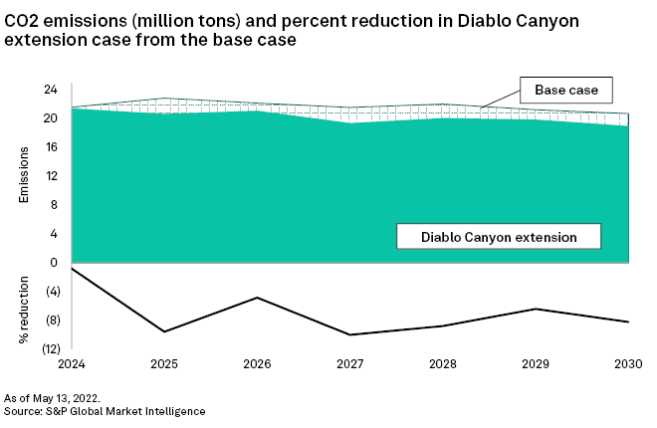

Despite ongoing decarbonization efforts and an electric reliability crisis, California seems to be proceeding with the planned closure of the Diablo Canyon nuclear plant. Our analysis indicates that keeping the plant online longer would not only provide needed reliable electricity but also lower carbon dioxide emissions.

![]()

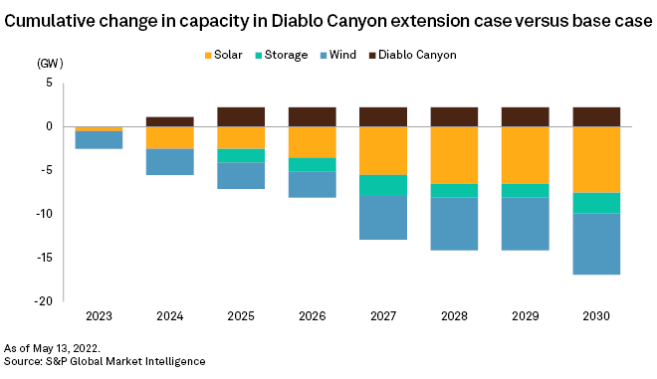

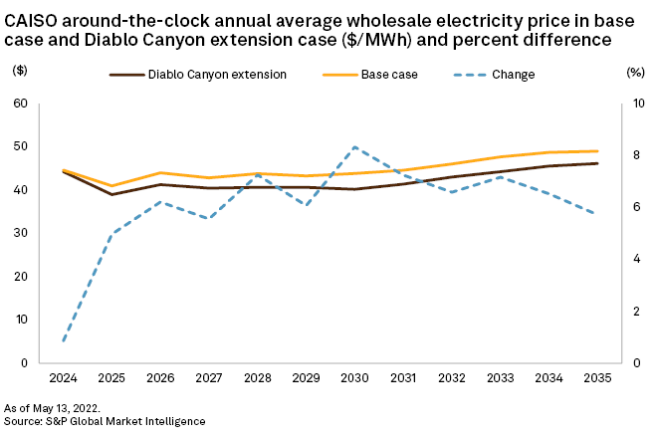

In a special scenario case of the S&P Global Market Intelligence Power Forecast in which Diablo Canyon remains online, the clean generation provided by the nuclear plant reduces the need for gas-fired generation and lowers emissions by 10% through 2030. The 2,240 MW of capacity would also decrease the need for 14.4 GW of new wind, solar and battery storage capacity, saving $20.9 billion in overnight capital costs, reducing California's reliance on neighboring imports and decreasing wholesale electricity prices by 5%-8%.

![]()

In 2018, the California Public Utilities Commission announced the retirement of the two units of the Diablo Canyon nuclear plant owned by Pacific Gas and Electric Co., or PG&E, when its existing Nuclear Regulatory Commission licenses expire in 2024 and 2025. Since the announcement, California has implemented an aggressive clean energy standard, with a goal of reaching zero carbon dioxide emissions from the electricity sector by 2045. The commission recently adopted a faster plan calling for 86% carbon-free electricity by 2032.

An ongoing reliability crisis in the state is complicating clean-energy initiatives, highlighted by extensive blackouts and systemwide shut-offs in Summer 2020. The energy shortfall prompted the creation of a new reliability reserve and delayed the retirement of fossil-fuel generating plants until more flexible, non-weather-dependent resources become available. Furthermore, California Gov. Gavin Newsom signed an executive order in October 2020 to protect 30% of California's lands and oceans from development, hindering land usage for new energy development, especially solar. Despite providing 8% of California's current electricity production and 15% of its carbon-free electricity, Diablo Canyon remains on the chopping block.

After a February announcement of $6 billion in support from the U.S. Energy Department for nuclear reactors facing retirement, Newsom is considering delaying the closure of Diablo Canyon. It will ultimately be up to PG&E to decide if it will apply before the extended deadline of July 5 for the first round of funding from the DOE program. It is also unclear whether Diablo Canyon meets the qualifications for receiving the government aid.

"The Governor is in support [of] keeping all options on the table to ensure we have a reliable grid, especially as we head into a summer where California ISO expects California could have more demand than supply during the kind of extreme events that California has experienced over the past two summers," Newsom spokesperson Erin Mellon said in an April 29 email. "This includes considering an extension to Diablo Canyon, which continues to be an important resource as we transition to clean energy."

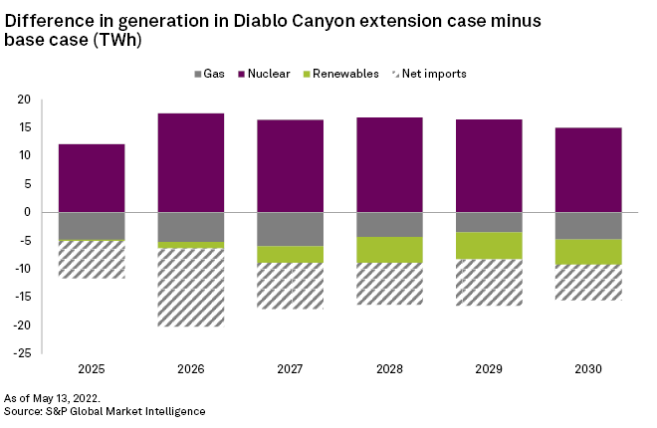

S&P Global Commodity Insights performed a distinct forecast scenario based on the first-quarter 2022 Market Intelligence Power Forecast with the two Diablo Canyon units remaining online beyond 2030. A new long-term capacity expansion analysis created an adjusted build plan to meet planning reserve margins and clean energy standards, and a production cost simulation produces associated prices and generation. The extension of the nuclear plant removes the need for other forms of capacity and generation from both emitting and clean energy sources.

Capacity and generation shifts

A total of 15.6 GW of renewable capacity beyond the existing pipeline of 3.8 MW in advanced development will be needed before 2026 to meet reserve margin and clean energy targets in the Diablo Canyon extension case. However, without the continued production of Diablo Canyon, California will need an additional 7.1 GW of clean energy capacity by 2026 and 16.9 GW through the end of the decade. In 2024 and 2025 alone, 4.6 GW of wind, solar and storage are no longer built when the 2,240 MW plant remains online.

Keeping Diablo Canyon online avoids approximately $20.9 billion in capital costs. According to Market Intelligence asset data, an estimate of the fixed costs to continue operations of Diablo Canyon through 2030 is approximately $1.5 billion before federal subsidy, indicating significant savings even after upgrade or construction costs required for extending the license.

The generation that Diablo Canyon replaces has far-reaching impacts for both emissions and imports and exports. Notably, gas-fired generation will increase by an average of 5 TWh from 2025 to 2030 when Diablo Canyon retires. In the base case, gas-fired generation rises from 27% of CAISO's generation in 2024 to 30% in 2030. With nuclear generation still available, gas-fired generation continues to decline steadily to 21% at the end of the decade.

In the base case, demand in PG&E ZP-26 and CAISO often exceeded available capacity, and net imports were positive. However, in the Diablo Canyon extension case, more generation is available than needed in PG&E ZP-26 and CAISO, leading to lower imports and higher exports. This change in net imports is a significant portion of the generation change in the extension case.

Impact on wholesale electricity prices

The changing generation breakdown also impacts wholesale electricity prices. Diablo Canyon can provide needed generation instead of relying on regional imports, thus reducing the average wholesale prices and further lowering system costs.

Increased emissions from Diablo Canyon replacement

One of the requirements for funding through the DOE program is that greenhouse gas emissions would rise with the retirement of the plant, and our analysis suggests Diablo Canyon would meet that qualification. The commission claims that procuring 11.5 GW of renewables between 2023 and 2026 will be sufficient for keeping emissions down, but even with the 19.2 GW of renewables built in the Diablo Canyon extension case, existing gas will be used less.

The reduction in gas-fired generation also leads to a decrease in total emissions, in line with California's clean energy goals. Since the largest replacement fuel for Diablo Canyon is gas-fired generation, keeping the nuclear plant generating will reduce up to 12% of carbon dioxide emissions through 2030. In total, 10.6 Mt CO2 will be saved by keeping Diablo Canyon online through 2030.

Extending the life of Diablo Canyon will also decrease reliance on nearby states for imports at peak demand hours. With California's strict emissions regulations, imports from Arizona or Nevada, and possibly the Pacific Northwest, would likely be sourced from carbon-emitting plants. By generating emissions-free electricity within California, the state remains in control of the emissions that are created to meet its demand.

Future of Diablo Canyon remains bleak

Though this study does not dive into the detailed finances of continuing to operate Diablo Canyon, or the alternative ways its electricity could be used, such as desalinization or hydrogen production, it indicates that there could be benefits to extending the lifetime of Diablo Canyon. However, it appears more and more likely that the nuclear plant will retire as scheduled by the end of 2025. In return, Californians will need to accept the trade-off of higher CO2 emissions and the cost of building significantly more renewables to make up for the loss of Diablo Canyon's carbon-free energy.