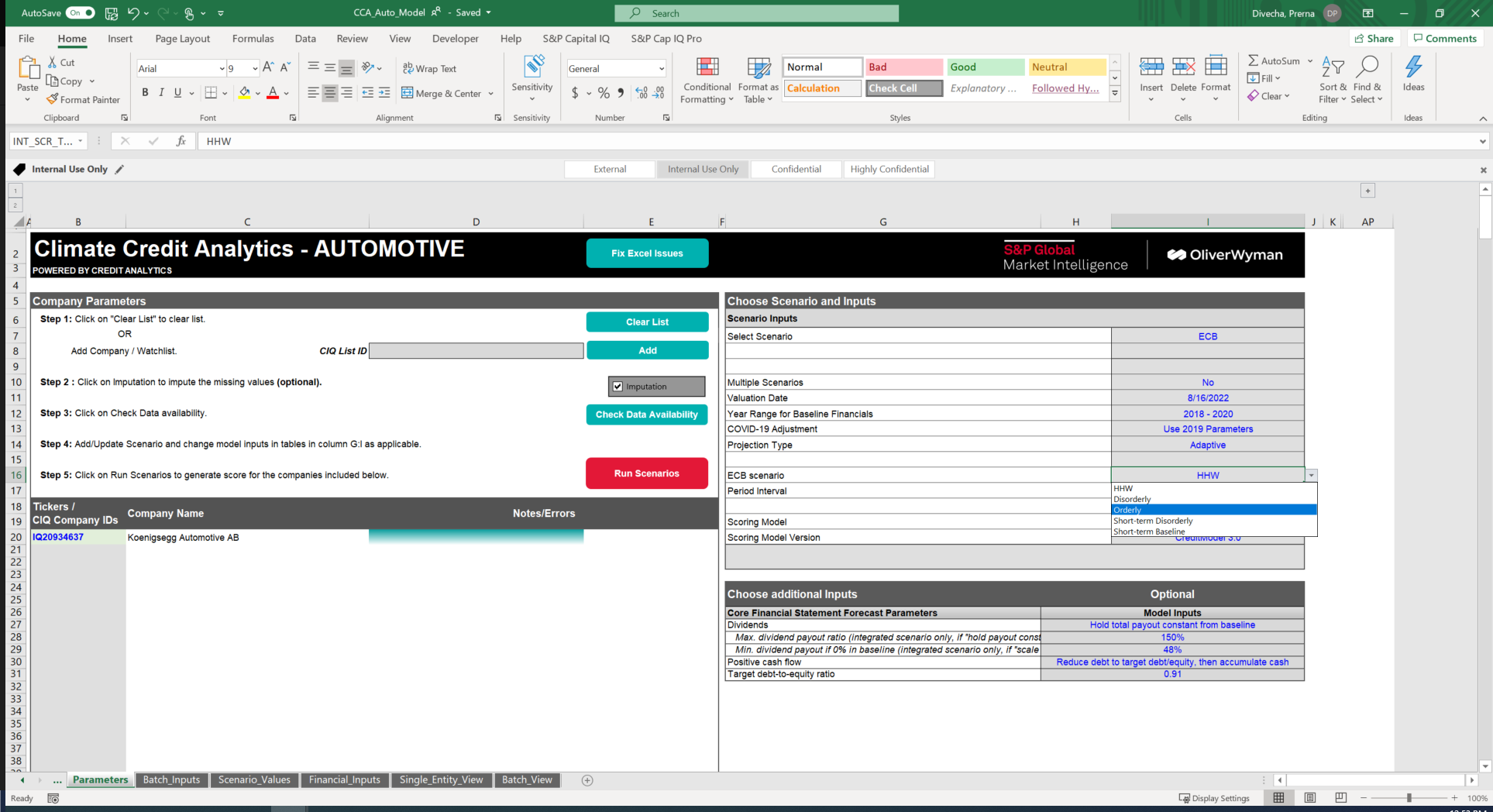

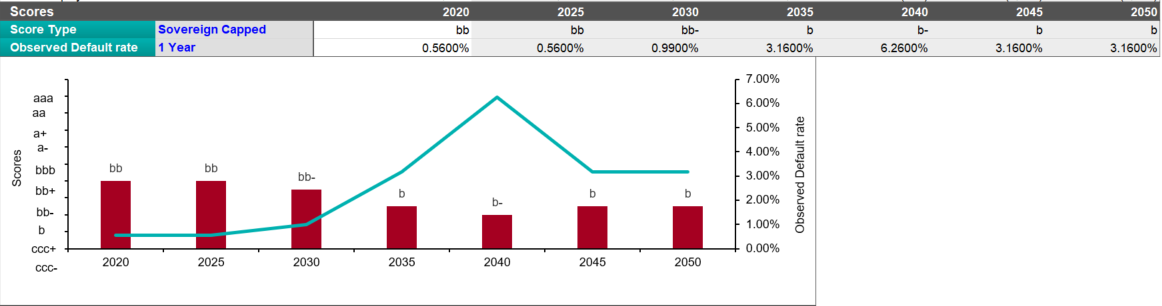

Figure 2: Fundamentals Driven Approach for high emitting sectors (Oil & Gas Example)

Source: S&P Global Market Intelligence. As of: 16 August 2022. For illustrative purposes only.

For more information, you may refer to: https://www.spglobal.com/marketintelligence/en/solutions/climate-credit-analytics.

Note: S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit model scores from the credit ratings issued by S&P Global Ratings.

[1] Oliver Wyman is an independent third-party firm and is not affiliated with S&P Global or any of its divisions.

Learn more about our Climate Credit Analytics

Request DemoA Globally Significant Financial Institution Improves its Capabilities to Assess Climate-Related Credit Risks

Read Now