Evergrande recently experienced a liquidity crunch as the firm was unable to sell their property holdings at the asset values they had on their books; this cascaded into their inability to pay their interest payments on their debt. This event leads to several questions that need to be answered; to name a few:

- How long have real estate firms in China been disclosing negative announcements?

- Did this have a cascade effect on other Chinese real estate firm?

- Are there cascading effects on other sectors in China?

S&P Global Market Intelligence continues to survey information on public and private companies globally. In China there are several mandatory disclosures obligated by the government to create transparency in the domestic market. This is mandated both for large public companies as well as smaller listed and private companies with public debt. These mandatory announcements and disclosures are obligations by the Chinese government on the company to disclose information to broader markets. These disclosures occur on a much more frequent basis than financial statement-based announcements and cover a variety of relevant events such as legal proceedings, payment warnings, and significant management changes.

S&P Global Market Intelligence collects, links and filters the relevant articles of these mandatory disclosures and extracts the opinions disclosed by the company to the market as obligated by the Chinese government. As an exporter of good and services to the global economy, it is important to monitor these first party mandatory disclosures from Chinese companies without any bias from other sources as a baseline for sentiment on these firms.

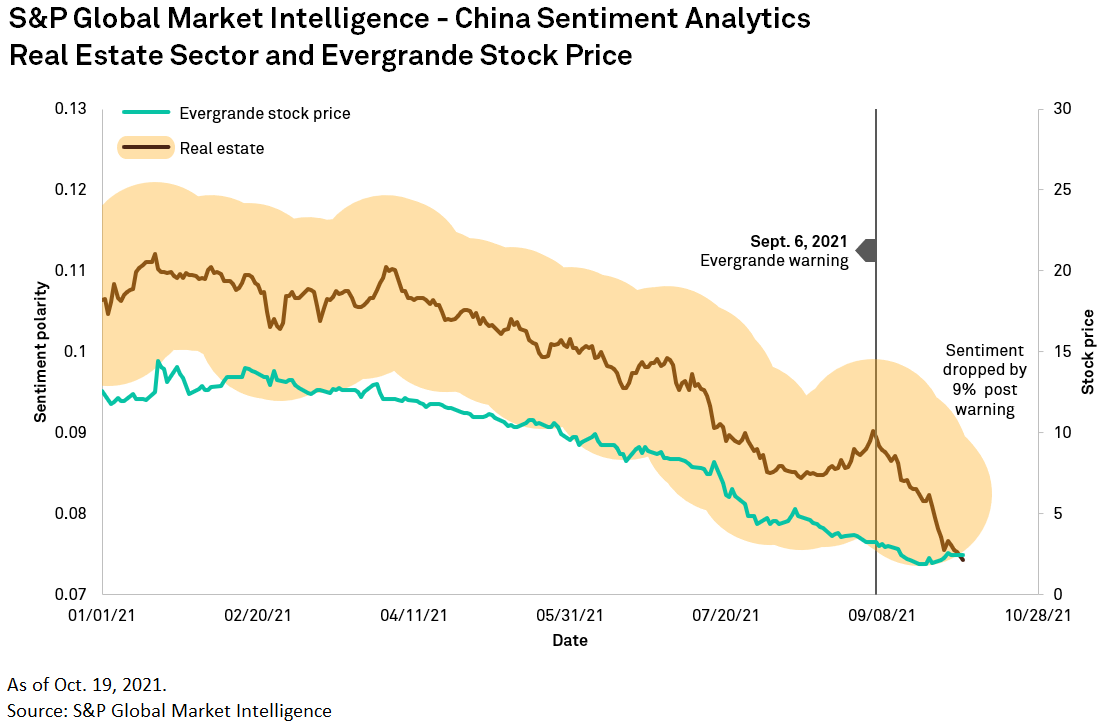

To answer question (1) we see that indeed real estate Chinese firms have been announcing negative events leading to a steady decline in real estate sentiment in China.

To answer question (2) we indeed see a significant decline in sentiment post the Evergrande warning from real estate Chinese firms. This leads to an approximately 9% drop over the month of September.

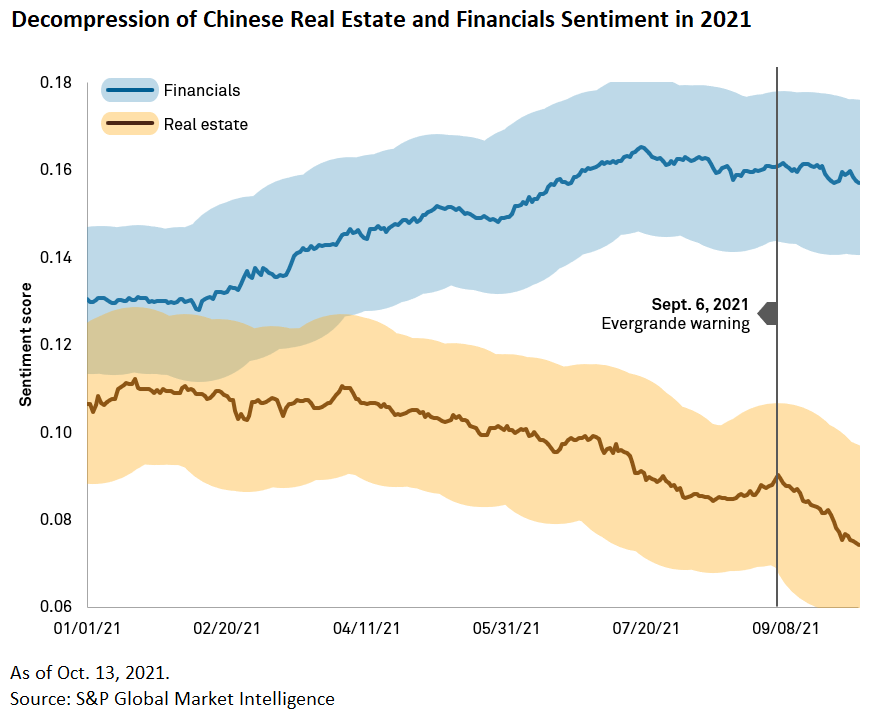

To answer question (3) and hence understand the implications on the broader market we current observe the following from first party disclosures. We see that Financials are in fact improving in sentiment announcements, despite the steady decline from Real Estate leading to a decompression in sentiment between the 2 sectors. About a month before and post Evergrande announcements Financials are holding steady compared to Real Estate.

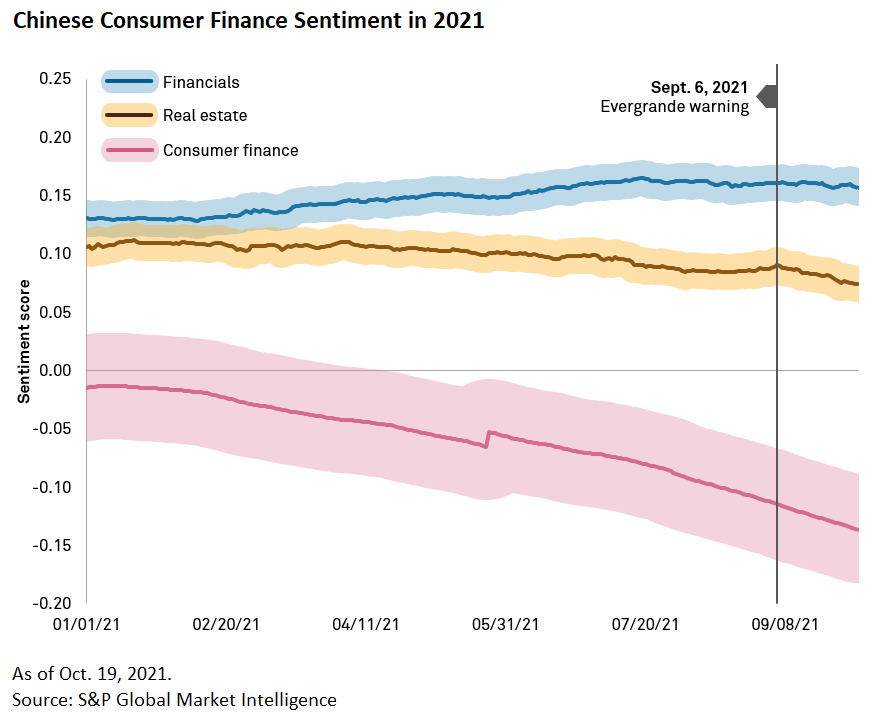

Analyzing a bit deeper by going down the third level PICS hierarchy, we see that despite Financials improving and then steading, Consumer Finance has in fact been declining.

In conclusion, being able to monitor thousands of disclosures allows analysts to keep track of the risks and potential impending cascading effects. These insights can inform potential global entities and make analysts much more efficient at surveying and responding to alerts when they have exposure to Chinese firms.