This blog is written and published by S&P Global Market Intelligence, a division independent of S&P Global Ratings. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings.

The Background

The British brand, Hunter Boot Ltd. (Hunter), beloved for its signature Wellington Boots, has lately found itself in administration. The company, which cemented its status as a British icon by – quite literally – putting boots on the ground in the muddy trenches of WWI, has faced mounting challenges since 2019, affecting its business operations and financial health.

The Causes

In their report on the matter, widely reported in the press,1 administrators Alix Partners, cited a blend of factors for the firm’s struggles, including supply chain disruptions, the impact of Brexit, inflation, unusually warm weather, Covid isolation impacts keeping people away from the countryside (and Glastonbury) and changes in consumer preferences.

Systematic

We note these factors are systematic. Most at the country level, affecting all UK businesses in the case of supply chain disruptions, Brexit, inflation, and the accompanying higher interest rates of borrowing. Despite these headwinds the median UK PD had shown a marked decline in the past few years – following the rise after Brexit vote and our model picked this up as an ameliorating factor. Other factors are systematic at the industry level of analysis, like weather and Covid impacts or changes in consumption patterns which led to decreased demand for the type of premium footwear produced by Hunter.

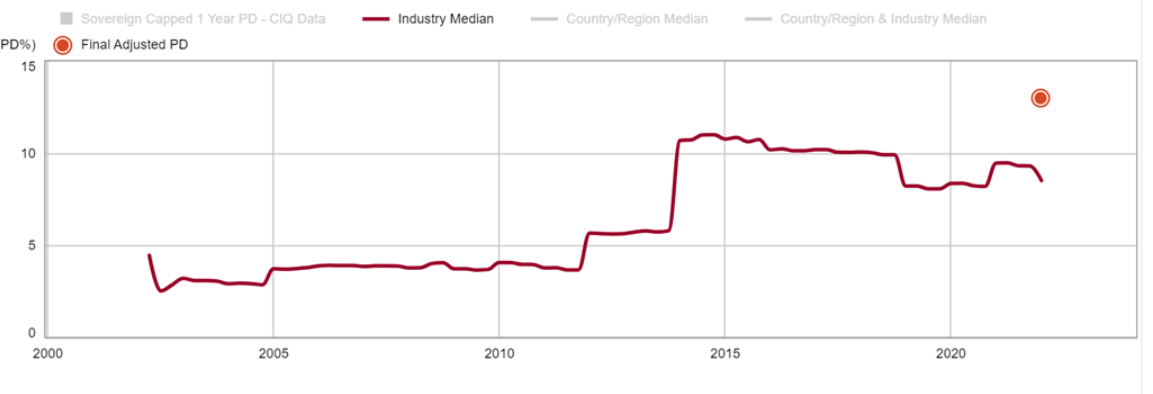

Chart 1: Median Probability of Default (PD) of the Global Footwear Industry Source: Credit Analytics from S&P Global Market Intelligence. Data as of 26 June 2023.

Source: Credit Analytics from S&P Global Market Intelligence. Data as of 26 June 2023.

Idiosyncratic

However, the sensitivity – and hence the response – of each individual company, (be it domiciled in the UK, active in the footwear industry, or both), to these systematic factors will differ, based largely on idiosyncratic factors relating to its make-up, financial situation, goals, and strategy of executing them.

Specifically, Hunter was more sensitive to supply chain disruptions than many of its peers due to the geographically expanded base of its operations with much of the production having moved to China, where in addition to supply chain disruptions, the generalized lockdowns persisted for longer.

According to Hunter’s own communications, some of these headwinds (like supply chain disruptions) would have led to increased operating expenses. Others would have driven drops in revenue on the back of reduced demand and hence sales. Together this created cracks in the company’s financials. These were at first papered over by increased lending, but this was never more than a stopgap. Furthermore, lending became a poisoned chalice when rising inflation – driven in part by the same supply chain disruptions that had contributed to the firm’s woes to begin with – led to this increased nominal debt burden being even harder to service. All these, inter-related factors, eventually led the company into administration, the British equivalent of bankruptcy.

S&P Global Market Intelligence’s PD Fundamentals Model

Credit Analytics’ PD Fundamentals Model had flagged Hunter with a risk assessment of Very High Risk as early as January 2020 on the back of several risk factors: chief among them the company’s low Net Income over Total Liabilities ratio. According to the commentary accompanying our PD Fundamental score:

Quote from S&P Global Market Intelligence, in reference to PD Fundamentals score drivers:

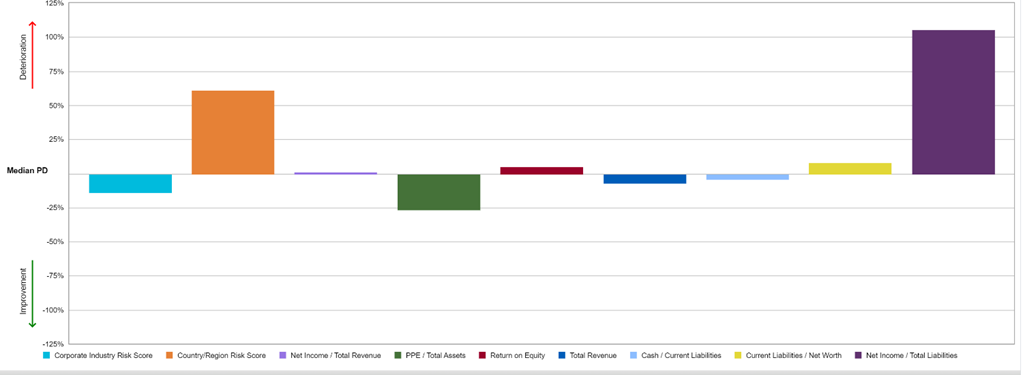

“Net Income/Total Liabilities is the most significant financial factor influencing the score, which is at -9.1%, versus -2.2% for the country/region and industry median, resulting in a relative contribution of 105.3%, increasing the PD by 105.3% relative to the country/region and industry median.”

Accessed 26 June 2023.

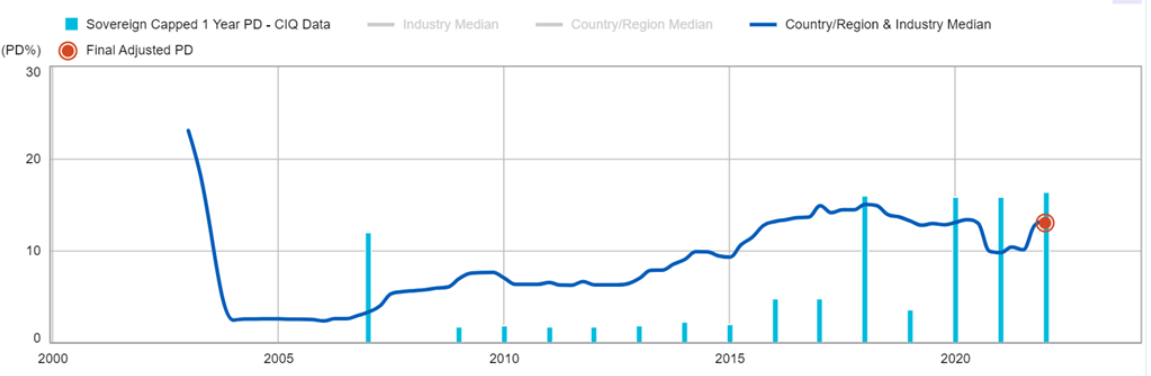

This indicator of debt sustainability flashed consistently red since early January 2020 and was significantly worse than the industry average. So, while the Footwear sector has not deteriorated dramatically in the last 3 years, Hunter consistently underperformed compared to its sector peers – as we can see in the following Chart 2, comparing the median PD of the UK footwear industry vs. Hunter Boot’s PD.

Chart 2: Median PD of the UK Footwear Industry vs. Hunter Boot

Source: Credit Analytics from S&P Global Market Intelligence. Data as of 26 June 2023.

NB: The high 1-year PD before 2005 is a statistical artifact, driven by a very low number of firms (5) in the, then, rated universe. By comparison is there were 50 firms, as of the latest cut-off date reported in the plot.

The relative importance of Net Income / Total Liabilities as a driver of the outcome is highlighted in our analysis of the relative importance of the factors driving the PD Fundamental outcome; as can be seen in Chart 3, below.

Chart 3: S&P Global Market Intelligence PD Fundamental Contribution Analysis

Source: Credit Analytics from S&P Global Market Intelligence. S&P Capital IQ platform Tearsheet for Hunter Boot Ltd. Data as of 26 June 2023.

The Consequences

Immediate

After creditors put the boot in, Hunter, was forced to go into administration, shouldering debts to the tune of £112.8 million. A considerable chunk of this debt was owed to secured creditors, which included major institutions like Wells Fargo and the Goldman Sachs-backed fund Pall Mall Legacy, along with Senior and Junior Loan Notes. Unsecured creditors, comprising landlords and suppliers among others, were due £16.9 million, a sum they are unlikely to fully recover. Wells Fargo, the company's principal lender, was owed £18.5 million, while Pall Mall Legacy had a claim of £7.5 million. The Senior and Junior Loan Notes combined accounted for £97.9 million.

Potential

We don’t expect Hunter’s administration to precipitate any sort of financial crisis or market panic in and of itself. However, we note that a venerable company chose to go into excessive borrowing on the back of flagging revenues and rising costs. They were then forced into administration when the rising interest rates rendered their debt burden no longer serviceableThis echoes the warnings, by the BIS, ECB, Edward Altman of Z-score fame, and others, of an impending zombie apocalypse when the so-called zombie SME’s – defined by the ECB2 as firms that would exit normally functioning markets but manage nonetheless to survive, typically relying on subsidised credit – would all succumb to the spectre of rising interest rates. It seems the time is nearing for the other boot to drop.

[1] Hunter Boot Says Inflation, Supply Chain Issues and Pandemic Led to Decline. Link. Accessed 26 June 2023.

[2] ECB Working Paper Series No 2743 / October 2022. Link. Accessed 26 June 2023.